Abstract

The link between health insurance ownership and over-utilization of health care services are highly debated. This paper examines the effect of insurance ownership on hospital utilization within the context of Malaysia. The study employs the data from Malaysia National Health and Morbidity Survey III and 14,223 respondents are selected for this purpose. Malaysia provides new evidence from an emerging market where voluntary purchase of private health insurance co-exists with almost free public health care. Logit model is used to identify the effect of insurance ownership on the probability of utilizing health care while the zero truncated Poisson model are used to identify the role of insurance ownership on the intensity of utilization. From the analysis, it is found that insurance ownership determines access to health care but it does not influence frequency of use. The findings suggest moral hazard problem may not be prevalent in the Malaysian health insurance market. Thus, institutionalizing health insurance through initiative such as national health insurance may be a sustainable program and give better access to care for the public.

Keywords: Health InsuranceUtilizationMoral HazardPoisson ModelMalaysia

Introduction

The link between health insurance ownership and over-utilization of health care services is highly debated. Some scholars argue that health insurance can induce moral hazard problem (Pauly, 1986). The moral hazard problem arises when an individual is indifferent on spending additional health care since the price paid during consumption is zero due to the reimbursement by the insurance company. Previous work examining the decision by an individual to purchase health insurance has provided conflicting evidence of the effect of ownership on health care utilization (Cheng & Chiang, 1998; Lopez-Nicolas, 1998; Shen, 2013). In the case of Taiwan, when the National Health Insurance (NHI) Program was introduced in year 1995, the use of medical care has increased (Cheng & Chiang, 1998). Empirical studies on the effect of insurance ownership within Malaysia context are quite limited except Kefeli and Jones (2012), Samsudin, Jamil and Zulhaid (2012) and Wan Abdullah and Ng (2009).

This study differs from Kefeli and Jones (2012) as it uses different empirical estimation and with some differences in selection of variables. While Samsudin, Jamil and Zulhaid (2012) focuses on the elderly this study covers individuals above 18 years. Unlike Wan Abdullah and Ng (2009) who analyzed individuals subscribed to employer sponsored health insurance this study uses individuals who purchased health insurance directly from the insurance company. Moreover, the result from other countries may be less applicable to Malaysia as the health care financing systems are different. It is expected that the existence of health insurance may induce demand thus those who own health insurance are more likely to use and utilize more health care.

The findings from this study are valuable to policymakers as ensuring access to health care is a policy issue. Can ownership of health insurance improve access to care? In addition, this study is of interest to health insurance providers as existence of moral hazard either by the policyholder or the medical providers may jeopardize the sustainability of a health insurance program.

The remainder of this article is organized as follows. The next section reviews the theoretical foundation and the literatures in the field. Then the methods employed in this study are discussed followed by the results and discussion. The final section concludes.

Theoretical background and literature review

A large and growing body of literature has investigated the effect of health insurance on health care use. Scholars have realized that spending on health care, and the utility that it generates, plays a central role in determining the value of health insurance. For an expected utility maximizing consumer, the demand for health insurance and health care is interdependence. Individual who expects to consume more health care will be more likely to buy health insurance or purchase more comprehensive health insurance coverage.

The utilization of health services can be explained using the Anderson Model which divides the factors that influence utilization into three main categories (Anderson, 1995). First, the predisposing factors which consist of inherent factors that exist within individuals. Examples are age, gender and education level and economic activity. Second, the enabling factors which are family means to obtain health care services. Examples are income, health insurance and distance to hospital. Lastly, the presence of need either perceived by individuals or required by medical providers. Example is individual health status.

As an enabling factor, insurance variable is often included in studies that are based on mixed health care financing system, as in the United States (Manning, Newhouse, Duan, Keeler, Leibowitz & Marquis, 1987; Munkin & Trivedi, 2003). Manning et. al (1987) found that there is no significant difference in utilization of health care services between the healthy and the sickly. However, Sarma and Simpson (2006) found that insurance has significantly determined doctor utilisation for healthy users and insignificantly for the less healthy in the Canadian health care.

Some studies found that utilization of health care is not different between the insured and uninsured or between types of insurance ownership (Lopez-Nicolas, 1998; Nandakumar, Chawla & Khan, 2000]. In other studies, in which the datasets are based on tax-financed system, such as Italy, UK, Sweden, Portugal and Spain, the role of insurance status in health care demand is not prominent. Empirical research in Jordan found that health insurance ownership does not affect the probability of health care use but it significantly influence the intensity of use (Ekman, 2007). While in Indonesia, Hidayat and Pokhrel (2010) found no evidence that insurance ownership influences future outpatient visits. In Australia, the use of medical care has increased sharply among the elderly when Medicare was introduced (Cameron, Trivedi, Milne & Piggott, 1988).

Method

Data

Data were extracted from the Malaysian National Health and Morbidity Survey (NHMS) III. NHMS III reported that 18.8% of the respondents owned some type of medical and health insurance (MHI). This study uses 14,223 cases of individuals above age of 18. The definition and summary statistics of variables used are explained in Table

Empirical specification

The objective of the analysis is divided into twofold where the first is to identify the role of insurance ownership on access to inpatient care and second to identify its role on the frequency of visits.

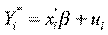

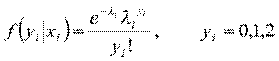

In the first analysis, the logit model is used to explain whether or not someone being hospitalized within the reference period. Suppose

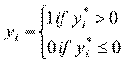

We can only observe dependent variable

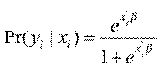

The probability density function is,

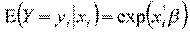

The second analysis involves the use of count data in modelling the frequency of hospitalization. We use both standard Poisson (one-part) and two-part Poisson models (TPM) or sometimes known as hurdle model for this purpose. We start with standard Poisson model where hospitalization, Y, is specified as below:

where

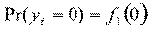

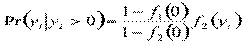

The next approach involves two-part process, where the first part represents access and the second part signifies the frequency of subsequent use after the first access. Two-part model is used in several studies and is considered this study due to the large number of zero-count (non-users) in the sample [4, 6, 15]. Strong assumption, however, has to be made that the hospitalization episodes are related to the same spell of illness. The first part involves logit model as its modelling access to care and the second part utilizes zero truncated Poisson model, where it only counts observation more than 0. The density function of these two distinct processes of health care demand,

and

Results and discussion

Table

The results show that health insurance ownership is significant in determining access but has no influence on subsequent use. The fact that health insurance ownership influence access to care provides evidence for the needs to promote health insurance ownership either private or public to ensure better access to care for all individuals. More importantly, the finding shows no evidence of moral hazard as health insurance ownership does not influence the intensity of health care use. In addition, as the model assumes that the subsequent health care visits are related to the same illnesses, then the finding also suggests that there is no evidence of moral hazard by the medical providers.

Other significant variables that determine access are age, marital status, household size, health status and income while only health status influences intensity of care. The findings indicate that individual who is married and from a household with a larger number of members are more likely to access health care. Perhaps the spouse and the family members become enabling factors pushing the individual to seek for care. The likelihood of access also increases with the increase in age. As health status is controlled, this may indicates that older individual are more risk averse or are more anxious about their health and thus seek more care.

As expected, the health status influences both the health access and frequency of use. Those with bad health status are more likely to seek care and have higher intensity of use. Interestingly, those with higher income are less likely to access health care. It may reflect that individuals with higher income have greater resources at their disposal to avoid inpatient treatment perhaps through better healthy lifestyle.

Conclusion

In the Malaysian context, extending health insurance coverage may increase health care access, in particular to inpatient services. This study finds no evidence of increase in intensity of inpatient care use by health insurance owners thus eliminating the presence of moral hazard behavior either from the insured or the medical providers. Thus, institutionalizing health insurance through initiative such as national health insurance may be a sustainable program and give better access to care for the public.

References

- Andersen, R. M. (1995). Revisiting the behavioral model and access to care: does it matter? Journal of Health and Social Behavior, 36(1), 1-10

- Cameron, A. C., Trivedi, P. K., Milne, F. & Piggott, J. (1988). A microeconometric model of the demand for health care and health insurance in Australia. Review of Economic Studies, 85-106.

- Chan, S. (2013). Determinants of health care decisions: insurance, utilization, and expenditures. The Review of Economics and Statistics, 95(1), 142-153.

- Cheng, S. H. & Chiang, T. L. (1998). Disparity of medical care utilization among different health insurance schemes in Taiwan. Social Science Medicine, 47(5), 613-620.

- Deb, P. & Trivedi, P. K. (2002). The structure of demand for health care: latent class versus two-part models. Journal of Health Economics, 21(4), 601-625.

- Ekman, B. (2007). The impact of health insurance on outpatient utilization and expenditure: evidence from one middle-income country using national household survey data. Health Research Policy and Systems, 5, 6.

- Friedman, B. & Savage, L. J. (1948). The utility analysis of choices involving risk. The Journal of Political Economy, 56(4), 279-304.

- Gerdtham, U. G. (1997). Equity in health care utilization: further tests based on hurdle models and Swedish micro data. Health Economics, 6(3), 303-319.

- Hidayat, B. & Pokhrel, S. (2010). The selection of an appropriate count data model for modelling health insurance and health care demand: case of Indonesia. International Journal of Environment Research and Public Health, 7, 9-27.

- Kefeli, Z. & Jones, G. (2012). Moral hazard and the impact of private health insurance on the utilization of health care in Malaysia. Jurnal Ekonomi Malaysia, 46(2), 159-175.

- Lopez-Nicolas, A. (1998). Unobserved heterogeneity and censoring in the demand for health care. Health Economics, 7(5), 429-437.

- Manning, W. G., Newhouse, J. P., Duan, N., Keeler, E. B., Leibowitz, A. & Marquis, M. S. (1987). Health insurance and the demand for medical care: evidence from a randomized experiment. American Economic Review, 77(3), 251-277.

- Munkin, M. K. & Trivedi, P. K. (2003). Bayesian analysis of a self-selection model with multiple outcomes using simulation-based estimation: an application to the demand for healthcare. Journal of Econometrics, 114(2), 197-220.

- Nandakumar, A. K., Chawla, M. & Khan, M. (2000). Utilization of outpatient care in Egypt and its implications for the role of government in health care provision. World Development, 28(1), 187-196.

- Nyman, J. A. (2006). Evaluating health insurance: a review of the theoretical foundations. The Geneva Papers, 31, 720-738.

- Pauly, M. V. (1986). Taxation, health insurance and market failure in the medical economy. Journal of Economic Literature, 24(2), 629-675.

- Samsuddin, S., Jamil, N. & Zulhaid, N. H. (2012). Health care utilisation in Kedah: a microeconometric analysis. OIDA International Journal of Sustainable Development, 4(5), 45-52.

- Sarma, S. & Simpson, W. (2006). A microeconometric analysis of Canadian health care utilization. Health Economics, 15(3), 219-239.

- Wan Abdullah, W. R. & Ng, K. E. (2009). Health insurance and health services utilisations: evidence from employer-based health insurance in Malaysia. Working Paper Series 2009-25. Universiti Malaya.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

22 August 2016

Article Doi

eBook ISBN

978-1-80296-013-6

Publisher

Future Academy

Volume

14

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-883

Subjects

Sociology, work, labour, organizational theory, organizational behaviour, social impact, environmental issues

Cite this article as:

Abu-Bakar, A., Samsudin, S., Regupathi, A., & Aljunid, S. M. (2016). The Effect Of Health Insurance On Health Care Utilization: Evidence From Malaysia. In B. Mohamad (Ed.), Challenge of Ensuring Research Rigor in Soft Sciences, vol 14. European Proceedings of Social and Behavioural Sciences (pp. 362-368). Future Academy. https://doi.org/10.15405/epsbs.2016.08.51