Abstract

This paper aims to investigate and identify Malaysian electricity utility customers' expectations and perceptions of the sustainability pillars of environment, social and governance, and economy (ESG) for future sustainability. This study was conducted through a Focus Group Discussion (FGD) of seven (7) organizations who are experienced and considered as one of the most important stakeholders (customers) of Malaysian electricity providers. The research data were analyzed using content analysis based on the objects and expectations due to the nature of research objectives. From the customers’ point of view, the results indicated that Malaysian electricity providers should focus on 11 factors of the environment, 14 factors of social, and 27 factors of governance and economics for their business sustainability. The findings are expected to provide plausible guidelines to the Malaysian electricity utility providers for enhancing their sustainability pillars based on the expectations of stakeholders, especially customers, to move forward to achieve them as one of the upmost electricity producing companies in the world.

Keywords: Customers’ perception, ESG, Malaysian electricity utility provider, sustainability

Introduction

Development and initiation of environmental, social, governance and economy (ESG)

The term “Environmental, Social, Governance and Economy (ESG)” was first used in research titled “Who Care Wins” in 2005 encouraged by the former UN Secretary-General Kofi Annan in a joint initiative under the United Nations Global Compact (Kell, 2018). ESG is a process of quantifying a company’s commitment to a principle of the framework system, including environment (E), social (S), and governance and economy (G) factors (Li et al., 2021). Moreover, ESG is initially a strategy to evaluate a corporate behavior incorporate with ESG for investment analysis and decision making (Li et al., 2021).

The primary purpose of ESG customers’ perspectives is to benefit the overall environment, social, governance, and economic concerns (Syed, 2017). According to research observation, integrating ESG factors into a company’s valuation model improved its stakeholder’s access to improve customer needs, market affirmation, and societal efficacy offered to the customers (Wan Mohammad & Wasiuzzaman, 2021). Environmental, Social, Governance and Economy (ESG) issues have been the basis of attentiveness for investors, regulators, and shareholders when it becomes an integral part of the company's strategy, as a risk management concern (Tarmuji et al., 2016). Small and medium-sized companies with a strong ESG emphasis will be in a better factor to gain recognition as investors want to venture more in companies with strong ESG standards. Increased top-line growth and fewer administrative and regulatory obstacles are two different ways in which adherence to strong ESG regulations reduces risk (Stevens, 2020).

Electricity business activities impact a wide variety of customers; therefore, it is crucial to analyse the sector’s performance and identify the policies affecting choices on sustainable growth based on customers. This research aims to identify customers’ perspectives on ESG to create value and perceive ESG factors that will improve the decision-making process's effectiveness and benefit the environment, society, governance, and economic concerns.

Dimension of ESG

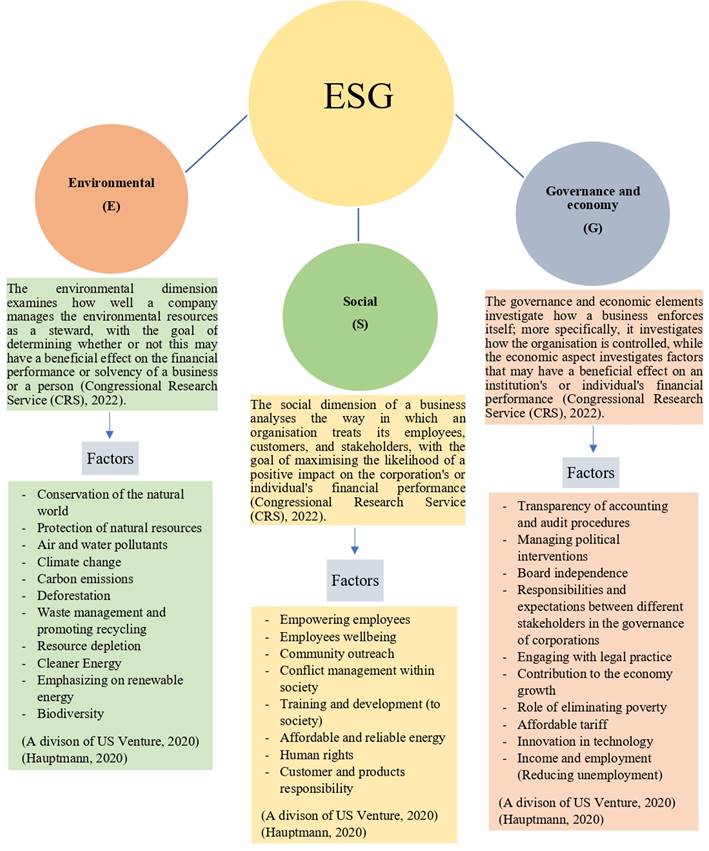

ESG is an abbreviation that stands for "environmental, social, and governance" and it refers to the three primary aspects that are used in determining how an investment in a business or corporation will affect its long-term viability and integrity (Kiehne, 2019; PricewaterhouseCoopers [PWC], 2020). The definitions and factors of ESG are explained as shown in Figure 1.

Method of Data Collection: Focus Group Discussion (FGD)

A Focus Group Conversation (FGD) is a qualitative research method and data collection approach in which a group of individuals participates in an in-depth discussion about a defined topic or problem. (Eeuwijk & Angehrn, 2017). The technique is based on the concept that group processes developed throughout an FGD's support and guidance demonstrate and justify general understanding among individuals and organizations.

Nonetheless, this strategy does not assume that all information is shared evenly within a studied group or that there is a common, underlying, homogenous knowledge in each society. During the discussion rounds, an FDG enables the researcher to seek both the participants' common story and their disparities in terms of experiences, attitudes, and worldviews. Thus, the team performed an FGD with seven of TNB's customers' key stakeholders as follows (see Table 1):

Findings

As the main objective of this project is to develop a comprehensive ESG framework guided by the relevant customers toward electrical utility companies. Based on the data collected from the focus group discussion (FGD) with customers, this research has received comprehensive feedback and framework factors and expectations of ESG as in Table 2, Table 3 and Table 4 below:

Environmental perspectives

Social perspectives

Governance and economical perspectives

Conclusions

The sustainability pillars are a set of requirements for how a company runs. Socially conscious investors look at Environmental, Social, Governance, and Economy (ESG) criteria to decide whether or not to invest in a company. This study examined Malaysia's electricity company's four sustainability pillars. This paper helps better understand in TNB’s ESG disclosure from a customer stakeholder’s point of view. Each pillar contains sustainable variables and criteria for stakeholder perspectives and initiatives.

Throughout the entire research, the researchers have conducted an extensive focus group discussion (FGD) with one of TNB’s prominent stakeholders; Customer stakeholders, as shown in Table 1. Through the FGD, the researchers have merged a synthesized list of 52 ESG factors from the stakeholder altogether as shown in Table 2, Table 3 and Table 4. Therefore, 11 factors for Environmental, such as TNB’s current emission rate, innovation, and customer-friendly technology, implementing of energy-efficient equipment and transparent system (tariff and billing), minimizing environmental impact, introduction and implementation of the climate change policy regulations, and consumer awareness on energy consumption.

Meanwhile, a total of 14 factors were compiled after synthesizing for the social point of view which are; general billing and charges guidelines, focusing on customer issues and maintaining satisfaction consistency, community outreach, practicing corporate social responsibility, creating awareness, upskilling and reskilling towards indigenous society (external), and income and employment (reducing unemployment).

Towards the conclusion of the study, 27 governance factors were synthesized, including the following; anti-corruption and bribery policy, implementing of a new system and innovation technology, generating new business opportunities, consumption, and evaluation data, ensuring efficient and reliable energy (no power cut), managing energy costs and ensuring affordable tariffs, implementing a robust and transparent governing system, establishing standard operating procedures (SOP) in line with top global electricity providers, instituting transparency of accounting and audit procedures, top management commitment and support to internal and external parties, compliance with other government agencies, and emphasizing on risk management.

The findings of this research will contribute to academic knowledge and provide guidance for the management of electricity-producing companies. The customer's stakeholders' ESG recommendations support the TNB process information. This implies that while we move toward sustainable energy, we must also improve and safeguard the well-being of both communities and stakeholders.

References

Eeuwijk, P. v., & Angehrn, Z. (2017). How to Conduct a Focus Group Discussion (FGD). Key Area of Activity (KAA-10) ‘Society, Culture and Health’.

Kell, G. (2018). The Remarkable Rise of ESG. Forbes. https://www.forbes.com/sites/georgkell/ 2018/07/11/the-remarkable-rise-of-esg/?sh=44d5ad1c1695

Kiehne, D.-O. (2019). Environmental, social and corporate governance (ESG) – also an innovation driver? Intellectual Property Solutions, 2-4.

Li, T.-T., Wang, K., Sueyoshi, T., & Wang, D. (2021). ESG: Research Progress and Future Prospects. Sustainability, 13. DOI:

PricewaterhouseCoopers (PWC). (2020). Environmental, social and governance (ESG) in Asia. Asset and Wealth Management, 3.

Stevens, P. (2020). ESG index funds hit $250 billion as pandemic accelerates impact investing boom. United States: Consumer News and Business Channel.

Syed, A. (2017). Environment, social, and governance (ESG) criteria and preference of managers. Cogent Business & Management, 1-13. DOI:

Tarmuji, I., the Faculty of Accountancy, Universiti Teknologi MARA, Maelah, R., Tarmuji, N. H., the Faculty of Economics and Management, Universiti Kebangsaan Malaysia, & the Faculty of Computer and Mathematical Sciences, Universiti Teknologi MARA. (2016). The Impact of Environmental, Social and Governance Practices (ESG) on Economic Performance: Evidence from ESG Score. International Journal of Trade, Economics and Finance, 7(3), 67-74. DOI:

Wan Mohammad, W., & Wasiuzzaman, S. (2021). Environmental, Social and Governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Cleaner Environmental Systems, 2 , 100015. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Zulkifli, N. H., Ahmad Taufik, N. N. A., Islam, M. K., Jaaffar, A. H., & Mohd Radzi, H. (2023). Exploring the Customers Perception on ESG Towards Malaysian Electricity Utility Company. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 542-550). European Publisher. https://doi.org/10.15405/epfe.23081.48