Abstract

This study's main objective is to determine the variables affecting worker performance in Malaysia's banking industry. Organisational change factors including communication, leadership, tolerance to change, employee’s development and procedural justice were employed as independent variables in this study. There are 5 hypotheses developed for this study’s hypotheses to test the significant relationship of these variables with the banking employee’s performance. A non-probability convenience sampling method is used to gather information from 201 respondents who are bank officers from various banks throughout Malaysia. The correlation coefficient analysis and hypothesis correlations were tested using the SPSS Statistics software. The findings show that the only factors that significantly affect an employee's performance are communication, leadership, and tolerance for change. Whereas employee’s development and procedural justice does not have any significant relationship. This study will help the banking industry to develop more effective strategies for increasing employee performance in service organisation.

Keywords: Banking industry, Employee’s performance, Organisation change

Introduction

The Malaysian financial system has been a significant catalyst in promoting the country's economy's transformation and expansion during its many stages of development. Malaysia financial sector has become more integrated and globalized environment with diverse investment and financing needs. The operational environment of the Malaysian financial system will alter because of the swift changes in the global economic and financial climate. To uphold the country's objective of achieving a high value-added, high-income economy, a more progressive and dynamic domestic economy is required. A consistent flow of talented and energetic individuals is essential to fostering the expansion and development of the financial sector. Employees in the banking industry may be worried about changes in their organisational culture, working environment and management. Thus, it is critical if the employees have a substantial connection to their banks. It can have an impact on the organisation's efficiency and effectiveness, as well as the achievement of established employee performance and corporate goals. Therefore, it is possible that organisational change will have a relationship on how well employees perform.

Organisations are undergoing significant transformations that are expanding markets and creating new avenues for growth and revenue. Organisational change generally encompasses wide-ranging shifts within a company, encompassing alterations in mission, operational restructuring, mergers, collaborations, and similar transformations. According to research, organisational change equates to organisational transformation (Kotter & Schlesinger, 2009). One of the most critical challenges would be employees' ability to absorb organisational change. Employees must be able to adapt to changing environments.

Literature Review

This study aims to explore five independent variables: employee development, procedural justice, leadership, communication, and tolerance for change. It is believed that these factors will help and benefit the study. This section will explore definitions and theories related to the dependent variable, employees' performance, and the independent variables. The novel framework introduced in this research is expected to have a meaningful impact on related studies.

Employee performance

Employee behaviour at work and factors like job quantity, quality, and effectiveness all affect how successfully employees perform (Donohoe, 2019). Because of improved financial performance, the banking industry has developed quickly in recent years. The banking industry differs from other industrial companies in that its employees are more integrated in the service sector. As a result, competent workers will be required to forecast the organisation's future performance. Another study found that competence positively but insignificantly affects employee performance. The role of innovation and technology in improving worker performance is still not given enough attention, and employee proficiency continues to be a barrier to career advancement. Employee performance is positively but modestly affected by job satisfaction, which is influenced by competence. In terms of enhancing performance, employee job satisfaction is low as utilizing the competencies that have been guided thus far is still comparable to satisfying work requirements (Hajiali et al., 2022). To begin dependable for evaluating personnel, the organisations leaders need to responsible hold the main strengths from the employees’ performance. This means it may identify the business's advantages, weaknesses, limitations, and any possible shortages. Even though, performance assessments are not pleasant, but it is still important for the company executives to start the level of performance for each employee (Leonard, 2019).

Communication

Communication is essentially the transmission of information and meaning from the sender to the receiver. It makes sense that words are stressed because effective communication relies on conveying the sender's intended meaning. The company's challenges can be resolved with effective communication. Therefore, transparent management will aid in the development of security maintenance and good loyal staff health (Maharani & Soraya, 2022). Additionally, managers may create the positive relationships with their employees through the communication, according to Dahlberg (2007). When a company keeps an open-door policy, it may lead the employees to react more response when the company undergoes organisational changes.

Organisational leadership

Organisational leadership entails articulating the company's mission and objectives, formulating a strategic plan, and inspiring personnel to leverage their skills in accomplishing the plan's objectives and, ultimately, realizing the leader's vision (Moe, 2021). Employees with high level relationship with their leader, according to Erdogan and Enders (2007), will have more quality satisfaction and job performance rather than a connection of poor quality. For the outcome, the leader relation requires the assistance of the workplace supervisor. It indicates that because the connection is of good quality, the workers will participate to the effectiveness of the organisation as an outcome of such engagements. Employees also desire a trustworthy leader and supervisor who is familiar with them, comprehends their needs, and respects the others fair (Borstorff & Marker, 2007).

Tolerance to change.

The tendency to adapt to changing or operating modes in an organisation or community is defined as tolerance to change. When an individual is change tolerant, he must rapidly learn to adapt to good current changes, and psychologically and emotionally posture himself such that such adjustments do not negatively affect him (Cleverism, n.d.). According to Kotter (2008), the greatest challenge to organisation is failure made by the manager towards alter their attitudes and behaviours which the companies need essential. However, the management realises that changes in their operations are necessary, but sometimes they are passionately unwilling for the adjustment.

Employee’s development

Employee’s development is the strategy of improving present talents and capabilities while also developing new ones to assist the company in meeting its goals (Valamis, 2022). Employee development is now increasingly recognised as an important instrument for a company's lasting development, efficiency, quality, and ability to reduce the employees who have a lack of talent. However, when the companies neglect some challenges, the employee development procedure may take extra time to manage and confront the employees. Typically, employee development is based on human resources prediction. As a result, employee development must always be long lasting, well-organized, and main objective strategy which may sync with the organisation's present and future work objectives. The system's aims must be connected to each employee's continuing expert and job growth. Aside from optimising and upgrading the job processes and training, it is also vital to develop and assign employee ability, guaranteeing may can create their expected engagement in the production process (Teculescu, 2010).

Procedural justice

Procedural justice, often known as fair treatment, is defined as fairness methods that persons in leadership places can utilise to attain specified results and judgments. The objective of engaging procedural justice in organisational change is to enhance employees' commitment to the organisation (Klendauer & Deller, 2009). Furthermore, workers and organizations are more impacted by procedural justice viewpoints than distributive justice viewpoints (Benson, 2002; Vasset et al., 2010). The link between the employee performance and procedural justice perceptions gives an effect for the organisational assurance, changing in the organisational attitudes and changing attitudes in the future (Imberman, 2009).

Problem Statement

One of the most critical challenges would be employees' ability to absorb organisational change. To remain in their positions, employees need to be able to adjust to shifting work settings. Not only must they comprehend human nature, but they also must possess the ability to effectively lead and manage change in order to sustain or even enhance their own performance. When engaging with or chatting with clients, professionals need to have strong communication skills in addition to certain abilities to compete with other employees. Therefore, it is crucial that this study investigates the organisational change factors that affects employee performance.

Research Questions

The study aims to investigate and explore the factors that influence employee performance through the formulation of research questions. These are the research questions:

What factors influence an employee's performance in the banking sector in Malaysia?

Is there any significant relationship between organisational change factors such as communication, leadership, employee’s development, tolerance to change, and procedural justice with employee’s performance.

Purpose of the Study

The primary aim of this study is to discern or identify the factors affect banking industry employee’s performance in Malaysian and whether there is a link between those variables and the banking sector employee’s performance.

Research Methods

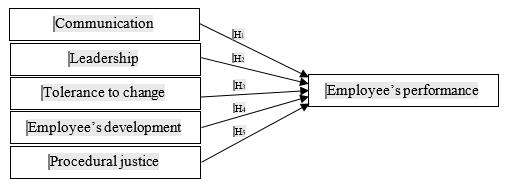

The research framework for this study was constructed using the findings from the literature review (see Figure 1). For the purpose of testing the significant relationship between the independent variables namely communication, leadership, employee’s development, tolerance to change and procedural justice and the work performance of banking industry employees in the Malaysian, five hypotheses were created.

In this study, correlational research methodology was employed. A non-probability convenience sampling technique was employed to choose the study's primary respondents from among employers in the Malaysian banking sector. The primary objective of the convenience sample is to gather data about respondents that the researcher already knows. For determining sample size and power for different statistical procedures, the G*Power programme is used (Kang, 2021) Using G* Power with 5 predictors, a medium effect size of 0.15, a probability error of 0.05, and statistical power of 95%, it was determined that the total of 138 samples would be required to have sufficient statistical power to examine factors. Therefore, this study involved 201 respondents from various banking institutions in Malaysia. An online survey platform was used to collect data between January and March of 2022. Written consent was sought from respondents prior to answering the survey.

Findings

A total of 201 bankers (respondents) participated in the study (see Table 1). There are 114 (56.7%) of male respondents while the remaining 87 (43.3%) are female. In total, 94 (46.8%) of those aged between 21to 30 years, were found to be the majority. 46 (22.9%) of those from 31 to 40 years and 41 (20.4%) within the age range from 41 to 50 years. Those below 20 years is 5 (2.5%) and those 51 years and above are 15(7.5%). 143 (71.7%) of the respondents are Malay, 31 (18.4%) are Chinese, 19 (9.5%) are Indians and 2(1%) are other races.

Majority of the respondents working in is Bank Islam Malaysia Berhad (BIMB) with 79 (39.3%). In comparison, the lowest bank industry that the respondents working in is Bank Muamalat which is only 2 people (1%). The Malayan Banking Berhad gains the second highest with 26 respondents (12.9%) followed by Commerce International Merchant Bankers Berhad (CIMB) with 17 respondents (8.5%), 14 (7%) respondents are from AmBank, 10(5%) are working with Hong Leong Bank, others are from Bank Negara Malaysia (BNM), RHB Bank and Public Bank with 9 respondents (4.5%) each (see Table 2).

Table 3 presents the different monthly salary of the respondents. 75 respondents, or 37.3%, have monthly salaries that fall between RM 2,001 and RM 5,000, which is the highest range among the respondents. 52 respondents, or 25.9%, reported receiving a monthly salary within RM 5,001 to RM 8,000 range. The study's lowest number of participants, 18 people, were from the income category of RM 11,001 and above, or 9% of the total.

To measure the reliability of the variables and data gathered, the Cronbach’s alpha reliability analysis were chosen. The following table displays the results of Cronbach’s alpha for each of the variables (see Table 4). The generally accepted reliability analysis rule according is that 0.6 to 0.7 implies acceptable reliability (Ursachi et al., 2015).

The main objective of this study is to examine what variables influence workers' performance in the banking sector in Malaysia and to determine whether worker performance in the banking sector is significantly correlated with communication, leadership, employee’s development, tolerance to change and procedural justice. Hence, the hypothesis test result for this study are as follows.

Table 5 shows that the strongest beta coefficient (0.244) between communication and employee performance. Then there is tolerance to change, which is 0.201. Then, leadership, which comes in third at 0.196. Next, employee development with 0.088. The employee performance and procedural justice have the lowest beta correlation (-0.024). Strong correlation is indicated by the P value < 005 between leadership, communication, and tolerance for change and employee performance. Employee’s development and procedural justice are two independent variables with no significant connection with the P-value of 0.209 and 0.752 respectively.

The findings of the hypothesis test indicate a strong correlation between employee’s performance and communication. Asians struggle with self-disclosure because they are afraid of coming across as overly brazen or disagreeable, especially since most Asians place a high priority on maintaining a positive public image (Dale, 1965). Moreover, even when top managers are aware of the changes that are coming, usually for a variety of reasons, they are unable to communicate the changes with employees effectively. Aside from the underlying reasons, any communication breakdowns make workers anxious about the transition and their future, which can be stressful.

Leadership is considered as a leading yet successful approach to managing individuals and the entire organisation. Human resource management has gradually supplanted the conventional paradigm of manpower planning. This emphasises the strategic planning of modern leadership styles into successful employee leadership and the enhancement of employee performance (Iqbal et al., 2015).

Organisational change is a stressful process that undermines personality as well as promotes uncertainty (McShane & Glinow, 2008). Organisations must implement stress - reduction practices that help employees cope with the changes to at least enhance motivation of employees and respond to the transition process. Employees who believe their organisation cares about their future are much more able to maintain a high tolerance for rapidly changing and increasingly their mobility levels.

One factor that lacks a significant correlation with employee performance is the requirement for employee development systems to be professional, personal, and work development of everyone. Apart from updating best practices and the optimization, it is also critical to build and allocate employee competency, making sure they can plan for the expected amount of involvement in the work process. Employee development enhances mutual trust in the employer-employee relationship, which improves the employee's employability. Employee dedication and commitment to their company will increase as a result.

Employees will be highly motivated to improve their work performance if they understand the value of justice and fairness. Enhancing employees' affective engagement to the organization is the goal of procedural justice interaction in organisational change. Procedural justice is a term used to describe the perceived equality or fairness of the processes used to decide how rewards are distributed (Klendauer & Deller, 2009). The lack of procedural fairness, on the other hand, will result in decreased work satisfaction and performance.

Conclusion

In summary, within the banking industry, communication stands out as the most potent influencing factor on employee performance, especially in the context of organisational transformation. Employees can share knowledge, ideas and information through communication. Communication is critical in a company to minimise adverse feelings from employees whenever changes occur. In fact, leaders are the ones who understand employees' needs the best, which is crucial for inspiring and convincing them to meet the objectives of the organisation. Tolerance to change is vital since it helps employees to pursue out changes in understanding, space and time in order to identify the optimum approach to achieve organisational production. There would be the ability to see things from other people's perspectives and to govern their actions while respecting their worth and privileges.

This study does, however, have significant limitations. The sample size is considered small and does not reflect the real population of Malaysian who are working in banking sectors. Further research on other factors impacting employees' performance in Malaysia's banking business can be considered novel.

Acknowledgments

The researchers want to express gratitude to all participants and Multimedia University for the supports in making this study possible.

References

Benson, C. A. (2002). Procedural justice, effective leadership, and organisational commitment amidst organisational change. University of California.

Borstorff, P., & Marker, M. (2007). Turnover drivers and retention factors affecting hourly workers: What is important? Management Review: An International Journal, 2(1), 14-27.

Cleverism. (n.d.). Tolerance of change and uncertainty. https://www.cleverism.com/skills-and-tools/tolerance-of-change-and-uncertainty/

Dahlberg, L. C. (2007). Supervisor-Subordinate communication during organizational change: The effects in employee trust and morale. Queens University of Charlotte.

Dale, E. (1965). Personal factors affecting the quality of communication. Management Theory and Practice.

Donohoe, A. (2019). Employee Performance Definition. Retrieved on 7 June 2019, from https://bizfluent.com/facts-7218608-employee-performance-definition.html

Erdogan, B., & Enders, J. (2007). Support from the top: Supervisors' perceived organizational support as a moderator of leader-member exchange to satisfaction and performance relationships. Journal of Applied Psychology, 92(2), 321-330. DOI:

Hajiali, I., Fara Kessi, A. M., Budiandriani, B., Prihatin, E., Sufri, M. M., & Sudirman, A. (2022). Determination of Work Motivation, Leadership Style, Employee Competence on Job Satisfaction and Employee Performance. Golden Ratio of Human Resource Management, 2(1), 57-69. DOI:

Imberman, M. D. (2009). Organizational change and organizational justice: Assessing the impact on organizational commitment, change-oriented organizational citizenship behavior, and attitude toward future change. Alliant International University.

Iqbal, N., Anwar, S., & Haider, N. (2015). Effect of leadership style on employee performance. Arabian Journal of Business and Management Review, 5(5), 1-6.

Kang, H. (2021). Sample size determination and power analysis using the G*Power software. Journal of Educational Evaluation for Health Professions, 18, 17. DOI:

Klendauer, R., & Deller, J. (2009). Organizational justice and managerial commitment in corporate mergers. Journal of Managerial Psychology, 24(1), 29-45. DOI:

Kotter, J. P. (2008). Force for change: How leadership differs from management. Simon and Schuster.

Kotter, J. P., & Schlesinger, L. A. (2009). Choosing Strategies for Change. The Principles and Practice of Change, 161-174. DOI:

Leonard, K. (2019, March 6). Importance employee performance business organization. https://smallbusiness.chron.com/importance-employee-performance-business-organizations1967.html

Maharani, I. A. D. P., & Soraya, D. (2022). Influence of Leadership and Communication on Employee Performance in Microfinance Institutions. International Journal of Multidisciplinary Research and Publications (IJMRAP), 5(1), 57-58, 2022.

McShane, S., & Glinow, M. V. (2008). Organizational behavior (4th Ed.). McGraw-Hill/Irwin.

Moe, K. (2021). What is organizational leadership and why is it important? Retrieved on 29 January 2021, from https://www.betterup.com/blog/what-is-organizational-leadership-and-why-is-it-important

Teculescu, S. A. (2010). Influence of human resources investments upon public administration. Young Economists Journal, 8(14), 75-82.

Ursachi, G., Horodnic, I. A., & Zait, A. (2015). How Reliable are Measurement Scales? External Factors with Indirect Influence on Reliability Estimators. Procedia Economics and Finance, 20, 679-686. DOI:

Valamis. (2022). Employee Development. Retrieved on 10 March 2022, from https://www.valamis.com/hub/employee-development

Vasset, F., Marnburg, E., & Furunes, T. (2010). Employees' perceptions of justice in performance appraisals: Frøydis Vasset and colleagues present a research study into the perceptions of justice in performance appraisals by nurses and auxiliary nurses in Norway's municipal health service. Nursing Management, 17(2), 30-34. DOI: 10.7748/nm2010.05.17.2.30.c7727

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 May 2024

Article Doi

eBook ISBN

978-1-80296-132-4

Publisher

European Publisher

Volume

133

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1110

Subjects

Marketing, retaining, entrepreneurship, management, digital marketing, social entrepreneurship

Cite this article as:

Hashim, H., Shamsuddin, N. S., Chelvarayan, A., & Lajis, K. N. (2024). Organisational Change Factors on Employee Job Performance in Malaysian Banking Sector. In A. K. Othman, M. K. B. A. Rahman, S. Noranee, N. A. R. Demong, & A. Mat (Eds.), Industry-Academia Linkages for Business Sustainability, vol 133. European Proceedings of Social and Behavioural Sciences (pp. 621-630). European Publisher. https://doi.org/10.15405/epsbs.2024.05.51