Abstract

Blockchain has promising potential to address several challenges in different use cases in the natural gas industry. The potential applications range from pipeline monitoring to life-cycle administration of the field assets, monitoring gas storage to auditing and reconciliation, required certification of field technical staff c to hiring employee and work effectiveness evaluation, gas exploration and production to billing and payment processes. There is no single type of solution that can be used in several areas with diverse requirements. Furthermore, blockchain incorporates certain risks that need to be carefully considered when designing solutions. There for, it is of critical importance for the managers, decision makers and solution providers to thoroughly evaluate the needs and availabilities of potential application areas and decide on the most suitable blockchain solutions. The risks are mainly listed under three main titles. The first is standard risk considerations. The second is value transfer risk considerations, and third is smart contract risk considerations. This study investigates the fundamental requirements of potential blockchain applications in several use cases in the natural gas industry. The relevant blockchain types and protocols that can be used for consensus are identified and the associated risks are discussed.

Keywords: Blockchain, consensus mechanisms, consortium blockchain, natural gas, supply chain

Introduction

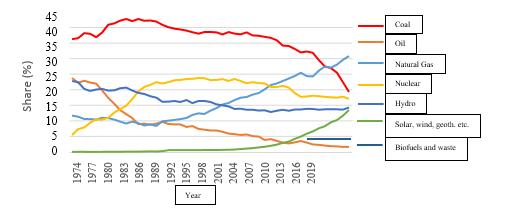

Production of natural gas at global scale had expanded in the last 10 years with a yearly compounded rate of 2.5%, except minor drops encountered in 2009 by around 2.6% and in 2020 by approximately 2.5% (International Energy Agency, 2021b). In global total electricity generatşon, natural gas has the second-largest share, by 23.5% after coal with 36.7%, outperforming the other sources [2]. In countries under OECD, it has been a unique source with a consistently increasing percentage in the overall electricity generation (International Energy Agency, 2021a) (Figure 1).

The natural gas industry has several long-standing problems (Miao et al., 2020). The outdated infrastructure of the majority of the existing natural gas pipeline networks and multiple-stage hierarchical software systems hardly meet the servicing needs of an enormous number of users and devices. Another challenge is the reliability of transactions. Currently, the gas purchase queries are iniated and validated by intermediary third party organizations without ensuring fairness, openness, and traceability in natural gas transactions. Price variations can be listed as the third major issue. The dynamic changes in natural gas resources are reflected in selling price fluctuations, which are hard to estimate in advance. Inaccuracies in gas data are another important problem. Due to relying on remote data feedback from several gas meters in the field, delayed index data usually leads to energy supply failures. There are also concerns about user information security, since users’ personal information, gas consumption, and some other important information is submitted during transactions and stored in centralized databases, which can be potentially targeted by cyberattackers for destruction or tampering. The experts in the sector appreciate the potential promising features of enhanced and advanced automation solutions and digitalization trends to improve profitability (Bazaee et al., 2020). The organizations in the gas and oil sector tend to integrate and establish recent digital solutions and make diversifications in their operational procedures (Gartner, 2019). Blockchain is one of the promising digital technologies that have significantly advanced in the past decade and expanded its areas of use in several sectors and processes, including but not limited to financial services to healthcare, mobility to supply chain management, and public governance to cybersecurity. Infrastructure and energy have also been listed among the primary areas of use of blockchain with promising benefits and opportunities. Based on IBM’s definition, “Blockchain is a shared, immutable ledger for recording transactions, tracking assets and building trust” (IBM, 2022). The participants in a blockchain network have access to the distributed ledger and immutable records. Dependence on time and sequence prevents the insertion of additional blocks between any existing two blocks and altering of former blocks. Smart contracts are a set of rules to autonomously execute fast transactions. They define the conditions for specific actions to be triggered in case of being met.

Blockchain technology can help cope with data management challenges, transaction cost reduction, prevention of mistakes and theft, and improving operational performance through wide monitoring and better maintenance. Blockchain is not a single type of solution that can be applied the same in different conditions, environments, and circumstances. There are different types and design features that could fit or might not be suitable according to the area of implementation. It is an important difficulty to evaluate and select the most beneficial blockchain type and design features. Moreover, it has certain risks and inevitable costs that need to be seriously assessed in possible applications.

A study explored the use of blockchain and edge computing for a micro gas industrial network (Miao, Song et al., 2020). Another study identifies blockchain applications and challenges in the oil and gas industry (Ahmad et al., 2022). A recent study assesses the adoption of blockchain in the midstream gas supply chain using the business process modeling method (Lyridis et al., 2021). A comprehensive evaluation of the currently available studies is made in a recent study, identifying blockchain technology maturity stages in the gas and oil industry (Bazaee et al., 2020). There is a lack of studies on determining the suitable blockchain types and characteristics based on natural gas sectoral applications and processes in detail. Furthermore, the possible risks and drawbacks of integration options have not been discussed satisfactorily. This investigates blockchain implementation opportunities in detail, considering different blockchain types and characteristics and possible risks for several natural gas industry applications and processes. Section 2 introduces the different types and characteristics of blockchain solutions and related risks. Section 3 investigates which blockchain type and characteristic could be suitable specific to each potential natural gas industry application area and evaluates possible risks along with the benefits. Section 4 summarizes the outcomes of the work and identifies possible areas of study in future research efforts.

Blockchain Types, Characteristics, and Risks

There are mainly four types of blockchain. The public (permissionless) blockchain is accessible to anyone (Albrecht et al., 2018). The participants are represented by random IDs (called as pseudonymity). This is the prominent blockchain used for Bitcoin and Ethereum. A central authority is presemt to supervise the ongoing traffic or admit new applications. This allows the participation of random and unknown devices without any initial check for trustworthiness. Two consensus mechanisms are preferred in public permissionless blockchains: Proof of Work (PoW) and Proof of Stake (PoS). PoW allows each willing miner to check and validate new transactions, while PoS selects several participants that own a stake of the network’s tokens to validate transactions. The decentralized structure provides enhanced security. On the other hand, in its applications using the PoW consensus mechanism transaction speed is low, while energy consumption is high. This structure also has high system costs.

Private (permissioned) blockchain only allows access to reliable participants, giving them the permission to read and/or write data. A single entity called as system provider has control over the network performers’ rms initial check for the trustworthiness of each participant. The system provider can roll back and reverse some processes. In addition to PoS, consensus algorithms such as Proof of Authority and Practical Byzantine Fault-Tolerant (pBFT) are preferred in private blockchains. Proof of Authority allows a single authorized node to generate new data blocks, reducing resource consumption and providing high transaction speed. PBT is based on a single authority’s permission to a network with trusted participants to validate transactions. Having a single authority brings together a single point of failure risk from the perspective of security, with the risk of causing the failure of the entire related process.

A consortium blockchain is a mid-solution between public and private blockchains, in which only reliable and confirmed participants can take part in validation of blocks. This is a permissioned blockchain governed by a group of organizations, rather than a single organization. It is more decentralized, compared to private blockchain and it provides higher security. On the other hand, the formation of consortiums involves the risk of intrusion of not trusted entities.

Public blockchain allows public viewing of all the transactions, providing full transparency. Conversely, private blockchains’ transparency to network participants or the public is controlled by the governing authority, optionally. Public permissionless blockchains allow discrete tasks around tens of transactions per second (fps), while private blockchains can perform hundreds to thousands of transactions. Especially permissionless blockchains with PoW algorithm are not suitable for high-frequency transactions. Transaction costs are relatively higher. Public blockchains are highly immutable, making it almost impossible to manipulate stored data without being detected. 50% of the network needs to be compromised in case of using PoW. On the other hand, private and consortium blockchains can relatively be tricked to alter the stored data in their distributed ledger in an easier way. Even private blockchains store several copies of the historical transactions, providing high availability even in case of successful attacks targeting permission-issuing nodes. Confidentiality is riskier for public blockchains, as even the random IDs can be analyzed to find the real entities and personal information while in private blockchains, parts of stored transactions can be cut by the central authority.

Blockchain applications incorporate several risks that need to be considered well. Deloitte (2017), categorizes possible threats to three main areas. The first is standard risk considerations. The second is value transfer risk considerations, and the third is smart contract risk considerations.

Standard risk considerations have eight subtypes. Strategic risk represents a firm’s preference to impelement the technology at an early state of its development or wait for the maturity of the technology. Moreover, it covers the network to participate in and the platform to use. Business continuity risk is the risk of service outages due to cyberattacks or failures in operation, requiring rapid incident response and very limited recovery time. Reputational risk is about complying with the existing infrastructure. Information security risk is mainly about account or wallet security vulnerabilities of the distributed database and transaction security in private permissioned blockchain type. Regulator risk is about complying with different regulations, especially in transactions at the international level. Operational and IT risks are about quickness, scale, and compliance with legacy systems during implementation. Contractual risk represents the need for service- level contracts between the participants and the network manager. Another risk, supplier risk is concerned with third-party technology providers’ related risks. There are four subtypes of value transfer risk considerations. Consensus protocol risk is related to the disadvantages of each consensus mechanism and possible vulnerabilities to cyberattacks or operational issues in the field. Key management risk is about the irreversible takeover of assets when accounts are hijacked. Data confidentiality risk is related to metadata revealing related information leakage to the other nodes in the network. Liquidity risk represents solving the conflicts based on previously determined regulations. There are four smart contract risk considerations. Business and regulatory risks are about the business, economic and legal arrangements when specifying smart contracts. Contract enforcement complies with legal constraints and monetary arrangements. Legal liability is about the risk of improper, mistaken, or intentionally tricky utilization of smart contracts. Information security risks are mainly concerned with cyberattacks. Similar 7 risks are identified in another recent study (Zhao & Chan, 2020). Legal risk is identical to regulatory risk, legal liability risk and business and regulatory risks. Technical risk is about partially operational and IT risks and can be considered as a part of strategic risk. Protocol risk is close to consensus mechanism risk and is also related to operational and IT risks. Cyber risk is related to key administration and information security risks. On the other hand privacy risk is identical to the risk about data confidentiality. Validation risk represent part of legal liability. Finally, market risk is related to reputational risk and strategic risk.

Suitable Blockchain Types and Risks for Potential Implementations

The natural gas industry has several stakeholders ranging from producer to shipper and supplier to regulator. This section describes the implementation opportunities and potential risks that need to be considered. Monitoring of natural gas network pipelines and critical points, mainly for leak detection could be one of the prominent areas of implementation. Gas pipelines allow fast transmission of gas over large distances beyond the borders. Secure operation and maintenance of the pipelines at the right time are of critical importance. Real-time monitoring systems with the features of leakage, theft, and physical attack-intervention detection, and notification can be very useful in the prevention of operational interruptions with technical and financial consequences. Blockchain can be used to authorize sensors and field devices and ensure a secure source of data. Smart contracts can be used to autonomously detect leakages in the gas transmission network and notify the responsible entities in a short time. Moreover, the maintenance and repair activities by the field crew can be recorded through blockchain, which can be traced and audited by other staff and parties on-demand. High transaction speed and security are of importance in potential blockchain applications for pipeline monitoring. Moreover, authenticated devices with known personal information would be required. Based on these needs, a consortium blockchain with PoW could be suitable.

Operationally critical data can be collected also from production fields, liquefaction plants, LNG carrier ships, LNG receiving and regasification terminals, and ultimate customers (Lyridis et al., 2021). For secure shipping, it is liquefied along the way and gasified back again. Monitoring systems can be used to trace and track the gas shipment and ensure the logistic activities are in line with the regulation’s operational principles. It can also provide useful data about the location of the shipment and the followed route. Any updates during shipment can be provided to notify the related responsible parties, and arrival times can be estimated. Immutable recording of shipment activities increases security and reliability, preventing/minimizing fraud. At certain parts of the shipment, the purity of the shipped product can be checked and the records can be traced back at any time to detect where impurities entered to the gas and who are the guilty parties for it. LNG tankers’ state of health can also be monitored through key identifiers such as temperature, humidity, pressure, volume, and others. Low transaction speed and handling of small amounts of the data stream is needed. Private or consortium blockchain types can be selected based on the priorities and availabilities specific to applications in the field. PoW and PoS seem to be more suitable. Another promising area is gas exploration and production. Exploration is done relying on geologists’ seismic methods to identify the location of reserves, which is followed by drilling of wells and testing of the quality and volume of the reserve. Exploration and extraction automation systems are centralized solutions vulnerable to errors and data corruption. Several stakeholders participate in exploration and production. Moreover, many stakeholders rent equipment from third parties. Blockchain can allow the automation of information sharing and payments. Furthermore, it can securely protect critical information. During exploration, big data from the field is collected and it needs to be stored and protected well to be used in post-processing. Any technical problems in data collection can be identified through smart contracts as well. Transparency is of higher importance in such applications. Permissionless access could be allowed with pseudonymity. Public blockchain or consortium blockchain seems to be more suitable than private blockchain in this area of use. PoW could be more suitable as the consensus mechanism. Gas asset life-cycle management is another promising area, since procurement, shipment, installation, and establishment and repair of gas assets are complex activities involving different partner organizations. Compliance of equipment to safety standards can be ensured, in addition to keeping an up- to-date inventory of assets in the blockchain platform. Buy and sell requests can be processed through the blockchain platform, along with scoring the equipment providers based on their reputations. Through the traceability feature of blockchain, the use of fabricated, uncertified, or equipment with insufficient performance or features in meeting the standards can be prevented by minimizing equipment cost, field staff safety, and service interruptions. Detailed immutable past maintenance and repair records about the equipment can provide useful information in predictive maintenance and condition-based maintenance activities. Consortium blockchain could be suitable for shared permission between several stakeholders. PoS could be a suitable consensus mechanism. Blockchain can ease billing and payment procedures as well. In the oil and gas industry, stakeholders are currently given up to 90 days to complete the payment process, due to the use of centralized systems vulnerable to cyberattacks, manual human-based settlement, and non- transparency. Blockchain can enhance payment provision, receival, and updates, providing a reliable verification option. Further checks can be performed to ensure the compliance of the payments with the related trading agreements. Eliminating the need for mediators in the transfer of payments, end to end transactions can be performed rapidly through blockchain. Blockchain can also help joint billing processes in joint ventures. Due to transparency needs, a public, permissionless blockchain with pseudonymity, with PoW could fit applications that do not require extreme transaction speeds. For microtransactions-based future applications, consortium blockchain could be more suitable, allowing relatively higher transaction speed. Regulatory compliance and accountability are important promising areas of implementation of blockchain in the natural gas industry. The stakeholders involved in the industry need to comply with state, regional and international laws, and related standards and regulations. Non-compliance can lead to license cancellation financial losses or penalties. Worker safety precautions can be tracked and ensured through blockchain as well. Moreover, the use of harmful and forbidden chemicals can be prevented. Consortium blockchain or public blockchain is suitable with PoW or PoS, due to the involvement of several stakeholders and the need for high transparency. Abandonment and restoration of wells can be traced through blockchain platforms. Temporarily or permanently abandoned wells can be ensured from the perspective of isolation. Related good abandonment, the reason for the abandonment, type of abandonment historical records of the well can be kept in a blockchain platform which could be of use in restoration. Private blockchain with pBFT, PoS and even PoA could be suitable with low system costs and relatively lower security needs. Gas waste disposal and recycling areas are also among the potential areas of implementation of blockchain. Complying with waste treatment guidelines before disposal, waste monitoring, and tracking through gathering, processing, shipping, treating, recycling, and landfilling stages can be monitored. The trust, security, fault-tolerance, and dependability of the current waste management mechanisms can be further enhanced through blockchain, minimizing illegal dumping, and shipment. Smart contracts can help manage waste treatment-based delays, fraud, and forging of data and documentation. Due to regulatory compliance and accountability needs, a consortium blockchain with PoS or PoW could be suitable. Considering the risks defined in section 2, for critical infrastructure applications such as pipeline, plant, and shipment monitoring and billing-payment, business continuity risk, operational and IT risks and information security risk needs to be taken into account, while for regulatory or multi-stakeholder applications, regulatory risk, reputational risk, and contractual risk come to the fore. In applications related to the use of public and consortium blockchains, data confidentiality risk is of importance, while for private blockchains key management risk and legal liability risk need to be considered. Liquidity risk could become dominant in billing and payment applications.

Conclusion and Discussions

This study provided an in-depth analysis of suitable blockchain solutions in the natural gas industry, highlighting suitable blockchain types that could be preferred and related risks that need to be considered. In most applications, consortium blockchain with PoW and PoS consensus mechanisms can meet the needs and expectations. In applications aiming to achieve high transparency and security, a public blockchain with a PoW mechanism could be more suitable. In applications with high transaction speed with low costs, private blockchain with even PoS, Pbft or even PoA can be a suitable alternative to consortium blockchain and PoW mechanism. For critical infrastructure-related applications and payment applications, business continuity risk, operational and IT risk, and information security risk are emphasized as the primary risks; while for high transparency, regulatory or multi-stakeholder applications regulatory risk, reputational risk, and contractual risk are stated as the prominent risks among all. Public blockchain and consortium blockchain applications need to be designed and preferred considering data confidentiality risk, while private blockchain applications involve key management risk. Billing and payment applications could be open to liquidity risks. Future studies in this area can focus on conducting case studies with the major players in the global natural gas industry, identifying organization-specific priorities and challenges, specifying suitable blockchain types, and determining ways to mitigate the related risks

References

Ahmad, R. W., Salah, K., Jayaraman, R., Yaqoob, I., & Omar, M. (2022). Blockchain in oil and gas industry: Applications, challenges, and future trends. Technology in Society, 68, 101941. DOI:

Albrecht, S., Reichert, S., Schmid, J., Strüker, J., Neumann, D., & Fridgen, G. (2018). Dynamics of Blockchain Implementation – A Case Study from the Energy Sector. in: The 51st Hawaii International Conference on System Sciences (pp. 1-10), Hawaii, USA, Jan. 2018. DOI:

Bazaee, G., Hassani, M., & Shahmansouri, A. (2020). Identifying Blockchain Technology Maturity's Levels in the Oil and Gas Industry. Petroleum Business Review, 4(3), 43-61.

Deloitte (2018, December). Blockchain risk management: Risk functions need to play an active role in shaping blockchain strategy. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/ financial-services/us-fsi-blockchain-risk-management.pdf

Gartner (2019, September). Hype Cycle for Blockchain Business Shows Blockchain Will Have a Transformational Impact Across Industries in Five to 10 Years. https://gartner.com/en/newsroom/ press-releases/2019-09-12-gartner-2019-hype-cycle-for-blockchain-business-shows

IBM. (2021, July) Blockchain. https://www.ibm.com/topics/what-is-blockchain

International Energy Agency. (2021a, July). Electricity Information: Overview-Electricity Production. https://www.iea.org/reports/electricity-information-overview/electricity-production

International Energy Agency. (2021b, July). Natural Gas Information: Overview. https://www.iea.org/reports/natural-gas-information-overview/production

Lyridis, D. V., Andreadis, G. O., Papaleonidas, C., & Tsiampa, V. (2021). A Novel Methodology using BPM to Assess the Implementation of Blockchaın in the Midstream LNG Supply Chain in: World of Shipping Portugal (pp. 1-19). Portugal, Jan. 2021.

Miao, Y., Song, J., Wang, H., Hu, L., Hassan, M. M., & Chen, M. (2020). Smart Micro-GaS: A cognitive micro natural gas industrial ecosystem based on mixed blockchain and edge computing. IEEE Internet of Things Journal, 8(4), 2289-2299. DOI:

Miao, Y., Zhou, M., & Ghoneim, A. (2020). Blockchain and ai-based natural gas industrial ecosystem: Architecture and design issues. IEEE Network, 34(5), 84-90. DOI:

Zhao, F., & Chan, W. K. V. (2020). When Is Blockchain Worth It? A Case Study of Carbon Trading. Energies, 13(8), 1980. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2022

Article Doi

eBook ISBN

978-1-80296-129-4

Publisher

European Publisher

Volume

130

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-270

Subjects

Strategic Management, Leadership, Technology, Post-Pandemic, New frontiers

Cite this article as:

Zehir, C., & Zehir, M. (2022). Identification of Suitable Blockchain Solutions for Promising Natural Gas Use Cases. In E. N. Degirmenci (Ed.), New Frontiers for Management and Strategy in the Post-Pandemic Era, vol 130. European Proceedings of Social and Behavioural Sciences (pp. 88-95). European Publisher. https://doi.org/10.15405/epsbs.2022.12.02.8