Abstract

The aim of this study is to research how organizational innovativeness and ınternal cooperation influence the firm Performance and new product performance. The survey was conducted with 270 employees. SPSS 25 Program was used for the analysis of the scales representing the variables used in the collected questionnaires. In the analysis of the data prepared using the 5-point Likert scale, firstly; factor and reliability analysis, and then correlation and regression analyzes were performed. In addition, regression analysis and sobel test were performed for the analysis of the effect of the mediation variable. In the first part of the questionnaire which consists of two parts, the questions related to the department where the employees are, their work and training are included. In the second part of the questionnaire, there are scales representing the variables examined within the scope of the research. The Internal-to-Firm Transaction Costs variable, which evaluates the mediation effect, has a positive effect on both firm performance and new product performance. This situation shows how important the control of costs is for production companies. Firms that evaluate the control of costs for performance and new product are also successful in the competitive environment.

Keywords: Organizational innovativenessinnovationfirm transaction costsfirm performancenew product performance

Introduction

Transaction cost theory defines the production and transaction costs of using the market, the costs associated with producing a product or providing services to a market, the cost of production, and the exchange between the buyer and the seller as the transaction cost. It is possible to list the transaction costs as costs arising from market research, costs related to the contract process, costs related to performance monitoring, cost of legal procedure, opportunity cost (Williamson, 1998). Furthermore, innovations are increasingly emerging in collaboration between organizational boundaries. The idea that a company has been decided based on calculating the transaction costs of its borders is often and unambiguously revealed in the academic research discourse on inter-agency co-operation. Williamson (1985) states that transaction cost theory is suitable for explaining the relationship of all kinds of change (Wikhamn & Knights, 2011). From innovation perspective, The Transaction Cost Economy relates to the make or buy options faced by any manager choosing the suitable limits of the firm when entering a new market. Innovative firms can also use other strategic workings time for intellectual property prosecution and market advantages, to achieve value from innovation (Teece, 2010, p. 281). On the other hand, Transaction cost theory focuses on difficult complex situations, including non-material capital, fixed assets and even capital structure. The cost variable provides a tremendous benefit in the routine and non-routine decisions of a business. The main advantage of this is that it creates a realistic basis for the cost variable and shows exactly where the costs are entered. Furthermore, the transaction cost theory also shapes economic activities, together with the innovation approach, in the shaping of the market mechanisms. Additionally, transaction cost theory indicated that vertical integration had low transaction costs. Nevertheless, it was claimed that significant transaction costs could also occur in-house. Transaction cost theory is also based on two important behavioural assumption: bounded rationality and the opportunism of human agents. People are deliberately rational, but their rationality is limited by their capability to define and resolve complex problems. Opportunism in-house (Alaghehband, Rivard, Wu, & Goyette, 2011). As set out in the purpose for this study, the transaction cost parameters of business organizations have been studied from the viewpoint of organizational innovativeness.

Literature Review and Theoretical Framework

Organizational Innovativeness

An innovation that is very useful in an administrative sense to an organization may not provide an additional contribution to the existing situation or structure of another organization. Accordingly, innovation will be first first adopted by the leading actors in the system, and then the pressures of the leading actors in different directions will cause the other actors in the system to adopt innovation and there will be a significant increase in the number of organizations that adopt them in the process. It is important how innovation is defined and perceived by organizations in order to expand and discuss such a discussion in the theoretical context. In order to be successful in the field of innovation, companies need to approach strategically. companies have to gain competitive advantage in their market. their performance is considered an important criterion (Dahiyat & Matsui, 2018). If firms want to stay in the market against their competitors, they need to give importance to innovation. The companies that carry out research and development activities in the field of innovation will have a strategic advantage because they will have the power to compete technologically. According to this perspective, more innovative companies are more: in a timely, creative, new way of introducing new goods or services, and sooner in changing existing offers to supply superior assets to customers. One of the important steps in gaining competitive advantage is to imitate competitors by following their products. However, this mimicry strategy can be successful for a certain period of time. Competitive advantage is sustainable in companies that give up the strategy of imitation and have distinctive features and creativity activities (Olavarrieta & Friedman, 2008). Studies on how innovation is spread in most of the studies on organizational innovation (Rogers, 1995). Organizational sense of innovation is explained as the ability of the organization to accept different ideas and to adopt an organizational atmosphere that is open to innovation and encourages thinking by creating brainstorming among employees (Lin, 2006). The aim of this study is to analyze the effects of organizational innovation on both organizational performance and new product performance.

Internal-to-Firm Transaction Costs

Transaction cost theory, which includes the study subject, is the starting point of literature in by Ronald Coase (1937)’s transaction Nature of the Firm. By pointing out the effect of Coase's transaction costs on the firm and other institutions, it has linked the market and the company hierarchy, and explained the alternative management models and revealed the costs associated with the operation of the price mechanism (Coase, 1937, p.390). Transaction cost theory plays a very important role in determining how rights are allocated in the economy. In this respect, the processes are not actually the transfer of a property or an object, but a transfer of many complex rights. Therefore, transaction costs are related to the change of rights (Coase, 1998, p.13). Then, in the Theory of Transaction Costs developed by Williamson (1985); the study by Coase was elaborated and it was tried to explain that the costs of the internal transactions of the enterprises may be lower than the market purchases due to the factors. Unlike the work of Coase (1937), Williamson (1985) used the concept of Co hierarchy “instead of” organization (Coase, 1998). At the same time, companies need to perform cost controls carefully during their operations. These costs, process costs that occur in the process related to product production, audit activities, costs arising from the increase of raw materials, etc. should be taken into consideration. Production should be realized by taking into consideration the cost increasing factors that may occur under market conditions. Because financial or economic factors that can occur under market conditions create predictable costs (Gulbrandsen, Lambe, & Sandvik, 2017). In the given theoretical context, the following hypotheses have been developed;

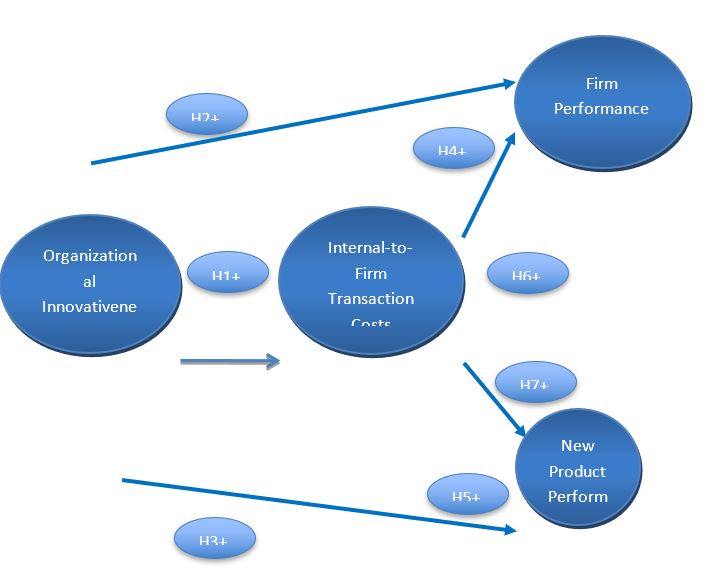

H1: Organizational Innovativeness has effect on Internal-to-Firm Transaction Costs.

H6: The relationship between Organizational Innovativeness and Firm Performance, Internal-to-Firm Transaction Costs Mediation has effect.

H7: The relationship between Organizational Innovativeness and New Product Performance is interrelated with Internal-to-Firm Transaction Costs.

Firm Performance

In order to measure whether the objectives and targets determined by the organization are fulfilled, performance criteria are examined (Ho, 2008). Firms evaluate both quantitative and qualitative criteria together when evaluating their performance. In term of quantitative criteria, it is seen that they include generally; profitability, sales growth, productivity, cost efficiency, rate of new products and the number of new supply contracts (Awwad & Akroush, 2016, p.8). Innovation is one of the most important concepts in the success of firm performance (Mone, McKinley, & Barker, 1998). In this study, the effect of organizational innovation concept on firm performance is analyzed. It confirms this idea in the empirical studies in the concept of innovation (Rogers, 1995; Cooper & Kleinschmidt, 2000). In order to be successful in the sector or in the market and to ensure the sustainability of organizations, performance is being considered as an important criterion. At the same time, to be successful in performance, innovation must be adopted by the organizations in order to achieve competitive advantage in the criterion (Li & Calantone, 1998). On the other hand, increasing the share of business in the portfolio of existing customers requires strong and long relationships with customers. The marketing literature emphasizes the importance of establishing long-term relationships with existing customers for various reasons. One of the most important criteria for successful company performance is the retention of customers and long-term commercial relations with customers. Companies that have continuous customer circulation cannot be expected to be successful in terms of performance. Without losing customers, the performance of companies that constantly gain new customers can be positive. Since consumer purchasing tendencies are constantly changing, it is very important that consumers are satisfied with their products and services. In other words, marketing, advertising and sales activities that are performed only to gain customers are not considered sufficient in today's and future competitive environment. At the same time, in order for companies to perform successfully, customers should not be lost and continuous customer acquisition is required. Therefore, customer protection programs and defense strategies are becoming more important for businesses than for customer acquisitions and sales strategies to protect existing customers and increase the share of businesses in these customers' total purchases. However, for each of the channels in which the enterprises are in contact with customers, the adequacy of existing customer service needs to be investigated and developed according to the segment of the customer. The impact of the company on management performance is analyzed (Capon, Farley, Lehmann, & Hulbert, 1992). In the given theoretical context, the following hypotheses have been developed;

H2: Organizational Innovativeness has impact on Firm Performance.

H4: Internal-to-Firm Transaction Costs have impact on Firm Performance.

New Product Performance

Globalization forces enterprises to tackle aggressive competitive strategies of challenging competitors. Continuously changing customer expectations and reducing product-life cycles in the orbit of technology rapidly transforms enterprises to continuously develop new products. Within this context, innovation is described as the company's ability and attainment to engage in new ideas, inventiveness and experience in the innovation and promotion of new products, services or operations. Within this context, Product innovation, launch a new product or present products to develop new functions. The meaning of the new concept here, business, consumer, user, manufacturer, distributor and product technology and their refers to being new for the combination. Product innovation related to a new product or service, or an existing product or it is an improvement that increases service life and competitive value Furthermore, risk taking is the intentness of an entrepreneurial firm to invest in or engage in an initiative or project that can be rather vague or unknown, such as engaging in courageous actions such as entering new markets. This means that the firm is afraid to move away from routine, riskless, reputable activities and want to enter the unknown. On the other hand, proactivity is defined as acting with the expectation of future problems, needs or changes. It represents the company's stance in search of new opportunities, anticipating future demands and needs in the market, including the introduction of new products or services in front of rivals (Aloulou, 2018). In the light of this information, organizational innovativeness strongly is associated with new product performance (Olavarrieta & Friedman, 2008). In the given theoretical context, the following hypotheses have been developed;

H3: Organizational Innovativeness has impact on New Product Performance.

H5: Internal-to-Firm Transaction Costs have impact on New Product Performance.

Methodology

In order to analyze the relationship between variables within the research model, questionnaires were collected from 300 employees. SPSS 25 program was used for the analysis of the scales representing the variables in the questionnaire. First of all, factor and reliability analyzes were performed to evaluate the scales representing the variables and factor and reliability scales were removed. Afterwards, the correlation between variables was examined by correlation analysis. Hypotheses were tested by regression analysis and sobel test was also performed to determine the effect of mediation. In the first part of the two-part questionnaire questions, questions about the demographic information and works of the participants are included. The second part of the questionnaire consists of Organizational Innovativeness, Internal-to-Firm Transaction Costs, Firm Performance and New Product Performance scales.

Research Goal

In this research, white collar workers working in the manufacturing sector; We aim to determine the effects of the relationships between Firm Performance and New Product Performance with the Internal-to-Firm Transaction Costs Interchange Variable Effect of Organizational Innovativeness. The selection of the production sector is the realization of innovation activities within this sector. The reason why white-collar engineers were chosen was the sample population because both product innovation and product technical performance were narrow. Therefore, our research aim is to evaluate and analyze the production companies both in terms of Organizational Innovativeness and performance. In order to test the propositions, a field survey was conducted using the questionnaire.

Analyses

The survey consists of 5 questions. In the first part of the questionnaire, the demographic information of the individuals and the information about the work are given. In the second part of the questionnaire, there are questions representing 5 variables. Organizational Innovativeness scale; In literature research, important studies referenced in many studies were taken into consideration; In 1990, a study by Capon et al. They were included in the analysis after being analyzed for factor and reliability using the 5-point Likert scale. Internal-to-Firm Transaction Costs were used in the measurement of the sample mass by Buvik and John (2000) and in 2017 the scale developed by Gulbrandsen and his colleagues was used. New product performance scales were measured by Atuahene-Gima and Ko (2001) and Moorman (1995). Scale; The 5-point Likert scale, which is "strongly disagree" and "strongly agree", was used. Considering the performance criteria of the last three years in our scale, the performance of the company was evaluated and it was asked to be evaluated in the 5-point Likert scale between ’Very Good-Very Bad (Homburg & Pflesser, 2000).

Findings

270 white-collar employees working in different departments of 18 firms answered our questionnaire in accordance with the criteria. 162 male 108 female white-collar respondents were included in our survey. 36.7% of the participants were in the 17-27 age group; 49.7% are in the 28-40 age group. The number of managers over the age of 41 is 13.1%. 6.8% of the workers who answered the questionnaire were high school, 16% were high school, 63.9% were university graduates. 12% have a master's degree and 1.1% have a doctorate degree. Descriptive analysis results for individual factors are shown in the table below. The level of achievement of the goals of the employees; The level of reaching the targets of the 34 participants was Very Low , the level of reaching the goals of the 57 participants was Low, the level of reaching the goals of the 137 participants was Medium, the level of reaching the targets of the 126 participants was High and the level of reaching the targets of the 46 participants was Very High 34.

Research Framework

By examining the relationships between the variables mentioned in the research model (Figure

Büyüköztürk (2005) is defined as a multivariate statistical technique that aims to discover meaningful variables by subtracting the scales representing variables, the non-meaningful or non-variable scales. In other words, factor analysis is performed in order to evaluate whether the scales representing the variables are appropriate. In the study, 5-point Likert scale was used in the preparation of the scales representing the variables. There are 30 questions in the survey. Some scales representing variables were excluded because they reduced scale reliability and showed different distributions. The remaining scales representing the variables were distributed to four factors to define the variables. All coeffecients are higher than 0.50 (Table

After the correlation analysis, where one-to-one relationships between variables were examined, In order to analyze whether hypotheses are supported or not, regression analysis was performed. 5 hypotheses were supported in the regression analyzes except mediation variable (Table

Determination of Mediation Variable (MV) Effect in Research Model; In research model, especially in determining the effect of the MV, Firm Transaction Costs; The MV role in the relationship between Organizational Innovativeness Independent Variable (IV) and Firm Performance dependent variable (DV); Firm Transaction Costs; The MV role in the relationship between Organizational Innovativeness (IV) and Firm Performance (DV); as a result of the analysis, it is stated that there is an effect with hypotheses established (Table

Sobel test is also used to analyze the effect of the MV. After regression analysis, the reason for analyzing the effect of the MV by the sobel test is to test whether the effect of the MV in both analyzes. In 1986, Baron and Kenny conducted an important study on the analysis of the effect of the MV between the IV and the DV. In this study, it was aimed to improve the mediation analysis performed by sobel in 1982. In the logic of Sobel test, the effect of the MV is analyzed by using standard error values and regression coefficients. In 1995, MacKinnon, Warsi, and Dwyer (1995) developed statistical-based methods in which the MV could be correctly evaluated. There are two main versions of the "Sobel test". These; Aroian (1947) and Goodman in 1960. Mediation variable of Internal-to-Firm Transaction Costs; analysis of the relationship between Organizational Innovativeness and Firm Performance by sobel test (Table

In order to explain the mediation effect, p value should be less than 0.05. Mediation variable of Internal-to-Firm Transaction Costs; analysis of the relationship between Organizational Innovativeness and New Product Performance by sobel test (Table

In order to explain the mediation effect, p value should be less than 0.05. Hypothesis results (Table

In our research model where Transaction Costs intermediate effect was measured, H6 and H7 hypotheses were supported in the relationship between Firm Transaction Costs and Organizational Innovativeness in the relationship between Firm Performance and New Product Performance.

Conclusion and Discussions

The fact that organizations adopt emerging innovations and that these innovations spread over time is a topic frequently discussed in the diffusion of innovations literature. Some of the researches on this subject, which have been studied in many disciplines such as sociology, economics, communication and organization theory, have focused on the explanation and modelling of the total process from the beginning to the end of the propagation of innovation. Many of the models established aim to identify the internal and external dynamics that emerged over the course of innovation and to determine different levels of change after adoption of innovation. When the subject is an organization, determining the effects of innovation on organizational structure, organizational learning and organizational change also enables the researches to be extended. For example, the type of the organization that adopts innovation, the unique characteristics of the innovation and its purpose, the level of adoption, the degree to which the degree of acceptance of innovation among organizations to be accepted and the degree of rejection are among the topics that can be investigated. Many researchers associate innovation with performance both strategically and in marketing in a highly competitive environment. Because organizations have to develop themselves and be dynamic in order to gain competitive advantage against competitors (Drucker, 2012; Hill & Deeds, 1996). In order to be successful in the performance and new product of organizations, they are successful in the promotion of creative, products and services, but also benefit their customers to provide value for products and / or services. Looking at the findings of the research, the results of the theoretical analysis are also supported (Deshpandé, Farley, & Webster, 1993; Moorman, 1995). In the case of having an innovative perspective in organizations and providing this innovation together with the control of the costs within the organization, success is achieved in company performance and the desired success is achieved in new product performance. In organizations that successfully implement innovation, performance success can be an inevitable result (Atuahene-Gima, 1996). The key to the survival of organizations is their innovation (Johnson, Meyer, Berkowitz, Ethington, & Miller, 1997). In a study by Hurley and Hult in 1998, organizational innovation is defined as a part of organizational culture, from a collective point of view, to new ideas. In other words, organizations can succeed as long as they adopt and apply innovation as a culture and achieve competitive advantage. Organizations firstly imitate products manufactured by competitors in order to support innovation activities and to launch more innovative products; they prefer the competition. The reason for the imitation of the products is to balance the advantageous position and knowledge differences in the race between the competitors, but also to lower the performances of the competitors relatively (Zander & Kogut, 1995). In order to be successful in the sector of organizations, they attach importance to cost management in order to be competitive and create a difference and to be advantageous against competitors (Golder & Tellis, 1993; Schnaars, 2002). Organizations can reach their goals more easily by analyzing the information they obtain from the market and reflecting them to their products (Dickson, 1992; Narver, Slater, & MacLachlan, 2004; Sinkula, 1994). Nowadays, rapid changes and developments in technology to reach unpredictable dimensions in the market it is of critical importance for the moves to be followed against competitors. When the analysis results are analyzed, organizational innovation and cost management can lead organizations to succeed.

References

- Alaghehband, K. F., Rivard, S., Wu, S., & Goyette, S. (2011). An assessment of the use of Transactions Cost Theory in information technology outsourcing. Journal of Strategic Information Systems, 20, 125-138.

- Aroian, L. A. (1947). The probability function of the product of two normally distributed variables. Annals of Mathematical Statistics, 18, 265-271.

- Aloulou, J. W. (2018). Impacts of strategic orientations on new product development and firm performances: Insights from Saudi industrial firms. European Journal of Innovation Management, 22(2), 257-280.

- Atuahene-Gima, K. (1996). Market orientation and innovation. Journal of Business Research, 35(2), 93-103.

- Atuahene-Gima, K., & Ko, A. (2001). An empirical investigation of the effect of market orientation and entrepreneurship orientation alignment on product innovation. Organization science, 12(1), 54-74.

- Awwad, A., & Akroush, M. N. (2016). New product development performance success measures: an exploratory research. EuroMed Journal of Business, 11(1), 2-29.

- Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51, 1173-1182.

- Buvik, A., & John, G. (2000). When does vertical coordination improve industrial purchasing relationships? Journal of Marketing, 65(4), 52–64.

- Büyüköztürk, Ş. (2005). Anket geliştirme. (Developing Survey). Türk Eğitim Bilimleri Dergisi, 3(2), 133-151.

- Capon, N., Farley, J. U., & Hoenig, S. (1990). Determinants of financial performance: a meta-analysis. Management Science, 36(10), 1143-1159.

- Capon, N., Farley, J. U., Lehmann, D. R., & Hulbert, J. M. (1992). Profiles of product innovators among large US manufacturers. Management Science, 38(2), 157-169.

- Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386-405.

- Coase, R. H. (1998). The firm, the market and the law. Chicago: The University of Chicago Press.

- Cooper, R. G., & Kleinschmidt, E. J. (2000). New Product Performance: What Distinguishes the Star Products. Australian Journal of Management, 25(1), 17-46.

- Dahiyat, E., & Matsui, Y. (2018). Lean management and innovation performance: Evidence from international manufacturing companies. Management Research Review, (42), 239-262.

- Deshpandé, R., Farley, J. U., & Webster, Jr, F. E. (1993). Corporate culture, customer orientation, and innovativeness in Japanese firms: a quadrad analysis. Journal of Marketing, 57(1), 23-37.

- Dickson, P. R. (1992). Toward a general theory of competitive rationality. Journal of Marketing, 56(1), 69-83.

- Drucker, P. (2012). The practice of management. Routledge.

- Golder, P. N., & Tellis, G. J. (1993). Pioneer advantage: Marketing logic or marketing legend?. Journal of Marketing Research, 30(2), 158-170.

- Goodman, L. A. (1960). On the exact variance of products. Journal of the American Statistical Association, 55, 708-713.

- Gulbrandsen, B., Lambe, C. J., & Sandvik, K. (2017). Firm boundaries and transaction costs: The complementary role of capabilities. Journal of Business Research, 78, 193-203.

- Hill, C. W., & Deeds, D. L. (1996). The importance of industry structure for the determination of firm profitability: A neo‐Austrian perspective. Journal of Management Studies, 33(4), 429-451.

- Ho, L. A. (2008). What affects organizational performance? The linking of learning and knowledge management. Industrial Management & Data Systems, 108(9), 1234-1254.

- Homburg, C., & Pflesser, C. (2000). A multiple-layer model of market-oriented organizational culture: Measurement issues and performance outcomes. Journal of Marketing Research, 37(4), 449-462.

- Hurley, R. F., & Hult, G. T. M. (1998). Innovation, market orientation, and organizational learning: an integration and empirical examination. Journal of Marketing, 62(3), 42-54.

- Johnson, J. D., Meyer, M. E., Berkowitz, J. M., Ethington, C. T., & Miller, V. D. (1997). Testing two contrasting structural models of innovativeness in a contractual network. Human Communication Research, 24(2), 320-348.

- Li, T., & Calantone, R. J. (1998). The impact of market knowledge competence on new product advantage: conceptualization and empirical examination. Journal of Marketing, 62(4), 13-29.

- Lin, Y. Y. (2006). An examination of the relationships between organizational learning culture, structure, organizational innovativeness and effectiveness: Evidence from Taiwanese organizations. University of Minnesota.

- MacKinnon, D. P., Warsi, G., & Dwyer, J. H. (1995). A simulation study of mediated effect measures. Multivariate Behavioral Research, 30, 41-62.

- Mone, M. A., McKinley, W., & Barker, III, V. L. (1998). Organizational decline and innovation: A contingency framework. Academy of Management Review, 23(1), 115-132.

- Moorman, C. (1995). Organizational market information processes: cultural antecedents and new product outcomes. Journal of Marketing Research, 32(3), 318-335.

- Narver, J. C., Slater, S. F., & MacLachlan, D. L. (2004). Responsive and proactive market orientation and new‐product success. Journal of Product Innovation Management, 21(5), 334-347.

- Nunnally, J. C. (1978). Psychometric theory (2nd ed.). New York: McGraw-Hill.

- Olavarrieta, S., & Friedman, R. (2008). Market orientation, knowledge-related resources and firm performance. Journal of Business Research, 61, 623-630

- Rogers, E. M. (1995). Diffusion of Innovations (4th Eds.) ACM The Free Press (Sept. 2001). New York, 15-23.

- Schnaars, S. P. (2002). Managing imitation strategies. Simon and Schuster.

- Sinkula, J. M. (1994). Market information processing and organizational learning. Journal of Marketing, 58(1), 35-45.

- Sobel, M. E. (1982). Asymptotic confidence intervals for indirect effects in structural equation models. Sociological Methodology, 13, 290-312.

- Teece, J. D., (2010). Forward Integration and Innovation: Transaction Costs and Beyond. Journal of Retailing, 86(3), 277-283.

- Thomas, J. R., Silverman, S., & Nelson, J. (2015). Research methods in physical activity, Human kinetics.

- Wikhamn, R. B., & Knights, D. (2011). Transaction Cost Economics and Open Innovation: Reinventing the Wheel of Boundary. Paper for DRUID 2011.

- Williamson, O. E. (1985). The Economic Institutions of Capitalism. London: The Free Press Collier Macmillan Publishers A Division of McMillan Inc.

- Williamson, O. E. (1998). Transaction Cost Economics: How It Works; Where It Is Headed. Economist (146), 23-58.

- Zander, U., & Kogut, B. (1995). Knowledge and the speed of the transfer and imitation of organizational capabilities: An empirical test. Organization Science, 6(1), 76-92.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 October 2019

Article Doi

eBook ISBN

978-1-80296-070-9

Publisher

Future Academy

Volume

71

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-460

Subjects

Business, innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Celtekligil, K., & Adiguzel*, Z. (2019). Investigation of the Effect of Innovation and Internal Cooperation on Product Performance. In M. Özşahin (Ed.), Strategic Management in an International Environment: The New Challenges for International Business and Logistics in the Age of Industry 4.0, vol 71. European Proceedings of Social and Behavioural Sciences (pp. 254-266). Future Academy. https://doi.org/10.15405/epsbs.2019.10.02.23