Abstract

The article reflects on the impact of financial education and technology on sustainable development methods for banks of the three global players (US, Europe and Asia-China) during the period between the global financial crisis and the pandemic crisis. The first two parts of the research highlight the relationships between the financial literacy and the degree of technological development of these three banking systems along with the results of other significant research on this issue. The third part of the research comprises the empirical study based on a series of indicators that can be assimilated to financial education and technological development, relevant indicators to the performance of the banking system, as well as indicators that can be assimilated to sustainability. The sample of analyzed countries contains a selection of 29 countries on three continents (USA, Europe and Asia-China) over a 12-year period between (2009-2020). The selection of these countries was based on the fact that together they account for about 62% of the world's GDP. The empirical study was based on the use of the Autoregressive Panel Vector methodology in order to identify the inter correlations between the indicators used in the research. Thus, the impact of each variable related to financial education and technology development in the short and long term was identified. The fourth part highlights the obtained results, together with qualitative correlations that add value to the research. The paper includes a final part with conclusions by the authors.

Keywords: Education, technology, sustainability, banking systems performance, Autoregressive Panel Vector

Introduction

Financial education is defined internationally as “the process by which consumers of financial products / investors improve their level of understanding of financial products, concepts and risks, followed by information, training and / or advice, to be able to develop the skills and self-confidence needed to be aware of financial risks and opportunities, to make informed decisions, to know where to look for support and to take other effective measures to improve the level of financial well-being” (OECD, 2015). According to this definition, financial education is a process that is not limited to acquiring an acceptable level of knowledge in the financial field, but also involves the adoption of appropriate attitudes and behaviors in addressing financial issues. The need for a coherent approach at national level to financial education has inevitably led to the emergence of national financial education strategies, which aim to establish specific objectives and directions of action of partners engaged in their development and implementation for a period of time to improve the level of financial education of the population of a country.

National financial education strategies initially appeared on the public agenda of developed countries in the early 2000 (OECD, 2013), (e.g., Japan, the United Kingdom, the Netherlands, the USA, etc.) after the 2008 crisis, with an expansion of these practices, more and more countries (OECD, 2013) deciding to coordinate and promote collective action to improve financial capacity among the population.

Currently, as a result of globalization and especially increased digitalization, almost all regions of the planet are connected by a series of well-defined trade routes, which ensure the delivery of raw materials, components or finished products to global consumers of a global market.

From the backstage of politics to academic platforms, the whole world is talking about global crises: a health crisis, an economic and financial crisis, a climate crisis and a nature crisis. Ultimately, all of these are symptoms of the same problem: the unsustainable way we produce and consume. The shock of the COVID-19 pandemic has only revealed the systemic fragility of the world economy and our society, with all the inequalities that characterize them.

The COVID-19 pandemic and containment measures have affected consumption and production patterns to some extent. The pandemic has shown how closely linked and interdependent our economy and societies are. Whether it is health or economic, a crisis can spread easily, and its impact can be felt around the world if coordinated and firm action is not taken from the outset.

Global economic developments have contracted sharply since the onset of the COVID-19 pandemic, and the outlook continues to be uncertain. Efforts to support the economy of authorities around the world have had the primary effect of improving investor and consumer sentiment. This crisis has shown, more than previous crises, the need for a change in the structure of economies, with a focus on environmental protection, implementation and support of technological innovations in the digital field, increasing inclusion and reducing inequality. Moreover, the current crisis will require remarkable efforts to ensure the sustainability of accumulated debt, both in the public and private sectors.

Peter Drucker (2014) one of the most well-known educators and management consultants in the world, said in one of his works that a company must "innovate or die", the ultimate goal of innovation being for companies to maintain its competitiveness and relevance to customers.

In the financial field, innovation is often a consequence of the development of technology that can help companies in the banking or non-banking financial sector to solve inefficiencies of business models (i.e., how they generate revenue) and meet the ever-changing needs of consumers of financial products. Technological innovations are useful when they are generating added value and when company managers decide that they can be capitalized in accordance with business strategies. In general, it can be said that financial innovations are good for society, although there have been periods in recent economic history in which, as a result of insufficient regulation, financial innovations have had adverse consequences, an eloquent example being the financial crisis of 2008-2009.

The financial sector is also conservative due to the fact that unlike other industries it is highly regulated and operates according to much stricter rules. However, the digital revolution of the last 15-20 years has led to an acceleration of technological innovation in the financial field. The Covid-19 health crisis and the challenges posed by it have further accelerated the adoption of technology by non-bank financial companies, in recent years they have made many investments in this regard. Technology in the financial field (or FinTech as it is generically called) has a very large number of applications, such as blockchain, artificial intelligence and machine learning, big data, as well as other categories of technology applications in the non-banking financial field.

Thus, through FinTech-type solutions, financial service providers are able to more efficiently manage the increasingly complex requirements of compliance with prudential rules, developing automated processes designed by specialized professionals. Thus, financial institutions can benefit from a certain organizational comfort in front of the regulatory and supervisory authority, and this, in turn, guarantees the existence of an adequate, automated and continuous system, which ensures the transparency of the way legislative requirements are implemented and managed.

The use of technology also helps to reduce the risks posed by human error. Thus, the technologies in question support the improvement of both operational and credit risk management processes, generating substantial cost savings.

Literature Review

This chapter critically reviews some of the empirical studies related to the impact of education and technology on sustainability and profitability in the banking sector. It is a summary of the studies conducted and describes the conceptual framework for the topic addressed in this paper.

The banking sector has essentially an important role in reaching the sustainability. According to Tarkhanova (2018), the financial sector can attain sustainable development and at the same time make sufficient financial profits by using the development of new and advanced environmentally-friendly technologies. For quite a long time, various financial institutions have been concentrating on generating profit without focussing on environmentally-friendly technologies or sustainable, but lately the positive trend of the technologies opened new horizons and gave new hope for the development and growth of the banking sector. Accordingly, the sustainable development should be simultaneously environmentally friendly, socially responsible and economically realistic.

A recent paper that investigates the efficiency and the productivity growth of the banking industry was written by Shair et al. (2021). They use the GMM (generalized method of moments) model because of its ability to overcome unobserved endogeneity, autocorrelation, and heterogeneity issues. The results of the study show that the risk of insolvency has a negative effect on the efficiency and banking productivity growth. So, they consider that while the development of the banking sector is negatively linked to environmental sustainability, banking development successfully allocates its financial resources to the development of energy efficient technology.

Nejad et al. (2021) and Moro-Visconti et al. (2020) investigate the social sustainability of the technology management process and propose an integrated decision-making model. They constructed their own model utilizing the AHP (Analytic Hierarchy Process) and they implemented it for E-banking technologies in Iran's AgriBank (one of the oldest banks of Iran). Their results indicated that internal exploitation, internet banking and internal R&D are the best decision alternatives from the social sustainability perspective.

Another paper that contributes to the academic research in the same field is The Impact of the COVID-19 Pandemic on the Banking Sector written by Marcu (2021). In her work she is exploring the banking strategies implemented during complex crises, and she focuses on the recent pandemic. In order to improve the understanding of the economic consequences of the crises, she analizes the differences between the financial crisis from 2008 and the coronavirus crises. In all previous crises, banks have been seen as part of the problem, however this time they are considered as part of the solution. This approach enhances the role of banks in the pandemic crisis, and the strategies adopted by them influence the whole economy. For example, although the need for innovation was always an important factor in banking, the pandemic accelerated digitalization in the banking system. The author also presents an opinion based on an analysis of the literature and a brief summary of the most important factors that redesign the banking system in the context of the COVID-19 pandemic.

Financial development has huge significance in a permanent changing environment and can enhance banking efficiency and also improve banking performance. Xie et al. (2022) conducted a study to investigate the impact of revenue diversification on the bank efficiency of Asian emerging economies over 2008–2019. They apply the quantile regression technique to estimate the bank efficiency in their analysis and find out the most important indicators that influence banking profitability. The authors conclude that the diversification of banking processes is vital for the development of socioeconomic activity, because it sets out sustainable goals and stimulates financial development.

Nevertheless, the sustainability of the banking industry is constantly being challenged that must be faced to maintain its efficiency and profitability. Currently, we highlight six challenges that banks are facing and that arose after the crisis:

- Obsolescence of traditional business models. On the one hand, the reduction of margins due to very low interest rates challenges the profitability of banks. On the other hand, the loss of customer confidence in banks favors the development of Shadow Banking (KPMG, 2019).

- Greater regulatory pressure. The last crisis revealed major weaknesses in the financial system that led the competent authorities, driven by social pressure, to promulgate regulations that require a certain level of deleveraging, reducing ROE and growth expectations and increasing operating costs in technological and humans’ terms (Solas, 2020).

- Loss of confidence on the part of society. The fact that large banks were rescued with public money after the economic crisis generated rejection and meant a deterioration in the reputation of banking entities. Globally, only 29% of customers trust banks to look after their financial well-being (FUNCAS, 2020).

- New technological challenges. Blockchain, AI, Cloud Computing and other technologies will mark the future of banking. In a context where returns are increasingly tight, banks must innovate and bet on technological infrastructure that supports the business models that are emerging (McIntyre et al., 2020).

- A customer-centric business model. Both customer preferences and behavior have changed, so banks must adapt to this new reality. Customers are increasingly demanding and therefore banks, relying on technological advances, have to be able to meet these demands by offering a personalized service (Ochoa et al., 2016).

- Changes in the market structure. New competitors such as Bigtech or Fintech have appeared. The former has been acquiring more and more importance by making use of Big Data and other technologies; while the latter try to impose a new way of doing banking (Deloitte, 2020).

In conlcusion, although the experimental methods used by the authors differ from one paper to another, their empirical studies have provided incontrovertible evidence over the impact of financial education and technological progress on sustainability and profitability in the banking sector.

Research Methodology

This research aims to contribute to the literature by identifying answers to a complex question: how can technological development indicators impact the sustainability and profitability of three global banking players: the US, China and Europe.

The study outlines three working hypotheses, formulated as questions, in order to build an appropriate framework, based on the six variables used and presented in Table 1:

Can technological development indicators influence bank performance and profitability?

Does the degree of technological development in banking have a negative impact on the reduction of Co2 emissions?

Which indicators of technological development, have a low impact on bank profitability and sustainability?

For this research, a total of 29 countries on three continents, North America, Europe and Asia, were selected and was used the World Bank's databases such as: Global Financial Development. DataBank. (n.d.) and World development indicators (DataBank, n.d.).

The time period over which the research was conducted was a 12-year period - between 2009-2020, and the choice for the group of countries was made, taking into account the fact that these three global players (US, Europe and Asia-China) account for about 62% of global GDP.

The research methodology used in this empirical study comprised 348 observations that were used in a linear regression and panel vector analysis (PVAR) using the Eviews 12 application. The data series used in this research are annual in frequency and countries have different degrees of evolution and development.

In order to identify the influence and impact of technological indicators on bank performance and sustainability, a quantitative set of financial instruments was used, taking into account two independent variables: (ROA - return on assets and Co2 emissions). Thus, we measured the impact of each independent variable on each of the two dependent variables included in the research both in the short term and in the medium and long term, in the context of the global financial crisis of 2008 and the pandemic crisis (Covid 19) of 2020.

For the estimation of the linear regression model and the panel vector (PVAR) it was necessary to evaluate and test some basic characteristics of all the data series used, as well as the specific assumptions of each econometric model used.

The countries included in this empirical research were the USA, Europe and Asia-China, and the selected European countries were: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

All the variables that have been used are presented in Table 1, and for the accuracy of the data both from an economic and statistical point of view, we have used two endogenous variables (ROA - return on assets and Co2 emissions).

Research Results

The use of technology in financial services Fintech, according to TheFinRegBlog (2020) and in particular in sustainable finance, has the potential to channel financial resources more efficiently to environmentally sustainable businesses.

According to Du and Liu (2022), fintech can help record and transmit extensive, accurate and relevant data at a low cost and at a fast pace, thus reducing research costs and improving the pricing of environmental risks and investment opportunities, and with the help of AI (artificial intelligence) and applications created specifically by the Bigtech giants, the evolution of sustainable projects financed by banks can be monitored.

In order to identify the significance of the variables used in the empirical models in this research, in the short, medium and long run we used the VARDL (Vector Autoregressive Distributed Lag) cointegration test, which is presented in Table 2.

Based on this test, we considered it appropriate to use two dependent variables - return on assets and the level of CO2 emissions. Thus, we can see that in the short term, even if the impact of the variables on technological development represented by (the volume of electronic payments and the degree of financial intermediation through Fintech and Bigtech companies) is statistically insignificant, investments in the development and implementation of new technologies and applications adapted to the banking industry have a negative impact from an investment point of view.

In the long term, we can see that the impact of investments in technology transfer and financial literacy becomes positive and significant both statistically and economically.

In this research, the size of the significance percentages of the technological development and financial intermediation variables plays an essential role in the short, medium and long term.

Thus, the VARDL (Vector Autoregressive Distributed Lag) model used was based on the Akaike AIC information criterion, and according to this criterion, in Table 2, we can see that in relation to the 5% significance level, we have both positive and negative relationships between the variables used.

In the short term, in the case of the dependent variable return on assets, a 1% increase in Fintech and Bigtech financial intermediation will decrease return on assets by 46.69%, while a 1% increase in the volume of electronic payments will decrease return on assets by 0.17%. For a 1% increase in the volume of renewable fuels used, return on assets will decrease by 0.24%, while for a 1% increase in return on equity, return on assets will increase by 0.02%.

When the dependent variable becomes the volume of Co2 emissions, in the short term we can note that a 1% increase in the degree of Fintech and Bigtech financial intermediation, the volume of Co2 emissions will decrease by 27.67%. For a 1% increase in the volume of electronic payments made, the volume of Co2 emissions will decrease by 1.97%, while for a 1% increase in the volume of renewable fuels used, the amount of Co2 emissions will decrease by 0.28%. For the same 1% increase in return on equity, the amount of Co2 emissions will decrease by 0.049%.

In the long term, for the dependent variable return on assets, for a 1% increase in Fintech and Bigtech financial intermediation, return on assets will increase by 2.59%, while for a 1% increase in electronic payments volume, return on assets will increase by 0.2%. For a 1% increase in the amount of renewable fuels used, return on assets will increase by 0.05%, while for the same 1% increase in return on equity, return on assets will increase by 0.03%.

If the dependent variable becomes the amount of Co2 emissions, a 1% increase in the degree of Fintech and Bigtech financial intermediation will result in a 5.38% increase in C02 emissions. Also, for a 1% increase in the volume of electronic payments, the level of Co2 emissions will increase by 22.2%, while for a 1% increase in the amount of renewable fuels used, the level of Co2 emissions will increase by 9.9%. For a 1% increase in the amount of equity used, the level of Co2 emissions will increase by 0.7%.

Following the analysis of the indicators in Table 2, we can see that despite the short-term impact, which is negative due to investments in financial education and the development of new banking applications and technologies, the long-term impact of investments is positive on the return on assets and for the level of CO2 emissions.

As far as the impact of new technologies on sustainable development is concerned, this needs to be done at a sustained but not very accelerated level in order to gradually reduce the carbon footprint in the medium and long term.

For most EU27 countries, the US and China, the variables considered for technological developments - the degree of Fintech and Bigtech financial intermediation and the volume of electronic payments - are the statistically significant variables in the short term.

Also, within the EU 27 we can notice a number of countries such as France, Germany and Spain, where both variables considered for technological development are insignificant or only one of them is statistically insignificant.

For France, the Fintech and Bigtech financial intermediation degree and electronic payments volume variables are 16.6% and 8.22% respectively. For Spain, the statistically insignificant variables are also the level of electronic payments and the degree of Fintech and Bigtech financial intermediation with probabilities of 90.28% and 99.83% respectively, and for Gemany, the statistically insignificant variable is the degree of Fintech and Bigtech financial intermediation with a probability of 98.32%. Within these countries the statistical significance is well above the 5% significance threshold, with the variables becoming insignificant in the short term.

This highlights the fact that from an economic point of view, in these countries the degree of digitization and technological development is at a lower level, at a pace that is not very accelerated so that the impact on economic growth, sustainability and reduction of CO2 emissions is significant in the medium term but especially in the long term, but in a manner that does not affect very strongly economic growth in the short term.

Although the impact of the variables considered for the degree of technological development in the financial banking sector, although statistically significant, is economically low in intensity in both the medium and long term, this suggests that increasing investment in this area at a sustained pace is a driving force for sustainable economic growth that will bring social, environmental and ecological benefits, as the authors show (Chueca Vergara & Ferruz Agudo, 2021).

In Table 3, we used variance decomposition to identify the proportion of the variation in the dependent variables explained by each independent variable used, and to analyze the percentage impact of the technology development and financial intermediation variables on the profitability and sustainability for the three global banking systems.

We can also recall from Table 3 that the strongest impact is recorded when a direct shock is applied in turn to each dependent variable, and for each of the variables used and analysed a specific time interval was considered for each interval analysed, as follows: short term - a period of (1-2 years) was analysed, medium term involved the analysis of an interval of (3-5 years) and long term involved the analysis of an interval of (5-12 years).

In the short term (1-2 years) we can observe that the impact of the variables specific to technological development is low - the degree of Fintech and Bigtech financial intermediation and the level of electronic payments being 0.00018% and 0.22% respectively when the dependent variable is the return on assets, and when the dependent variable becomes the level of CO2 emissions - the impact of these technological variables becomes 0.0071% and 0.00094% respectively.

In the medium term (3-5 years) - the research shows that the impact of the technological variables used - the degree of Fintech and Bigtech financial intermediation and the level of electronic payments have a moderate impact on the return on assets being 0.0014% and 0.35% respectively, and on the dependent variable the level of CO2 emissions - the impact is 1.36% and 0.51% respectively.

Following the analysis of the time interval - long term (5-12 years), the research shows that the impact on the dependent variable return on assets from the variables of technological development and financial intermediation - the degree of financial intermediation Fintech and Bigtech and the level of electronic payments will be: 0.0016% and 0.36% respectively, and when the dependent variable becomes the level of CO2 emissions, it can be seen that the impact of technological and financial intermediation variables will be: 1.55% and 0.79% respectively.

Regarding the answer to Question 3, following the analysis carried out, we identify that both variables of technological development - the degree of Fintech and Bigtech financial intermediation and the level of electronic payments - have a reduced impact in the medium and long term due to the fact that the adoption of new technologies, both financial and environmental, requires a more efficient risk management and a correct understanding of customers' behaviour and actions.

Thus, banking regulatory and supervisory instruments will have to adapt in the future and balance profitability, competition, stability and sustainability in global banking between financial service providers and players in the banking industry (Feyen et al., 2021).

The analysis of the impact of the adoption of new technologies and appropriate financial education, according to OECD reports (2013, 2015) reports, needs to be done in a broader context, starting from the global financial crisis of 2008 which had a determining role on banks to adopt sustainable activities, contributing to the reduction of bank profitability, which with the Covid 19 pandemic crisis of 2020 turned into a need for banks to collaborate with Fintech and Bightech industries (Moden & Neufeld, 2020; KPMG, 2020).

The collaboration between the banking industry and the Fintech and Bigtech industries has been focused on developing applications that keep customers safe during social isolation and allow for the protection of customer data, that contribute to increased banking performance and that are also sustainable.

New rules also need to be defined on the identification of the type of data that is allowed for each financial service offered, as well as the control of this data, in a way that offers protection to individuals and balances the relationship between profitability, sustainability, privacy and consumer protection.

Thus, following the analysis of the different timeframes, we can notice that in the medium and long term, in order for the variables of technological development and financial intermediation to have a significant impact on the profitability of banking and the sustainability of banking systems, it is necessary for global banking systems to make constant and consistent investments both in the field of creating new applications to guide investors towards sustainable investments, but also for the subsequent monitoring of all these green projects, with a view to a significant annual reduction of the carbon footprint.

The collaborative relationship between banks and Fintech companies can also contribute to the promotion of banks by attracting new customers, and the competition between them allows them to improve their product innovation capacity, thus representing the answer to question 1.

The answer to Question 2 is partially validated, considering that the impact of the variables of technological development and financial integration in the short term on CO2 reduction is negative, in the long term the impact of these variables will become positive, but for an effective reduction of CO2 emissions it is necessary that global banking players make major investments in technological development and sustainability at the same time.

Thus, FinTechs through mobile banking and digital payments together with unregulated BigTech players (such as Amazon, Apple, Google or Facebook) broker data and consumer relationships using standard interfaces that help promote sustainable development as well as green finance (Zetsche et al., 2017).

This requires finding a balance between the world of traditional banks, profitability and acceptance of new business models such as FinTech, which are increasingly involved in supporting the Sustainable Development Goals. Financial technology is also an excellent tool for building sustainable communities and eliminating poverty (Al Hammadi & Nobanee, 2019), as it promotes responsibility, responsible consumption and production, encouraging gender equality in both developed and developing countries.

The results of the empirical analysis show the existence of a cointegrating relationship between the indicators of technological development, those of sustainable development and those of bank financial performance, which, although in the short term for almost all the countries analysed, have a negative impact, in the medium and long term, this impact becomes positive and statistically insignificant, but at the same time economically significant.

This suggests that the blending of traditional banking systems and new fintech business models in the global banking sector is only just beginning, and that the transmission of the shocks of investing in new financial technologies is both directly and indirectly transmitted to banking performance and sustainable development, and that increased investment in both new financial technologies and green energy is needed to reduce the carbon footprint, simultaneously and at a steady pace.

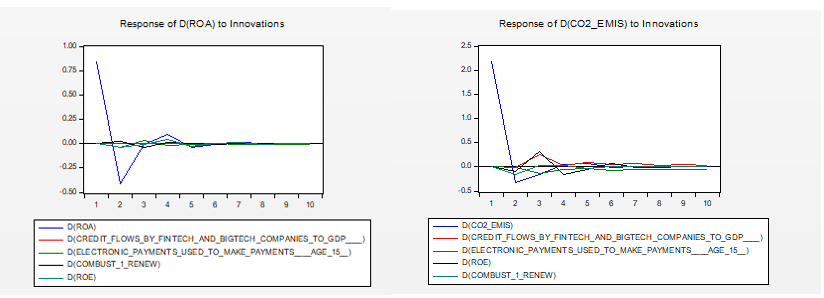

Figure 1 highlights the impulse response function of the independent variables used on each of the two dependent variables - return on assets and level of CO2 emissions, but also shows the correlations between the independent variables used in the empirical study.

Thus, the shock on the return on assets generated by the indicators of technological devolution in the banking sector will have a decreasing trend becoming negative in the first two years, then follows an increasing and positive trend - years (3-5), then again following a decreasing and negative trend in years (5-7), and then returns to a constant level after 7 years.

Concerning the shock felt by the dependent variable the level of Co2 emissions due to the impact of technological development variables, it also has a decreasing and negative trend in the first four years, then its trend becomes increasing and positive between years 4-5, during year six its trend becomes negative again, and from year seven it returns to a constant level.

Thus, the sustainable finance and Fintech sectors share many common aspects, and the link between them offers complex synergies that through certain Fintech applications (in particular crowdfunding, tokens and DLT systems, data analytics, AI and machine learning) can fill some of the gaps highlighted in sustainable finance, especially in terms of transparency, verification, availability and reliability of information, data and ratings (Macchiavello & Siri, 2022).

Given that almost all banks are investing in emerging technologies and innovations to boost their platforms and offer top-notch services to customers, creating a competitive advantage and improving their business figures, they should launch occasional programs or courses to educate customers who are not willing to go digital (Singh et al., 2021).

This would help banks to explore this untapped market and create a new customer base, so banks should advertise or market their latest technological innovations to the customers, who contribute most of the profits, such as professionals in different fields and students etc.

Also, banks that base their medium and long-term growth strategies on ESG principles will be able to generate substantial increases in their profits by making mixed investments in both sustainable finance sectors and technological innovations, which will have a positive impact globally (Shao et al., 2020).

Financial technologies have the potential to reduce costs by maximising economies of scale, increasing the speed and security of transactions, but at the same time authorities and policy makers need to establish new regulations to enhance the integration of these new financial technologies by banks and consequently improve the stability and prosperity of the financial sector. However, legislation also needs to be similarly strengthened to supervise banks in the area of environmental technology and to guarantee the security of the new services and products developed for consumers (Chhaidar et al., 2022).

In order to respond to the technological demands on consumers, banking systems are adopting financial technology features to improve the user experience, which have a significant medium to long-term impact on banking performance and sustainability. As the entire banking system evolves, allocating resources to digital agility through specific banking products and services, banks can also provide financial support to educate and influence customer preference for investing in sustainable projects.

The regulatory framework to be considered with regard to the relationship between banks and fintech is important to contribute to a level playing field in the provision of financial services and to avoid unjustified discrepancies, which may affect the competitive position of traditional operators such as banks vis-à-vis new entrants - fintech and big tech financial service providers, who may gain dominant positions, which they can then use to adopt anti-competitive practices.

Thus, cooperation between the three global banking players - the US, Europe and China on the international regulatory framework can show significant results in terms of the balance between financial education, financial technology, bank training and sustainability, and a level playing field.

If the promotion of these objectives interferes with the level of competition, then the governments of each country must decide on the choice of certain competitive public policy objectives in order to achieve the objectives of financial technological development, sustainability and improved banking performance in the medium and long term.

Conclusions

The process of integrating financial education and financial technology along with increasing banking performance and investing in sustainable projects and renewable energy in the medium and especially the long term represents significant challenges both for the three global banking players: the US, Europe and China, and for most banking systems globally.

Converting these significant challenges into strategic solutions can be achieved by using a new combination of policies: bank and fintech regulatory, monetary, competition and environmental, adopted at the level of each individual banking system, but at the same time connected and managed internationally.

The integration of fintech and financial education into global banking systems will be a benchmark for future "high-performing, green and technology-enabled" banks that are in line with the evolution and trends of new economies.

Thus, the development of business models based on financial education and digitization in order to finance a higher percentage of investments in digitization and sustainability will contribute to bringing competitive advantages to banking systems, starting from influence, position in global banking markets and making a smart contrast for the future with banking systems less or not at all oriented towards digitization, financial education and sustainability.

This process will generate a significant impact on multiple levels, at the level of each global banking system, starting from the banking organisational level, from a technological and educational perspective, contributing to influencing customer perception of the era of banking digitalisation and sustainability, and ultimately having an impact at the systemic level.

This research highlights the crucial future role of financial education, financial technology and the variables used in this empirical model on bank sustainability and performance, as well as the degree of interconnectedness with the rest of the selected variables, in which the main role is played by digitization and monitoring of investments in sustainable projects, starting from the role of financial education and customer persuasion in this future direction, in which the results of the research conducted are also consistent with the rest of the significant studies in this field.

In order to have a significant medium and long-term impact on banking performance, profitability and sustainability, financial technology must be integrated with financial education and carbon footprint reduction. Thus, contrary to the risks of diminishing profitability in the short term, constant and concomitant investments in digitalisation, financial technologies, financial education and renewable energy will make a significant contribution to profitability, generating high banking performance in the medium and long term, but also being in line with environmental conservation and protection for future generations.

Thus, financing digitisation and sustainability can make a major contribution to a level playing field, generating a strong impact on the general public and global economies by integrating innovation and artificial intelligence to generate new jobs and acting as a radical stimulus to monitor and control investments in financial technologies and sustainable projects with the help of artificial intelligence.

Acknowledgments

No funding for this research. There is no conflict of interest in the realisation of this research.

References

Al Hammadi, T., & Nobanee, H. (2019). Fintech and sustainability: a mini-review. DOI:

Banking on the Future: Vision. (2020). In Deloitte. https://www2.deloitte.com/content/dam/Deloitte/in/ Documents/financial-services/in-fs-deloitte-banking-colloquium-thoughtpaper-cii.pdf

Chhaidar, A., Abdelhedi, M., & Abdelkafi, I. (2022). The Effect of Financial Technology Investment Level on European Banks’ Profitability. Journal of the Knowledge Economy, 1-23. DOI: 10.1007/s13132-022-00992-1

Chueca Vergara, C., & Ferruz Agudo, L. (2021). Fintech and Sustainability: Do They Affect Each Other? Sustainability, 13(13), 7012. DOI: 10.3390/su13137012

Drucker, P. (2014). Innovation and Entrepreneurship (1st ed.). Routledge. DOI: 10.4324/9781315747453

Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., & Saal, M. (2021). Fintech and the digital transformation of financial services: implications for market structure and public policy. BIS Papers. Bank for International Settlements, number 117. https://ideas.repec.org/b/bis/bisbps/117.html

Global Financial Development. DataBank. (n.d.). Retrieved May 8, 2022, from https://databank.worldbank.org/source/global-financial-development

KPMG. (2020, September). Digitalization in banking beyond-Covid-19. https://assets.kpmg/content/dam/ kpmg/be/pdf/2021/Digitalization-in-banking-beyond-Covid-19.pdf

Lv, S., Du, Y., & Liu, Y. (2022). How Do Fintechs Impact Banks’ Profitability? An Empirical Study Based on Banks in China. FinTech, 1(2), 155-163. DOI: 10.3390/fintech1020012

Macchiavello, E., & Siri, M., 2022. Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green Fintech’and ‘Sustainable Digital Finance’. European Company and Financial Law Review, 19(1), 128-174. DOI: 10.1515/ecfr-2022-0005

Marcu, M. R. (2021). The impact of the COVID-19 pandemic on the banking sector. Management Dynamics in the Knowledge Economy, 9(2), 205-223. DOI: 10.2478/mdke-2021-0013

McIntyre, A., Van Der Ouderaa, E., Kirk, P., Bertelsen, A., & White, K. (2020, December 8). Banking Consumer Study: Making digital banking more human. Accenture. https://www.accenture.com/us-en/insights/banking/consumer-study-making-digital-banking-more-human

Moden, N., & Neufeld, P. (2020). How Covid-19 has sped up digitalization for the banking sector. https://www.ey.com/en_gl/financial-services-emeia/how-covid-19-has-sped-up-digitization-for-the-banking-sector

Moro-Visconti, R., Cruz Rambaud, S., & López Pascual, J. (2020). Sustainability in FinTechs: An explanation through business model scalability and market valuation. Sustainability, 12(24), 10316. DOI: 10.3390/su122410316

Nejad, M. C., Mansour, S., & Karamipour, A. (2021). An AHP-based multi-criteria model for assessment of the social sustainability of technology management process: A case study in banking industry. Technology in Society, 65, 101602. DOI: 10.1016/j.techsoc.2021.101602

Ochoa, B., de Salas Lasagabaster, A., & Robredo Núñez, M. (2016). The new Banking value creation model based on Disruptive Technologies. Minsait. https://www.minsait.com/en/news/insights/bankings-new-value-creation-model-based-disruptive-technologies

Organisation for Economic Co-operation and Development. (2013). Advancing National Strategies for Financial Education. OECD Publishing. https://www.oecd.org/finance/financial-education/G20_ OECD_NSFinancialEducation.pdf

Organisation for Economic Co-operation and Development. (2015). National Strategies For Financial Education. OECD/INFE Policy Handbook. https://www.oecd.org/daf/fin/financial-education/National-Strategies-Financial-Education-Policy-Handbook.pdf

Restoy, F. (2021). Fintech regulation: how to achieve a level playing field. Financial Stability Institute, Bank for International Settlements. https://www.piie.com/sites/default/files/documents/restoy-2020-03-10ppt.pdf

Shair, F., Shaorong, S., Kamran, H. W., Hussain, M. S., Nawaz, M. A., & Nguyen, V. C. (2021). Assessing the efficiency and total factor productivity growth of the banking industry: do environmental concerns matters? Environmental Science and Pollution Research, 28(16), 20822-20838. DOI: 10.1007/s11356-020-11938-y

Shao, L., You, J., Xu, T., & Shao, Y. (2020). Non-Parametric Model for Evaluating the Performance of Chinese Commercial Banks’ Product Innovation. Sustainability, 12(4), 1523-1538, DOI:

Singh, R., Malik, G., & Jain, V. (2021). FinTech effect: measuring impact of FinTech adoption on banks' profitability. International Journal of Management Practice, 14(4), 411-427. DOI: 10.1504/IJMP.2021.116587

Tarkhanova, E. A. (2018). Innovations and sustainability in the financial and banking sectors. Terra Economicus, 16(2), 75-82. DOI: 10.23683/2073-6606-2018-16-2-75-82

TheFinRegBlog. (2020, October, 23). Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green FinTech’. https://sites.law.duke.edu/thefinregblog/2020/10/23/sustainable-finance-and-fintech-can-technology-contribute-to-achieving-environmental-goals-a-preliminary-assessment-of-green-fintech/

World development indicators. DataBank. (n.d.). Retrieved May 8, 2022, from https://databank.worldbank.org/source/world-development-indicators

Xie, Z., Liu, X., Najam, H., Fu, Q., Abbas, J., Comite, U., Cismas, L. M., & Miculescu, A. (2022). Achieving Financial Sustainability through Revenue Diversification: A Green Pathway for Financial Institutions in Asia. Sustainability, 14(6), 3512. DOI:

Zetsche, D. A., Buckley, R. P., Arner, D. W., & Barberis, J. N. (2017). From FinTech to TechFin: the regulatory challenges of data-driven finance. NYUJL & Bus., 14, 393. DOI:

Copyright information

-

About this article

Publication Date

30 December 2022

Article Doi

eBook ISBN

978-1-80296-959-7

Publisher

European Publisher

Volume

3

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-245

Subjects

Education, educational psychology, pedagogy, positive pedagogy, special education, second language teaching

Cite this article as:

Anghel, C., Ciurel, A., & Seresoan, A. (2022). The Impact of Education and Technology on Sustainability and Profitability in the Banking Sector. In A. Güneyli, & F. Silman (Eds.), ICEEPSY 2022: Education and Educational Psychology, vol 3. European Proceedings of International Conference on Education and Educational Psychology (pp. 81-96). European Publisher. https://doi.org/10.15405/epiceepsy.22123.8