Abstract

The COVID-19 pandemic is an unprecedented event that creates tremendous uncertainty and generates a huge demand for information from investors. This paper aims at investigating the Coronavirus 2019 (COVID-19) disclosure practices of Malaysian public listed companies operating in the energy industry. The content analysis of annual reports is used to examine the COVID-19 disclosure practices of 28 energy companies for the year 2021. On average, these companies reported 57.39 sentences of information related to COVID-19, with a minimum and maximum score of 7 and 159 sentences, respectively. Most of the information is found in the Sustainability Statement and Management Discussion and Analysis (MD&A) sections. From the findings, there is a large variance in the information reported and companies tend to disclose qualitative information with a minimal level of quantitative information. To our best knowledge, this is one of the first kinds of studies undertaken to examine COVID-19 disclosure in the context of Malaysia.

Keywords: Annual reports, COVID-19 disclosure, energy companies, Malaysia

Introduction

The COVID-19 pandemic is affecting the whole world in every industry and has caused enormous challenges for the development of the global economy and significant market volatility and uncertainty (Elmarzouky, Albitar, Karim, et al., 2021; Wang & Xing, 2020). As COVID-19 is considered as a systematic risk, stakeholders have exerted increasing pressure on companies to deal with the uncertainty instigated by the COVID-19 pandemic. According to Fu et al. (2020), COVID-19 disclosure facilitates stakeholder understanding of the containment measures. By disclosing information related to COVID-19, it sends a good signal to market participants about the managers’ ability to mitigate this risk, which will create a self-commercial advantage for the firm and attract more potential investors (Elmarzouky, Albitar, & Hussainey, 2021).

The study on COVID-19-related disclosure is comparatively new in accounting research (Iddamalgoda Mohotti, 2021). The Financial Reporting Council has issued a disclosure guideline on risk arising from the emergence and spread of COVID-19 for companies, auditors and regulators (Elmarzouky, Albitar, & Hussainey, 2021). This will enable firms to report the impact of the COVID-19 pandemic on operations and the proposed actions to mitigate this impact. Despite the fact that the COVID-19 disclosure has received considerable attention, only Naderipour et al. (2020) investigated COVID-19 disclosures in Malaysia. Therefore, the current study is inspired to examine the COVID-19 disclosure practices of Malaysian companies. This is an exploratory study that primarily concentrates on the COVID-19 disclosure of companies operating in the energy sector. According to Gollakota and Shu (2022), the ongoing COVID-19 pandemic has armed the energy sector causing a slowdown in economic activity and production as well as a reduction in the demand for energy globally. Hence, it is of utmost importance to study the COVID-19 disclosure of the energy companies to understand how these companies are affected by COVID-19 and what action can be taken to lessen its negative effects on their operations.

This research has numerous contributions. First, this study was undertaken during the crisis, which enriches the literature on COVID-19 disclosure. It adds to the literature by examining COVID-19 disclosure in developing countries, particularly in the energy sector which has been identified as one of the sectors with the least COVID-19 disclosure (Roberts et al., 2022). Second, the findings of the study could serve as a helpful practical guide for disclosure preparation in energy firms. Second, this study has a significant implication for investors in evaluating the potential detrimental effects of the COVID-19 pandemic on firms through relevant COVID-19 disclosure. Finally, the findings of this study hint at the regulators' need to provide clear guidelines for COVID-19 disclosure to reduce inconsistency in COVID-19 disclosure.

COVID-19 Disclosure Practices

Accounting research on COVID-19-related disclosure is relatively new (Iddamalgoda Mohotti, 2021). COVID-19 disclosure is viewed as a means of satisfying the informational needs of stakeholders and a mechanism to manage the firm's reputation (Zyznarska-Dworczak & Rudžionienė, 2022). Donatella et al. (2021) asserted that by disclosing COVID-19 information, it signals to society that the firms are accountable and transparent. This allows society to evaluate the legitimacy of the company's decisions (Crepaz & Arikan, 2021). There have been numerous studies conducted on various aspects of voluntary COVID-19 disclosures all over the world. Buchetti et al. (2022) examined how financial statements’ informativeness and transparency are affected by temporary changes to accounting rules in the aftermath of a systemic crisis. Some studies investigated the level of and types of COVID-19 disclosure in various reporting mediums. For instance, Al Sawalqa (2020) analysed the COVID-19 disclosures made in separate disclosure reports sent to the Jordan Securities Commission by Jordanian companies, and indicates that the average disclosure score is 65.6%. Based on the distribution of 20 risk factors across five categories, “the operational category” ranked first, followed by “the investor relations”, “the financial”, “the strategic”, and “the market” category. Larcker et al. (2020) reported that COVID-19 disclosures most frequently took the form of disclaimers to forward-looking statements and were most frequently included in sections on risk and management discussion and analysis (MD&A). Zhao et al. (2021) conducted a comparative study on website COVID-19 disclosure between South Korea, China, and Japan. There were numerous significant discrepancies between the major items published and the important indicators made public by each country. Carnegie et al. (2022) examined the COVID-19 disclosures in annual reports of public Australian universities and reported that the quality of COVID-19 information disclosed is low, with information in the form of qualitative, neutral, and consistent format. On the other hand, Elmarzouky, Albitar, Karim et al. (2021) showed that the COVID-19 disclosure score in the United Kingdom (UK) is moderate with an average score of 52.9 and a maximum score of 594. In terms of types of information disclosed, Iddamalgoda Mohotti (2021) revealed that firms disseminated more information about "uncertainty", "effects on performance", "liquidity management", "substantial impairments of assets", "extended customer support", "ceased dividend payments", and "health and safety of the employees and customers" by New Zealand listed companies.

Several studies examine the determinants of COVID-19 disclosure. Naderipour et al. (2020) reported that Malaysian banks that were larger in size, more profitable, and have participated in corporate social responsibility (CSR) activities in the past were more proactive in disclosing their strategy for COVID-19. Alshabibi et al. (2021) analysed the influence of audit committee characteristics on COVID-19 good and bad news in the chairman’s report of Omani firms. The size, overlap of audit committee members, and gender diversity are related to COVID-19 disclosure tone. Albitar et al. (2021) assessed the extent to which UK firms disclose COVID-19 in their CSR reports and came to the conclusion that the COVID-19 disclosure is significantly and positively correlated with the presence of independent external assurance. Furthermore, the disclosure is enhanced when the Big Four accounting firms provide assurance. Another study on COVID-19 disclosure of UK firms was conducted by Albitar et al. (2022), which reveals that leverage and ownership concentration have an adverse effect on COVID-19 disclosure. While in New Zealand, changes in the number of disclosures have been linked to the size of the firm and the number of board meetings (Iddamalgoda Mohotti, 2021). In a different study, Hegazy et al. (2022) revealed that the position of the auditor has the greatest influence on the recognition of key audit matters in the new audit report, leading to an improvement in audit quality. Hao and Dong (2022) discovered that companies with favourable growth prospects were more likely to provide COVID-19 pandemic information.

Additionally, there is research examining the effects of COVID-19 disclosures. Majumdar and Singh (2021) investigated the effect of online risk sentiment of USA public listed COVID-19-related disclosures on information asymmetry. The author concludes that such disclosures improve the firm's information asymmetry. From the earnings management perspective, Iddamalgoda Mohotti (2021) found COVID-19 disclosure influenced New Zealand companies to have more discretionary accruals. In other aspects, Elmarzouky, Albitar, Karim, et al. (2021) revealed that COVID-19 disclosure influences uncertainty in the annual reports of UK companies. The finding suggests that the greater the COVID-19 disclosure prepared by firms, the greater the risk of adverse selection and increased ambiguity for stakeholders.

A recent study on the COVID-19 pandemic has also emphasised investors' uncertainties and market responses. By examining the disclosure of COVID-19 impact covering the time period between January 1 and May 29, 2020, Larcker et al. (2020) observed that United States public listed companies experienced more negative stock price performance and sharp share price declines in March as compared to companies that did not disclose in March. Hao and Pham (2022) revealed that quarterly filing of COVID-19 disclosures reduces information risk and investor uncertainty, and that COVID-19 helps market players evaluate the changes in firm values during a crisis. Jin et al. (2022) reported that voluntary disclosure of pandemic exposure has a strong impact on the risk of a future stock price crash. This shows that the firm’s COVID-19 disclosure has an immediate and severe impact on investor trust. Duan and Lin (2022) also provided evidence that COVID-19 disclosure on a specific medicine triggered stock price crashes. On the other hand, Hao and Dong (2022) found that firms that report COVID-19 information have a much lower risk of a stock price crash than that are non-reporting firms.

From the above studies, several aspects of COVID-19 disclosure are examined. However, there is only one study conducted in Malaysia. Hence, this study was conducted to address this void. As COVID-19 disclosure is relatively new in accounting research, this study is exploratory in nature, conducted to examine what Malaysian companies have disclosed in relation to the COVID-19 pandemic as a response to Elmarzouky, Albitar, Karim, et al. (2021)’s call to consider COVID-19 disclosure practises in developing countries.

Research Methodology

Data

This study utilised a purposive sampling method by focusing on energy companies. The population of this study is Malaysian public listed companies. This study's sample consists of all energy companies. The initial sample size is 30 companies for the year 2021. This study excluded companies with no annual reports for the year 2021, which resulted in a final sample of 28 companies. The energy sector was selected because the COVID-19 pandemic has had an effect on all aspects of the energy sector and has heavily impacted its stock prices (Gollakota & Shu, 2022; Zyznarska-Dworczak & Rudžionienė, 2022). Hence, energy companies are anticipated to incorporate more transparent information on the disclosure of risk-related information, which includes COVID-19 information (Heffron et al., 2021).

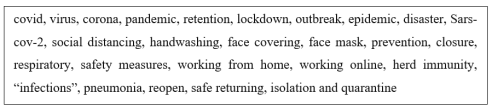

The data is collected using content analysis of annual reports, as this document is generally regarded as the essential source of corporate information (Gonidakis et al., 2020). We downloaded firms’ annual reports from Bursa Malaysia’ websites. This study examines COVID-19 disclosure in the following: "Chairman's Statement and CEO’s Review", "MD& A", "Sustainability Statement,", "Corporate Governance Overview Statement", "Statement on Risk Management and Internal Control", "Independent Auditor’s Reports", and "Notes to the Financial Statements". The number of sentences is utilised as a measurement unit (Zyznarska-Dworczak & Rudžionienė, 2022). Following Elmarzouky, Albitar, Karim, et al. (2021) and Zyznarska-Dworczak and Rudžionienė (2022), keywords in Figure 1 had to appear within any sentence to count into the analysis.

Findings and Discussion

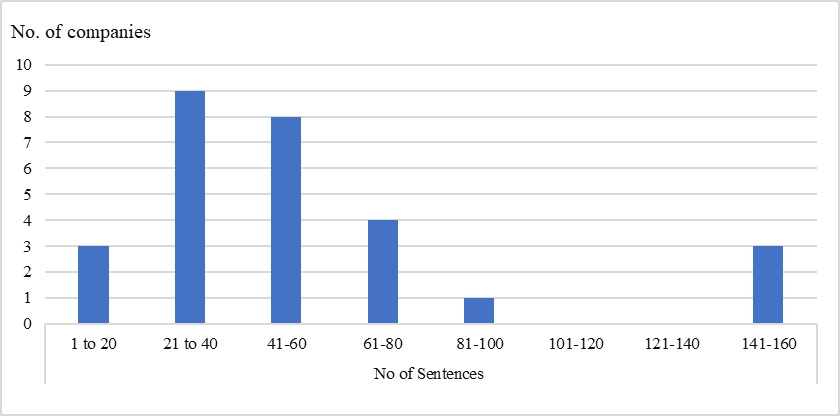

Figure 2 shows the range of COVID-19 related information disclosed by Malaysian firms operating in the energy sector. The majority of the firms disclosed between 21 and 40 sentences, and only three companies that disclosed high amount of COVID-19 related information.

Table 1 presents an overview of descriptive statistics on COVID-19 disclosure. On average, the mean score for COVID-19 disclosure is 57.39 sentences, with a minimum and maximum score of 7 and 159 sentences, respectively. The result of this study is comparable with that of Elmarzouky, Albitar, Karim and Mouss (2021), as the study was also conducted in the electricity sector. In fact, our study has a higher disclosure score, in which they reported an average score of 52.9 sentences. In addition, all companies in our sample disclosed COVID-19 related information, while there were non-reporting firms in their study. Of particular note, the highest disclosure was made in a Sustainability Statement, followed by disclosure in MD&A. Information that is usually found in these sections is related to the challenges and risks of COVID-19, its implications for the companies, mitigation strategies and opportunities. According to Khan (2020), it is of the utmost importance for management to understand not only the risks that their organisation is facing but also how these risks can impact management.

The more in-depth analysis highlights that the companies had reported COVID-19 impact and the containment measures. The major COVID-19 impact is employee safety, which has caused operational disruption and impacted the company's revenue. For instance, the following impacts have been reported by the companies.

“The prolonged COVID-19 pandemic has limited the number of project developments which has intensified competition for new oil & gas projects in both local and international markets”.

“The MCO 2.0 was impacting the logistics arrangement of the supply chain in project execution coupled with reduced maintenance activities deployed by the client, hence recording lower revenue for the FY2021”.

In particular, there are companies that disclose quantitative and monetary information about COVID-19’s effect on revenue and other costs.

“The OS segment’s revenue decreased by 4.8% or RM5.2 million to RM104.2 million against the previous year's revenue of RM109.4 million. This was mainly attributed to the challenges posed by the COVID-19 pandemic, resulting in reduction and deferment in activities”.

In the assessment on the response to the COVID-19 pandemic, it was found that most of the firms mentioned the response in general. For instance,

“The disruptions caused by the pandemic also led to delays in project timelines, consequently forcing us to work through the monsoon season which would normally be avoided. Working through such inclement weather conditions created extra expenditure for the Group. COVID-19 related costs were approximately RM286 million in FY2021 while weather related costs amounted to about RM149 million”.

It seems that the firms are genuinely concerned about COVID-19 when discussing its impact. For instance,

“To ensure business continuity, we have effectively and efficiently manage the impact of COVID-19 by committed towards its obligation to ensure that our business operates in a fair and orderly manner, and our services are available, reliable and resilient at all times”

Most of the initiatives taken to protect the safety and health of the employees are reported in line with the instructions and guidelines of the National Security Council and the Ministry of Health, Ministry of International Trade and Industry. For instance, implementing several precautionary measures, which include working from home ("WFH"), alternate working from office arrangements, monitoring physical distancing in the office, and observing applicable SOPs issued by the government. Some of the companies in the sample established an emergency crisis centre for COVID-19, ran COVID-19 and WFH awareness campaign, performed a COVID-19 audit, and promoted health awareness among employees upon their return to the workplace. The companies pledged to protect the health of all employees with a mandatory requirement of self-quarantining for employees returning from overseas, and a restriction of non-essential overseas travel was introduced. In fact, there is a company that spent on COVID-19 test kits for staff members amounting to RM5 million.

Yet, there are companies that issued a specific guideline and reveal serious action taken to mitigate COVID-19's impact on operations. For example, conducting a COVID-19 energy risk framework assessment to improve its ongoing preventive controls and manage to keep operations minimally uninterrupted. There is a company that activated their robust Business Continuity Plan and COVID-19 Directive to monitor the global situation and its impact on operations. The companies are not only focused on themselves but also contribute to the community during the COVID-19 period. There is a company that contributed money to a specific COVID-19 fund such as that launched by UNICEF and the Taiwan Buddhist Tzu-Chi Foundation Malaysia. In fact, there is a company that disclosed the donation amount. For instance, "RM1.2 million contributed towards the global fight against COVID-19". There is a company that donated sets of double fowler beds with mid-length sides, complete with bedding and PVC mattresses, to Miri General Hospital to support the fight against COVID-19. Companies also disclosed their funds to the business owners under the B40 category that were badly affected by COVID-19.

The third highest COVID-19 disclosure is in the Notes to the Financial Statements. According to Khan (2020), financial reporting and its accompanying disclosure in the financial statement must explain all material present or anticipated impacts of COVID-19 and must adapt to the implications of IFRS disclosure requirements. The companies had adopted and disclosed new accounting standards and/or interpretations, namely, "Amendment to MFRS 16: Covid-19-Related Rent Concessions". In addition, companies reported significant events that occurred during the fiscal year as well as accounting judgments, estimates, and assumptions, such as impairment of financial assets and contract assets, fair value of investment properties, and write-downs of obsolete or slow-moving inventories. In addition, companies also explain how the COVID-19 epidemic has affected their cash flows, liquidity, financial situation, and financial performance.

In the Chairman's Statement and CEO’s Review, Corporate Governance Overview Statement, and Statement on Risk Management and Internal Control sections, most of the companies disclosed that they are facing a difficult business environment arising from the COVID-19 pandemic. Some of the companies disclosed the most significant challenges, discussed the impact of COVID-19, provided specific mitigation actions and precautionary procedures, and presented succession planning. Information on training programmes attended by directors to improve the efficacy of individual directors and the board during the COVID-19 pandemic and manage uncertainty in the post-COVID environment is also disclosed in the firm’s Corporate Governance Overview Statement.

COVID-19 also has notable consequences for accounting and auditing aspects (Khan, 2020). As for the Independent Auditor’s Reports, companies disclosed the effect of COVID-19 pandemic while giving opinions regarding key audit matters such as cash flow projections against recent performance, the key assumptions used in the projections to available external industry sources of data, the group and the company liquidity position and recoverability of the carrying amount of intangible assets and equipment.

Conclusions

The COVID-19 pandemic is an unprecedented event that creates tremendous uncertainty and generates a huge demand for information from investors. This study explores the COVID-19 disclosure of a Malaysian energy firm for the year 2021. On average, these firms disclose 57.39 sentences of COVID-19 related information. From the findings, there is a large variance in the information reported. Owing to high level of ambiguity that exists during the early phases of the COVID-19 pandemic, reporting on COVID-19 related information poses a challenge for certain companies. In addition, there is a probability that firms are having difficulty predicting the impact of the COVID-19 epidemic and disseminating meaningful information to investors as a result of these difficulties. Despite these difficulties, it seems that firms provide COVID-19 disclosure as a means to satisfy stakeholders’ expectations and as a mechanism to manage their reputations. From a stakeholder standpoint, investors required extensive COVID-19 disclosure on how firms have been affected by COVID-19 (Elmarzouky, Albitar, & Hussainey, 2021). As for Malaysian energy companies, the COVID-19 related information disclosed is limited, hence it may not generate enough knowledge to judge governmental action.

This study is an early attempt to examine COVID-19 disclosure. Nevertheless, this study is limited to one sector only, which may make it difficult to extrapolate our findings to other industries. Future research may extend the study to other sectors and examine COVID-19 disclosure in other reporting mediums and examine the quality of information disclosed. In particular, it may be beneficial to evaluate the determinants and effects of COVID-19 disclosure.

Acknowledgments

This work received financial support from Universiti Tenaga Nasional through UNITEN Pocket Grant (J510050002/P202216).

References

Al Sawalqa, F. A. (2020). Risk disclosure patterns among Jordanian companies: An exploratory study during the COVID-19 pandemic. Accounting and Finance Research, 9(3), 69-84.

Albitar, K., Al-Shaer, H., & Elmarzouky, M. (2021). Do assurance and assurance providers enhance COVID-related disclosures in CSR reports? An examination in the UK context. International Journal of Accounting & Information Management, 29(3), 410-428.

Albitar, K., Elmarzouky, M., & Hussainey, K. (2022). Ownership concentration and Covid-19 disclosure: the mediating role of corporate leverage. International Journal of Accounting & Information Management, 30(3), 339-351.

Alshabibi, B., Pria, S., & Hussainey, K. (2021). Audit committees and COVID-19-related disclosure tone: evidence from Oman. Journal of Risk and Financial Management, 14(12), 609-626.

Buchetti, B., Parbonetti, A., & Pugliese, A. (2022). Covid-19, corporate survival and public policy: The role of accounting information and regulation in the wake of a systemic crisis. Journal of Accounting and Public Policy, 41(1), 106919.

Carnegie, G. D., Guthrie, J., & Martin-Sardesai, A. (2022). Public universities and impacts of COVID-19 in Australia: risk disclosures and organisational change. Accounting, Auditing & Accountability Journal, 35(1), 61-73.

Crepaz, M., & Arikan, G. (2021). Information disclosure and political trust during the COVID-19 crisis: Experimental evidence from Ireland. Journal of Elections, Public Opinion and Parties, 31(sup1), 96-108.

Donatella, P., Haraldsson, M., & Tagesson, T. (2021). Reporting on COVID-19–or not? Annual report disclosure of the pandemic as a subsequent event. Journal of Public Budgeting, Accounting & Financial Management, 34(6), 117-136.

Duan, J., & Lin, J. (2022). Information disclosure of COVID-19 specific medicine and stock price crash risk in China. Finance Research Letters, 48, 102890.

Elmarzouky, M., Albitar, K., & Hussainey, K. (2021). Covid-19 and performance disclosure: does governance matter? International Journal of Accounting & Information Management, 29(5), 776-792.

Elmarzouky, M., Albitar, K., Karim, A. E., & Moussa, A. S. (2021). COVID-19 disclosure: a novel measurement and annual report uncertainty. Journal of Risk and Financial Management, 14(12), 616.

Fu, Y., Ma, W., & Wu, J. (2020). Fostering voluntary compliance in the COVID-19 pandemic: an analytical framework of information disclosure. The American Review of Public Administration, 50(6-7), 685-691.

Gollakota, A. R., & Shu, C. M. (2022). COVID-19 and Energy sector–Unique opportunity for switching to clean energy. Gondwana Research.

Gonidakis, F. K., Koutoupis, A. G., Tsamis, A. D., & Agoraki, M. E. K. (2020). Risk disclosure in listed Greek companies: the effects of the financial crisis. Accounting Research Journal, 33(4/5), 615-633. https://doi.org/10.1108/ARJ-03-2020-0050

Hao, J., & Pham, V. T. (2022). COVID‐19 disclosures and market uncertainty: evidence from 10‐Q Filings. Australian Accounting Review, 32, 238-266.

Hao, Y., & Dong, B. (2022). Determinants and consequences of risk disclosure: Evidence from Chinese stock markets during the COVID-19 pandemic. Emerging Markets Finance and Trade, 58(1), 35-55.

Heffron, R., Connor, R., Crossley, P., Mayor, V. L. I., Talus, K., & Tomain, J. (2021). The identification and impact of justice risks to commercial risks in the energy sector: post COVID-19 and for the energy transition. Journal of Energy & Natural Resources Law, 39(4), 439-468.

Hegazy, M. A. A., El-Haddad, R., & Kamareldawla, N. M. (2022). Impact of auditor characteristics and Covid-19 Pandemic on KAMs reporting. Managerial Auditing Journal, 37(7), 908-933.

Iddamalgoda Mohotti, R. (2021). COVID-19 Disclosures in Annual Reports (Doctoral dissertation, Auckland University of Technology).

Jin, J., Liu, Y., Zhang, Z., & Zhao, R. (2022). Voluntary disclosure of pandemic exposure and stock price crash risk. Finance Research Letters, 102799.

Khan, G. (2020). COVID-19 and the related accounting considerations in preparing financial statements and disclosure requirements. (A case study based on Unilever Pakistan Limited). International Journal of Experiential Learning & Case Studies, 5(2), 183-192. https://doi.org/1022555/ijelcs.v5i2.60

Larcker, D. F., Lynch, B., Tayan, B., & Taylor, D. J. (2020). The spread of covid-19 disclosure. Rock Center for Corporate Governance at Stanford University Closer Look Series: Topics, Issues and Controversies in Corporate Governance No. CGRP-84, 1-15.

Majumdar, A., & Singh, P. (2021). Analysis and impact of COVID-19 disclosures: is IT-services different from others? Industrial Management & Data Systems. Vol. ahead-of-print No. ahead-of-print.

Naderipour, A., Abdul-Malek, Z., Ahmad, N. A., Kamyab, H., Ashokkumar, V., Ngamcharussrivichai, C., & Chelliapan, S. (2020). Effect of COVID-19 virus on reducing GHG emission and increasing energy generated by renewable energy sources: A brief study in Malaysian context. Environmental Technology & Innovation, 20, 101151.

Roberts, R., Jang, D., & Mubako, G. (2022). Pandemic risk disclosure in integrated reports: after COVID‐19 is hindsight 2020? Accounting & Finance, 1-20.

Wang, V. X., & Xing, B. B. (2020). Battling uncertainty: Corporate disclosures of COVID-19 in earnings conference calls and annual reports. https://doi.org/10.2139/ssrn.3586085

Zhao, B., Kim, M., & Nam, E. W. (2021). Information disclosure contents of the COVID-19 data dashboard websites for South Korea, China, and Japan: A comparative study. In Healthcare, 9(11), 1487.

Zyznarska-Dworczak, B., & Rudžionienė, K. (2022). Corporate COVID-19-related risk disclosure in the electricity sector: Evidence of public companies from Central and Eastern Europe. Energies, 15(16), 5810.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Abd Rahman, N. R., & Mohamad, M. (2023). Preliminary Study of Covid-19 Disclosure in Annual Reports of Malaysian Energy Firms. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 176-185). European Publisher. https://doi.org/10.15405/epfe.23081.15