Abstract

This paper aims to assess a new path for the middle corridor of transportation for the B&R initiative. The analysis of the course update to the middle corridor can indicate the strengths and weaknesses of such a solution in the field of international logistics. A possible route of this key logistics connection for the development of trade cooperation Europe – Asia may use three strategically allocated ports. Namely: Filyos - Turkey, Odessa - Ukraine and Gdansk in Poland. The adaptation of the previously specified route seems to be unavoidable it the light of recent events. The Russia - Ukraine conflict outbreak may affect the final outline of the middle corridor of B&R initiative as it created a new logistics barrier of a military kind. Due to the sanctions in trade with Russia, bypassing its territory is in the interest of the logistics providers of Asia and Europe. For this reason, the route of the transport corridor should avoid the territory of Russia as an aggressor state which is a target of international sanctions. .

Keywords: International logistics, infrastructure, logistic performance, transport, trade

Introduction

Starting with improving connectivity between two continents, the main production hub in Asia and the key distribution hub in Europe, it was always important to find a way for transportation that would be both efficient and practical.

In this regard, initiatives from both continents were very helpful in designing and constructing logistics connections which may improve any transport operation between Europe and Asia. On one side, there was a proposition generated mainly by China, the B&R initiative. From the European side, there was a strategy built to improve connectivity in a general sense but also direct spending on infrastructure in a Trans European Transport Network (TEN-T). It seems that there was an agreement toward improving existing connections and constructing infrastructural solutions to decrease the cost of logistics operations. It built a very beneficial climate for sustaining and improving international connectivity and improved trust for allocating manufacturing and logistics operations abroad. Corporations of the industry, for example, Germany and China, opened a perspective for merging advanced technology with an affordable price of labour and resources. This becomes a certain way to win the global competition. Although promising, it was really difficult to deliver an efficient solution to make it happen logistically. Therefore, ideas to improve connectivity and help businesses to operate more efficiently due to faster and cheaper transport operations are seen as a stimulus to improve the economy on both continents. Unfortunately, the events of 2022 will probably influence all business operations, especially those connected over Russia's territory. From the date of the conflict between Russia and Ukraine, all operations of logistics had to be carefully undertaken to bypass a critical area where difficult and dangerous activities for cargo can be identified. That is a main reason for assessing a new path for the middle corridor of transportation.

Literature Review and Theoretical Framework

The scenario between Russia and Ukraine started with political differences leading quickly to logistical problems of businesses operating in this area. Clearly, political logistic barriers can become military barriers when the military is used to maintain or enforce legal status in a particular area. Thus, the military barriers in the flow of goods resulting from the deepening of the political crisis revealed by the use of force by one of the opposing political parties. Such a situation is characterised by the suspension of civil order, the introduction of military solutions that regulate legal status, and all events in a particular region. For logistics flows, this is a crisis-related situation. It is basically impossible to transport goods, information, and cash by contract safely. The life-threatening risk in an exclusion zone means that the company cannot carry out transportation because it does not want to endanger the lives of its employees. Insurance contracts that explicitly exclude the insurer's liability for damages resulting from military action are no longer applicable. There is the potential for goods to move, but there is a potential risk of delays due to patrol inspections and military closures in conflict zones.

On February 24, 2022, the Russian Federation launched a "special military operation" to mark the aggression on the territory of Ukraine. The aggravation of the current conflict includes the entry of Russian troops and the implementation of military actions in the regions of the independent state of Ukraine aimed at capturing the cities: Kyiv, Kharkiv, Mariopol, Kherson, and Mykolaiv. In addition, military operations from afar were carried out, including firing missiles at cities in western Ukraine, such as Lviv, Lutsk and Ivano-Frankivsk. The climate that directly threatens Ukrainian citizens has caused massive migration. Industrial facilities operating normally until February 24, 2022, were forced to cease operations and allow civil protection activities for citizens. As a result, planned logistics operations were halted due to large-scale military conflicts, which led to the appearance of a military logistical barrier. The consequences of that obstacle have been borne by enterprises cooperating with Ukrainian entities and indirectly by the global supply chain and transport operations carried out through Ukraine. An example of a company forced to stop its current production is the Volkswagen plant in Poznan. Due to the failure to deliver on the planned supply of wire harnesses and other parts, production was stopped, and a crisis team was formed to minimise the cost of suspending automobile assembly (Mnich, 2022). It is also expected to have major consequences for the supply chain of agricultural products on a global scale. US Secretary of State W. Sherman estimates that 30% of the world's wheat exports and about 75% of sunflower oil come from war-affected Ukraine. As a result of the military activities carried out in the Black Sea region, three merchant ships carrying goods according to the logistics operation plan were bombed at the very beginning of the conflict. The Russian Navy's blockade of Ukrainian ports means that about 94 merchant ships carrying agricultural products are prevented from accessing the Mediterranean Sea. This information also affects the actions of shippers who refuse to send ships to the Black Sea region or even call commercial ships into Russian ports. The effect of such a military logistic barrier is an increase in food prices in low and middle-income countries. In the Middle East and Africa, the prices of basic commodities, including wheat, rose by 20 to 50 per cent in 2022. Countries such as Lebanon, Pakistan, Libya, Tunisia, Yemen and Morocco rely heavily on blocked Ukrainian imports of crops to feed their populations (Shemayev, 2022). The economic sanctions imposed on Russia, also resulting from this conflict, may further reduce the supply of grains and other agricultural products (Paprocki, 2022). Deputy director of the Ukrainian Railways Investments Department, Volodymyr Shemayev, points to the possibility of overcoming this logistic barrier by launching additional land transports. Ukrainian railways can transport agricultural products to the seaports of the following countries: Romania and Poland, and only Poland has the ability to tranship cargo further thanks to seaports on the Baltic sea. Unfortunately, in these circumstances, there is a need for a prompt solution as the strategic decision-making speed affects operational performance (Bayarçelik et al., 2021).

Additionally, economic sanctions toward Russia force logistic transport operations to avoid Russia's territory. All modes of transportation were affected. Air transportation operations become significantly more expensive due to the cost of additional mileage in reaching the final destination. Road and rail transportation was hit by decreased availability of staff. Many Ukrainian drivers released this occupation and went back to Ukraine to support their military forces. Marine transportation faces severe blockade measures (Golubchik & Pak, 2022). By UE administration decision, no cargo ship which previously entered Russia's port may dock in port on the territory of UE member. Looking for an alternative route for transportation is, in these conditions, a necessity right now, and the unknown date of conflict end may enforce usage of it for a longer time.

Research Method

To assess a new route for transport avoiding the territory of Russia, it is possible to use Logistics Performance Index as a guide. The data gathered by The World Bank examine the development of six particular subfactors hidden behind the overall LPI index. The countries chosen for comparison are Turkey, Ukraine and Poland. The data will be presented and compared on graphs allowing for qualitative analysis. There are, however, limitations to planned comparison. The first one is about the data actualisation. The World Bank made the last published research in 2018. During the pandemic period acquiring the data and research processes was halted. Therefore, it is advised to stress the need for up-to-date data and asses findings carefully. The second limitation to this research is the progress of the military conflict between Russia - Ukraine. Military operations also focus on destroying logistics infrastructure that may influence Ukrainian capabilities to maintain logistics performance to the state observed in 2018 by The World Bank. As far as the conflict status allows, the main and critical for planned rout seaport of Odessa is still undestroyed and operational in Ukrainian hands.

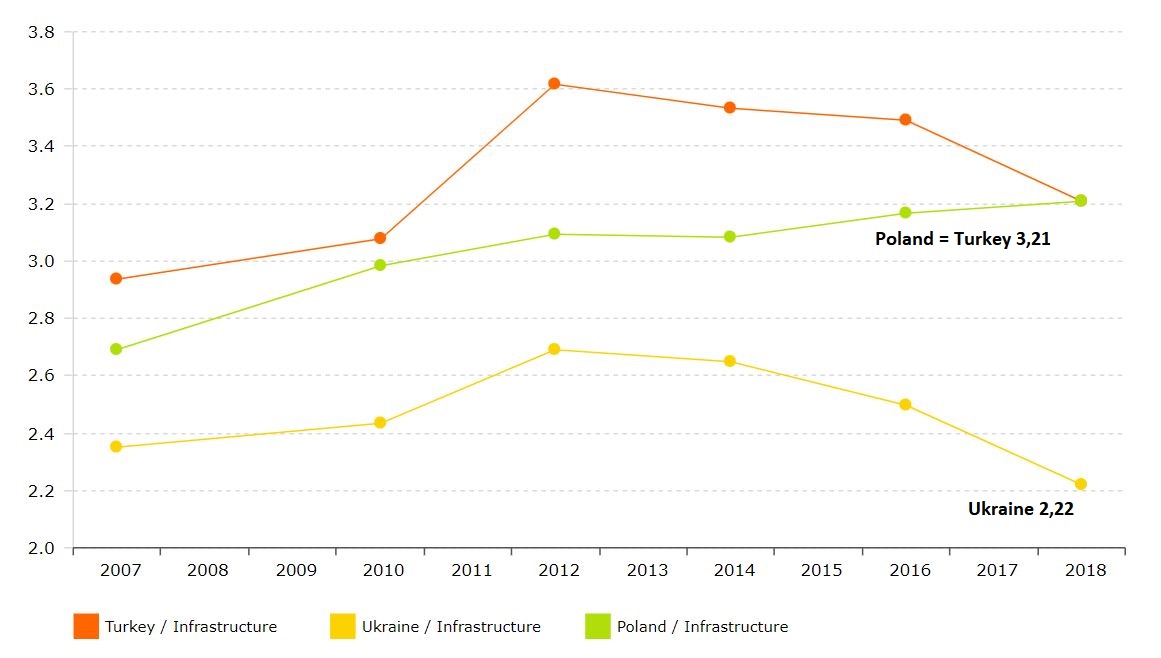

In a group of six categories chosen by The World Bank: custom, infrastructure, international shipments, logistic competence, tracking & tracing, and timeliness, two of them seem critical for assessment of the new route, namely: infrastructure and tracking & tracing. Starting from infrastructure subfactors visible in Figure 1, there is easily identified equality between Turkey and Poland. Although with a different development path, both countries' index equals 3,21. The development of logistics infrastructure in Turkey and Poland is significant and aims to improve readiness for expected growth in trade exchange Europe -Asia. Stable and continued efforts of those two countries allow now to use of existing infrastructure to interconnect the middle corridor of B&R imitative without Russian participation.

The critical for the new route is Ukraine territory, which brings a different set of challenges. Firstly, the LPI index is significantly lower than in Turkey and Poland, and the score of 2,22 locates Ukraine between Solomon Islands and Senegal despite an overall higher score of LPI index. In the global LPI ranking 2018 Ukraine took 66 place (with 160 countries researched). This creates a gap of performance in the area of infrastructure. If the researched route became a reality, it would be advisable to consider additionally decreased logistics capabilities due to the war effort and damages caused by military actions.

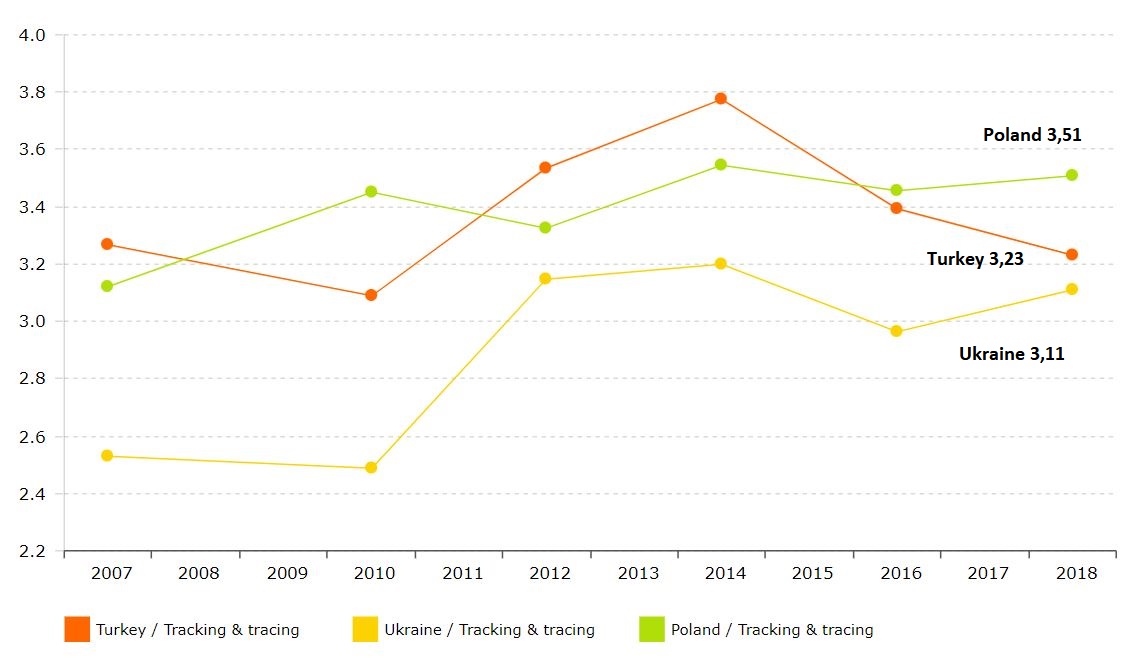

The second subfactor of LPI, namely tracking & tracing Figure 2 is good news in this comparison. The countries' indexes lie close to each other, which is very reassuring. The ability to track cargo and control logistic processes is now vital due to time constraints and the increased recent cost of transportation. Efficient real-time tracking is made possible through Blockchain. However, that requires the infrastructure supporting the flow of information (Acar & Clarke, 2021). Moreover many business partners build a digital platforms as a form of organizational interaction between service providers and consumers simply to minimize the costs and improve information exchange (Karacay & Alpakan, 2019). Employing supply chain based exchange of information is important also because of observed seasonality in agricultural production (Tagiyev, 2021). For such application tracking & tracing abilities are a basic requirement.

Modernisation of Ukrainian transport will progress to European standards due to increased cooperation and support declared by UE and its nearest neighbour Poland. Cooperation between those two countries lies in the interest of Europe and countries dependent on Ukrainian grain; therefore, it is expected that rapid actions will be undertaken with global support to prevent disastrous famine and avoid an additional economic crisis.

Findings

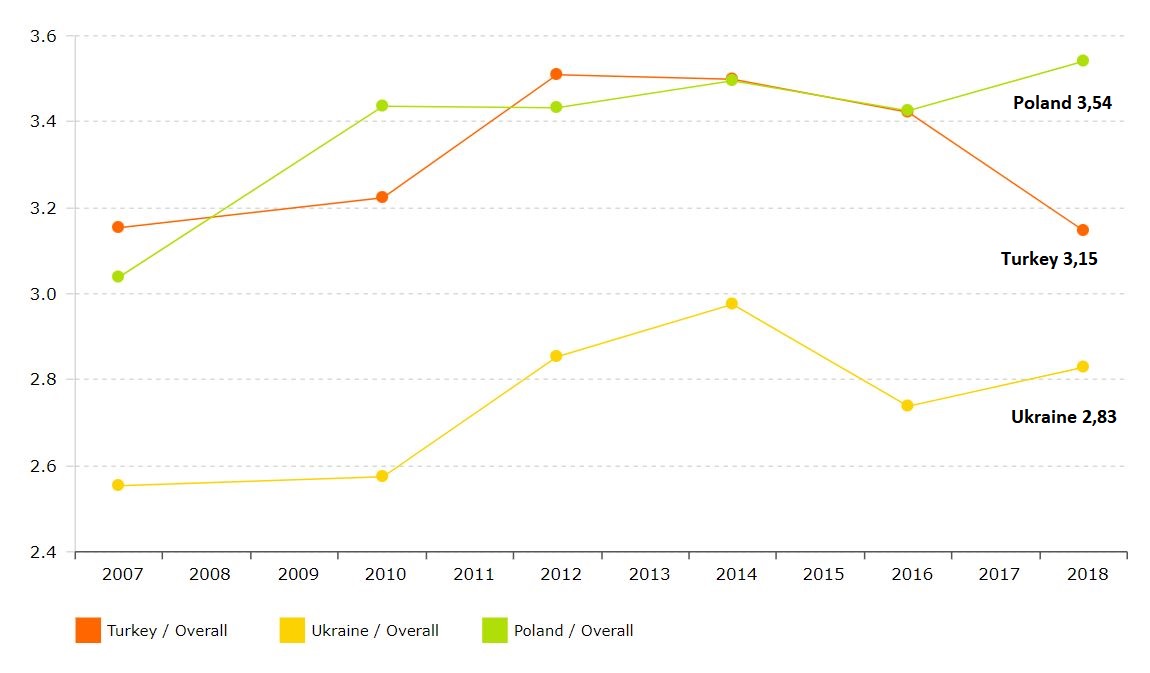

Due to the urgency in the need for logistics solutions to sustain the economy of Ukraine, there is a need to improve logistic ties between Poland and Ukraine significantly. To achieve that, PM Denys Shmyhal and PM Mateusz Morawiecki signed a Memorandum in Kraków to strengthen cooperation in the railway sector. The goals are: to improve the level of the two countries' railway infrastructure, the development of transport hubs and border crossings, establish a joint logistics company between the two countries and prepare to significant increase the volume of rail transportation (Government Portal, 2022). Urgently improving Ukrainian exports to the EU and world markets through Europe may postpone rising food prices and avoid another unfavourable factor for the global economy. The overall LPI index analysis Figure 3 sets an internal ranking of logistic performance, with Poland leading the way. In the period 2007-16 Turkey and Poland developed similarly fast. Pearson correlation coefficient of the LPI index for that time frame equals 0,73, which indicates a high correlation (Bentyn, 2021). Only in the year 2018 there is a visible discrepancy in the path of development.

The recent lower output of Turkey isn't a problem. On the contrary, Turkey develops fast despite its economic problems (Acar et al., 2020). Especially infrastructural development may be critically useful in a described military logistic barrier. Recently put into service Filyos seaport may be an essential link for the researched transport route. Convenient location, logistics capabilities, and inland connectivity put this port among three seaports Filyos, Odessa, and Gdansk, creating a passage around Russian territory and effectively connecting Europe and Asia by rerouting the Middle corridor of transport.

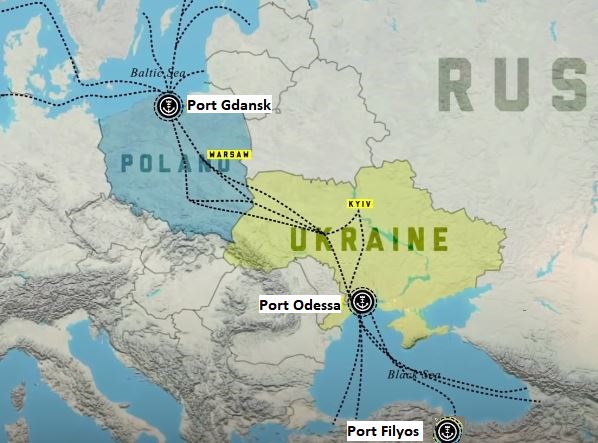

In Figure 4 there is a proposed route including three seaports Filyos, Odessa, and Gdansk. A critical condition to realise this route is the ability to ship cargo on the Black Sea, and the current military logistics barrier prevents sea transport. World opinion exerts pressure on Moscow to advert blockade and helps Ukraine sustain food shipments. Recent information from Russia's foreign ministry brings hope in the form of the condition that the opening of the Black Sea is possible after the revision of sanctions against Russia (Euronews, 2022). That condition may be reasonable because to alleviate pressure on global food supplies in the coming months, closer international cooperation will be needed. There are negotiations in Turkey between Ukraine and Russia where creating a corridor for ships carrying food is discussed (Shankar, 2022).

In Turkey's part of the researched route, there is potential to use the existing and developed infrastructure of two land corridors: Zangezur corridor, now in development after a positive outcome of Azerbaijan- Armenian negotiations (Aa.com.tr, 2022) and The Baku–Tbilisi–Kars (BTK) corridor ready for service since 2017. The meaning of infrastructural development in this region is strategically essential in the larger context of further Asian cooperation. At the other end of the planned route lies Poland, with Gdansk Seaport providing access through the Baltic Sea to the rest of the world. Additionally, Poland serves as a local European transport hub, providing easy access to all European countries with a proven Trans-European Transport Network (TEN-T) and additional transport infrastructure.

Short three-port analysis Table 1 proves three countries' readiness to effectively provide transhipment operations. Annual capacity is above average and growing towards the Polish end of the route. The newest port is Filyos, with an increased maximum draft and second long berthing line. The oldest port is Odessa, where the longest berthing line is located. Polish Gdansk Seaport, located directly on the waters of Gdańsk Bay, includes deepwater terminals at which the largest ships that sail through the Danish Straits may be admitted and handled.

Conclusion and Discussions

Adaptation of the route for a middle corridor of transport is underway. External factor in the form of military logistics barrier due to the conflict Russia-Ukraine forced evolution towards securing a new safe path for international cooperation in the global supply chain. Despite the region's dynamic situation, there is a logistics potential to sustain this vital transport corridor. Critical conditions for realisation depend on decisions on a political level and negotiations between two sides of a military conflict. The cooperation of Poland and Turkey serves as an example of countries providing logistics solutions in a perspectively critical situation in the global food supply chain. Functioning sea ports, developing land corridors, supporting international cooperation and readiness for international shipments preventing humanitarian crises delivers hope for already stretched global supply chains. It is also important to point out political factors helping to bypass the existing military logistics barrier. Thanks to proactive diplomatic measures taken by Turkey and United Nations focused on allowing a safe passage for ships going in and out of three Ukrainian Black Sea ports on 22.07.22, bilateral deals were signed. Ukraine and Russia decided to create the Joint Coordination Center in Istanbul, which will oversee departures from the ports of Odesa, Chernomorsk and Yuzhny. The centre's primary focus is to provide safe sea transportation of grain and similar food products to be exported from Ukraine (Akar, 2022). This diplomatic achievement may secure a food corridor for a U.N estimated 50 mln people awaiting prompt delivery of Ukrainian grain. Moreover, it brings definitely closer fulfilment of the proposed transport corridor for international logistic operations. The realisations of the researched route may also be beneficial in the larger context of the global supply network and Europe-Asia trade exchange. Additionally, Turkey and Poland may benefit from supporting their role as regional and international hubs for transport.

References

Acar, A. Z., & Clarke, O. E. (2021). Applicability of blockchain technology in the global logistics systems. Proceedings of the 16th International Strategic Management Conference. New Strategic, Social and Economic Challenges in the Age of Society 5.0 Implications for Sustainability. European Proceedings of Social and Behavioural Sciences.

Acar, A. Z., Bentyn, Z., & Kocaoğlu, B. (2020). Comparing the development of Turkey and Poland as potential logistics hubs in the context of international logistics. International Journal of Logistics Systems and Management, 35(3), 410-424.

Akar, H. (2022.07.27). Joint Istanbul grain center opens with 1st shipment awaited soon, Daily Sabah. Istanbul. https://www.dailysabah.com/business/economy/joint-istanbul-grain-center-opens-with-1st-shipment-awaited-soon

Bayarçelik E., Özşahin M., & Vardarlıer P., (2021). Linking decision making style to organizational performance through the strategic decision making speed. Proceedings of the 16th International Strategic Management Conference. New Strategic, Social and Economic Challenges in the Age of Society 5.0 Implications for Sustainability. European Proceedings of Social and Behavioural Sciences.

Bentyn, Z. (2021). Comparing Of Logistic Performance In Turkey And Poland. Explaining Divergence In Development. In M. Ozsahin (Ed.), New Strategic, Social and Economic Challenges in the Age of Society 5.0 Implications for Sustainability, vol 121. European Proceedings of Social and Behavioural Sciences (pp. 225-235). European Publisher.

Bhattacharjee, S. (2022.05.08). Major ports in Poland. Marineinsight.com. https://www.marineinsight.com/know-more/5-major-ports-in-poland/

Euronews. (2022.05.20). Euronews.com. Russia says easing Ukraine Black Sea ports blockade dependent on sanctions review. https://www.euronews.com/2022/05/19/russia-says-easing-ukraine-black-sea-ports-blockade-dependent-on-sanctions-review

General information (2022.04.22). Port gdańsk. https://www.portgdansk.pl/en/business/general-information/

Golubchik A. M., & Pak E. V. (2022). Economic Sanctions Against Russia: A Transport Perspective, Russian Foreign Economic Journal, Russian Foreign Trade Academy Ministry of economic development of the Russian Federation, 3, 50-58.

Government Portal, (2022.04.23). Gov.ua. Prime Ministers of Ukraine and Poland signed a Memorandum on strengthening cooperation in the railway sector. Retrieved from https://www.kmu.gov.ua/en/news/premyer-ministri-ukrayini-ta-polshchi-pidpisali-memorandum-pro-posilennya-spivrobitnictva-v-zaliznichnij-sferi

Karacay, G., & Alpakan, L. (2019). Social policy requirements for the digitalized world of work. In M. Özşahin (Ed.), 15th International Strategic Management Conference. The European Proceedings of Social & Behavioural Sciences, 71 (pp. 1-8). Future Academy.

Mnich D. (2022.03.03). Volkswagen Poznań wstrzymuje produkcję w fabrykach w Poznaniu i we Wrześni, [Volkswagen Poznań suspends production in factories in Poznań and Września] epoznań.pl. https://epoznan.pl/news-news-126820-volkswagen_poznan_wstrzymuje_produkcje_w_fabrykach_w_poznaniu_i_we_wrzesni

Paprocki, W. (2022.03.07). Jak wywieźć zboże z Ukrainy? Bez niego światu może grozić głód, [How to export grain from Ukraine? Without it, the world could run into hunger], Rzeczypospolita, Logistyka. https://logistyka.rp.pl/morski/art35819561-jak-wywiezc-zboze-z-ukrainy-bez-niego-swiatu-moze-grozic-glod

Rallynews.com (2021.05.06). Filyos Port, the New Logistics Base of the Black Sea, was put into service. https://raillynews.com/2021/06/karadenizin-yeni-lojistik-ussu-filyos-limani-hizmete-acildi/

Rehimov R. (2022.05.24). Azerbaijan agrees with Armenia on Zangezur corridor. https://www.aa.com.tr/en/world/azerbaijan-agrees-with-armenia-on-zangezur-corridor-aliyev/2595859#

Rishab, J. (2022.04.12). Facts of Odessa Port. Marineinsight.com. https://www.marineinsight.com/know-more/8-facts-of-odessa-port-you-might-not-know/

Shankar P. (2022.05.30). Could naval convoys lift the blockade on Ukraine grain? https://www.dw.com/en/could-naval-convoys-lift-the-blockade-on-ukraine-grain/a-61940944

Shemayev, V. (2022.03.07). Jak wywieźć zboże z Ukrainy? Bez niego światu może grozić głód. Rzeczypospolita, [How to export grain from Ukraine? Without it, the world could run into hunger] Logistyka. https://logistyka.rp.pl/morski/art35819561-jak-wywiezc-zboze-z-ukrainy-bez-niego-swiatu-moze-grozic-glod

Tagiyev, A. (2021). Opportunities for supply chain management in agrobusiness. Proceedings of the 16th International Strategic Management Conference. New Strategic, Social and Economic Challenges in the Age of Society 5.0 Implications for Sustainability. European Proceedings of Social and Behavioural Sciences.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2022

Article Doi

eBook ISBN

978-1-80296-129-4

Publisher

European Publisher

Volume

130

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-270

Subjects

Strategic Management, Leadership, Technology, Post-Pandemic, New frontiers

Cite this article as:

Bentyn, Z., & Tanyaş, M. (2022). Adaptation of the Middle Corridor of Transport - A Military Logistic Barrier. In E. N. Degirmenci (Ed.), New Frontiers for Management and Strategy in the Post-Pandemic Era, vol 130. European Proceedings of Social and Behavioural Sciences (pp. 14-23). European Publisher. https://doi.org/10.15405/epsbs.2022.12.02.2