Abstract

Tax potential of a region is a principal link in budgeting, as it governs financial distributions at the federal level and performs a stimulating function in the tax system both at the level of constituent entities of the Russian Federation and at the municipal level. Local tax potential is built through different impacts and needs to be assessed for solving various research and applied tasks. Modern scientific literature offers various methods for assessing the tax potential of a constituent entity of the Russian Federation. The entire set of existing tools can be divided into direct and indirect. Direct methods assess and forecast variations in tax revenues, while indirect methods provide a comprehensive analysis of the functioning of the economic infrastructure, the number of local labor force and resource potential. Each of the methods for assessing local tax potential has certain positive and negative characteristics. Once jointly applied, various methods ensure efficient forecasting and planning of tax revenues in the constituent entities of the Russian Federation. Strengthening local tax potential requires support in the scientific, technical and innovative fields. The methods studied increase local tax potentials and accelerate their socio-economic development. Thus, the paper suggests that an overall consideration of all of the above impacts helps to shape local tax potential. The scope of impacts on tax potentials directly depends on economic status of a region.

Keywords: Assessment tools, region, tax potential

Introduction

Tax potential depends on the financial status of a particular region and the volume of its taxable resources. The economic status of the region has a decisive effect on the tax base, while budget revenues become a realized part of tax potential. The tax potential is a macroeconomic category, on which the content and quality of public goods depend. In this regard, it is important to assess tax potential and explore its impacts (Basnukaev, 2021).

Local tax potential is a principal link in budgeting, as it governs financial distributions at the federal level and performs an enabling function in the tax system both at the level of constituent entities of the Russian Federation and at the municipal level.

Problem Statement

Assessing regional tax potentials is of pivotal importance for solving the following research and applied tasks:

- Managing the local economic system – for a better idea of the patterns and trends in the development of economic infrastructure in the target area;

- Regulating intergovernmental relations – for timely determination of the region’s need for additional funding through intergovernmental transfers;

- Improving the regional budget system – for an information basis enabling to identify the potential for increasing tax revenues in a constituent entity of the Russian Federation and its constituent municipalities.

Research Questions

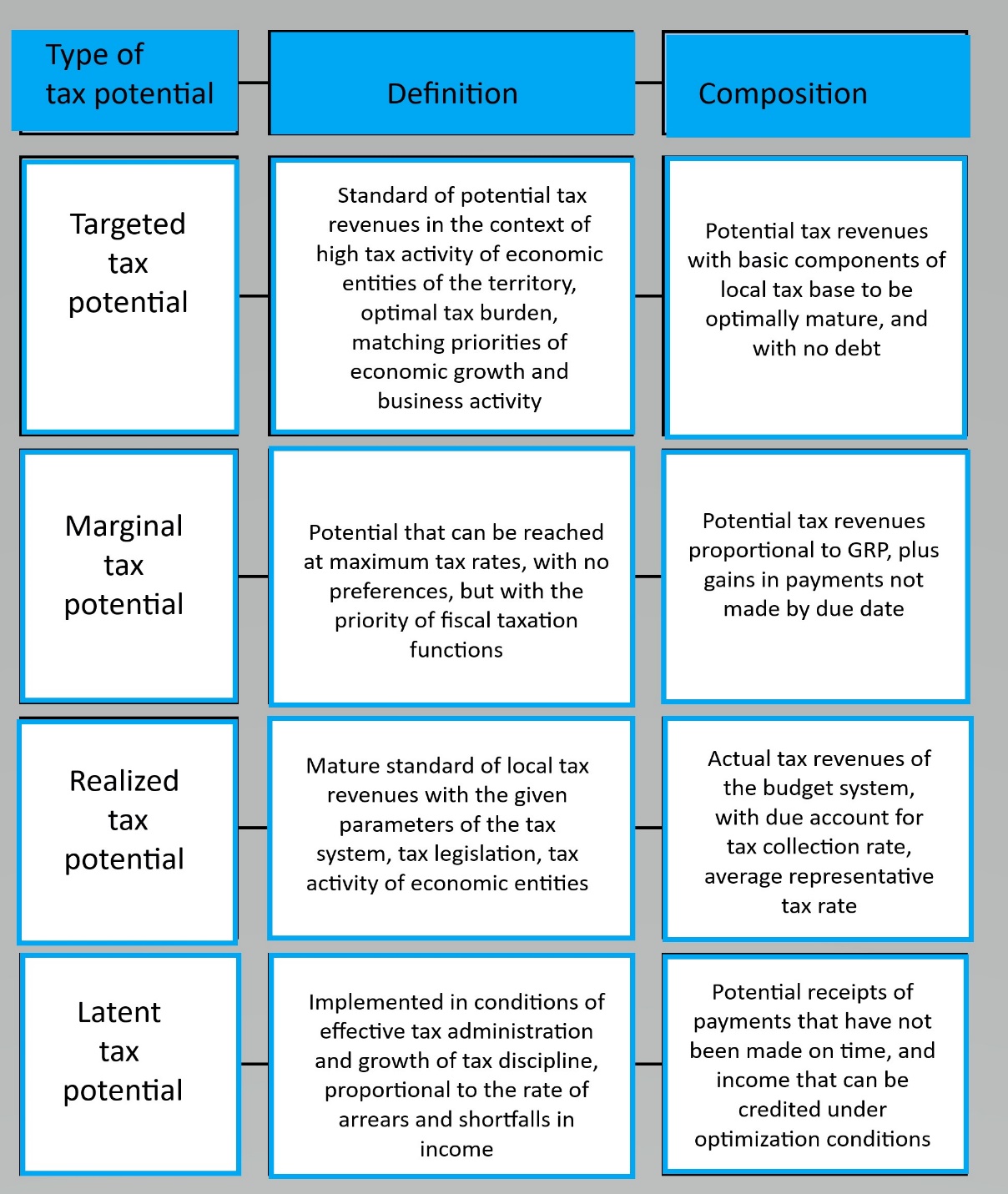

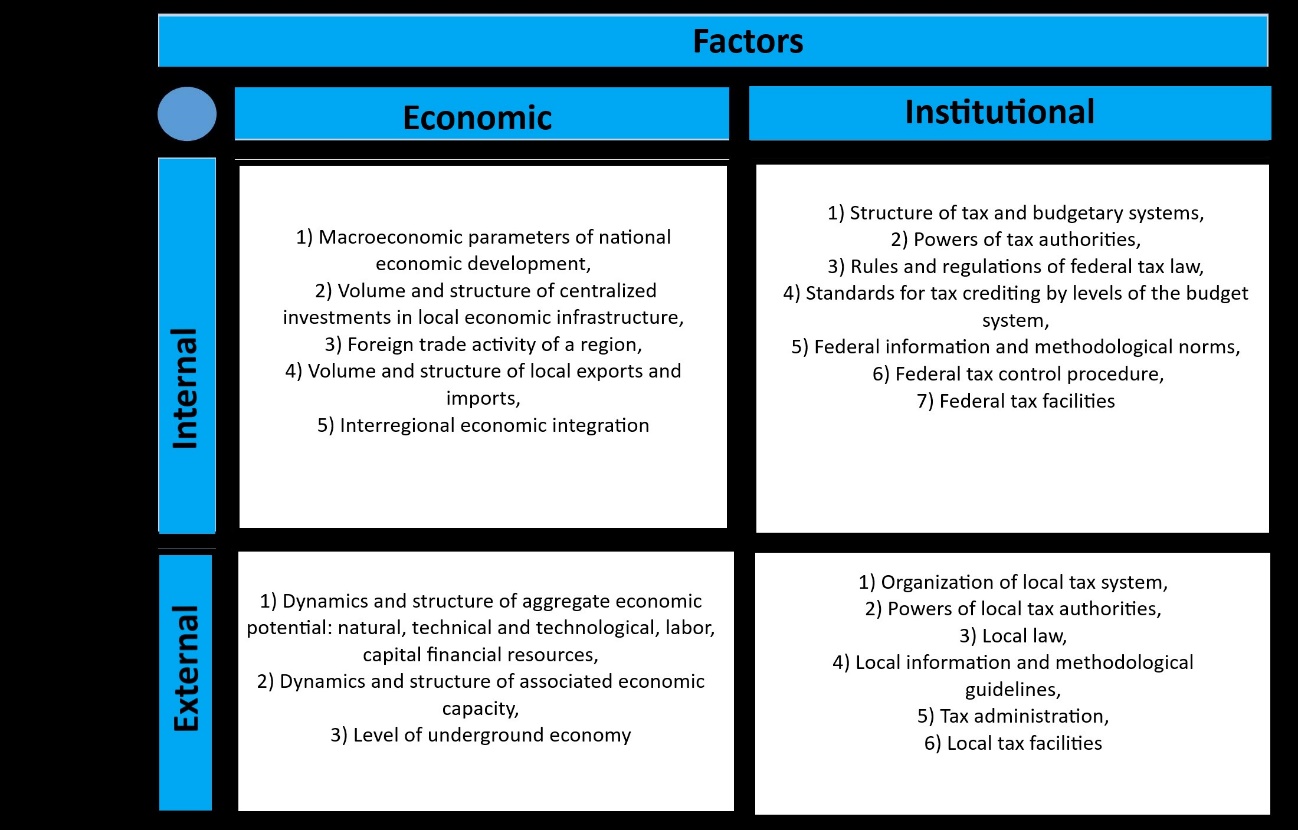

Modern researchers (Belogorskaya, 2014) distinguish several main types of local tax potential, subject to a focus of assessment and the prospects for increase (Figure 01). Building local tax potential is conditioned by many different factors. Thus, Vlasova (2012) believes that tax potential is directly related to a structural economic factor. Others believe that among factors affecting local tax potential, external (exogenous) and internal (endogenous) factors should be distinguished. Markin and Makovetsky (2020) believe that the tax potential of a subject of the Russian Federation is influenced by regulatory, resource, demographic, organizational, production and infrastructure factors. The typology of factors proposed by Igonina and Kusraeva (2009) is of greatest interest (Figure 02).

Tax potential of a subject of the Russian Federation is built in close connection with the structure of tax revenues. Its high diversification by sectors of the economy and types of tax payments ensures the stability of the taxation system at the regional level.

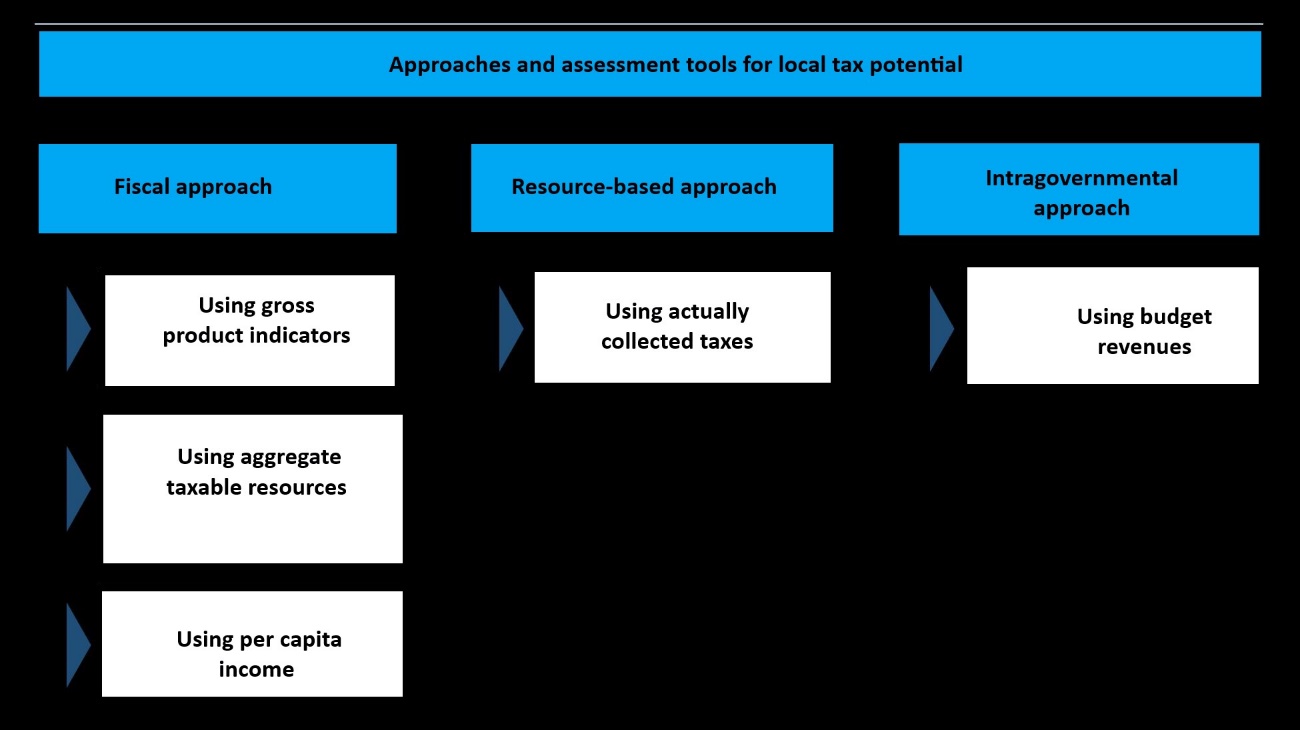

Modern literature offers various methods for assessing the tax potential of a constituent entity of the Russian Federation (Kunitsyna & Roshchupkina, 2008). Direct methods assess and forecast variations in tax revenues, while indirect methods provide a comprehensive analysis of the functioning of the economic infrastructure, the number of local labor force and resource potential. The most common approaches and methods for assessing the regional tax potential are arranged in Figure 03.

Therefore, the first of the methods for assessing the tax potential is an assessment using indicators of the gross regional product (GRP). GRP is the sum of the gross value added at all stages of the production process by all economic entities in a region. In a broader sense, GRP is the tax base for all key regional taxes. Besides, in accordance with the earlier taxation practice, the average tax burden on the economy can be calculated for each region.

The second method involves aggregate taxable resources for analysis. It is supposed to calculate separately the revenue of organizations, personal income, property value, vehicles and other indicators that constitute the taxable base for various categories of taxes, fees and insurance premiums.

The next method for assessing the tax potential involves studying per capita income flows, which is directly related to the level of regional economic development. Based on statistical data, potential per capita budget income is forecast.

All considered variants of the fiscal approach to assess tax potential are indirect. They provide high accuracy of analysis but are quite difficult to use.

A fairly common method for assessing tax potential of a region is a follow-up analysis of actually collected taxes, fees and insurance payments over several past tax periods. This method is easy to use, but it does not assess the potential of uncollected tax payments. An intergovernmental approach to assessing tax potential can also be used, which involves a general assessment of budget revenues with the allocation of a share of tax revenues and planning of budget expenditures.

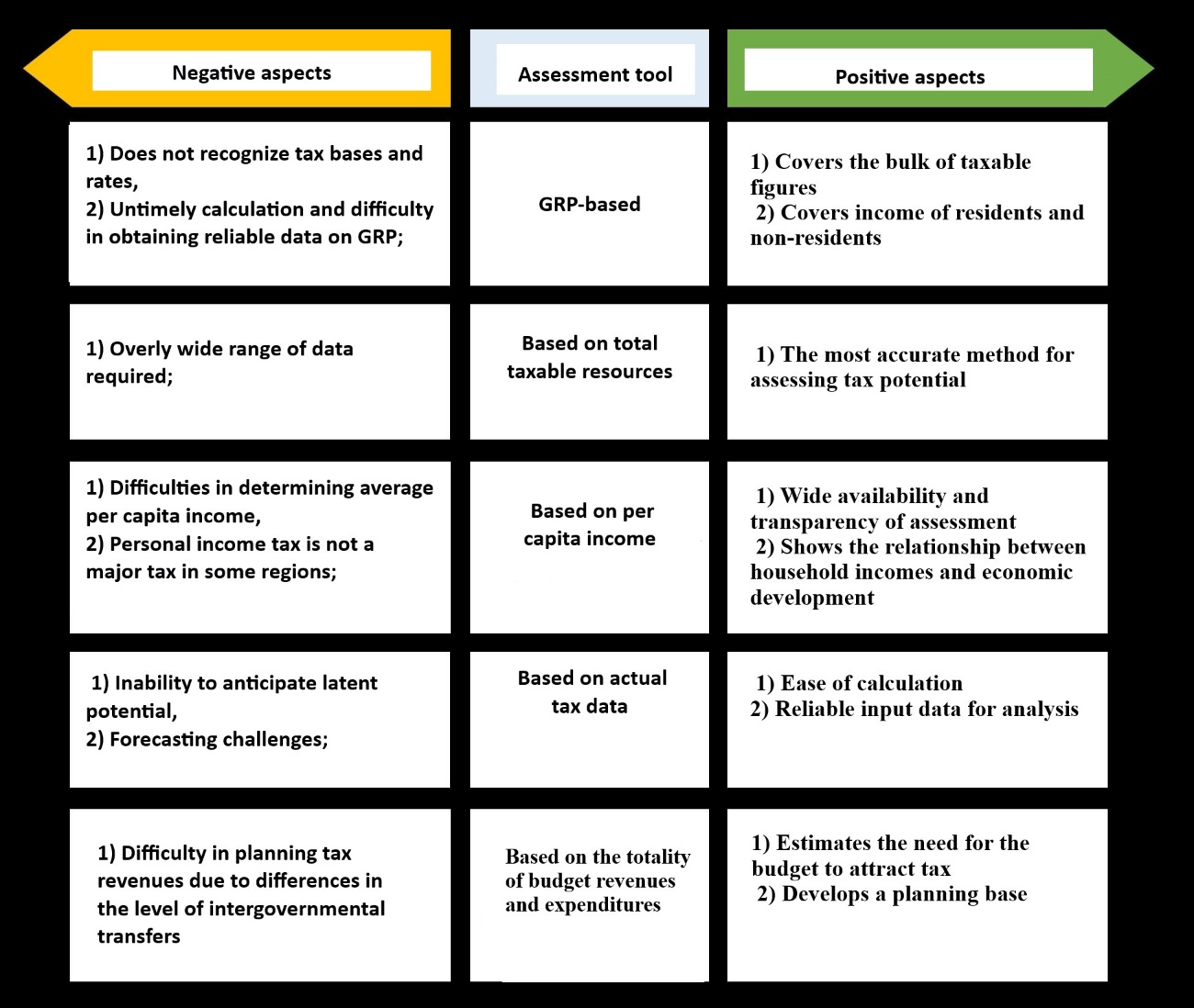

It is possible to arrange the positive and negative ways of all the tools considered for assessing tax potential of a region in Figure 04.

The use of various methods and their particular importance lie in the possibility of developing ways to increase local tax potential. Thus, in order to increase the income tax received by the budget of the territory, regional authorities can implement measures to improve the investment climate, support innovative enterprises, participate in lending to the most significant business entities, develop infrastructure, etc. Moreover, certain types of organizations (innovative, infrastructural, etc.) can receive tax incentives, which will revive the economy in the region.

Taxes resulting from the simplified taxation system are fully credited to the budget revenues of the constituent entities of the Russian Federation. To increase the volume of these tax revenues, a regional policy should be pursued to support small and medium-sized businesses, including budgetary co-financing, information and consulting support, transfer of ownership or use of state and municipal property.

Purpose of the Study

Each of the listed methods for assessing tax potential of a region has certain positive and negative characteristics. Once jointly applied, various methods ensure efficient forecasting and planning of tax revenues in the constituent entities of the Russian Federation. The goal is to be able to develop ways to increase local tax potentials.

Research Methods

The paper used general scientific methods: historical, system analysis, measurement, analogies and generalizations, comparisons, as well as structural and functional approaches and special methods of economic analysis, statistical, correlation and regression analysis.

Findings

Strengthening local tax potential requires a full-fledged support in the research, technical and innovative fields, which can be implemented in the following forms:

- development of research, technical and innovation infrastructure;

- simplified procedure and support for patents and state registration of results of research, technical and innovative activities;

- conditions enabling to involve small and medium-sized businesses in contracts in the research, technical and innovation fields;

- establishment of joint-stock and mutual investment funds at the regional level.

The above methods increase tax potentials and accelerate socio-economic development on a region.

Conclusion

All in all, the paper suggests that an overall consideration of all of the above impacts helps to shape local tax potentials. The scope of impacts on tax potentials directly depends on economic status of a region.

References

Basnukaev, M. Sh. (2021). System establishment in taxation: causes and impacts on transformations and changes in the tax base. Economic and Humanitarian Sciences, 4(351), 40–45.

Belogorskaya, A. N. (2014). Tax potential of the region and methods of its assessment. Bulletin of the Russian University of Cooperation, 3(17). https://cyberleninka.ru/article/n/nalogovyy-potentsial-regiona-i-metody-ego-otsenki

Igonina, L. L., & Kusraeva, D. E. (2009). On methods for assessing tax potential of a region — a subject of the Russian Federation. TERRA ECONOMICUS. Economic Bulletin of the Rostov State University, 7(4), (Part 2). https://cyberleninka.ru/article/n/o-metodikah-otsenki-nalogovogo-potentsiala-regiona-subekta-rf

Kunitsyna, N. N., & Roshchupkina, V. V. (2008). Problems of assessing tax potential of a region. Finance and Credit, 2(59). https://cyberleninka.ru/article/n/problemy-otsenki-nalogovogo-potentsiala-regiona

Markin, V. S., & Makovetsky, M. Y. (2020). Assessment of tax potentials of the regions of the Russian Federation. Proceedings of the All-Russian scientific-practical conference of students, graduate students, young scientists. Sevastopol.

Vlasova, E. V. (2012). Tax potential as an objective economic category. Science Vector of Togliatti State University. Ser. Economics and Management, 1(8).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 November 2022

Article Doi

eBook ISBN

978-1-80296-127-0

Publisher

European Publisher

Volume

128

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-742

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Basnukaev, M. S., Mambetova, A. A., & Tuskaeva, M. R. (2022). Tax Capacity Assessment: Approaches And Methods. In D. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism (SCTCMG 2022), vol 128. European Proceedings of Social and Behavioural Sciences (pp. 86-92). European Publisher. https://doi.org/10.15405/epsbs.2022.11.13