Abstract

The article deals with an urgent issue related to the mechanisms of interaction and integration of national economic models and the role of accounting and analytical systems in this process. In modern conditions, the economies of all countries are under the influence of crisis processes. Russian business has also been operating under significant pressure from crisis phenomena and restrictions for several years. In such conditions, it is difficult for both individual states and individual economic entities to maintain their positions and ensure a sufficient level of their stability. To maintain their competitive positions, as well as neutralize possible threats, States seek to combine their resources and capabilities to jointly combat emerging crisis phenomena. The most important trends of world economic development in such conditions are the processes of globalization and integration, because of which regional associations of economic integration arise. The article tested a scientific approach to the content and role of accounting and analytical systems in the context of global economic integration, which consists of the formation of an information basis based on the methodological unity of functional subsystems in the process of generating accounting and analytical information flows. It is shown that accounting and analytical systems are key information aggregators subject to transformation and adaptation to new conditions of functioning and interaction within the framework of global integration processes under the influence of the expansion of the digital environment.

Keywords: Accounting and analytical systems, global economic integration, IFRS, information flows

Introduction

Russian business in modern conditions has been operating under significant pressure of crisis phenomena and restrictions for the first year. The economies of other countries are also under the influence of crisis processes. In such conditions, it is difficult for both individual states and individual economic entities to maintain their positions and ensure a sufficient level of their stability. As a result, to maintain their competitive positions, as well as neutralize possible threats, states seek to combine their resources and capabilities to jointly combat emerging crisis phenomena.

In this regard, there is an active integration interaction at the interregional and international levels. In the Strategy of Economic Security of the Russian Federation for the period up to 2030, the level of the economic integration of the subjects of the Russian Federation is one of the key performance indicators (without specifying the calculation methodology or threshold criteria) (Kotov, 2021).

Problem Statement

The problems of interregional interactions, as a form of economic space functioning, are traditionally considered in economic, geographical and economic studies from different points of view (Sidorenko & Tishutina, 2020)

The Russian government has repeatedly made attempts to take a course for integration with the Pacific economies (Minakir & Prokapalo, 2017).

"Current macroeconomic shocks have a sharply different impact depth and therefore different necessary anti-crisis measures both at State and regional levels" (Dubovik et al., 2021; Schegoleva et al., 2021, p. 1779). The most important trends of world economic development in such conditions are the processes of globalization and integration, because of which regional associations of economic integration arise. A striking example of such regional integration is the creation of the Eurasian Economic Union (EEU), which united countries significantly different in resource potential, industrial structure and scale (the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation) and became "a serious geopolitical player connecting Western Europe with the Asia-Pacific region" (Gordova, 2017, p. 12).

The key factor uniting the EEU member states is "the desire to increase the effectiveness of national socio-economic policy to ensure the growth of the quality of life and well-being of the population" (Meshkova et al., 2019, p. 4).

The specificity of the economic development of each region, projected on solving tasks within the framework of economic security of the region make it difficult to work out general principles for assessing the level of resistance and economic security in the region and specific measures to ensure security. (Akhmetshin et al., 2018, p. 2310)

If we consider the economic system of the state systematically, in the form of a set of relatively independent elements represented by regions, individual economic entities, administrative institutions integrated into the overall goals of the economic development of the country, it becomes obvious that the stability, development and competitiveness of the economic system of the state as a whole are closely related to the level of development and interaction of each of its functional subsystems.

Research Questions

The processes of globalization and integration occurring in the world economy in recent decades have led to the realization of the need to develop common accounting and reporting rules from an international viewpoint, with the help of which it would be possible to ensure unity and transparency of indicators. IFRS (International Financial Reporting Standards) has been recognized as such rules in the international community.

These processes require the use of unified accounting and analytical tools and "the development of new educational, research and commercial standards for developing universities" (Gasanov, 2021, p. 1308).

The development of IFRS as an international instrument for the exchange of financial information began in 1973 on the initiative of the UN Centre for Transnational Corporations. In the same year, state accounting and auditing organizations in several countries (Australia, Great Britain, Germany, Canada, USA, France) created an international professional non-governmental organization - the Committee on International Accounting Standards.

Currently, there is a systematic implementation of International Standards in the practice of accounting and reporting, both in Russia and in other EEU member countries. Note that the introduction of IFRS into the practice of national accounting systems is due, among other things, to the fact that economic entities have the opportunity to enter foreign markets, which means that they need to generate reports on their activities in a format understandable to foreign partners and credible to them. Moreover, at present, the processes of implementing IFRS are characteristic of economic entities not only of the commercial but also of the public sector.

Purpose of the Studу

The need of individual states and economic entities functioning in their economies for mechanisms to overcome crisis phenomena and preserve the parameters of their normal functioning, as well as their desire to integrate into the international economic community, objectively leads to the need to manage the parameters arising in the external and internal environment. These parameters, as management tools, are necessary for the transparency of the strategy, for the organization of accounting and reporting, for planning and forecasting, for generating goal-setting processes.

Obviously,

the development of the regional economy also needs an array of information about the key parameters of the functioning of both the region as a whole and its functional subsystems to make relevant and effective economic decisions, which will be implemented through the tools and methods of controlling and its accounting and analytical component. (Kotlova, 2021, р. 198)

Each functional subsystem of the economy needs an array of information about the main parameters of its functioning to make relevant and effective economic decisions that can be implemented using tools and methods of accounting and analytical systems. The purpose of the study is to evaluate the capabilities of accounting and analytical systems in the context of global economic integration.

Research Methods

According to experts, in modern conditions, the main strategic resource, "which determines the further development of economic entities at the microlevel and provides them with sustainable competitiveness in the long term, and at the macrolevel – the development of the economy as a whole," is information (Sidorova & Gulyaeva, 2016, p. 51).

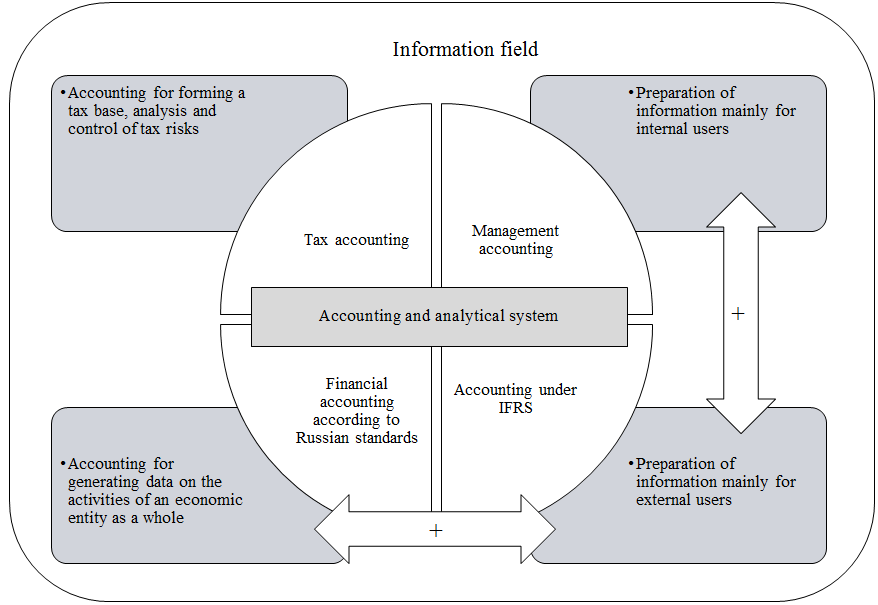

Based on a systematic approach, we note that the accounting and information space is a single system that integrates such elements as financial, tax, management accounting and accounting based on IFRS, as well as interdependent relationships between them. It is in the accounting and analytical system of an economic entity, structurally consisting of accounting (financial), tax and management accounting, as well as accounting according to the rules of international standards, that all possible information flows are accumulated, through which it is possible to assess the features, nature and results of its functioning. The integration of these three subsystems makes it possible to form a high-quality information field. The interrelation of the elements of the accounting and analytical system of an economic entity is shown in Figure 1.

Findings

Note that for the first time the idea of developing the concept of an accounting and analytical system was put forward by L.V. Popova together with I.P. Ulyanov. The authors defined it as a system

that is based on accounting information containing operational data and uses statistical, technical, social and other types of information for economic analysis. In this regard, in a broad sense, an accounting and analytical system is the collection, processing and evaluation of all types of information necessary for making managerial decisions at various levels. (Ulyanov & Popova, 1999, p. 20)

In the future, economists have repeatedly addressed this category, developing and supplementing its essence and economic content, expanding scientific knowledge in this area. As a result, during further research, a team of researchers led by Popova et al. (2003) significantly supplemented the initial definition of the accounting and analytical system. As a result, the author's position was formed, according to which

an accounting and analytical system, in a broad sense‒ is a system based on accounting information, including operational data and using statistical, technical, social and other types of information for economic analysis. Therefore, in a broad sense, the accounting and analytical system is the collection, processing and evaluation of all types of information consumed for making managerial decisions at the micro and macrolevels. (Popova et al., 2003, p. 21).

It is impossible not to agree with this definition, especially in the context of ongoing integration processes. Note that this interpretation is consistent with the possibility of using the potential of accounting and analytical systems at the macro level, including in the process of regional economic integration. This approach makes it possible to judge that accounting and analytical systems can act as a driver of development and improvement of integration processes, including within the framework of the EEU, not only on a micro- but also on a macroeconomic scale.

Simultaneously, note that the integration and interaction of each element of accounting and analytical systems are due to the common goals of the information flows formed by them.

Thus, the need for the formation and presentation of reports to interested users determines the interaction and integration of IFRS, both with the traditional domestic financial accounting system and with the variable management accounting system. The only difference is that the users of the information flow formed because of it will be different categories of persons: internal users with exclusively managerial accounting, and external users with financial accounting based on IFRS. In this regard, it is possible and justified to use international standards, including for management accounting and controlling purposes.

The domestic system of Russian accounting (financial) accounting and reporting, despite the gradual convergence with IFRS, differs significantly from the principles adopted by international standards. This feature is also characteristic of the EEU member states, which implement the process of integration of national accounting and analytical systems with IFRS standards in different ways.

In some cases, economic entities, by national legislation, must transform the reporting indicators by the rules set out in IFRS, to bring this information into line with the requirements of internationally accepted accounting rules.

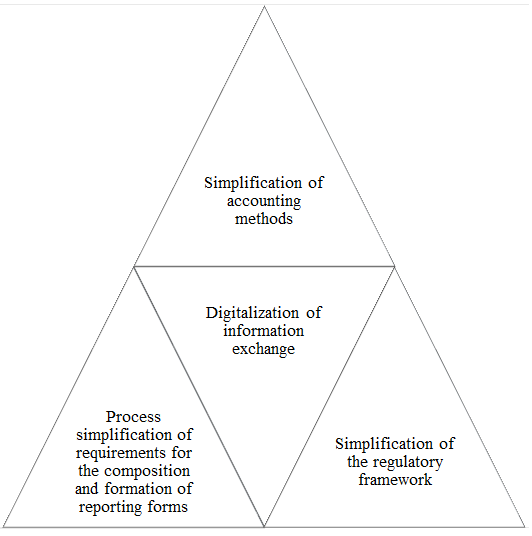

Integration processes within the EEU affect various processes in their content. In this regard, the potential for deepening and developing integration processes within the EEU lies, among other things, in the possible formation of a single information space formed based on convergence of accounting and analytical systems of the participating countries (Figure 2).

Based on accounting rules (IFRS) developed and recognized in the world community, countries need to coordinate national accounting methods by simplifying them. Uniformity in approaches to the assessment of assets and liabilities of economic entities as functional structural elements of the economic system of individual states will lead to the unity of information flows formed by accounting and analytical systems of the EEU member states.

The next step in this process is to coordinate and bring to unity the composition of financial reporting forms, as well as the requirements for the formation of indicators reflected in them. Within the framework of the single economic space, such a unity of methods for compiling reporting forms will lead to the formation of a correct judgment regarding the methods of evaluation and disclosure of information in accounting (financial) statements. The unity of approaches, in this case, will make it possible to avoid subjective assessments, and, consequently, will lead to the formation of reliable information within accounting and analytical systems.

The convergence of national accounting methodologies should be performed within the framework of the regulatory framework, therefore, an inevitable step in this process is the modelling of a unified regulatory framework for the functioning of accounting and analytical systems of the EEU member states to consolidate the adopted unified methodologies regulatory.

Again, these processes should be based on IFRS - accounting standards adopted in the international community.

Finally, the processes of forming the information field and the processes of information exchange between the EEU member states should be digitized, which fits into the context of current trends and allows access to information, reduces the risk of its loss, and provides "open opportunities for those who will make decisions in the future" (Rumsey, 2013, p. 168). In this context, the decision of the Supreme Eurasian Economic Council No. 12 dated 11.10.2017 "On the Main directions of the implementation of the EEU Digital Agenda until 2025" was adopted, the main essence of which is that within the framework of the EEU "the digital platform will contribute to the elimination of barriers that hinder the formation of a single market for goods, services, capital and labour within the Union" (On the main..., 2017).

Simultaneously, the simplification of accounting and analytical systems of the EEU member states can also be performed within the information space of management accounting, which is not regulated by law. In the development of the above, we note that due to the specifics of the reports generated and certain regulatory methods, accounting according to the rules of IFRS is primarily focuses on providing reliable and useful information to external users, for them to make management decisions regarding the economic entity that compiled IFRS reports.

In turn, management accounting declares a similar goal, with the only difference that the provision of reliable and useful information within it is focused, to a greater extent, on the management of the economic entity and other internal users.

In this regard, the proximity of the objectives of accounting under IFRS and management accounting is also obvious, which means that the use of IFRS for management accounting purposes is justified (Necheukhina & Mustafina, 2018).

Thus, according to IFRS 14 "Financial information by Segments," the activity of an economic entity is presented in the form of a set of geographical or operational (production) segments. The management accounting system has historically developed as a cost accounting system based on its differentiation by responsibility centres. Simultaneously, according to IFRS 14, each segment can be recognized as a cost centre and a profit centre, which corresponds to the principles of management accounting and indicates the possibility of integrating the interests of internal and external accounting when making decisions by the management of the organization.

Consider another standard, IAS 39 "Financial Instruments: Recognition and Measurement," according to which, the revaluation of assets should be performed, considering their market, fair and amortized cost. Management needs operational data on the value of assets and liabilities at the moment. Therefore, the use of the fair value approach is appropriate from the standpoint of management accounting. It follows from it that it is justified to use the Kazan standard for management since it will enable management, within the framework of management reporting, to obtain relevant information about the real value of assets and liabilities of an economic entity, and therefore adequately assess the value of the business.

Since internal management accounting is not regulated, the IFRS rules developed and tested by the international community can be integrated at the level of economic entities into accounting policies for management accounting purposes. Thus, the potential for integrating the management component of the accounting system with IFRS is obvious.

It should be borne in mind that the array of information used by management accounting is much wider than when accounting by international standards. Because the management of an economic entity objectively needs qualitatively different, maximally analytical, detailed information for making managerial decisions, while IFRS standardizes accounting methods for a predetermined set of objects.

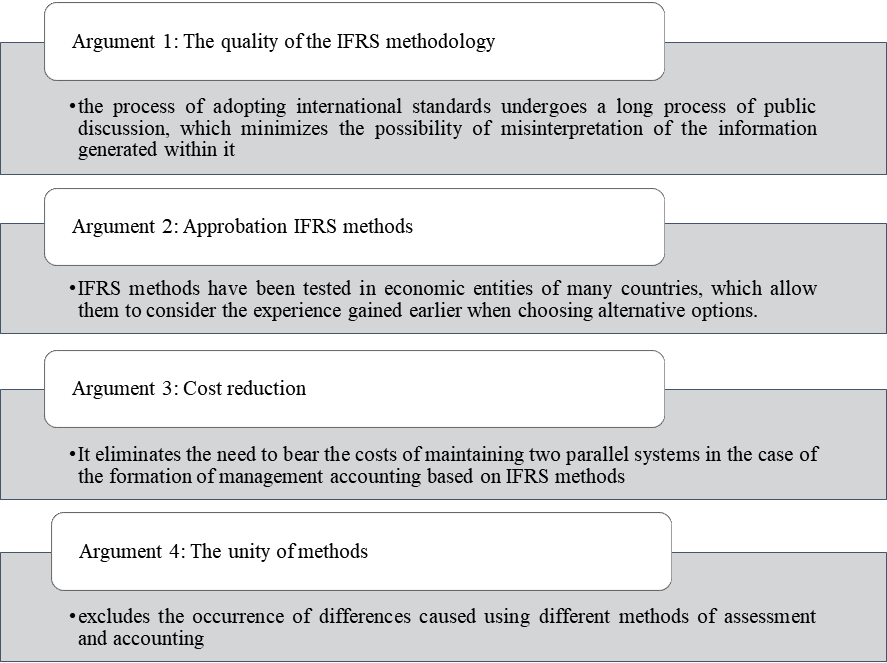

Thus, as the key arguments in favour of the formation of the management component of accounting and analytical systems based on the norms of IFRS, we note the following (Figure 3).

Let us explain, firstly, since the process of developing and adopting IFRS is lengthy and relies on public discussion of norms and methods of standards, it minimizes the possibility of misinterpretation of the information generated within it. Secondly, many economic entities of different countries have been using IFRS methods in practice for a long time. It indicates their successful testing and allows them to consider the experience gained earlier when choosing alternative options. Thirdly, the integration of management accounting with IFRS eliminates the need to bear the costs of maintaining two parallel systems, which means it avoids additional costs in this aspect. And, finally, fourthly, the use of uniform methods for the formation of indicators within the framework of management accounting and IFRS eliminates the possibility of differences and problems with their interpretation caused using different methods of assessment and accounting.

Conclusion

Thus, accounting and analytical systems, being key information aggregators, inevitably transform and adapt to new conditions of functioning and interaction within the framework of global integration processes under the influence of the expansion of the digital environment. The formation of an information basis based on the methodological unity of functional subsystems in the process of generating accounting and analytical information carries several advantages, including the possibility of mutual access to reporting data of economic entities of the EEU member states, as well as improving the quality and comparability of accounting information generated within a single information field of accounting and analytical systems.

References

Akhmetshin, E. M., Pavlyuk, A. V., Kokorev, A. S., Lazareva, T. G., & Artemova, E. I. (2018). Assessment of the economic security of the region (on the example of Chelyabinsk region). Journal of Applied Economic Sciences, 13(8), 2309-2322.

Dubovik, M. V., Gubarev, R. V., Sizova, D. A., & Sizova, T. V. (2021). Interregional Inequality: Experience in Medium-Term Forecasting. Proceeding of the International Science and Technology Conference "FarEastСon 2020". Smart Innovation, Systems and Technologies, 227. 1177-1185.

Gasanov, E. A. (2021) Mechanisms of Interaction and Integration of Universities into the Global Higher Education Space in the Modern World. Proceeding of the International Science and Technology Conference "FarEastСon 2020». Smart Innovation, Systems and Technologies, 227.1301-1311.

Gordova, M. A. (2017). Metodologiya garmonizatsii bukhgalterskogo ucheta gosudarstv-chlenov Evraziyskogo ekonomicheskogo soyuza v usloviyakh tsifrovoy ekonomiki [Methodology of harmonization of accounting of the member states of the Eurasian Economic Union in the digital economy]. Naukovedenie, 9(5) https://naukovedenie.ru/PDF/83EVN517.pdf

Kotlova, Y. A. (2021). K voprosu o potentsiale kontrollinga v upravlenii regional'nym ekonomicheskim razvitiem Dal'nevostochnogo federal'nogo okruga [On the issue of controlling potential in the management of regional economic development of the Far Eastern Federal District] Socio-economic development of the East of Russia: new challenges and strategic guidelines: Materials of the international scientific and practical conference. Khabarovsk: KSUEL, 197-201.

Kotov, A. V. (2021). The territory requires coherent work: the role of interregional interactions in economic recovery (for the 100th anniversary of I.G. Alexandrov's work "Economic Zoning of Russia") Spatial economics, 17(1), 18-34.

Meshkova, T. A., Serova, E. V., Malakhova, A. V., Vishnevskiy, K. O., Demidkina, O. V., Proskuryakova, L. N., Korolev, A. S. Gershman, M. A., Izotov, V. S. Zuev, V. N. Bordachev, T. V., Likhacheva, A. B., Sabel'nikova, E. V., Danil'tsev, A. V., Kutsenko, E. S., Islankina, E. A., Kuznetsova, T. E., Glazatova, M. K., Turovets, Yu. V., Tokareva, M. S., … Gryazin, N. O. (2019). Evraziyskaya ekonomicheskaya integratsiya: perspektivy razvitiya i strategicheskie zadachi dlya Rossii [Eurasian Economic Integration: Development Prospects and Strategic Objectives for Russia]. Report forthe XX April International Scientific Conference on Problems o fEconomic and Social Development, Higher School of Economics, 1-123. https://issek.hse.ru/news/263123216.html

Minakir, P. A., & Prokapalo, O. M. (2017). Russian Far East: economic phobias and geopolitical ambitions. ECO, 4(514), 5-26. https://en.eastrussia.ru/material/dalniy-vostok-ekonomicheskie-fobii-i-geopoliticheskie-ambitsii/

Necheukhina, N. S., & Mustafina, O. V. (2018). The genesis of accounting and analytical support for management of revenues and expenditures of economic agents in the retail segment of the consumer market. Scientific and Technical Bulletin of SPbPU. Economic sciences.11 (2).70-80.

On the main directions of implementation of the digital agenda of the NPP until 2025: Decision of the Supreme Eurasian Economic Council (2017). 12 dated 11.10.2017. https://docs.eaeunion.org/pd/ru-ru/0121967/pd_28072017_att.pdf

Popova, L. V., Maslov, B. G., & Maslova, I. A. (2003). Osnovnye teoreticheskie printsipy postroeniya uchetno-analiticheskoy sistemy [Basic theoretical principles of building an accounting and analytical system]. Financial management, (5), 11-13.

Rumsey, A. S. (2013). Ustoychivaya ekonomika dlya tsifrovoy planety: obespecheniye dolgovremennogo dostupa k tsifrovoy informatsii [Sustainable economy for the digital planet: ensuring long-term access to digital information]. MCBS.

Schegoleva, S. A., Kharlamova, J. O., Khomyakov, I. V., Shilov, A. S., & Shilov, A. S. (2021). Innovation Development of the FEFD Regions: Rating Methodology. Proceeding of the International Science and Technology Conference "FarEastСon 2020". Smart Innovation, Systems and Technologies, 227. 323-329.

Sidorenko, O. V., & Tishutina, O. I. (2020). Problems and mechanisms of regional policy of Russia. Smart Innovation. Systems and Technologies, (172), 243-249.

Sidorova, M. I., & Gulyaeva, A. A. (2016). Upravlencheskiy uchet kak element edinogo informatsionnogo prostranstva organizatsii [Management accounting as an element of the unified in formation space of the organization. Accounting]. Analysis. Audit, (5), 50-65.

Ulyanov, I. P., & Popova, L. V. (1999). Buhgalterskij uchet: posobie dlya buhgaltera i menedzhera [Accounting: a manual for an accountant and a manager]. Moscow: Business Inform.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

03 June 2022

Article Doi

eBook ISBN

978-1-80296-125-6

Publisher

European Publisher

Volume

126

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1145

Subjects

Social sciences, education and psychology, technology and education, economics and law, interdisciplinary sciences

Cite this article as:

Kotlova, Y. A. (2022). Accounting And Analytical Systems In The Context Of Global Economic Integration. In N. G. Bogachenko (Ed.), AmurCon 2021: International Scientific Conference, vol 126. European Proceedings of Social and Behavioural Sciences (pp. 533-542). European Publisher. https://doi.org/10.15405/epsbs.2022.06.59