Abstract

The need to apply modern methods in assessing the effectiveness of innovative projects is evident. There are differences in determining the effectiveness of innovative projects in comparison with the investment ones. Rational management of innovation processes involves the assessment of their effectiveness based on the joint use of the discounted cash flow method and the method of real option valuations. This allows you to obtain an aggregate result that takes into account the quantitative and qualitative parameters of innovation projects. The effectiveness of the traditional methods based on the assessment of discounted cash flows is rather high, but innovations require the use of more modern approaches. The article outlines the negative consequences of a one-sided valuation based on the discounted cash flow method. It should be combined with other methods, in particular, with the method of real option valuations. The real option valuations method combines decision tree and NPV methods. This methodological tool is aimed at the formation of a reasonable innovative behavior of the company, focused on flexible management, optimization of information flows, increasing the investment attractiveness of the project. The combination of the traditional and modern approaches allows use to evaluate both quantitative and qualitative parameters of an innovative project, identify the economic, technological, social and political components. Reasonable conclusions about the feasibility of investment into an innovative project make it possible to improve the competitiveness and stability of the company in the market segment.

Keywords: Discounted cash flow, innovation, real options

Introduction

The interdependence of innovation and investment, determining the effectiveness of innovative solutions, is a particularly significant problem in the development of modern technologies used in economic activities. The significance of innovation in the development of the national economy and companies is growing; moreover, there are economic activities that differ from the traditional ones, requiring modern tools to assess their effectiveness. The need to improve the methodology for determining the effectiveness of innovative projects is manifested in the high level of uncertainty in the implementation of innovative solutions, as well as in the existence of other risks.

The effectiveness of the traditional methods based on discounted cash flow assessment is rather high, but the following factors should be taken into account:

- favorable opportunities created by the factor of uncertainty;

- flexibility in project management based on the market fluctuations;

- new opportunities from obtaining new information.

It is necessary to assess the innovation, which is often unparalleled; therefore, it is impossible to conduct a comparative assessment. Improving the methodology for qualitative assessment of the effectiveness of innovative projects increases the validity of the choice, reduces the risks of financial losses and negative impacts on society.

Problem Statement

For a competent assessment of the investment into an innovation, it is impossible to make a comparative assessment. The rational approach involves the assessment of effectiveness according to the selected criterion. The traditional method based on discounting cash flows does not correspond to the conditions that appear in implementing innovative projects, underestimates their attractiveness for the investor, does not take into account the benefits of risks and opportunities that can be provided by flexible management. It is not advisable to reject it, but it is possible to supplement it with modern methodological solutions.

Research Questions

The subject is the methodology for assessing the effectiveness of an innovative project, which makes it possible to take into account its individual characteristics, presented through a system of quantitative and qualitative indicators.

- Discounted cash flow method (DCF)

- Real options method (ROV)

Purpose of the Study

The purpose is to consider the compatibility of the traditional method of discounted cash flows and the more progressive method of real option valuations for assessing the effectiveness of an innovative project, which will take into account economic, social, environmental and other components.

Research Methods

The research uses the empirical and theoretical methods: abstraction, analogy, deduction and induction, analysis and synthesis, etc.

Findings

In assessing the effectiveness of innovative solutions, the methodology based on discounted cash flows (DCF) is traditionally used. On its basis, "Methodological recommendations for assessing the effectiveness of investment projects" have been developed. They include such criteria as the required value, implementation and payback periods, the level of return on investment. The discounting methods are used to substantiate the effectiveness of investment. In assessing an innovative project, the DCF method does not take into account risks and opportunities that can be provided by flexible management when choosing a high discount rate. A significant value of the discount rate implies a higher degree of risk and a negative NPV, which has a significant impact on the decision to abandon the innovative project. With regard to assessing the real effectiveness of an innovative project, negative consequences are as follows:

- the growing rate of depreciation of funds;

- focus on the quantitative values of indicators, whose subjectivity creates the "illusion of quantitative substantiation" of the project effectiveness (Daskovsky & Kiselev, 2015);

- the social component is not taken into account: the impact on the natural and social environment (Bendikov, 2001);

- insufficient attention to the degree of uncertainty and the level of risks arising from the implementation of an innovative project, which are much higher in comparison with the investment project;

- partial analysis of alternative scenarios, which reduces the ability to exclude an ineffective project at the initial stage.

The innovative orientation of the Russian economy dictates the need to use other approaches in assessing the economic feasibility of an innovative project. The modern theory and the prevailing world economic practice recognize that the DCF method does not meet the conditions that determine the processes of implementing innovative projects, underestimates their attractiveness for the investor (Lipatnikov et al., 2013).

The possibility of eliminating these disadvantages can be achieved using the method of real option valuation (ROV). Uncertainty can be considered as a source of additional value in the implementation of the strategy of increasing value (Vorobiev et al., 2013). The ROV, assessing investment opportunities, allows you to overcome NPV limitations, make more flexible innovative solutions in the face of uncertainty, minimize risks, maximize efficiency. It implies changes in project conditions and alternatives (Bukhvalov, 2004a; Bukhvalov, 2004b).

There are differences in determining the effectiveness of innovative projects in comparison with the investment ones. The methods based on discounted cash flows are quantitative; a qualitative assessment is available only when combining different methodological approaches to assessing the effectiveness of innovative projects. The effectiveness of the innovative solution is manifested through an economic assessment; it is also important to consider the positive impact on the environment and society, etc. Management of innovations involves the joint assessment based on quantitative and qualitative parameters.

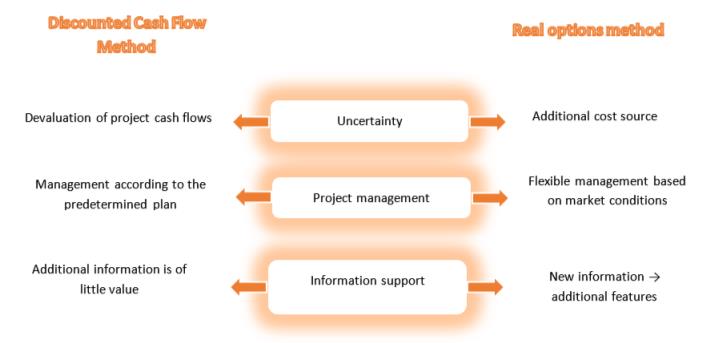

Comparison of the DCF and ROV methods allowed us to assess the role of their characteristics (Figure 01).

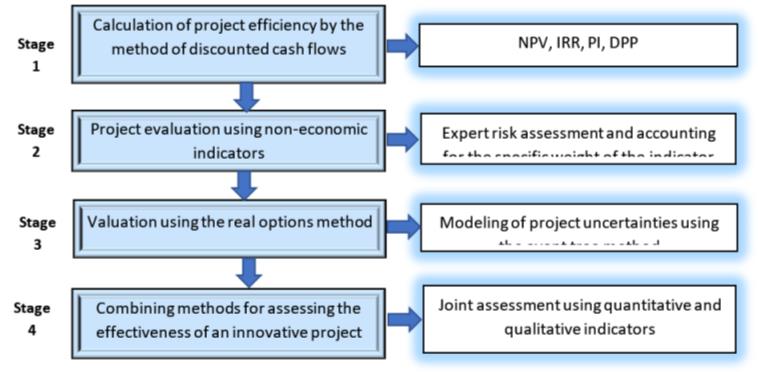

The combined application of the DCF and ROV methods in assessing the investment opportunities of an innovative project involves the "chain of stages", shown in Figure 02.

The project is initially assessed using the dynamic methods. When developing an innovative program containing several innovative projects, cash flows that are formed during the life cycle of each of the projects are calculated (Schumpeter, 2004; Vorobiev et al., 2013). It is one of the main tools in the analytics of non-financial companies, considering cash flows in the forecast period as the difference between the inflow and expenditure of cash. When choosing from several alternatives, it is advisable to apply a point assessment. This is the subjective perception of the most significant factors influencing the result, which are assigned weighted values according to their degree of importance.

The ROV method is a successful combination of the decision tree method and the net present value method, which increases its importance in evaluating innovative projects. However, it is not always correct to consider the extended value of an innovative project according to the Black-Scholes model, represented by formula 1, as the sum of the net present value and the value of real options (Bukhvalov, 2004a).

Expanded Value = Expected NPV + Value of Real Options, (1)

The Black-Scholes model is applicable for European options. In Russia, its use is problematic: firstly, the cost of a real option includes a difficult-to-predict standard deviation of the contract's yield, and secondly, the possibility of early execution of the option is not considered (Trifonov et al., 2012).

When determining the expected NPV of the project, the free cash flow can take negative values; the projects without and with real options differ in the style of management and the amount of resources involved. Formula 1 will be valid for the simplest version of the project, for stable financing to cover losses. The unpredictability of the financing option determines the low accuracy of forecasting the value of the cost of covering losses. It became necessary to use another model - the binomial option pricing model associated with an increased risk. The application of the real option valuation method reflects a significant proportion of the risk, which is leveled by the rational behavior of investors. With the known value of the Put option in the last period, using the reverse of the binomial model, we can calculate the value of the Put option in the previous period by Formula 2 (Vorobiev et al., 2013):

C = , (2)

where – probability of the asset growth; – the upper bound of the asset price; – the lower bound of the asset price; 1– – probability of a decline in the asset; – risk-free rate (refinancing rate).

Comparing the last period with the present one, we can find the value of underestimation of the flexible management of an innovative project. As a result, we get the real NPV taking into account the option value of the innovative project.

Applying the event tree method, based on the conditions, uncertainties are modeled and the stages of project execution are established. Taking into account the uncertainties, the subsequent actions are presented as the calculation and analysis of quantitative and qualitative indicators in dynamics for each of the alternative project options. Based on the results obtained, the key option is determined and an informed decision about the conditions for the project implementation is made (agreement or refusal to implement, adjustment, prolongation, etc.) (Grant, 2005).

Difficulties in determining the value of an innovative project using the ROV method are mainly due to the adaptation of the instrumental apparatus. Further design changes in the toolkit are required to assess the feasibility of an innovative solution.

Conclusion

The assimilation of modern technologies in economic activities makes it possible to develop a well-founded strategy of the company's innovative behavior, focused on flexible management and considering uncertainty as a source of additional value. The decisive factors that determine the choice of an innovative proposal are individual characteristics and economic opportunities for the project implementation and efficiency criteria.

The fundamental difference between innovative projects and investment projects dictates the need to transform the methods for assessing their effectiveness. Innovation management involves joint assessment based on quantitative and qualitative parameters. In addition to the traditional method, modern methodological tools can be used. One of them is the method of real option valuations. It screens out unpromising projects; provides for adaptation and making adjustments to the project conditions; provides alternatives at the implementation stage; considers uncertainties as a source of additional value and higher levels of risk in comparison with an investment project; allows you to overcome the limitations of NPV when assessing the possibility of investing money. The ROV method is a successful combination of the decision tree method and the net present value method, which increases its importance in assessing the effectiveness of innovative projects.

The comparison of the DCF and ROV methods allowed us to assess their characteristics: uncertainty, project management, information support. The high level of uncertainty in the implementation of innovative solutions creates favorable opportunities and allows us to consider it as a source of additional value. Flexible management, taking into account the rapidly changing market conditions and based on an analytical study of opportunities, increases the investment attractiveness of an innovative project. Additional attraction of new information reveals additional opportunities in increasing the efficiency of the innovative solution.

The "chain of stages" in assessing the effectiveness of an innovative project reflects the rationality of the joint application of the DCF and ROV methods, requires a joint assessment based on the quantitative and qualitative parameters, indicates the development of modern approaches.

It is possible to use the real option valuations method in addition to the traditional methods based on the valuation of discounted cash flows. This allows you to adapt the innovative activities to risk conditions, and increase the real NPV, taking into account the option value of the innovative project.

References

Bendikov, M. A. (2001). Assessment of the feasibility of an innovative project. Management in Russia and abroad, 2, 27–43.

Bukhvalov, A. V. (2004a). Real options in management: an introduction to the problem. Russian Management Journal, 2(1), 3–32.

Bukhvalov, A. V. (2004b). Real options in management: classification and applications. Russian Management Journal, 2(2), 27–56.

Daskovsky, V. B., & Kiselev V. B. (2015). A new approach to the economic feasibility of investments, Canon + RPOI “Rehabilitation”.

Grant, R. M. (2005). Contemporary strategy analysis (5th ed.). Malden, MA: Blackwell.

Lipatnikov, V. S., Lobas, A. S., & Galdikaite, K. V. (2013). Price forecast for an innovative product based on time series analysis. Scientific and technical bulletin of St. Petersburg State Polytechnic University. Economic Sciences, 4(175), 128–134.

Schumpeter, J. (2004). Economic Development Theory (Study of Entrepreneurial Profit, Capital, Credit, Interest and the Business Cycle). In: World economic thought. Through the prism of centuries (Vol. 5). Mysl.

Trifonov, Yu. V., Koshelev, E. V., & Kuptsov, A. V. (2012). Russian model of the method of real options. Bulletin of Nizhny Novgorod University n.a. N.I. Lobachevsky, 2(1), 238–243.

Vorobiev, V. P., Lobas, A. S., & Pyankova, D. O. (2013). Evaluation of innovative projects based on the method of real options. Scientific and technical statements of SPbSPU. Economic Sciences, 61(185), 182–186.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2021

Article Doi

eBook ISBN

978-1-80296-116-4

Publisher

European Publisher

Volume

117

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2730

Subjects

Cultural development, technological development, socio-political transformations, globalization

Cite this article as:

Andreevich Surzhikov, M., Alekseyevna Saltanova, T., Alexandrovna Chlysheva, E., & Mitina, I. A. (2021). Method Of Real Options In The Evaluation Of Innovative Projects. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Social and Cultural Transformations in The Context of Modern Globalism, vol 117. European Proceedings of Social and Behavioural Sciences (pp. 1344-1350). European Publisher. https://doi.org/10.15405/epsbs.2021.11.177