Abstract

The article examines the theoretical foundations and methods of effective public debt management and evaluates the methods of managing public debt obligations. In order to balance the budget and regulate the economic cycle, it is necessary to use various economic methods of public debt management. Public debt management is a system of measures implemented by the state to establish debt relations, which are aimed at paying off its debt obligations. There are two main methods of managing public debt: marked and administrative. The use of public debt management techniques contributes to the formation of an effective debt policy by reducing public debt and optimizing debt servicing costs. The analysis of the state debt obligations and the constituent entities of the Russian Federation for the period 2017–2019 is carried out. The structure of the external public debt and its dynamics for the period due to review are considered in detail. The sources of its repayment were analyzed. The structure of the domestic debt of the Russian Federation and the dynamics of expenses for its servicing are researched. The analysis showed that in most Russian regions the level of debt burden has decreased by the end of 2019. The thesis paper provides an analysis of the dynamics of the RSO-Alania public debt in all categories of debt obligations. The directions of improving the efficiency of the public debt management mechanism are considered, the world practice of public debt management is described

Keywords: public debt, external debt, domestic debt, debt, risk management, regulation

Introduction

The public debt management strategy is an important component of public financial policy for most countries of the world. Its effectiveness affects the state of public finances, investment climate, monetary circulation, consumption patterns, as well as international rating and international cooperation. Effective public debt management is made by defining clear goals for managing state guarantees, establishing risk boundaries associated with the volume and structure of payments on accumulated debt and its monitoring, the cost of government loans, making conditions to ensure the subject's constant access to the debt capital market (Anisimova, 2018; Abdumazhidova, 2018);

Problem Statement

Public debt is one of the most important indicators of the country's economic security. It negatively affects the economic situation of any state. First of all, it is connected with increasing dependence on the states that provided the loan when making decisions in the field of economic policy. The next factor is a decrease in the level of investment attractiveness of Russia, due to the decline in confidence of creditors and investors in the country as an international borrower. And finally, funds are used to pay off debt, which could be used to develop other areas of public policy. In this regard, it is necessary to talk about establishing an effective system of public debt management, which will be closely connected with other areas of public policy (Antonova, Ponomarenko, 2018; Ogurtsova, Komkov, 2019; Ushakova, 2018).

The relevance of the research work is related to the fact that public debt management in Russia is allocated to an independent branch of the Russian economy. One of the main factors determining the economic policy of the state in general and the intensity of new loans in particular is the need to pay off the debt obligations previously accepted by the state.

The article deals with the problems of public debt management within the framework of the current state policy, which the work presents an analysis of the public debt’s dynamics for (Fudzi, 2017; Khmelnitsky, 2018; Babich, 2016).

Research Questions

Public debt, in fact, is an ordinary loan. Only in this case we are talking about impressive amounts. When financial difficulties arise, the state is made to seek help from those who are currently in a more stable position. The main factors influencing the emergence of public debt are shown in Figure 1.

Public debt includes all recognized debts of the Russian Federation, estimated at nominal value. This is due to the fact that the public debt consists of loaned obligations necessary for repayment upon the due date. «Debt is a fortune (stock), not a movement (flow), since it is valued on a certain date, and its change in a certain period (between dates) occurs due to net loan (loan minus repayment)" (Valieva, 2020; Vakhrin, 2018).

Most countries of the world turn to external sources of financing during economic reforms. Proper use of foreign loans and credits helps to bring the national economy to a higher level and solve socio-economic problems. The problem of Russia's external debt is the most significant, if we consider it from the point of view of maintaining the country's own level in the world economy and the prospects for achieving economic growth within the state (Kosov, Sharov, Akhmadeev, 2019; Bezvezyuk, 2018).

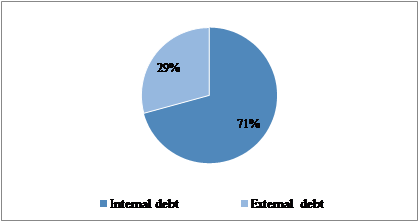

As of 01.01. 2020, the structure of the Russian Federation state debt was as follows:

As it is shown in the diagram, domestic debt accounted for about 71 %, which amounted to in actual terms – 9,331,4 billion rubles. The share of external debt amounted to 29 percent or 3,858 billion rubles ($ 49,156,5 million). The ratio of Russia's public debt to the country's GDP amounted to 13.2 % of GDP at the end of 2019. The state debt of the Russian Federation reached such indicators in connection with the imposed sanctions, which negatively affected the overall state of the country's economy. It is worth noting that the public debt by the end of this year may amount to 14.7 % of GDP, and at the end of 2021 it will increase to 15.7 % of GDP.

The implementation by the authorities of the effective management policy of the Russian Federation’s state debt should be aimed at ensuring the country's ability to make loans in the amounts provided for solving the main socio-economic problems. It is necessary to distinguish between the stages of public debt management. There are at least five enlarged stages, each of which has its own specific objectives. (Table 01).

As a rule, the government's debt case is the largest financial case of the state, which presents a rather complex structure of its country financial obligations, the use of which is a serious risk to the financial stability of any state and its budget. Table 2 shows the dynamics and volume of the Russian Federation external debt for the period of 2017–2019.

From the data, it could be concluded that external debt during the period of review has been moderately reduced. In 2018, public debt decreased by 1,384,5 million. In 2019, the opposite picture was observed: state guarantees increased and practically reached their 2017 level, that is, we can conclude that this decline was short-lived. But due to a decrease of the main public debt by USD 1,881 million or 5 % compared to 2018, its overall component, although insignificantly, tends to decrease.

Such stable dynamics had a favorable effect on the national economy of the country, which is also important in the regulation of domestic debt, and also affects the reputation of the state in the international arena, namely, recommends itself as a reliable counterparty (Zotikov, Lvova, Arlanova, 2019; Sobolev, 2018).

An analysis of the dynamics and structure of the external public debt showed that the debt to official multilateral creditors is significantly decreasing. Compared to 2017, it fell by $ 313.4 million. In general, any of the indicators either stands stably in place, or goes down. This result has a positive effect on the state and reflects it as a reliable partner for investors. According to the Ministry of Finance, in 2019, the total size of Russia's public debt, which includes the obligations of the former USSR, amounted to about $ 50 billion. If we look at the structure of debt, we can note that the largest part falls on external bond loans and accounts for 74 % of the total debt portfolio. State guarantees of the Russian Federation in foreign currency account for 24 % of the total volume of external debt obligations.

The analysis of domestic debt for the period 2017–2019 showed positive dynamics. The largest volume in the structure of domestic borrowing was held by federal loan bonds with constant income, which also showed an upward trend. By the beginning of 2019, fixed-income bonds grew by RUB 731.2 billion. or 17 %. This growth contributed to an increase in the total volume of domestic public debt by 565.2 billion rubles. or 8 %, amounting to 7,812.3 billion rubles. In 2020 – 2019, an even more difficult situation developed. Fixed income bonds increased by RUB 1,459.9 billion. or 29 %, which influenced the growth of the total domestic public debt in comparison with 2019 by RUB 1,519.1 billion or 19 %. This steady growth negatively affects the overall structure of the Russian national economy (Tereykovskaya, 2017).

It should be noted that over the entire period, the decline was observed only in bonds with debt amortization, but their indicators did not in any way affect the growth of the total volume of public debt. Full payment of current debt in the amount of RUB 7,103.55 billion is expected by 2036.

OFZ-AD and OFZ-PD will be repaid most actively, which by 2036 will amount to 539.84 billion rubles. and 4,141.26 million rubles. respectively. Moreover, it is planned to pay off most of the debt on these bonds by 2026, namely 505.62 billion rubles. or 94 % of the total amount on bonds with debt amortization and 3,024.45 billion rubles. or 73 % of the total amount for bonds with a constant coupon yield. At the same time, the most passive repayment of loans is expected for OVOZ, despite the minimum share – 1 %, of this instrument in the debt portfolio of the Russian Federation. By 2036, this figure will remain unchanged at RUB 90 billion.

Domestic public debt repayment will decrease over time. In 2022, payments on obligations will reach their maximum – 781.61 billion rubles.

At the present stage of unstable economic ties and the simultaneous development of the financial and economic system, the issues of public debt management of the constituent entities of the Russian Federation is one of the most acute problems of balancing the budgets of not only the regional economy, but the state as a whole. And thus, the problem of the growth of debt obligations of the constituent entities of the Russian Federation comes to the fore (Valieva, 2020; Vakhrin, 2018).

Having failed to recover from the financial crisis of 2008-2009, which unbalanced the budgetary system of the Russian Federation and caused a rapid increase in the debt burden, the constituent entities faced new problems that impeded the restoration of a positive budget balance. The situation began to worsen already in 2010, when tax revenues of the regions fell sharply after the financial crisis. The table below shows the consolidated public debt of the constituent entities of the Russian Federation for 2013–2019.

As can be seen from the table, the total volume of public debt of the constituent entities of the Russian Federation grew up to 2018. It should be noted that relative to 2013, the volume of public debt of all constituent entities of the Russian Federation has almost doubled. At the same time, the maximum growth, namely by 28.57 %, fell on 2015. In 2015, the debt was 1,737.46 billion rubles. The smallest increase was in 2018 and amounted to 34.6 billion rubles, or 1.49 percentage points.

As of January 1, 2020, the absolute size of the state debt of the constituent entities of the Russian Federation amounted to 2,315.40 billion rubles, having decreased by 1.61 percentage points.

The subjects of the Russian Federation were analyzed by the level of debt burden in 2019 to determine the level of debt burden. The rating is based on the ratio of the state debt of the constituent entity of the Russian Federation as of 01.01.2020 to the regional budget revenues for 2019. If we consider the top 10 regions with the lowest level of debt burden, it can be noted that the level of public debt was less than 10 % of tax and non-tax revenues to the regional budget. In the Sakhalin Oblast and Sevastopol, the public debt, as in the previous year, was completely absent. In general, in most Russian regions at the end of 2019, the level of debt burden decreased, this trend is observed in 61 constituent entities of the Russian Federation (Zotikov, Lvova, Arlanova, 2019; Sobolev, 2018).

An increased level of debt burden is observed in 22 regions of the country, of which in 7 – more than 10 %. The highest level of debt dependence was observed in the Kostroma region (135 %), the Republic of Khakassia (136.4 %) and the Republic of Mordovia (225.7 %), in connection with which treasury support was introduced in these regions to help control and regulate regional expenses. For a number of years, the Republic of Mordovia has closed the rating of the regions of the Russian Federation in terms of debt burden, but here, too, a positive trend was observed. At the end of 2019, the debt burden on the regional budget decreased by 6.5 %.

Next, we will analyze in more detail the structures of the state debt of the North Caucasus Federal District at the end of 2019. The total amount of public debt of all subjects of the North Caucasus Federal District in 2019 amounted to 83,184.67 million rubles, with the majority belonging to the Stavropol Territory – 36,856.04 million rubles or 44 %. The volume of debt could have been much less if the regional leadership did not set the main goal to direct funds to support the real sector of the economy.

The second largest state debt subject of the North Caucasian Federal District is the Republic of Dagestan – 12,193.74 million rubles or 15 % of the total volume in the North Caucasus Federal District. The report on the work of the government of the Republic of Dagestan for 2019 notes that commercial loans in the amount of 3.2 billion rubles were repaid ahead of schedule, which made it possible to save more than 103 million rubles. At the same time, a loan in the amount of 9.4 billion rubles was restructured with gradual repayment until 2026.

Ingushetia has the smallest debt on budget loans – 2,251.34 million rubles or 3 % of the total volume for FD. This result was achieved due to the growth of the region's own revenues by 9.4 % and a decrease in the volume of public debt by 26 %.

After analyzing the public debt of the Republic of North Ossetia-Alania, we can say that for 2020 the public debt is RUB 8,417.03 million, with most of the budget loans received from the federal budget, which amount to RUB 7,267.03 million. The public debt of North Ossetia-Alania is steadily decreasing, creating a positive platform for the region's economy. Debt load has been significantly reduced, and this successful trend has been maintained for several years. But in order to continue this trend, different approaches or new methods of work are needed,

The presence of external debt is a serious burden for the economy of any state, since a significant part of the country's budget is allocated for servicing it, which inhibits the growth of the national economy, in turn, entailing a decline in production. To minimize the consequences, it is advisable to monitor the indicators of debt sustainability, control the financial condition of strategic enterprises, and reorient the structure of the external debt portfolio of the state towards the development of the domestic borrowing market.

The analysis of the structure of the domestic public debt showed that its value is quite high, and the main share of debt falls on securities issued by the government to cover the debt. The volume of domestic debt is at its highest level over the past few years, this trend can lead to serious economic consequences for the country.

The main task of the state today is related to maintaining the stability of the state external debt and maintaining the volume of domestic debt, as well as solving the strategic task of reducing the indicators of their volumes, in order to ensure the guaranteed fulfillment of their obligations to service and repay them.

In order to improve the state policy in the field of public debt management of the constituent entities of the Russian Federation, it is advisable to propose a set of measures, including:

- to plan appropriations and borrowings to cover debt obligations in strict accordance with the budget policy of the region;

- create a reserve fund of the subject to service the region's debt obligations;

- to use the most effective sources, forms and instruments of borrowing at a certain time interval;

- switch to the use of budget loans and bonded loans;

- to provide regions on acceptable terms with constant access to internal sources of debt capital;

- to ensure constant control over the upper limit of the state debt of the subject and to improve the monitoring system of the region's debt obligations.

Purpose of the Study

The main purpose of the work is to analyze the current state of the public debt, its impact on the development of the country's economy, as well as to develop proposals for the formation of an effective debt policy.

Research Methods

Methods of scientific research used in this article: description, comparison and generalization, structural and functional analysis, graphical method, vertical and horizontal analysis.

Findings

In the course of the analysis carried out for the period from 2013 to 2019, it can be said that the total volume of public debt of all regions of the Russian Federation has been continuously increasing until 2016. During this period, the debt of the constituent entities of the Russian Federation has doubled.

The reasons for this growth were a sharp drop in tax revenues in the post-crisis period and the cost of implementing the President's May Decrees adopted in 2012, which included an increase in the salaries of employees of budgetary institutions and an intensification of housing construction at the expense of the regional budget. The turning point occurred in 2017, when for the first time in almost 10 years, the total debt of the constituent entities of the Russian Federation began to decrease. The decrease in the national debt took place against the background of the growth of tax and non-tax revenues of the regions (Tereykovskaya, 2017).

Conclusion

After analyzing debt obligations for the constituent entities of the Russian Federation for 2017–2019. we can conclude that the situation in the regions has a negative trend. The tendency to an increase in the debt of the subjects has a detrimental effect on the volume of the domestic public debt and on the national economy as a whole. Obviously, such consequences are observed due to a decrease in tax and non-tax revenues, an illiterate management of public debt and the use of borrowed funds. The imposed sanctions also affect the state of the economy. In conclusion, it can be noted that the problem of public debt management is one of the most acute and intractable. The general state of the national economy depends on the level of national debt, which in turn affects the standard of living of the population.

Based on the results of the analysis of external debt, it can be concluded that the external debt of the Russian Federation is very stable, which has a positive effect on the country's economy as a whole. This indicator is especially important if we consider it from the point of view of maintaining the country's level in the world economy. This positive result was achieved due to the repayment of state guarantees of the Russian Federation in foreign currency.

Russia has fully repaid its debts to official bilateral creditors – the former CMEA countries. Bosnia and Herzegovina was the last in the long list, to which Moscow paid out more than $ 100 million.

Acknowledgments [if any]

References

Abdumazhidova, A.A. (2018). Improving the public debt management system of the Russian Federation. Innovat. sci. in the modern world, 84–87.

Anisimova, E.A. (2018). The most heavily credited regions may not get access to budget loans. Acre. Regions budgets, 3, 73–75

Antonova, A.D., Ponomarenko, E.V. (2018). Is external debt a threat to the national security of the country? RUDN Bull., Econ. ser., 4, 49–60.

Babich, A.M. (2016). State and municipal finance. Monograph. Moscow: Unity-Dana.

Bezvezyuk, K.V. (2018). The current state of the state debt of the Russian Federation and methods of its regulation. Human. Res., 6. Retrieved from: http://human.snauka.ru/2018/06/15513

Fudzi, A.V. (2017). Features of public debt in the Russian Federation. Econ. 8, 39–43.

Khmelnitsky, M.M. (2018). Turkish and Portuguese experience in public debt management: quality assessment and implementation potential. Russ. Entrepreneurship, 17(18), 2433–2438.

Kosov, M.E., Sharov, V.F., Akhmadeev, R.G. (2019). State debt. Theoretical and methodological aspects. Moscow, Ser. Scientific publications for economists.

Ogurtsova, E.V., Komkov, I.V. (2019). Development of the domestic market for Russian public debt: factors of formation, prospects for change. Izv. Sarat. un-that. New ser. Ser. Econ.. Control. Right, 19(3), 246–256.

Sobolev, V.I. (2018). Public debt management to ensure the balance of the state budget of Russia. V Int. Sci. and Pract. Conf. on the Problems of Science of the XXI Century , collection of articles. Part 3 (pp. 123–129). Moscow: Int. Res. Organizat. “Cognitio”.

Tereykovskaya, I.A. (2017). State debt of Russia: causes, consequences, regulation. Sat. Art. based on materials XLVIII int. scientific-practical conf. Economics and modern management. No. 4(48). Part I (pp. 142–145). Novosibirsk: Ed. SibAK.

Ushakova, S.P. (2018). Features of the formation of the revenue side of the RF budget: problems and development prospects. Creative econ., 2, 19–25.

Vakhrin, P.I. (2018). The budgetary system of the Russian Federation. Textbook. Moscow: Publ. house – Trading corporat. “Dashkov and Co”.

Valieva, E.N. (2020). State (municipal) finance. Textbook. Moscow: Rusines.

Zotikov, N.Z., Lvova, M.V., Arlanova, O.I. (2019). Features of the formation of federal budget revenues. Bull. of Eurasian Sci., 1. Retrieved from: //esj.today/PDF/12ECVN119.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2021

Article Doi

eBook ISBN

978-1-80296-106-5

Publisher

European Publisher

Volume

107

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2896

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Lazarova, L. B., Kairova, F. A., Gioeva, H. G., & Igorevna, K. V. (2021). Servicing Problems Of The Russian Federation Public Debt In Modern Economic Conditions. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization - ISCKMC 2020, vol 107. European Proceedings of Social and Behavioural Sciences (pp. 2751-2759). European Publisher. https://doi.org/10.15405/epsbs.2021.05.366