Abstract

Last year aporia has been marked in the socio-economic development of regions of Russia, which is as follows: there is a state of the socio-economic system which is characterized by normal levels of indicators and tendencies. However, there are some preconditions for the regression of the system. Application of the method of economic security in this situation allows to a certain extent to resolve the contradiction. The method is continuously developing; new approaches appear from one side. From the other side, economy is continuously under the influence of opposing tendencies, challenges and threats, conflicting trends. False preconditions for economic development, misinterpretation of processes lead to a slowdown in development or a transition to a crisis state of the socio-economic system of the region. The authors work on improving diagnostic tools: they develop methods of express diagnostics, determine new directions of researches. The new type of direction is pseudo - security of the region, when the region can lose the stable development in future even at positive dynamics of particular indicators. Methodical tools have been worked out in the territories of the Ural federal district.

Keywords:

Introduction

In a short period of history, modern Russia has experienced several crises among which the most severe ones can be defined: crisis and default of 1998-1999, financial and economic crisis of 2008-2009 and, at last, the pandemic of coronavirus (beginning of 2020). The state of socio-economic system is characterized as unstable. First of all, it concerns the welfare of citizens: the GDP growth is not more than 1,5%; financing of education, culture, science and healthcare – about 10 % in total (in Europe – more than 20-25 % to compare). Population decline in 2019 was 0,3 million people at migration growth 0.2 million people. Population mortality was -12,4 people per 1000 people. Population loss after 2000 is 9 million people (Nigmatulin, 2017; Nigmatulin, 2019). Crisis phenomena have been worsened in 2020.

Several severe challenges and threats which Russia has already faced or will face in the nearest future can be defined: deformed structure of Russian economy, lost economic growth, corruption and the shadow economy, increasing poverty, discriminatory measures to crucial sectors of the Russian economy from leading world states, emphasis on resource development, underfunding of social expenses.

Stagnation model of the country’s development raises doubts about the achievement of targets and the principal of catch-up modernization has not justified itself.

Problem Statement

The definition “Economic security” appeared first in scientific vocabulary in 1934 in the frame of “New course” of the US president Roosevelt. The incentive in Russia to do researches in this direction was the article by academician Abalkin (1994) in the magazine “Economic issues” (p. 4-13), in which three most important problems including economic independence of the country, stability of the national economy, ability to self-development and progress were determined. The most significant contribution in the development of this direction was made by Glaziev, Oleynikov, Senchagov. In particular, Glaziev worked out the system of indicative indicators of security, consisting of 22 modules and he did a complex research of national economic security (Glaz’ev, 1997). Work by Senchagov offer the system of indicators, characterizing the temporary and predicting state of the object of researching, justify the economic security criteria with defining modules of living standard and life quality. Also, their decomposition with the emphasis on resource potential, physical capital and labour was offered (Senchagov, 2001). Oleynikov (2005) offered the classification of 39 most important indicators according to 5 features ( the level of the object of economic security, the degree of indicator significance , period of threats their size) and possible damage.

The most complete definition of economic security of the territorial entity, which was spread on regions, republics and federal districts belongs to the scientists of the Ural school under the direction of the academician Tatarkin et al. (1997). The definition of "economic security of the district" is interpreted as the ability to implement the minimum of the necessary control (regulatory) actions to maintain the given level of regional development. Considering after predecessors the economic security as one of the characteristics of the state of the socio-economic system of the territory, we take into account the ability of the regional system to suppress "the excess " risks, that is imagined economic security as "a safety bag" helping the region stay steady in the face of various economic, financial, structural, ecological, social shocks.

Research Questions

The authors set themselves the task to offer the method of express-diagnostics of the economic security of the region and verify it by example not only separate modules describing the state and structure of the regional economic system but integrated regional spheres of life.

As an integrated sphere, the authors have chosen the complex indicators, describing the welfare of an individual in the territory of residence. The original message is that the welfare of an individual is a complicated socio-economic category, which characterizes the degree of satisfaction of needs of the population and providing the territory with all vital benefits. In this article, the apparatus for diagnostics of the welfare of an individual, described in work (Kuklin & Chichkanov, 2017) is used.

Purpose of the Study

Please replace this text with context of your paper. One of the problems in modern science is identifying consistent patterns between different indicators. One of the methods of statistic mathematics identifying these consistent patterns is correlation analysis. This approach allows seeing the hidden quantitative and qualitative connection between different parameters.

Correlation approach described in the works (Lindfield & Penny, 2019; Menke & Menke, 2016; Mishra & Datta-Gupta, 2018; Zhang et al., 2016) allows to determine not only levels of interacting indicators but make meaningful interaction schemes. The approach connected with the definition of autocorrelation and cross-correlation parameters included in various modules of economic security is used in this work. Autocorrelation allows choosing the most significant indicators out of multi-parameter system. They influence the economic security. Cross-correlation of two indicators allows determining the degree of randomness of one indicator to another one (Bertinetto et al., 2016). If two correlation dependencies are compared for different components of the same system, you can get the information about the mutual correlation of these components in the frames of one research. It is also possible to determine the differences in the states of the system under consideration during a particular crisis in this way.

The economic example of using the cross-correlation is the research of mutual influence of financial-economic indicators of some countries from the point of the nonlinear shear of the cross-correlation function. (Ferreira et al., 2019; İşcanoğlu-Çekiç & Gülteki̇n, 2019; Qin et al., 2018; Zhang et al., 2020).

Research Methods

To identify quantitative and qualitative patterns of mutual influence of indicators included both in one socio-economic module and different ones the coefficient of cross-correlation is used. According to the work (Mishra & Datta-Gupta, 2018; Roger & William, 2016) this coefficient is calculated by the formula:

, (1)

where

Indicator interaction matrix of economic security

The coefficient of cross-correlation allowed to select 7 most important indicators of the methods of economic security out of 34 ones (Tatarkin et al., 2001). The example of the matrix of mutual influence of indicators

is given in table

Notice. Indicators:

1. Depreciation rate of the fixed assets.

2. Ratio of the export production of the territory to the GRP.

3. Consumer price index.

4.Ratio of the per capita income to the cost of living.

5. Life expectancy at birth.

6. Degree of per capita satisfaction of the need for basic types of agricultural products according to the medical standards.

7. Specific emissions of harmful substances into the atmosphere from stationary sources of pollution.

Resource: author’s calculations.

The results of table

The matrix of the interaction of the indicators of the welfare of an individual in the territory of residence

According to (1) the matrix of the coefficients of mutual influence of 6 selected indicators of the welfare of an individual in the territory of residence of separate subjects of the Ural federal district was calculated. The example of the matrix mutual influence

of the indicators of the welfare of an individual in the territory of residence is given in table

1.Amount of the overdue debt on mortgage loans in the total amount of issued mortgage loans.

2. Ratio of the budget spending on education to GRP.

3. General unemployment rate.

4.Share of the population with incomes below the cost of living.

5.Polulation growth rate.

6.Ratio of budget spending on health care to GRP.

Tensor of interaction of indicators of economic security and indicators of the welfare of an individual in the territory of residence

it’s possible to define the basic interaction schemes with the help of cross-correlation coefficient. For this purpose, the matrix of interaction of the basic indicators of economic security and the indicators of the welfare of an individual in the territory of residence was calculated (Table

1.Amount of the overdue debt on mortgage loans in the total amount of issued mortgage loans.

2. Ratio of the budget spending on education to GRP.

3. General unemployment rate.

4.Share of the population with incomes below the cost of living.

5.Population growth rate.

6.Ratio of budget spending on health care to GRP.

According to Table

1.Unidirectional behavior of the temporary trends of the indicators of welfare of an individual in the territory of residence and economic security, e.g. increase of “Consumer price index” leads to the increase of the indicator “Share of the population with incomes below the cost of living” (coefficient

2. Multidirectional behavior of the temporary trends of the indicators of welfare of an individual in the territory of residence and economic security. This case is characterized by negative values of the cross-correlation coefficient

3. Stationary behavior (plateau) of the indicators of both modules. This case is characterized by small values of the cross-correlation coefficient., e.g. “Ratio of the per capita income to the cost of living” (indicator of the economic security) and “ Ratio of budget expences on health care to GRP” ( the indicator of the welfare of an individual in the territory of residence) and

Findings

Pseudo-security

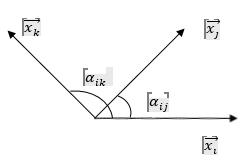

To define hidden influence of the indicators on each other, it is supposed that the indicators apart from their values (normalized assessment) have one more direction. It means that all indicators are placed at certain angles to each other (Figure

According to this assumption, the degree of influence of the primary influence indicator and secondary influence indicator on the main indicator by the formula will be defined

. (2)

This expression alows to calculate the main soci-oeconomic indicator considering influence of the primary influence indicator and secondary influence indicator. If cosα>0 – supporting action of the secondary indicator (vector

); if cosα<0 – inhibitory action of the secondary indicator (vector

). Using this expression hidden latent patterns of the changes in the main indicators have been calculated (table

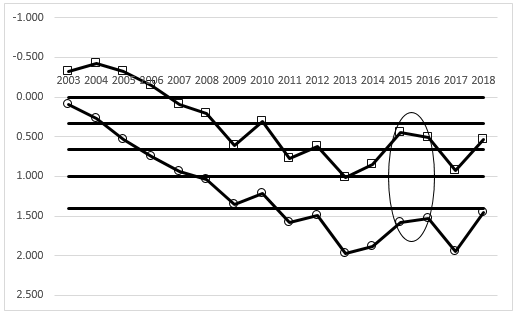

The dynamics of the “Consumer price index” without taking into account any influence had worsened by 2009 to the level of the crisis PK2 ( rate of indicator changes 0,404).Further, the indicator rate improved and in the period from 2014 to 2018 reached the level N with the average rate of indicator 0,200.

Accounting of the indicators interaction of the primary and secondary influence resulted in the increase of the value of the normalized score from 15 to 45 % in 2007-2010 and 2015-2018.There has been the improvement of the value of the normalized score in 2014 by 10% .The increase of the main indicator in the year of crisis happened due to the rate support “The ratio of the territory’s export to the GRP” ( the value of rate is 0,400) and supporting actions from the indicator “Ratio of the per capita income to the cost of living” (weak rate fluctuations within the PKZ level).

Notice:

Main indicator – Consumer price index.

A – primary influence indicator on the main indicator (Ratio of the per capita income to the cost of living).

B – secondary influence indicator on the main indicator (Ratio of the export production of the territory to the GRP).

C- joint influence indicators A and B on the main indicator.

Normalized indicator scores are shown in the table. Crisis thresholds (from N to K3) correspond to the scale in which N –from -2 to 0, PK1-from 0,001 to 0,332; PK2 –from 0,333 to 0,665; PK3 – from 0,666 to 0,999; K1- from 1 to 1,399; K2-from 1,4 to 1,799; K3 –from 1,8 .

Resource: authors’ calculations.

Distortion of the main indicator (pseudo-security) was calculated according to the expression:

. (3)

The example of triple interaction of indicators is given in table

Trends of two interacting indicators are shown in figure

1) 2003-2005 - ratio of the export production of the territory to the GRP shows stationary behavior (rate isn’t practically changed) when the main indicator moves by inertia from PK1 to PK2;

2) 2005-2008 – simultaneous inertial variant of development for both indicators.

Conclusion

In the context of constant threats, instability of the behaviour of the socio-economic system of the region, confusion and abundance of all kinds of regulations and insufficient study of prospects, the development of tools for assessing the state and balance of the territory comes to the fore. The tools have to consider the real state, not to be complicated and capture the history of development and perspective, constantly signalling about the emergence of latent characteristics via feedback about socio-economic system.

1. It is supposed, that it is impossible to judge the socio-economic state of the region by the level of economic security. Economic security – is the ability to maintain at a certain level the general set of different manifestations characterizing the state and development of the research object. (a kind of a security bag).

2.Express-diagnostics of economic security and welfare of an individual in the territory of residence is presented.

3.Behavior of economic security and welfare of an individual can be described by 3 types of behavior, that makes it much easier to describe such a complex nonlinear system and predict the time trend in future.

Acknowledgments

The article was prepared with financial support of the grant RFBR № 19-010-00100 «Harmonization of the "society-authority-business" triad as the basis for the progressive socio-economic development of Russian regions».

References

- Abalkin, L. I. (1994). Ekonomicheskaya bezopasnost' Rossii: ugrozy i ikh otrazheniye [Economic security of Russia: threats and their reflection]. Voprosy ekonomiki, 12, 4-13.

- Bertinetto, L., Valmadre, J., Golodetz, S., Miksik, O., & Torr, P. H. (2016). Staple: Complementary learners for real- time tracking. IEEE Conference on Computer Vision and Pattern Recognition, 1401–1409.

- Ferreira, P., de Area LeãoPereira, É. J., Fernandes da Silva, M., & Borges Pereira, H. (2019). Detrended correlation coefficients between oil and stock markets: The effect of the 2008 crisis. Physica A: Statistical Mechanics and its Applications, 517, 86-96.

- Glaz'ev, S. Yu. (1997). Genotsid, Rossiya i novyy mirovoy poryadok, strategiya ekonomicheskogo rosta na poroge XXI veka [Genocide. Russia and new world order. The Strategy of the economics growth on the threshold of the 21st century]. Moscow: Astra sem'.

- İşcanoğlu-Çekiç, A., & Gülteki̇n, H. (2019). Are cross-correlations between Turkish Stock Exchange and three major country indices multifractal or monofractal? Physica A: Statistical Mechanics and its Applications, 525, 978-990.

- Kuklin, A. A., & Chichkanov, V. P. (2017). Kompleksnaya metodika diagnostiki blagosostoyaniya lichnosti i territorii prozhivaniya [Complex methodology for diagnosing the welfare ofthe individual and the territory of residence]. Ekaterinburg: Institute of Economics of the Ural Branch of RAS.

- Lindfield, G., & Penny, J. (2019). Numerical methods (fourth edition). Using MATLAB. Kidlington: Elsevier Inc.

- Menke, W., & Menke, J. (2016). Environmental Data Analysis with Matlab. Kidlington: Elsevier Inc.

- Mishra, S., & Datta-Gupta, A. (2018). Applied Statistical Modeling and Data Analytics. A Practical Guide for the Petroleum Geosciences. Kidlington: Elsevier Inc.

- Nigmatulin, R. I. (2017). Gde nakhoditsya mesto vstrechi akademii nauk i gosudarstva [Where is the meeting place of the Academy of Sciences and the State]. http://nigmatulin.ru/publikatsii-i-intervyu/stati-v-presse/item/66-gde-nakhoditsya-mesto-vstrechi-akademii-nauk-i-gosudarstva

- Nigmatulin, R. I. (2019, December 17). Seminar po problemam prognozirovaniya i strategicheskogo planirovaniya RF [Seminar on the problems of forecasting and strategic planning of the Russian Federation]. https://scientificrussia.ru/articles/seminar-po-problemam-prognozirovaniya-i-strategicheskogo-planirovaniya

- Oleynikov, E. A. (2005). Ekonomicheskaya i natsional'naya bezopasnost' [Economic and National Security]. Moscow: Ekzamen.

- Qin, J., Ge, J., & Lu, X. (2018). The effectiveness of the monetary policy in China: New evidence from long-range cross-correlation analysis and the components of multifractality. Physica A: Statistical Mechanics and its Applications, 506, 1026-1037.

- Roger, T. D., & William, T. M. D. (2016). Dangers and uses of cross-correlation in analyzing time series in perception, performance, movement, and neuroscience: The importance of constructing transfer function autoregressive model. Behav Res. Methods, 48(2), 783-802.

- Senchagov, V. K. (2001). Ekonomicheskaya bezopasnost' kak osnova obespecheniya natsional'noy. bezopasnosti Rossii [Economic security as the basis for ensuring the national security of Russia]. Voprosy ekonomiki, 8, 64-79.

- Tatarkin, A. I., Kuklin, A. A., & Myzin, A. L. (2001). Kompleksnaya metodika diagnostiki ekonomicheskoy bezopasnosti territorial'nykh obrazovaniy Rossiyskoy Federatsii [A comprehensive method of diagnosing the economic security of the territorial entities of the Russian Federation]. Ekaterinburg: Institute of Economics of the Ural Branch of RAS.

- Tatarkin, A. I., Kuklin, A. A., & Romanova, O. A. (1997). Ekonomicheskaya bezopasnost' regiona: yedinstvo teorii, metodologii issledovaniya i praktiki [Economic security of the region: the unity of theory, research methods and practice]. Ekaterinburg: Ural State University Publ.

- Zhang, K., Liu, Q., Wu, Y., & Yang, M. H. (2016). Robust visual tracking via convolutional networks without training. IEEE Transactions on Image Processing, 25(4), 1779–1792.

- Zhang, N., Lin, A., & Yang, P. (2020). Detrended moving average partial cross-correlation analysis on financial time series. Physica A: statistical mechanics and its applications, 542.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Chichkanov, V., Kuklin, A., & Okhotnikov, S. (2021). National Economic Security Diagnostics. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 353-364). European Publisher. https://doi.org/10.15405/epsbs.2021.04.39