Abstract

In the context of globalization, it is increasingly difficult to talk about the possibility of the long-term viability of Russian enterprises focused exclusively on the domestic market. Consequently, even for firms, including those who have not achieved significant success in the Russian market, there is an opportunity to develop foreign markets. Moreover, the world economy's current trends contribute to an easier entry into the world space for both large and small and medium-sized enterprises. The research aims to analyze the strategies of the Russian economy's economic entities to enter the world market in terms of exporting their products. The research methodology includes methods of analysis of foreign trade of the Russian economy, modern theories of foreign trade, and methods of processing statistical data of the Federal Customs Service through modern programming languages. The analysis results of the development of export activities and the proposed strategic objectives for integrating enterprises into the world economic system allow us to conclude that their actual implementation will contribute to the sufficient growth of Russia's manufacturing sector.

Keywords:

Introduction

From a macroeconomic perspective, exports are a strategically important factor in any country's economic growth involved in foreign economic relations. In this regard, issues related to the export development strategy is relevant for any state. Exports represent the value of all sales abroad by export-oriented enterprises of the national economy. For microeconomics, a firm operating only in the domestic market takes the risk of losing it. It can fall prey to stronger national and foreign competitors. Therefore, the company is faced with entering global markets if it has never been involved in international trade. Moreover, if it has exported earlier, maintaining its position in the world economy is a question. Consequently, researching strategies, and choosing the best scenarios from them, is significant for any company that is about to enter the global market or already operates in it.

Problem Statement

The enterprise development strategy's theoretical approaches can be divided directly into the theory of enterprise development strategies and the theory of strategies for an enterprise to enter the world market to obtain proceeds from its products' export.

The classics of modern management Mintzberg et al. (1998) singles out "5P" in their theory. Each of these stands for plan, ploy, pattern, position, and perspective. The first "P" stands for "Strategy as a plan". Its essence boils down to drawing up an exact algorithm for the sequence of actions to achieve a specific goal. The plan's disadvantage is that it is developed in advance, and the external and internal environment can change during its implementation. The second "P" means a ploy (trick), a step of the enterprise that its competitors do not expect (patent applications, price reductions, product range expansion, the threat of legal action). The third "P" means developing an enterprise strategy in terms of existing and established models. The fourth "P" implies the positioning of an enterprise in the industry relative to competitors. Examples of such positioning can be: "most reliable", "cheapest", "multifunctional", "service of a specific consumer niche", "wide service network", etc. The fifth "P" is a strategy as a perspective. For a perspective to be effective, all members of the enterprise must agree with it. It also needs to be supported by the actions that the enterprise takes daily. Thus, most of the enterprise's top management will be to convince to move towards the same goal (perspective).

Gurkov (2008) understands a strategy as a system of actions and decisions to achieve the long-term goals of an individual or a firm. He uses a rational and intuitive approach to research the strategic behavior of an organization. The representative of the rational approach Andrews (1997) is based on the logic and detailed economic analysis of the market situation with maximum consideration of various scenarios for the development of events, economic risks and economic returns, and external effects. In this case, the strategy is considered successful if the organization possesses more information than competitors, and therefore, more effectively transforms this information. Hence, the external environment of the organization is considered partially cognizable. Simon (1957) believes that this point of view is limited since it is impossible to build an accurate forecast for all scenarios of future events. Summing up, it can be noted that strategy and logic are considered identical categories with a rational approach. The scientific methods of research and analysis, theory, and forecasting of results under the expected hypotheses become fully applicable to strategic objectives. The intuitive approach is based on human intuition.In developing an enterprise strategy, imagination and unpredictability are of particular value. Strategic decisions are based on human judgment, not logic, as was the case in the rational approach. The external environment is assumed here as partially cognizable and subjective. According to Gurkov (2008), the strategy's implementation appears in the form of an algorithm, a particular sequence of actions, which consists of five stages. At the first stage, strategic tasks are set for the enterprise and each of its departments. An agreement is reached at all government levels on the priorities and importance of these tasks. At the second stage, strategic algorithms are created that are necessary for the implementation of the tasks.In developing an enterprise strategy, imagination and unpredictability are of particular value. Strategic decisions are based on human judgment, not logic, as was the case in the rational approach. The external environment is assumed here as partially cognizable and subjective. At the third stage, the financial budget of the organization is specified. The fourth stage is monitoring. Its task is to answer the question: are the costs and actions consistent with the original objectives. The fifth stage of strategic planning is the selection and stimulation of personnel.

Kleiner (2008) proposes an original approach in his work. He classifies the enterprise's strategy into thirteen forms corresponding to the types of its activities: commodity-market, resource-market, technological, integration, financial and investment, personnel, cultural, institutional, cognitive, imitation, eventual, managerial and restructuring. In this classification, within our study framework, a unique role is played by the product-market strategy, which is subdivided into product strategy (nomenclature, assortment, and release of goods) and market (methods of promoting goods on the market and selling them). In his research, the author proposes to consider not a separate commodity item, but the entire range of the enterprise. When analyzing the product strategy, three nomenclature types of the enterprise are distinguished: single-product (SP-type), dominant-product (DP-type), and poly-product (PP-type). The first type includes enterprises, 90% or more of which are sold by one product. If one product accounts for at least 70% and no more than 89% of all sales, then such an enterprise belongs to the DP-type. All other enterprises are considered a multi-product. The product strategy of the enterprise in this situation is reduced to the implementation of one of the following options: maintaining the nomenclature lines at the same level, increasing the list of nomenclature lines, reducing the list of nomenclature lines, excluding (including) the nomenclature lines in the production program.The author highlights the factors that influence the choice of a product strategy. Among them: demand for a product and its stability, price elasticity of demand, supply elasticity of demand, supply stability and its supply and demand elasticity, the financial position of an enterprise, etc. The market strategyis reduced to choosing the structure of the sales market, the strategy of market competition, and the strategy of pricing.

In the above approaches, the strategy for developing the enterprise's export activities is not considered. If we assume, from Kleiner (2008) theory, that the market strategy involves an increase in the number of countries of the world economy to which the company supplies its products, then this approach can be applied to export-oriented enterprises.

Crick & Crick (2021) look at the firm's strategies for partnering with industry competitors. They conclude that hostile relationships between the firm and competitors lead to a deterioration in the firm's financial performance. By being selective of competitors, there is scope to build trust and help overcome some of the potential power imbalances and dark-sides of coopetition strategies. Anh et al. (2017) investigate the relationship between manufacturing strategy and performance in 25 factories in Vietnam. Variance and regression analysis indicate the relevance in the formulation and implementation of manufacturing strategy in relation to its performance. Guo et al. (2018) found that firms with a product differentiation strategy spend more on R&D than firms with a cost leadership strategy. For firms adopting a cost leadership strategy, the relationship between R&D spending and performance is like an inverted U-shape. Kholodova et al. (2020) developed theoretical and empirical approaches to the analysis and assessment of trends in Russian agricultural production development in the implementation of the export-oriented strategy of agro-industrial firms. They presented the forecast parameters of the export potential of Russian agricultural products. Three scenarios for forecasting the production of primary food products per capita in the Russian Federation for up to 2025 (baseline, best and worst scenarios) have been developed and substantiated. Karipidis et al. (2020), based on a study of 83 Greek exporting firms of agricultural products, assessed the impact of the value chain parameters of manufacturing products on exports. The most critical parameters are the quality of raw materials, procurement costs, and producer prices. Edeh et al. (2020) assess the impact of innovation strategies on exports in developing countries. Arora & De (2020) argue that Latin America firms must first use a sustainable product strategy to enter international markets successfully. Wang & Wei (2020) analyze the strategies of Chinese exporters. Exporters are very active in their strategies for their export product range and destination portfolios. They regularly introduce new products and ditch some old ones to have a range of products for their target markets while maintaining their core product strategy. Bashiri Behmiri et al. (2019) analyze the impact of size, age, and production efficiency of winemaking firms in Portugal on export strategy. Wang & Ma (2018) consider firms with two types of export strategies: expansion-oriented and escape-oriented. The goal of escape-firms is to escape from the imperfect institutional environment in their country, creating additional costs for doing business. Such exporters are more sensitive and responsive to changes in the environment, although they do not improve their learning level to the same extent as expansion-oriented exporters.

Research Questions

We researched the strategy for developing exports of the metallurgical and agricultural industries in Russia in 2006, 2010, 2014, and 2018. The research is carried out based on the statistical database of foreign trade of the Federal Customs Service of Russia.

Purpose of the Study

The study aims to identify the trajectories of export strategies of the important sectors of the Russian economy related to product assortment and traded countries.

Research Methods

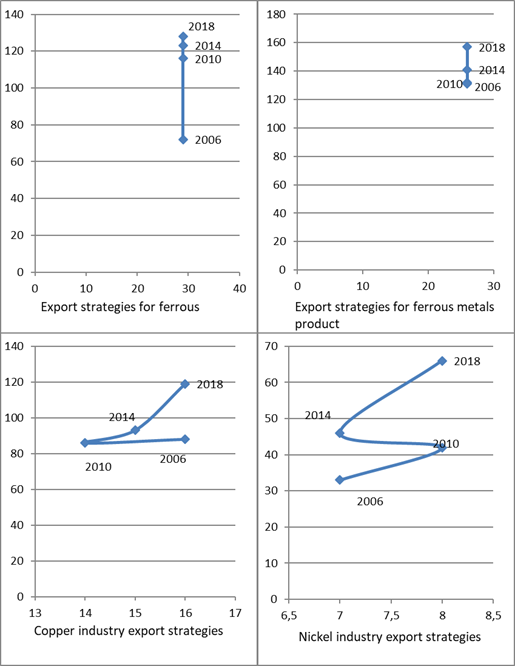

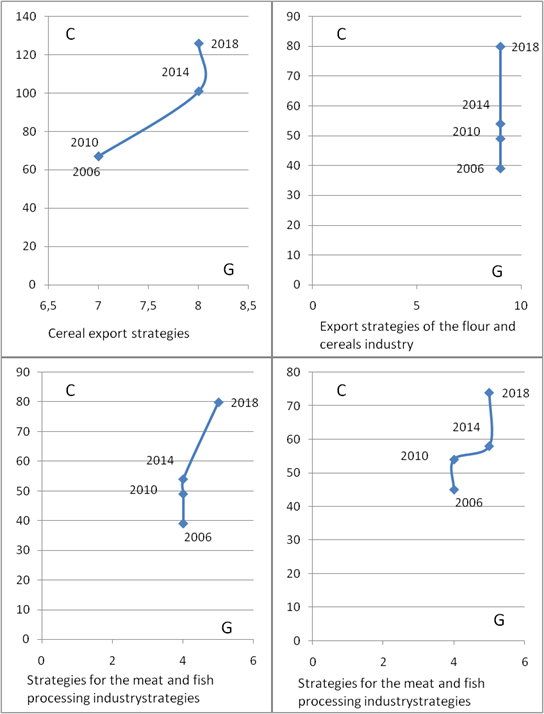

The research methodology is based on the methodology for analyzing the company's product-market strategy Kleiner (2008). The authors' contribution consists of applying this methodology not to a specific enterprise, but to an aggregated group of subsectors of the analyzed industry in 2006, 2010, 2014 and 2018. We have selected two basic export sectors of the Russian economy - metallurgy and the food sector. In metallurgy, we consider the following subsectors: production of ferrous metals and products from them (72 and 73 commodity groups), copper industry (74 commodity group) and nickel industry (75 commodity group). In agriculture and the food sector, grain production (10 commodity group), flour-and-cereal industry (11 commodity group), the sub-industry of meat and fish processing (16 commodity group), and the sub-industry of cereals and flour processing (19 commodity group) are analyzed. Within the framework of the studied commodity groups, the trajectories of these subsectors' behavior in the "commodity item - country" coordinate system are identified. The "X" axis will denote the number of headings (G) in the product group, and the "Y" axis - the number of countries to which the products of the sub-sector (C) are exported. A point in this coordinate system will indicate the product-market strategy of the sub-sector. Change in the number of exported commodity items in the sub-industry from 2006 to 2018 we will consider it as a change in the commodity strategy of the subsector, and a change in the number of traded countries as a change in the market strategy.

Findings

Based on the analysis of the sectoral structure of modern domestic exports (Table

Figure

The change in the commodity market strategy of the copper industry in Russia from 2006 to 2018 is shown in Figure

In figure

Meat processing and fish processing sub-industry of Russia (Figure

Conclusion

When analyzing the commodity strategies for the development of enterprises' export activities, it is crucial to understand which enlarged the group of industries. If an enterprise produces fuel and energy products, metallurgical products, chemicals, and extracts mineral raw materials, it should be classified as a single product. While maintaining a stable demand for these industries' products, maintaining the supply of raw materials, materials, working capital at the same levels, the only factor of uncertainty is competition. If there is no competition, then strategically, this enterprise should increase production volumes.

If an enterprise produces food products, clothing, footwear, and engineering products, it is usually classified as a dominant food type. Suppose the demand for some nomenclature lines of dominant food enterprises tends to fluctuate, and for other nomenclature lines is stable. In that case, such enterprises' strategic development is reduced to a nomenclature shift towards a decrease in the number of strategic nomenclature lines due to unstable lines. If the demand for products is stable, but there is a high level of competition in the market, then the product strategy is reduced to horizontal integration and decreased production costs.

Having considered the trajectories of strategies in the "commodity item country" coordinate system, the following options for the trajectory of subsectors' trajectory can be distinguished:

"I-trajectory" or "vertical trajectory" is a change in a sub-sector's strategies, keeping the number of commodity items at the same level, and leading to a change in the number of trading countries. On the graph, the trajectory looks like absolutely inelastic.

"L-trajectory" is a change in a sub-industry strategy aimed at reducing the production of commodity items while maintaining the number of traded countries, with a subsequent increase in the number of traded countries, while maintaining the number of commodity items.

"Horizontal strategy" is a change in a sub-sector's strategies, keeping the number of countries traded at the same level, and leading to a change in the number of commodity items. On the graph, the trajectory looks like absolutely elastic.

To develop strategies for the development of an enterprise's export, it is necessary to determine its industry affiliation. The export development strategy is subdivided into commodity and market.

The development of a commodity export development strategy depends on the enterprise's nomenclature type, which can be of three types: single-product, dominant-product poly-product.

The development of a market strategy for the development of an enterprise's export depends on the partner country's institutional environment, the presence of representative offices, regional and federal support for export-oriented enterprises, tariff and non-tariff restrictions in the importing country.

Acknowledgments

The reported study was funded by RFBR and VASS, project number 20-510-92006.

References

- Andrews, K. (1997). The Concept of Corporate Strategy. Irwin: Homewood.

- Anh, P., Tuan, N., & Hoa, H. T. (2017). Relationship between manufacturing strategy and firm performance: the empirical study of Vietnamese manufacturing plants.Economic Annals-XXI 166(7-8), 41-45. DOI:

- Arora, P., & De, P. (2020). Environmental sustainability practices and exports: The interplay of strategy and institutions in Latin America. Journal of World Business, 55(4). DOI:

- Bashiri Behmiri, N., Rebelo, J., Gouveia, S., & António, P. (2019). Firm characteristics and export performance in Portuguese wine firms. International Journal of Wine Business Research, 31(3), 419-440. DOI:

- Crick, J., & Crick, D. (2021). The dark-side of coopetition: Influences on the paradoxical forces of cooperativeness and competitiveness across product-market strategies. Journal of Business Research, Volume 122, January 2021, 226-240. DOI:

- Edeh, J., Obodoechi, D., & Ramos-Hidalgo, E. (2020). Effects of innovation strategies on export performance: New empirical evidence from developing market firms. Technological Forecasting & Social Change, 158. DOI:

- Guo, B., Wang, J., Wei, S. (2018). R&D spending, strategic position and firm performance.Frontiers of Business Research in China 12(1), 14. DOI: 10.1186/s11782-018-0037-7

- Gurkov, I. (2008). Strategiya i struktura korporatsii [Corporation strategy and structure] Moscow: Delo.

- Karipidis, P., Chrysochou P., & Karypidou, I. (2020). The importance of relationship characteristics in the export performance of food firms. British Food Journal, 122(4), 1305-1320. DOI:

- Kholodova, M., Kabanenko, M., Orekhova, L., Dubrova, L., & Kolycheva, Z. (2020). Prospects for development of Russian agricultural industry in the context of export-oriented strategy implementation in the agro-industrial complex. XIII International Scientific and Practical Conference “State and Prospects for the Development of Agribusiness – INTERAGROMASH 2020”, 1-11. DOI:

- Kleiner, G. (2008). Strategiya predpriyatiya [Enterprise strategy]. Moscow: Delo.

- Mintzberg, G., Lampel, J., & Ahlstrand, B. (1998). Strategy Safari: A Guided Tour Through The Wilds of Strategic Management. New York: Free Press.

- Simon, H. (1957). Models of the Man. NewYork: JohnWiley.

- Wang, W., & Ma, H. (2018). Export strategy, export intensity and learning: Integrating the resource perspective and institutional perspective. Journal of World Business, 53(4), 581-592. DOI:

- Wang, Y., & Wei, W. (2020). Chinese firms export dynamics: experimental but promising. Transnational Corporations Review, 12(1), 10-23. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 April 2021

Article Doi

eBook ISBN

978-1-80296-104-1

Publisher

European Publisher

Volume

105

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1250

Subjects

Sustainable Development, Socio-Economic Systems, Competitiveness, Economy of Region, Human Development

Cite this article as:

Stepanov, E., & Tran, T. P. (2021). Export Strategies Of Russian Firms. In E. Popov, V. Barkhatov, V. D. Pham, & D. Pletnev (Eds.), Competitiveness and the Development of Socio-Economic Systems, vol 105. European Proceedings of Social and Behavioural Sciences (pp. 1021-1030). European Publisher. https://doi.org/10.15405/epsbs.2021.04.108