Abstract

Digitalization of the economy together with introduction of innovations is actively entering the industrial production, including diamond cutting. Being such a specific product, diamonds and diamond jewelry faced a significant challenge in reducing consumers demand and the threat of market replacement by diamonds grown in laboratory. The article revealed threats and risks faced by the industry in the global trend of decrease in consumers demand, including due to the spread of new infections (COVID-19). The types of innovations required to minimize risks and threats with the help of end-to-end technologies introduced into the diamond production are identified. The authors presented end-to-end technologies expected to be used in the diamond production. The authors conducted a technology audit of diamond-cutting enterprises engaged in processing in the North of Russia. The innovative development of the industry together with introduction of product and process innovations determines the need for the development of innovation management mechanisms. Furthermore, promising areas of innovative development that have a need for diamond production in the North are identified.

Keywords: Technology auditdiamond cuttinginnovative infrastructuretechnological backloggem industrydatabase technology

Introduction

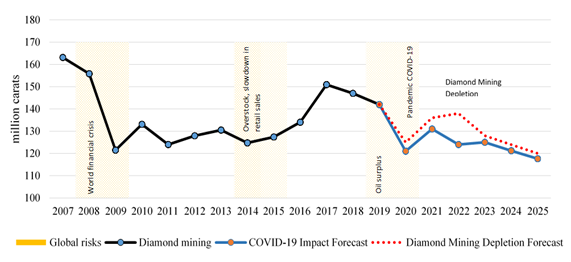

The diamond industry is currently experiencing difficulties in all segments of the diamond pipeline, from diamond mining to diamond production and marketing of finished products. In 2018, global natural diamond mining amounted to 147 million carats. In 2019, the planned global diamond mining is 142 million carats (The Global diamond report, 2019), but this forecast is more likely to be even lower due to the ongoing pandemic. Firstly, the drop in global diamond mining is associated with deterioration in raw material base, caused by decrease in the average diamond grade in ore and ore processing volumes. Secondly, the difficulties of financial and credit relations led to a cyclic economic problem of limited financial resources in the economic sectors, which provoked a prolonged decrease in consumers demand, especially for luxury goods. Thirdly, the restrictive measures introduced due to the spread of a new infection (COVID-19) reduced the retail sales of diamond jewellery and even forced many countries to close the jewelry stores. Wholesaling is stopped on diamond exchanges and sight holders temporarily suspended trading from February 2020. Despite the negative trends in the global diamond market, the business will undoubtedly recover from this crisis events (Figure

Important of the problem

According to expert survey conducted during Edahn Golan (The Golan Diamond Market Report…, 2020) seminar, most experts predict the diamond market recovery to be in the pre-holiday period of Christmas 2020 and New Year 2021. Revival of tourist trips as well as growth of postponed weddings and celebrations after the pandemic will give an impetus to increase consumers demand for diamonds.

The forecast estimate of global diamond mining until 2025 is based on the informational background prepared on the basis of annual reports of diamond mining companies (Annual reports of ALROSA, PJSC, 2020; The diamond insight report, 2019) and analytical reports on diamond industry research, including large consulting companies as AWDC, Edahn Golan Diamond Research & Data, Diamond Pipeline, etc. (The Global diamond report, 2019; The Golan Diamond Market Report…, 2020; Even-Zohar, 2020). Scientific approaches and research methodology are developed based on the scientific results of researchers, expert opinions and specialists interviews (Aletdinova, 2013; Koki Costa da Nogami et al., 2018; Mohtasham et al., 2017). Methodological foundations of the study on the management of innovation and digital development of the economic sectors were based on scientific papers prepared by the following scientists (Bhat & Bowonder, 2017; Nikolaev et al., 2016; Salimova & Khakhaleva, 2017; Samsonov et al., 2017).

The key factor of business liquidity for diamond manufacturers is the value of processed rough, namely diamonds. In the majority of cases, diamond manufacturer’s use for processing natural diamonds mined in South Africa, Russia, Botswana and other countries (Pototskaya, 2013). The price of natural diamonds is formed according to the law of supply and demand, but the price dynamics depends on the following quality characteristics of diamonds: mass, purity and color (more than 6,000 items). The price changes in different ways depending upon the demand for diamonds of a certain quality category of raw materials. Diamond manufacturers have a small added value of 1-3% (The Global diamond report, 2019), which determines the need to pay special attention also to control of production costs reduction. During the crisis period, diamond manufacturers try to maintain at least 1% of added value, and sometimes even 0% added value is considered a good result for business as compared to incurring losses. Thus, the problem of reducing the diamond production costs is considered relevant and desired during the crisis of the industry. The liquidity issue is particularly acute for diamond manufacturers operating in the North. Difficulties lie in bearing additional expenses for utility bills and transportation costs associated with servicing production facilities (heating, water supply, electricity and other expenses) under the conditions of uncongenial climate of the Extreme North, where the temperature in severe winter periods drops to 45-50°C below zero. Therefore, the introduction of innovations and their management in order to achieve the goal of reducing the finished products costs is relevant and important in difficult socio-economic conditions of the region.

The study object of this article is the diamond-cutting enterprises of Russia located in harsh environment of the Republic of Sakha (Yakutia). Yakutia is world famous for its reserves and volumes of extraction of natural diamonds. Over 90% of mined diamonds are exported to world diamond exchanges in China, Belgium, India, the USA and other countries (Mbayi, 2015; Radhakrishna, 2007). In 1992, the regional government of Yakutia made a political decision to organize the processing of mined diamonds at local production in order to create employment opportunities and gain added value. As a result, large-scale state programs to organize diamond-cutting shops in rural settlements of Yakutia were launched, the educational system for training personnel was created, and the work of financial institutions (banks, holdings, leasing, etc.) was organized) (Grigoryeva, 2020). As a consequence of this, high commercial and managerial costs with low gross profit did not allow many diamond-cutting enterprises to remain liquid, and the number of enterprises decreased from 55 to 6.

Maintaining the industrial production of diamonds in the North remains the state decision of the regional executive bodies. Changed conditions of socio-economic development of the region together with emergence of process, product and marketing innovations with change in technological mode make it possible to bring market participants to a new managerial level of development of the diamond-cutting industry in Yakutia using new techniques and mechanisms for managing innovations.

Results

Technology audit conducted in diamond-cutting enterprises of Yakutia shows that fixed assets of the enterprises were acquired and imported into the region in the 90s. High technical level of operating equipment, machines and mechanisms can be maintained by enterprises with a sufficient level of profitability. Insufficient production capacity of high-tech equipment or absence of it as well as high degree of depreciation of fixed assets leads to increase in production cost along with higher prices for diamonds against poor cutting and larger share of production fault (Table

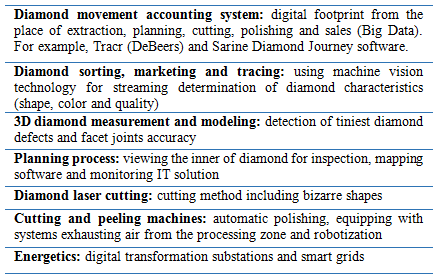

Diamond-cutting companies have an average technological position relative to leading foreign mining companies. Possible areas of modernization and technological re-equipment are as follows:

-updating of cutting and peeling technologies;

-modernization of diamond sawing technology;

-use of systems with the ability to localize diamond crystal inclusions to take them into account when calculating the optimal position of diamonds;

-use of control systems for diameter of the workpiece and intensity of crystal during the turning process; and

-equipping cutting machines with systems exhausting air from the processing zone.

Development and creation of new types of technological support innovations as well as conducting research and development of the innovation infrastructure segment are irrational in the North due to a number of insurmountable difficulties.

Discussion

Consequently, the introduction of process innovations is possible only by borrowing and acquiring ready innovative products (technologies, equipment, tools, etc.) from a number of companies specializing in the development of advanced diamond processing technologies. The leader is Sarine Technologies Ltd, which is a publicly traded company on the Singapore Exchange headquartered in Hod HaSharon (Israel) with an extensive network of affiliates, distributors, service centers and technology laboratories all over the world. Therefore, process innovation management is possible solely through modernization and technological re-equipment by directing investments in purchase of advanced technologies.

Promising scientific direction for the development of diamond laboratory tooling is associated with introduction of artificial intelligence for the diagnosis, evaluation and automation of industrial production (Figure

At the stage of entering the digital economy, the Russian diamond mining and processing business will undergo transformation in the following components: production relations, economic system structure and the need for new competencies of specialists. Also, the transformation of the personnel training system, the need for new requirements for communication, computing and information systems, and transformation of the production process are expected (Grigoryeva & Sentizova, 2019).

The complexity of implementing measures for the innovative development of diamond manufacturers in the North lies in attracting investments and other financial resources to update the material and technical basis of industrial production. The introduction of process innovations will help reducing production costs, increasing labor productivity and, therefore, achieving positive added value.

Conclusion

Transition to a new technological mode of industry provides additional opportunities for organizing and managing diamond production with less dependence on the location of production and entrance to global markets. The introduction of marketing innovations in management of diamond and jewelry sales will help expanding the scale of sales. The introduction and development of online sales mechanisms can attract consumers from all over the world.

Sales activity of regional diamond manufacturers in the North is distinguished by the problems of selling finished products of retail sales abroad; therefore, wholesaling that do not allow them to reach a competitive level is peculiar to them. The introduction of process and product innovations by industry competitors determines the need to develop mechanisms for managing innovations and their active implementation in diamond production. Distinctive aspects of the organization and management of diamond production in the North leads to the development of special individual mechanisms for managing innovations adapted to the conditions of the Extreme North, which is the main task of the further research.

Acknowledgement

The authors express their gratitude and reverence to their research advisor Professor M.V. Nikolaev for the gained knowledge and skills of research work (Nikolaev et al., 2016). The article is prepared within the framework of the project on the state task of the Ministry of Science and Higher Education of the Russian Federation titled The Patterns of Spatial Organization and Spatial Development of Socio-Economic Resource Systems of the Northern Region (No. FSRG-2020-0010).

References

- Aletdinova, A. A. (2013). Information Support for Management of Innovative Development of Organizations. NSTU Publishing House.

- Annual reports of ALROSA, PJSC. (2020). Official website of ALROSA, PJSC. http://www.alrosa.ru

- Bhat, B., & Bowonder, B. (2017). Innovation as an enhancer of brand personality: Globalization experience of titan industries. Creativity and Innovation Management, 10(1), 26-39.

- Even-Zohar, C. (2020). Diamond Pipeline 2003-2018. IDEX Online News. http://www.idexonline.com

- Grigoryeva, E. E., & Sentizova, N. R. (2019). Features of the Russian Raw and Cut Diamonds Business Digitalization. AEBMR-Advances in Economics Business and Management Research, 81, 131-134,

- Grigoryeva, E. E. (2020). External and internal factors of transformation of diamond industry of Russia. Smart Innovation, Systems and Technologies, 172, 259-265.

- Koki Costa da Nogami, V., Giovanni David Vieira, F., & Rodriguez Veloso, A. (2018). Concept of innovation in low-income market [Conceito de inovação no mercado de baixa renda]. Revista Brasileira De Gestao De Negocios, 20(1), 127-149,

- Mbayi, L. (2015, 27 September). Turning Rough Dreams into a Polished Reality? The Development of Diamond-Processing Capabilities in Botswana's Diamond Cutting and Polishing Industry. The Global Diamond Industry: Economics and Development, 2, 229-250.

- Mohtasham, S. S., Sarollahi, S. K., & Hamirazavi, D. (2017). The effect of service quality and innovation on word of mouth marketing success. Eurasian Business Review, 7(2), 229-245.

- Nikolaev, M. V., Grigoryeva, E. E., & Gulyaev, P. V. (2016). Assessment of risks influencing innovation activity of industrial enterprises (on example of diamond-brilliant complex). Eurasian Mining, 2, 6-10.

- Pototskaya, T. I. (2013). International division of labor, the diamond complex: specialization and cooperation. Regional studies, 2, 52-60.

- Radhakrishna, B. P. (2007). Diamond exploration in india: Retrospect and prospect. Journal of the Geological Society of India, 69(3), 419-442.

- Salimova, T. A., & Khakhaleva, E. V. (2017). Implementation of the policy of import substitution as a condition for ensuring sustainable competitiveness of enterprises. Digital transformation of economy and industry: problems and prospects, St. Petersburg, 553-575.

- Samsonov, N. Y., Tolstov, A. V., Pokhilenko, N. P., Krykov, V. A., & Khalimova, S. R. (2017). Possibilities of russian hi-tech rare earth products to meet industrial needs of BRICS countries. African Journal of Science, Technology, Innovation and Development, 9(5), 637-644,

- The diamond insight report. (2019). De Beers, Inc., 56. https://www.debeersgroup.com/~/media/Files/D/De-Beers-Group/documents/reports/insights/the-diamond-insight-report-2019.pdf

- The Global diamond report. (2019). Bain and Company, Inc., 49. https://www.bain.com/contentassets/e225bceffd7a48b5b450837adbbfee88/bain_report_global_diamond_report_2019.pdf

- The Golan Diamond Market Report – Q1 2020. (2020). Edahn Golan Diamond Research & Data, Inc., 12. https://www.edahngolan.com/the-golan-diamond-market-report-q1-2020

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

08 March 2021

Article Doi

eBook ISBN

978-1-80296-102-7

Publisher

European Publisher

Volume

103

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-644

Subjects

Digital economy, cybersecurity, entrepreneurship, business models, organizational behavior, entrepreneurial behavior, behavioral finance, personnel competencies

Cite this article as:

Grigoryeva, E. E., & Sentizova, N. R. (2021). Innovation Management In Diamond Cutting In The North. In N. Lomakin (Ed.), Finance, Entrepreneurship and Technologies in Digital Economy, vol 103. European Proceedings of Social and Behavioural Sciences (pp. 312-318). European Publisher. https://doi.org/10.15405/epsbs.2021.03.39