Abstract

The digital virtual world is objectively and realistically affecting the material world more and more. A technological revolution is taking place. Its result is not only a change in the paradigms of management theories and the formation of the goods value in a new digital environment but also a change in cultural practices, relations between people, groups and the state. Researchers agree that the most important task for the Russian economy is to provide tax safety now and in the future. Its role is increasing in the digital economy as well. The business entities in the field of taxation have a great influence on ensuring tax security. Specifically, these are legislative bodies; executive authorities; taxpayers; participants in the credit and banking system; representatives of international financial institutions functioning in the Russian Federation. The subject of the study is problems of ensuring tax security, objectively arising in connection with the development of information and communication technologies and transition to a digital economy. The purpose of the work is to pose a scientific problem being the initial stage in the development of taxation theory under the conditions of digital economy. The problems emerging in the field of digital economy taxation are identified on the basis of literature review and are then systematized. Particular attention is paid to the impact of new problematic situations on ensuring tax security. The findings can be used to develop directions for overcoming threats to the tax security of the state.

Keywords: Digital economyeconomic securitytax security

Introduction

In the modern world, innovations are not only related to the capabilities of digital technologies but also are largely based on them. The development of the digital economy is inextricably bound to the issue of security. Each company at its own level creates the conditions for minimizing risks and reducing the impact of negative external factors on the results of their activities. Security of the economic system of business entities is ensured by coordinating actions in the fiscal, budgetary, scientific and legal systems.

According to the concepts found in domestic literature, all approaches to defining the term “tax security” can be divided into three groups (Nevzorova, Kireenko, & Sklyarov, 2017).

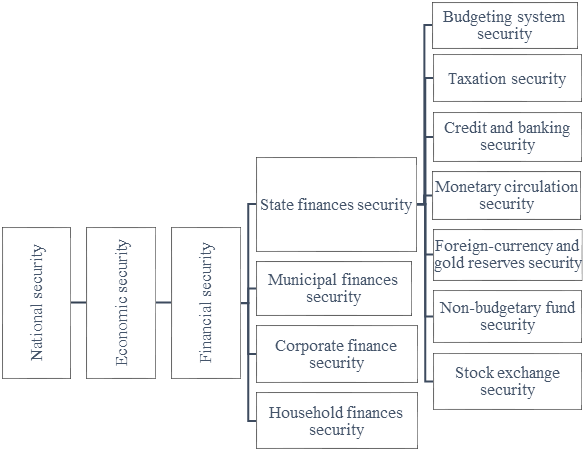

1) The types of security being a part of national security are identified at the first level (information, social, economic, military, etc.) and at the second level (for example, economic security is divided into types such as financial, food, foreign economics, energy, etc.).

2) A more detailed classification of security types, which involves separation of the more detailed types of the third and fourth levels (for example, financial security is divided into the safety of state, municipal, corporate, finance and household finances) from the types of security of the second level (Figure

3) Tax security is identified with tax optimization.

Problem Statement

The major problem is that the existing system of taxation and, accordingly, ensuring tax security not only in Russia but also in other world powers is aimed at a business model for the production and sale of tangible objects. Concurrently, various experts claim that the effective tax rate for companies involved in the digital business is only 8.5 % while the same aspect of the traditional business is equal to 20–23 %. Global e-commerce retail sales in 2017 reached $2.290 trillion, accounting for 10.1 % of total retail sales. This stock will exceed 16 % by 2021 when sales reach $4.479 trillion. Additionally, experts foresee a significant growth of this market in Russia to ₽2.163 billion in 2020 compared to ₽1.478 billion in 2018. On average, the volume of Russian Internet commerce will grow by 23 % over the year. The leaders of the World Digital Competitiveness Ranking are the USA, Singapore, Sweden, Denmark and others. Russia ranks 40 out of 63. The volume of losses from cyberattacks was estimated by Russian entrepreneurs at ₽116 billion in 2017. An amount of $ 650 billion is a global loss. Problems associated with changing forms of doing business. In the context of digitalization, it has become much more difficult to track which country a product or service was produced in and where it was purchased. Potentially, this is dangerous due to a decrease in tax collection, emergence of potentially conflict situations and abuse of copyright and related rights (Nevzorova, Bobek, Kireenko, & Sklyarov, 2016).

We have highlighted the problems of taxation arising in relation to entrepreneurial activities carried out on the basis of digital platforms or if the products of entrepreneurs are fully or predominantly digital (high-tech business).

In the first case, a platform-based business (for example, Uber, Yandex-taxi, etc.) is managed by a platform company.

In the second case, the business is done on the basis of digital platforms using blockchain technologies. Taxation in such calculations is not discussed. In our opinion, this is an issue requiring research. In case of a certain proportion of digital platforms, it makes sense to establish a mode of not taxed transactions within the system. Otherwise the development of the digital economy may be slowed down. Another group of problems associated with the formation of a new paradigm for creating value, digital management, digital culture, virtual assets is worth noting.

Research Questions

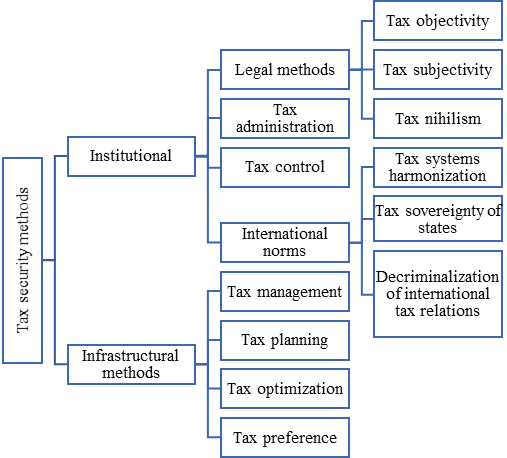

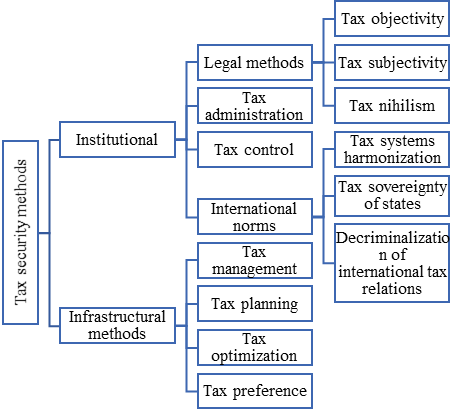

Tax security methods are also under the scrutiny of scientists and practitioners. Some domestic authors highlight the institutional and infrastructural methods necessary to maintain a safe state of the country’s tax system (Figure

Scientists note that when discussing the prospects of the digital economy, a description of its capabilities, forms of business based on digital platforms and blockchain technology prevails. Issues of taxation, creation and destruction of value, and tax security are not paid sufficient attention to, despite the fact that they affect the interests of all economic entities, including the population, business, and the state (Nechaev, Antipina, Prokopyeva, & Romanov, 2016).

Purpose of the Study

The attention of the target audience is a particular product or resource that objectively exists in the digital economy. This resource has a certain value, possibly influencing the cost. Since the Internet offers many services to promote various goods and services, it’s worth considering the target audience attention to be an income-generating asset.

The role of digital control is growing rather significantly. Management implies promotion of digital products, digital images of real products or services, pages of legal entities and individuals on the Internet (including social networks), while the control levers are managed by those who promote these digital products on the web and those who own or control telecommunications. This is a huge sphere of influence and a huge market (Anwar, 2019).

It is worth saying that the above transformations and identified problems of digital economy taxation pose a threat to the tax security of the country. In our view, it is advisable to identify and explore options for overcoming the main threats being budget insecurity with tax revenues (divided into threats to fail in preserving the size of the physical tax base; to increase a latent tax base; threats of excessive tax burden affecting tax capacity); erosion of the tax base and its withdrawal outside the state; the presence and growth of the shadow economy; tax environment deterioration.

Research Methods

The methods of ensuring tax security are diverse and their adaptation to changing conditions is necessary (Figure

It is advisable to develop automated tax security systems, including those aimed to improve tax management, achieve strategic and tactical goals, monitor indicators for assessing tax security; a system of measures to overcome tax risks and eliminate threats to tax security as well as to raise the level of tax culture with the objective to neutralize the threats to tax security in the context of the Russian economy digitalization.

Findings

The following measures aimed to comply with the tax system in the digital economy in Europe are being discussed:

1) to start a series of negotiations on a new cross-border VAT calculation system based on taxation in areas of consumption to replace the current mechanism, which leaves room for fraud;

2) to modernize the system of calculating VAT for cross-border e-commerce;

3) to concur a single list of non-cooperative tax jurisdictions at the level of the EU;

4) to start a discussion on whether it is worth imposing obligations to disclose tax evasion schemes for financial intermediaries and consultants;

5) to introduce an equalization tax on the turnover of digital companies being a tax on all non-taxable or insufficiently taxable income derived from all Internet business operations, including B2B and B2C, in the form of a surcharge for corporate income tax or as a separate tax;

6) to apply withholding income tax on digital transactions being an autonomous final withholding tax on certain payments made in favor of non-resident suppliers of goods and services ordered online;

7) to use the income tax derived from the provision of digital services or advertising being a separate fee that can be applied to all transactions made remotely with customers within a country where a non-resident enterprise has a significant economic presence.

According to some experts, the tax administration system being created in Russia, including the introduction of digital technologies has already reached a fairly high level (Benghozi, 2016).

The Federal Tax Service of Russia (FTS) is actively engaged in developing an information system for digitalizing tax administration and integrating all sources of information and data flows into a single information system, followed by analysis of these data based on modern technologies for processing large amounts of information. A model for assessing the digital maturity of tax administrations, which is in demand by foreign services, has been developed. An automated system for controlling VAT refunds, which enables to automatically find data inconsistencies in supply chains, online cash registers, RFID tagging systems (fur market), QR codes (pharmaceutical market) and electronic offices of taxpayers has been introduced. According to the Federal State Statistics Service, the share of tax revenues in total income increases annually, specifically, in 2015 tax revenues amounted to 78.1 % of total income, in 2016 to 79.8 % and in 2017 to 83.6 %. Most of the remote desk checks are already carried out by robots (Alekseev, Savenkov, Shvakov, Lebedev, & Ragulin, 2018).

Among other things, the Russian Government plans to create a system enabling to fully trace the circulation of goods from the manufacturer to the final consumer by 2024. In January 2018, almost a year-long piloting period of tobacco products labeling was launched; in June, shoes labeling began. The concept of the so-called physical Internet in freight traffic, enabling to trace the movement of any goods from a sender to a final recipient is being developed (Shan, 2019).

Cash register equipment of a new technology has been implemented since 2017. This technology can be registered using an electronic service on the website of the Federal Tax Service and entrepreneurs can monitor how sales proceed, what impact seasonal and temporary factors have, what commodity items are in demand and much more. In addition, the sound use of the accounting system at the box office will help increase profits by 5–20 % due to automatic pricing and other useful tools. For buyers there is a mobile application which enables to check the issued receipt as well as save it electronically.

Conclusion

The new electronic services “Transparent Business” and “Tax Calculator for Calculating Tax Burden” are an effective analytical tool for public authorities of the constituent entities of the Russian Federation. They are available on the official website of the Federal Tax Service. They provide an opportunity to receive full information on fulfilling tax obligations by Russian Federation subjects, including organizations that receive tax benefits, subsidies and government orders.

The information system “Analysis of property taxes” enables to analyze the structure of taxation, predict the volume of tax revenues, and monitor tax debt. More than 18 thousand local governments are connected to the mentioned system.

Since 2019, a special taxation scheme “Professional income tax” within the framework of the experiment has been applied in some regions of the Russian Federation. This special taxation scheme has an attractive tax payment procedure through a mobile application, does not require tax reporting and provides a low tax rate. According to the developers of the project, this will allow legalizing the activities of self-employed citizens (Kostakis, 2016).

Thus, the considered area requires mandatory attention on the part of government bodies, practitioners, and scientific community. Lack of attention or unwillingness to improve taxation principles for states implies potential threats to ensure tax security including huge losses in tax profits due to budget revenues reduction or slowing down, and development of new business forms and an unfavorable lag behind world powers already implementing the processes. The author considers the possibility of modeling the level of tax security depending on tax conditions to be the further stage of research based on the accumulation of an array of information.

Acknowledgments

The authors acknowledge receiving support from state-funded research program of Irkutsk National Research Technical University and Baikal State University. We are responsible for all errors as well as heavy style of the manuscript.

References

- Alekseev, A. N., Savenkov, D. L., Shvakov, E. E., Lebedev, N. A., & Ragulin, A. D. (2018). Financial problems of regional development and the ways of their solution in contemporary Russia Quality. Access to Success, 19(S2), 71–75.

- Anwar, S. (2019). Use of blockchain technology (Smart contract) for small and medium enterprises sector to increase transparency and reduce default rates. Journal of Advanced Research in Dynamical and Control Systems, 11(6 Special Issue), 1730–1737.

- Benghozi, P. -J. (2016). The cultural economy in the digital age: A revolution in intermediation? City, Culture and Society, 7(2), 75–80.

- Kostakis, V., Roos, A., & Bauwens, M. (2016). Towards a political ecology of the digital economy: Socio-environmental implications of two competing value models. Environmental Innovation and Societal Transitions, 18, 82-100.

- Nechaev, A., & Antipina, O. (2015). Analysis of the impact of taxation of business entities on the innovative development of the country. International Journal of Economic Perspectives, 19(3), 5–8.

- Nechaev, A. S., Antipina, O. V., Prokopyeva, A. V., & Romanov, R. V. (2016). Investigating and developing methods for stimulating innovative and investment activities applying taxation tools. Indian Journal of Science and Technology, 9(29), 99465-99465.

- Nevzorova, E. N., Bobek, S., Kireenko, A. P., & Sklyarov, R. A. (2016). Tax evasion: the discourse among government, business and science community based on bibliometric analysis. Journal of Tax Reform, 2(3), 227-244.

- Nevzorova, E. N., Kireenko, A. P., & Sklyarov, R. A. (2017). Bibliometric Analisis of the Literature on Tax Evasion in Russia and Foreign Countries. Journal of Tax Reform, 3(2), 115–130.

- Quiggin, J. (2014). National accounting and the digital economy. Economic Analysis and Policy, 44(2), 136-142.

- Shan, J. (2019, November). Optimization Strategy of Tax Planning System in the Context of Artificial Intelligence and Big Data. In Journal of Physics: Conference Series, 1345(5), 052006.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Sanina, L. V., Antipina, O. V., & Xu, S. (2020). Threats To Tax Security In The Digital Economy. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 22-28). European Publisher. https://doi.org/10.15405/epsbs.2020.12.4