Abstract

This empirical study investigated the impact on customer loyalty in Family Takaful of perceived service quality and customer satisfaction. Based on the literature review, the research was guided by four hypotheses. The population of this sample is employees of three Pahang universities and Family Takaful policy holders. A total of 400 questionnaires was circulated and 114 responded analyzed. Findings from the study found that three hypotheses were supported, providing new ideas for Takaful providers and Takaful agents to improve their current low level of market penetration. Theoretically, this study adds to the growing body of literature on Takaful service quality, particularly in customer satisfaction and customer loyalty. Practically, measuring Takaful service quality can help Takaful providers to effectively establish control mechanism and initiate improvement programs. This study found that customer and Takaful providers can create affect on Takaful service quality. The results of the current study provide support for the notion that customer loyalty is a vital component of successful Takaful service offerings.

Keywords: Family Takafulcustomer loyaltyperceived service quality and customer satisfaction

Introduction

In the early 1980s, the Takaful or Islamic insurance industry in Malaysia was developed to complement the Islamic banks ' services and in 1984, the first Takaful institution began operating (Islamic Banking and Finance Institute Malaysia, 2018). There are currently 15 Takaful operators in Malaysia from local and foreign companies; indicating that Malaysia is firmly committed to promoting the country as a global Islamic financial hub in the region (Bank Negara Malaysia, n.d.). Takaful is protection scheme, the word was derived from the word kafala, meaning joint guarantee, whereby a group of participants jointly agrees to contribute (tabarru ') to the takaful fund in order to guarantee each other against any loss or damage that may occur to any of them (Islamic Banking and Finance Institute Malaysia, 2018).

Takaful (Islamic insurance) is one of the world's growing industries. The global Takaful market is valued at USD 14.7 billion in 2014, of which Saudi Arabia accounted for 55%, Malaysia and Indonesia for 27% and the Gulf Cooperation Council (GCC) for 10% (Ernst and Young, 2015). Malaysia was reported to be the largest Takaful market outside the Arab world, whose initial asset base of RM1.4 million in 1986 grew to a whopping RM23 billion figure in 2014 (Ernst and Young, 2015). Thus, Malaysia is known for its product innovation and organizational best practices as a fast-growing international Islamic finance hub. The Takaful industry has emerged as one of the most important components of Islamic finance leading to the overall development of the Malaysian economy (Sherif and Shaairi, 2013)

The Takaful market in Malaysia has been on an active growth path, achieving growth momentum of around 19 percent and supported by a strong asset base of almost RM23 billion (Ernst and Young, 2015). There are two types of Takaful scheme in Malaysia: General Takaful, which provides material loss coverage and Family Takaful, which provides consumers with financial security from financial loss. The Family Takaful contributions reached RM4.8 billion, with steady growth, according to Ernst and Young (2015). Nevertheless, only half of the population in Malaysia is covered by either life insurance or the Family Takaful (Abdou et al., 2014). Therefore, the Family Takaful has great potential to grow their market in Malaysia.

Literature review

Significant studies have been carried out in the Takaful sector, but the Family Takaful studies are still scarce. Researchers have therefore identified the antecedents of customer loyalty. Interestingly, perceived service quality and customer satisfaction are consistently among some of the constructs that are increasingly recognized as predictors of customer loyalty in the existing literature (Abd Wahab et al., 2016: Tsoukatos and Rand, 2007). Perceived service quality, customer satisfaction and customer loyalty are therefore important factors that any service organization should strive to achieve at a higher level. The current study, therefore focused on the determining factors of the Family Takaful service quality by analyzing the relationship between constructs; that is, perceived service quality, customer satisfaction and customer loyalty. Understanding the factors that affect the perception of service quality, satisfaction and loyalty of customers is necessary in order to be effective in the future. A brief discussion on the concepts of customer loyalty, customer satisfaction and perceived service quality is presented in the following section.

Customer Loyalty

Understanding the loyalty behavior of customers is critical for service providers to provide excellent customer services (Pritchard et al., 1999). Customer loyalty behavior is of utmost importance to business as it is an indication of continuity of business, potential future revenue generation and thus contributes to business profitability (Abd Wahab et al., 2016). Any company must therefore identify the factors that contribute to customer loyalty. Accordingly, researchers have found that it is more profitable to keep existing customers than to acquire new customers (Woo & Fock, 2004).

Loyalty refers to the positive attitude of a customer towards the service and plans to purchase the service again (Oliver, 1999; Wu, 2011). A loyal customer could be determined through their actions such as repurchase, easy to retain and positive word of mouth (Ladhari et al., 2011). In a service-dependent Takaful business, loyalty becomes an important factor in overcoming competition. This study conceptualizes customer loyalty as a multidimensional concept; (i) refers to behavioral intent, e.g., repeat purchase, (ii) affective loyalty, e.g., positive attitude towards providers, and (iii) cognitive loyalty, such as considering the provider as the sole option for future transactions (Picón et al., 2014). Loyal customers would be committed to one Takaful provider irrespective of other providers ' offers. Heskett et al., (1994) clearly shows that customer satisfaction with the quality of service contributes to loyalty and profitability. In addition, the key factor in determining customer loyalty is satisfied with the service provided (Zeithaml et al., 1996).

Customer satisfaction

Customer satisfaction is very important for any business organization's growth. Satisfaction is customer measurement of a product or service after consumption (Chang, 2006; Gallarza et al., 2011). That is, satisfaction is heavily influenced by the assessment of the products or services delivered to the customers. Accordingly, satisfaction obtained after consuming a product or service when a need, desire or goal is satisfied (Oliver, 1999; Orel & Kara, 2013). It is found that customer satisfaction is an important factor in creating and maintaining loyal customers (Chen & Wang, 2009). Therefore, in accordance with the scope of this research and agreeing with previous studies, customer satisfaction in this research is referred to as customer assessment of overall service quality and this may result in loyalty (Orel & Kara, 2013; Parasuraman et al., 1988). Researchers have reported that perceived service quality has an indirect impact on loyalty through satisfaction; customer satisfaction mediates the relationship between perceived service quality and loyalty (e.g., Alexandris et al., 2004; Clemes et al., 2011). It is therefore proposed that Takaful providers or agents offer excellent services in order to gain a good reputation and to give customers satisfaction. In fact, it is the essence of the Takaful industry; an industry involving intangible services with complex products and long service life at high risk. Customer satisfaction is therefore considered necessary for customer retention and loyalty and clearly contributes to the achievement of economic goals such as profitability, market share and return on investment (Kumar et al., 2013).

Studies show that offering products or services that please customers is critical for businesses because satisfied customers are loyal and generate better repeat purchases as a result (El-Adly, 2018). In essence, customer satisfaction is an important component for creating and maintaining loyal customers. Kumar et al. (2013) found that customer satisfaction was positively linked to customer loyalty in their comprehensive literature review. Abu Hassan et al. (2014) supported the finding by examining the factors influencing customer loyalty among Malaysian Takaful customers and found that customer satisfaction related positively to customer loyalty.

Perceived Service Quality

The role of quality cannot be underestimated by any organization, as success is heavily dependent on customer acceptance and satisfaction. Customers in the service organization are looking for service quality indicators. Consumer perception of the quality of service is significant because it is synonymous with awareness. Accordingly, the most explored subject in service marketing is perceived quality (e.g., Ladhari, 2009; Lee et al., 2000). Quality thus leads to a significant factor in an organization's long-term competitiveness and survival (Kumar et al., 2013). Based on assessment of a service's supremacy, the consumers should consider service quality as opposed to other offers (Parasuraman et al., 1988). Service quality is defined as meeting the expectations of customers, which is the gap between the expectations of customers for service and their perception of service experience (Zeithaml et al., 1988). High quality of service helps to increase customer satisfaction, customer loyalty and market share growth by obtaining new customers (Dabholkar et al., 2000). Service quality is therefore considered a competitive advantage for a business organization and a path to profitability.

Studies have confirmed that a high level of customer satisfaction is influenced by on excellent service quality (1988). Accordingly, Zeithaml et al. (1996) analyzed the behavioral effects of service quality on a computer manufacturer, a retail chain, a car insurer, and a life insurer, and found a strong correlation between perceived overall service quality and customer loyalty across multiple companies. Mohd Suki (2013) studies life insurance customers in Labuan in Malaysia and found a positive relationship between perceived service quality and customer satisfaction. Consequently, Yazdanpanah et al. (2013) conducted research on crop insurance among farmers in Iran and found that perceived quality of service is one of the factors that has a greater impact on the satisfaction of farmers and contributes to the loyalty of farmers to the insurance. Takaful providers offer credential services that are very difficult for customers to determine the quality of their services. Usually, customers rely on other extrinsic indications such as agents ' attitude or behavior to perceive the quality of service. Therefore, perceived service quality in the Takaful industry plays an important role in maintaining the position of the service provider in a highly competitive industry. Takaful providers and agents then need to pay close attention to this factor and start strategically to satisfy their customers through the provision of high-quality services.

Problem Statement

This study would be useful to Takaful service providers in Malaysia as the results would help them develop action strategies that are most suitable. Malaysia's Takaful industry has grown very rapidly, thus raising the rivalry among providers to provide products and services, but there is still an untapped Takaful market (Abdou et al., 2014). Customers become more sophisticated, so Takaful providers should offer goods and services of high quality. Information on the view of the customer of service quality, customer satisfaction and customer loyalty towards the Takaful providers must therefore be investigated. Because knowing the factors that promote repeat purchasing or loyalty is one of the main strategies for segmenting the target market. This study would be useful to Takaful agents as it helps them to determine the factors that actually attract consumers to repurchase or to be loyal to Takaful operators. According to Che Mohd Salleh et al. (2013), poor marketing practices have influenced the Takaful industry, particularly in the Family Takaful scheme whereby customers are not retained. The agents may not provide enough service to their customers, thereby affecting customer satisfaction and loyalty to the Takaful providers. It is normal for consumers to feel that if some service providers are concerned about their needs, they are more likely to choose these service providers. It is understandable that Takaful's research into service quality is limited. The present study, therefore, explores critically the impact of perceived service quality on customer satisfaction and customer loyalty with service delivery in Malaysia's Takaful industry. This research also seeks to fill the gaps in previous research since the impact of Family Takaful service quality in the Malaysian context has not been taken into consideration before. This study will also describe the critical factors that may be useful for Takaful service providers in Malaysia.

Research Questions

Research Framework

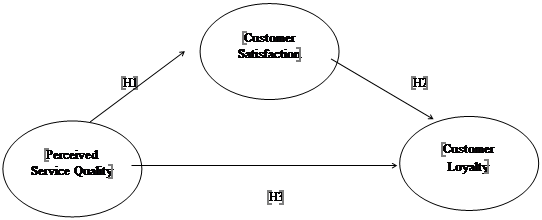

The literature shows that the evaluations of service quality are highly complex processes because the relationships are highly involved. The Takaful Industry is a service high in credentials, making evaluations of customers complex and difficult. It is usually no universal quality construct in the literature which extends to all service contexts. It is therefore necessary to modify the established models to suit different contexts and settings. The theoretical model is shown in Figure

Hypotheses

Based on the review of literature, the hypotheses to be empirically tested are as follows:

H1: Perceived service quality is positively associated with customer satisfaction

H2: Customer satisfaction is positively associated to customer loyalty

H3: Perceived service quality is positively related to customer loyalty

H4: Customer satisfaction is mediating the relationship between perceived service quality and customer loyalty

Purpose of the Study

The purpose of this study is to examine the effect of perceived service quality and customer satisfaction on customer loyalty in Family Takaful. Therefore, this study is to identify the most critical service quality factors that will ensure Takaful company survival and growth. Takaful providers should have based their approaches by rising customer satisfaction and loyalty through improving the quality of service. Several researchers address the definition of perceived service quality and customer satisfaction, but which of the two builds better predicts customer loyalty, which are the causal directions of their relationships, whether the customer satisfaction mediating the relationship between perceived service quality and customer loyalty remains unresolved (e.g., Cronin et al., 2000; Howat & Assaker, 2013; Kumar et al., 2013). Accordingly, the level of participation in Family Takaful schemes in Malaysia is low, as such study is needed to understand the determining factors that influence the behavior of consumers to repurchase or loyalty to a family Takaful scheme (Md Husin et al., 2016). Several customer awareness studies were conducted in Takaful (e.g., Abdou et al., 2014; Che Mohd Salleh et al., 2013). However, little effort has been made to investigate the Family Takaful scheme in Malaysia with a specific reference to the factors that could lead to customer loyalty.

Research Methods

A quantitative approach is used in the study. Assess the relationship between latent constructs, which was the effect on customer loyalty of perceived service quality and customer satisfaction. It also sought to confirm the mediating effect of customer satisfaction on the relationship between the perceived service quality and customer loyalty. The study was carried out in the State of Pahang on Family Takaful policy holders. To obtain data from the respondents, the convenience sampling approach was used for this analysis.

Subjects

Population

According to Malhotra (2009), the population reflects the sample elements or individuals from which the relevant information is extracted. The population has been described as adults and Family Takaful policy holders in the current study. This sample can be viewed as a strong representation of the hypothetical population because the respondents come from different organizations, consisting of different age groups, different experiences and different working cultural (Leong et al., 2013). The study respondents were all individuals who were at least 18 years of age and who held a Family Takaful policy for over a year.

Sample and procedure

The current study used the convenience sampling procedure in the absence of population lists (e.g., Akter et al., 2013; Berhe et al., 2013). For data analysis, this study used the Partial Least Square Structural Equation Modeling (PLS-SEM). According to Hair et al. (2014), the most effective approach for assessing

the adequacy of PLS-SEM sample size criteria is by mean of statistical power analysis. The G*Power 3.1.9.2 for windows was therefore used to determine a minimum requirement for sample size (Faul et al., 2009) and to ensure rigor in modeling. The results of the analysis show that the appropriate sample size was 107 to 5% of the significance level and 95% of the statistical power level. Nonetheless, sample sizes of 400 were selected to ensure representation, in keeping with the average sample size suggested by Krejcie and Morgan (1970).

The research employed a cross-sectional survey method. The population of this study are workers of three universities in Pahang and policy holders of Family Takaful. To obtain data from the respondents, the convenience sampling technique was used for this analysis and the intercept method used to administer the questionnaire. The respondents ' engagement was completely voluntary and 114 functional responses were received out of the 400 the questionnaire form administered. This translates into a response rate of 29 percent. The demographic profiles of the respondents are listed in Table

Measure

Structured questionnaires were used in this study based on a five-point Likert-type scale anchored by strong disagree to strongly agree. The questionnaire also included demographic questions. All constructs and indicators in the questionnaire have been adapted from previously validated scales and updated to operationalize the research model. The questionnaire was thoroughly examined, updated and accepted by a group of research methods and Takaful experts to provide support for face validity. Some of the indicators were rephrased on the basis of their suggestions. The questionnaires have been made available in Malay and English for convenience and attraction. The questionnaire was translated into Malay using the method of back-translation (Brislin, 1970). All constructs contained reflective indicators as they measure the same underlying phenomenon (Chin, 1998). The questionnaire consists of 15 indicators representing the exogenous and endogenous constructs to evaluate the research model. The indicators grouped under 3 latent constructs (see Table

Findings

Result and discussion

Statistical method

The Partial Least Square Structural Equation Modeling (PLS-SEM) was used to analyze the data. The testing of the research model was performed with Smart PLS 3.2.3 software (Ringle et al., 2015). The choice of PLS is because of the following reasons (Roldán & Sánchez-Franco, 2012). First, this study focuses on the prediction of the endogenous construct. Second, the study based on prior models, but introduces new measures and structural paths (Chin, 2010).

Common methods variance

Common Method Variance (CMV) is a possible source of error in the self-report survey study data collection. Nevertheless, the issue was addressed by grouping the indicators into their particular exogenous or endogenous constructs in an effort to reduce the single-source method bias (Podsakoff et al., 2003). The respondents ' confidentiality and anonymity have been treated very strictly, and all items in the questionnaire have been scaled very clearly and accurately to ensure less biased (Reio, 2010).

Measurement model

In this current study, a reflective design (Mode A) was used to model the Takaful service quality. The analysis was carried out on the measurement model in which a series of tests for the reliability and convergent and discriminant validity of the reflective constructs was performed (Hair et al., 2014). In Table

The discriminant validity was assessed by using the Fornelle Larcker Criterion (Fornell & Larcker, 1981). Tables

Structure Model

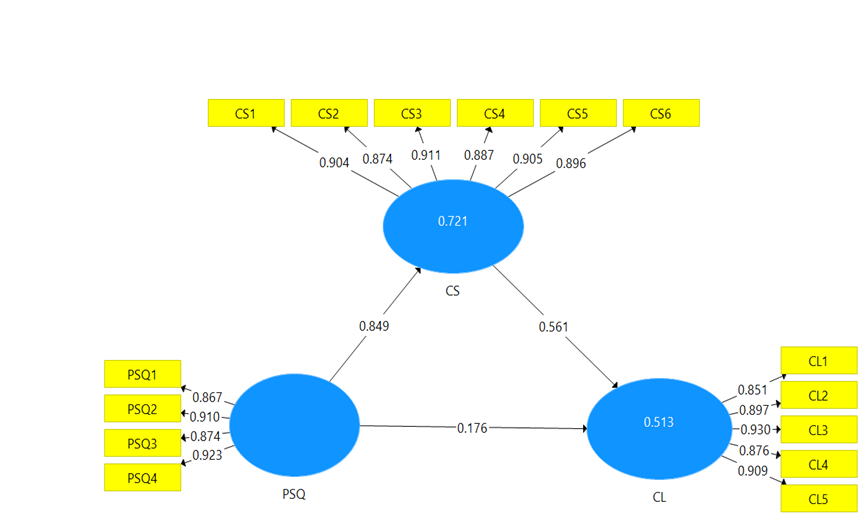

To evaluate the statistical significance of the path coefficients bootstrapping of 500 resamples (Henseler et al. 2009) was run. Figure

Conclusion

Discussion

Customer satisfaction is really important to get loyal customers and it can help Takaful providers to understand the reasons their customers are looking for when buying a Takaful service. The aim of this study was to investigate the relationship between perceived service quality, customer satisfaction and customer loyalty in the Takaful industry and the mediating effect of customer satisfaction. The study found an important relationship between perceived service quality (PSQ) and customer satisfaction (CS) and a significant relationship between CS and customer loyalty (CL). In this study, however, there was no direct relationship between PSQ and CL. In the relationship between perceived service quality and customer loyalty, the empirical data also confirmed a mediating role of customer satisfaction.

The model implemented in this study shows that the perceived service quality and customer satisfaction can account for 51.3% of the variance in customer loyalty and perceived service quality can explain 72.1% of the variance in customer satisfaction. This result shows that the model has relatively good predictive power on Takaful service quality.

This result offers important implications for both theoretical and practical developments. Theoretically, this study adds to the growing body of literature on Takaful service quality, particularly in customer satisfaction and customer loyalty. Practically, measuring Takaful service quality can help Takaful providers to effectively establish control mechanism and initiate improvement programs. This study found that customer and Takaful providers can create affect on Takaful service quality. The results of the current study provide support for the notion that customer loyalty is a vital component of successful Takaful service offerings. That is, perceived service quality is fundamental to improving customer satisfaction and influences customer loyalty. The results also implicate that service provider expertise is also an important driver of customer loyalty. Sustained operation of a Takaful company is only possible by keeping a high quality of service, that necessitate them to understand customer expectation and needed. Thus, Takaful providers need to ensure their agents have the best professional knowledge and competence, mastering the technical skills necessary to convey expertise with respect to the services. Therefore, the Takaful providers could utilize the findings of this study to further refining service performance. Constant efforts of the Takaful provider to improve service performance will be rewarded by appropriate and subsequent improvements in customers’ attitude from the customers’ preference to customer retention.

Limitation and Suggestion for Future Research

Several limitations and future research opportunities must be acknowledged from the results obtained in this study. First, the data for this study were collected from staff of a few universities in Pahang. Future research could replicate and extending this research to other population from different localities to improve its validity. Second, while the sample size for this study was appropriate for the analytical technique, replicating this study with a larger sample would present an opportunity to conduct more analysis with a different technique. Finally, this study focused on theory development, thus, the reflective indicators of the latent constructs were used. For the future, researchers might prefer formative models as suggested by Bjertnaes et al. (2012).

Conclusion

Malaysia's economy has greatly improved as such the demand for high service quality for Takaful is growing. Several major insurance companies have grown to offer different insurance products, including Islamic Insurance. Service quality evaluations are therefore essential in order to improve both the status of the policyholder and the capacity of the Takaful providers. This study found that perceived service quality and customer satisfaction play an important role in achieving good overall results in customer loyalty. Thus, the issue of customer perceptions of the professionalism of Takaful agent is important for researchers and managers alike. This study, therefore suggested improving the profile of skills of Takaful agent professionals by enhancing working conditions and practice.

References

- Abd Wahab, N., Abu Hassan, L. F., Md Shahid, S. A., & Siti Maon, S. N. (2016). The Relationship Between Marketing Mix and Customer Loyalty in Hijab Industry: The Mediating Effect of Customer Satisfaction, Procedia Economics and Finance, 37, 366-371.

- Abdou, H., Ali, K., & Lister, R. (2014). A comparative study of Takaful and conventional insurance: empirical evidence from the Malaysian market, Insurance Markets and Companies: Analyses and Actuarial Computations, 4(1), 23-35.

- Abu Hassan, L. F., Wan Jusoh, W. J., & Hamid, Z. (2014). Determinant of Customer Loyalty in Malaysian Takaful Industry, Procedia - Social and Behavioral Sciences, 130, 362-370.

- Akter, S., D’Ambra, J., & Ray, P. (2013). Development and validation of an instrument to measure user perceived service quality of mHealth. Information & Management, 50, 181–195.

- Alexandris, K., Zahariadis, C., Tsorbatzoudis, C., & Grouios, G. (2004). An empirical investigation of the relationships among service quality, customer satisfaction and psychological commitment in a health club context. European Sport Management Quarterly, 4(1), 36–52.

- Bank Negara Malaysia. (n.d.). Financial Stability-Licensed Insurance Companies and Takaful Operators. http://www.bnm.gov.my/index.php?ch=li&cat=insurance&type=TKF

- Berhe, G., Enqueselassie, F., Hailu, E., Mekonnen, W., Teklu, T., Gebretsadik, A., Berhe, R., Haile, T., & Aseffa, A. (2013). Population-based prevalence survey of tuberculosis in the Tigray region of Ethiopia. BMC Infectious Diseases, 13, 448-454.

- Bjertnaes, O. A., Sjetne, I. S., & Iversen, H. H. (2012). Overall patient satisfaction with hospitals: effects of patient-reported experiences and fulfillment of expectations. BMJ Qual Saf, 21(1), 39–46.

- Brislin, R. W. (1970). Back translation for cross-cultural research. Journal of Cross-Cultural Psychology, 1, 185-216.

- Chang, J. C. (2006). Customer Satisfaction with Tour Leaders’ Performance: A Study of Taiwan’s Package Tours. Asia Pacific Journal of Tourism Research, 11(1), 97-116.

- Che Mohd Salleh, M., Abdullah, N. I., & Razali, S. S. (2013). The Relationship of Takaful Agents’ Islamic Ethical Behaviour towards Customers’ Satisfaction, Trust and Commitment: A Preliminary Analysis. Journal of Islamic Finance and Business Research, 2(1), 77-88.

- Chen, M. F., & Wang, L. H. (2009). The moderating role of switching barriers on customer loyalty in the life insurance industry. The Service Industries Journal, 29, 1105–1123.

- Chin, W. W. (1998). Issues and opinion on structural equation modelling. MIS Quarterly, 22(1), 7-16.

- Chin, W. W. (2010). How to write up and report PLS analyses. In V. E. Vinzi, W. W. Chin, J. Henseler, & H. Wang (Eds.), Handbook of Partial Least Square: Concept, Methods and Applications in Marketing and Related Fields (pp. 655-690). Springer.

- Clemes, M. D., Brush, G. J., & Collins, M. J. (2011). Analysing the professional sport experience: A hierarchical approach. Sport Management Review, 14(4), 370–388.

- Cronin, J. J., Brady, M. K., & Hult, G. T. M. (2000). Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments, Journal of Retailing, 76(2), 193–218.

- Dabholkar, P., Shepherd, C., & Thorpe, D. (2000). A comprehensive framework for service quality: An investigation of critical conceptual and measurement issues through a longitudinal study. Journal of Retailing, 76(2), 139–173.

- El-Adly, M. I. (2018). Modelling the relationship between hotel perceived value, customer satisfaction, and customer loyalty. Journal of Retailing and Consumer Services. https://doi.org/10.1016/j.jretconser.2018.07.007

- Ernst and Young. (2015). Malaysian Takaful Dynamics Central Compendium https://www.ey.com/my/en/industries/financial-services/insurance/ey-malaysian-takaful-dynamics-central-compendium-2015.

- Faul, F., Erdfeider, E., Buchner, A., & Lang, A. G. (2009). Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41(4), 1149-1160.

- Fornell, C., & Larcker, D. F. (1981). Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Journal of Marketing Research, 18(3), 382–388.

- Gallarza, M. G., Gil-Saura, I. G., & Holbrook, M. B. (2011). The value of value: Further excursions on the meaning and role of customer value. Journal of Consumer Behaviour, 10, 179–191.

- Gefen, D., Straub, D., & Boudreau, M. C. (2000). Structural equation modeling and regression: Guidelines for research practice. Communications of the association for information systems, 4(1), 7.

- Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A primer on partial least squares structural equation modelling (PLS-SEM). SAGE Publication.

- Hair, J., Anderson, R. E., Babin, B. J., & Black, W. C. (2010). Multivariate data analysis: A global perspective. Pearson.

- Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. Advances in International Marketing, 20(1), 277–319.

- Heskett, J. L., Jones, T. O., Loveman, G. W., Sasser, W. E., & Schlesinger, L. A. (1994). Putting the service-profit chain to work. Harvard Business Review, 164-74.

- Howat, G., & Assaker, G. (2013). The hierarchical effects of perceived quality on perceived value, satisfaction, and loyalty: empirical results from public, outdoor aquatic centres in Australia. Sport Management. Review, 16(3), 268–284.

- Islamic Banking and Finance Institute Malaysia. (2018). A hand book for AQIF.

- Krejcie, R. V., & Morgan, D. W. (1970). Determining sample size for research activities, Educational and Psychological Measurement, 30, 607-610.

- Kumar, V., Pozza, I. D., & Ganesh, J. (2013). Revisiting the Satisfaction–Loyalty Relationship: Empirical Generalizations and Directions for Future Research, Journal of Retailing, https://doi.org/10.1016/j.jretai.2013.02.001

- Ladhari, R. (2009). A review of twenty years of SERVQUAL research, International Journal of Quality Service Science, 1(2), 172–198.

- Ladhari, R., Pons, F., Bressolles, G., & Zins, M. (2011). Culture and personal values: How they influence perceived service quality, Journal of Business Research, 64(9), 951–957.

- Lee, H., Lee, Y., & Yoo, D. (2000). The determinants of perceived service quality and its relationship with satisfaction. Journal of Service Marketing, 14(3), 217–231.

- Leong, L. Y., Ooi, K. B., Chong, A. Y. L., & Lin, B. (2013). Modeling the stimulators of the behavioral intention to use mobile entertainment: Does gender really matter? Computers in Human Behavior, 29, 2109–2121.

- Malhotra, N. K. (2009). Basis Marketing Research: A Decision-Making Approach (3rd edition). Pearson Education.

- Md Husin, M., Ismail, N., & Ab Rahman, A. (2016). The roles of mass media, word of mouth and subjective norm in family takaful purchase intention. Journal of Islamic Marketing, 7(1), 59-73.

- Mohd Suki, N. (2013). Customer Satisfaction with Service Delivery in the Life Insurance Industry: An Empirical Study. Jurnal Pengurusan, 38, 101-109.

- Oliver, R. L. (1999). Whence consumer loyalty? Journal of Marketing, 63, 33–44.

- Orel, F. D., & Kara, A. (2013). Supermarket self-checkout service quality, customer satisfaction, and loyalty: Empirical evidence from an emerging market, Journal of Retailing and Consumer Services, https://doi.org/10.1016/j.

- Parasuraman, A., Berry, L. L., & ZeithamI, V. A. (1988). SERVQUAL: A Multiple- Item Scale for Measuring Consumer Perceptions of Service Quality, Journal of Retailing, 64(1), 12-40.

- Picón, A., Castro, I., & Roldán, J. L. (2014). The relationship between satisfaction and loyalty: A mediator analysis, Journal of Business Research, 67, 746–751.

- Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

- Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior research methods, 40(3), 879-891.

- Pritchard, M. P., Havitz, M. E., & Howard, D. R. (1999). Analyzing the commitment-loyalty link in service contexts. Journal of the Academy of Marketing Science, 27(3), 333-348.

- Reio, T. G. Jr. (2010). The threat of common method variance bias to theory building. Human Resources Development Review, 9(4), 405-411.

- Ringle, C. M., Wende, S., & Becker, J.-M. (2015). SmartPLS 3. www.smartpls.com

- Roldán, J. L., & Sánchez-Franco, M. J. (2012). Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In M. Mora, O. Gelman, A. Steenkamp, & M. Raisinghani (Eds.), Research methodologies in engineering of software systems and information systems: Philosophies, methods and innovations (pp. 193–221). Information Science Reference

- Ryu, K., Lee, H. R., & Kim, W. G. (2012). The influence of the quality of the physical environment, food, and service on restaurant image, customer perceived value, customer satisfaction, and behavioral intentions. International journal of contemporary hospitality management, 24(2), 200-223.

- Sherif, M., & Shaairi, N. A. (2013). Determinants of demand on family Takaful in Malaysia Journal of Islamic Accounting and Business Research, 4(1), 26-50.

- Tsoukatos, E., & Rand, G. K. (2007). Cultural influences on service quality and customer satisfaction: evidence from Greek insurance. Managing Service Quality: An International Journal, 17(4), 467-485. https://doi.org/10.1108/09604520710760571

- Woo, K., & Fock, H. K. Y. (2004). Retaining and divesting customers: an exploratory study of right customers, “at-risk” right customers, and wrong customers, Journal of Services Marketing, 18(3). 187-197.

- Wu, L. W. (2011). Satisfaction, inertia, and customer loyalty in the varying levels of the zone of tolerance and alternative attractiveness, Journal of Services Marketing, 25(5), 310–322.

- Yazdanpanah, M., Zamani, G. H., Hochrainer-Stigler, S., Monfared, N., & Yaghoubi, J. (2013). Measuring satisfaction of crop insurance a modified American customer satisfaction model approach applied to Iranian Farmers, International Journal of Disaster Risk Reduction, 5, 19–27.

- Zeithaml, V. A., Berry, L. L., & Parasuraman, A. (1988). Communication and control processes in the delivery of service quality. Journal of marketing, 52(2), 35-48

- Zeithaml, V. A., Berry, L. L., & Parasuraman, A. (1996). The behavioral consequences of service quality. Journal of marketing, 60(2), 31-46.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Jamaludin, H., Mohamed, B., & Abdul Razak, F. Z. (2020). Perceived Service Quality, Customer Satısfaction, and Customer Loyalty in Takaful Industry. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 765-778). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.83