Abstract

The aim of the article was to develop and test a methodological approach to assessing the development potential of the market for organic products and its competitive advantages in the global space using the example of Saratov region. The developed methodological approach is based on the allocation of agricultural, environmental, market and managerial components of potential, the calculation of private indicators based on indices and an integrated indicator using importance weights. The study used a set of methods, including statistical processing and analysis of data, sociological methods of survey and interviews, expert estimates. Testing the methodological approach on the materials of Saratov region led to the conclusion that there is a sufficiently high potential for the development of organic agriculture in the region, which can become a supplier of organic food to both domestic and foreign markets, including chickpeas, winter rye and wheat, spring durum wheat varieties, barley, millet, safflower, sunflower, lamb. The authors propose a cluster model for the development of organic agriculture, which focuses on small and medium-sized businesses, the lack of narrow specialization and the construction of closed product chains from the production of innovations to the processing of agricultural organic products. The article substantiates that the realization of the region potential requires comprehensive measures within the framework of a special state or regional program, including mandatory measures to create a logistics and commodity distribution infrastructure for the organic market in the region, increased hectare subsidies, soft loans, compensation for certification and training costs.

Keywords: Organic agricultureorganic food marketdevelopment potentialgovernment support

Introduction

Many experts argue that Russia has a great potential for organic farming and can become a competitive supplier of organic food on the global markets. The Ministry of Agriculture of the Russian Federation confirmed the statement about the realistic occupation of the country in the future by the share of the organic world market of 10–15 %. A scientific study of the development potential of organic agriculture and the development of an appropriate mechanism for its implementation are necessary.

Problem Statement

The development of scientifically based approaches to the development of organic agriculture in Russia requires a reliable assessment of the level, competitiveness and potential of production of organic products, which in the absence of statistical information is a non-trivial task. Currently, in Russia there are only a few examples of studies of the organic market in individual regions or in the country (Arkhipova et al., 2016; Kharitonov, 2014; Peshkova, 2012), performed by various methods.

Research Questions

-

What are the prospects for the development of the Russian market of organic products in a territorial context?

-

What are the barriers and incentives for the development of the organic market?

-

What are the necessary conditions and factors for the development of the market for organic products?

Purpose of the Study

The aim of the article was to develop and test a methodological approach to assessing the development potential of the market for organic products and its competitive advantages in the global space using the example of Saratov region.

Research Methods

When studying the objectives, a set of methods was used, including statistical methods for processing and analyzing data, sociological methods with the collection of primary empirical information based on a survey and interviews, and a method of expert assessments (involving specialists in the field of organic agriculture in the assessment).

Findings

The organic market is a high-margin fast-growing segment of the global food market (Willer & Lernoud, 2018). However, in Russia it is currently at the genesis stage. There are only 55 certified producers of organic agricultural products, 35 certified processing enterprises and 9 companies in the country exporters (Bernet et al., 2018; Mironenko, 2017). The spatial dimensions of the country cause significant differences in the level of its development in different regions, among which we can distinguish regions – consumers and regions – organic producers. In spite of general macroeconomic and political factors, there is a strong territorial differentiation and features of the functioning of the organic market.

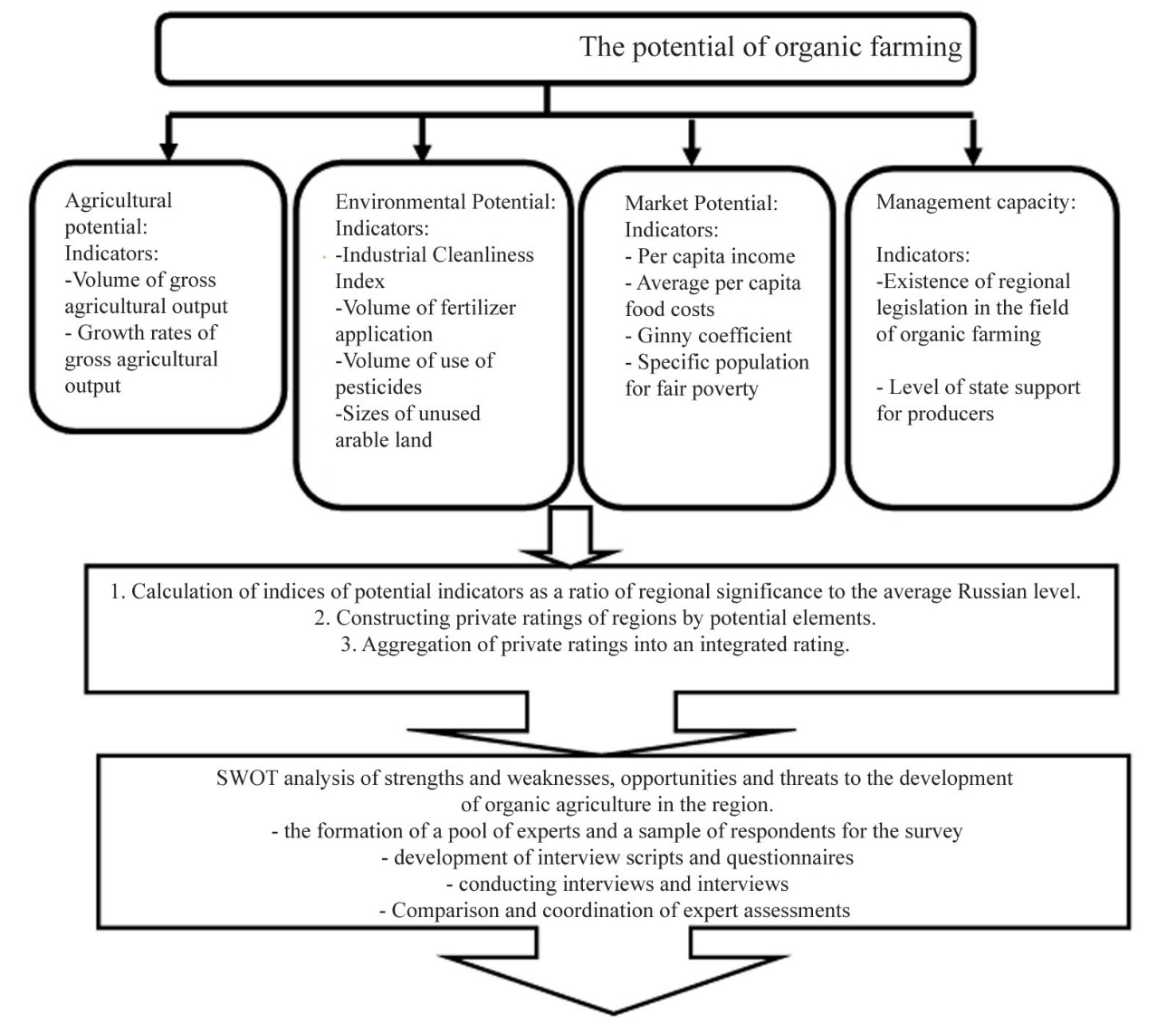

A study of the existing and applied methods in Russia showed that most of them are based on the use of indirect statistical indicators and the construction of integral indices of the potential level on their basis (Egorov, 2011). The main differences are in the set of indicators used and how to weigh them. The author’s methodological approach to assessing the potential and competitive advantages of organic farming in the region (Figure

The authors identify 4 main components in the potential for the development of organic agriculture and use an expanded set of indicators compared to other methods. A feature of the methodological approach is the allocation of managerial potential as a necessary mechanism that drives other resource components. The developed methodology for assessing the potential includes calculating the values of private indicators based on indices and comparing with the national level, weighing private indicators into group and integral indicators using importance weights. This approach allows to build regional ratings, the analysis of which allows you to determine the competitive advantages of a region. Using the methodology of strategic SWOT-analysis allows us to justify possible development scenarios and recommendations on organizational and financial measures of state support for production and promotion of regional organic products on global food markets.

Testing the methodology on the materials of Saratov region showed an average potential level compared to the Russian level (table

Unfortunately, the potential demand for organic products within the region is small due to low incomes and cash expenditures on food consumption, a small specific rich. The distribution channels are also underdeveloped; online stores of farming communities are mainly used. The low level of state support and the absence of special regional legislation, market mechanisms for promoting products result in a low level of managerial potential.

A sufficiently high ecological potential is associated with the fact that in agricultural organizations 7 times fewer mineral fertilizers and herbicides are applied. In addition, in the region there are more than 500 thousand hectares of unused arable land (deposits). Of the total area of unused land, about 300 thousand hectares are suitable for putting into circulation, the rest are unproductive.

A survey of the region’s population revealed that a quarter of the population of the Saratov region is active in purchasing organic products (24.4 %), 46.3 % buy organic goods on occasion, only 2.4 % of the population think about switching to organic products, 9.8 % of the respondents grow their products in subsidiary plots and does not plan to switch to organic. The most significant characteristics when buying food for consumers are price and discounts. The most active buyers of certain types of organic products have a share of food costs of up to 30 % and spend from 15 to 30 % of the total volume of food purchases on the purchase of eco-goods.

A survey of the leaders of agricultural organizations showed the willingness (under certain conditions) of regional producers has switched to organic technologies. Only a small part of respondents (less than 10 %) replied that they did not produce and did not plan to produce organic products in the next 3 years. The survey also confirmed the hypothesis that there is an implicit (i.e. non-certified) or close to organic production of agricultural products in the region that is sold together with the traditional one at the same prices and distribution channels. When answering the question “Does your company have land on which no fertilizers, pesticides, herbicides, plant growth regulators, GMOs have been used for 3 years?” Almost 60 % of respondents answered in the affirmative.

In this case, two persistent trends emerged:

the presence and size of the "organic" wedge is significantly higher in small farms, there is an inverse relationship between the size of the arable land and the share of the "organic" wedge;

the presence and size of the "organic" wedge is significantly higher in the Volga region, where the return on the use of mineral fertilizers and other chemical components of intensive production due to the risks of climatic conditions can be very low and therefore extensive agriculture is more common.

The development of organic agriculture is facing high objective barriers. The survey showed that the most significant constraints are the absence of breakeven guarantee (54.8 % of respondents included this factor among the 3 key), the lack of experience in using organic technologies (45.2 % of respondents), and the lack of state support for organics (35.5 %), high production costs (32.3 % of respondents) and low market demand (32.3 % of respondents). In addition to these barriers, the negative role is played by high economic risks, the uncertainty of the economic situation in the country, and large initial investments.

During the interview, most experts emphasized that organic agriculture cannot be mass, only a partial transition to this technology is possible, since there are problems with pest control that cannot be solved by organic technologies. As a result, there will be a decrease in agricultural production, which will undermine Russia's food security and weaken its position in the world market as the main supplier of grain. In addition, in the absence of stable domestic demand for organic products, established sales channels, it is advisable to engage in the production of organic products as part of export abroad, that is, in limited quantities. Nevertheless, organic products can diversify the region export structure and significantly increase its profitability (Gorbunov et al., 2018; Kuznetsov et al., 2018).

The results of the author’s study of the competitiveness of the domestic market for organic products in Saratov region allow us to highlight the following characteristics:

price for organic products (cereals, legumes) varies between 150–300 % of the price level for traditional products;

when switching to organic technology, crop yield is reduced by an average of 15–30 %;

the potential market capacity of organic products in Saratov region is approximately 12.5 billion rubles (10% of the total agricultural production);

agricultural producers are not ready for a complete transition to organic farming, considering it appropriate to produce only 10–30 % of the total volume of agricultural production using organic technologies;

the lack of formed market demand and established sales channels for organic products is one of the main barriers to the development of organic agriculture. Domestic demand for organic products is very low, so it is advisable to engage in the production of organic products subject to export abroad;

the structure of the organic segment will repeat the structure of traditional production, while the product specialization of the region will continue. So, in the first place, organic production will be developed of such regions that are most suitable for the climatic conditions of the region and profitable crops as chickpeas, winter rye and wheat, durum spring wheat, barley, millet, safflower, and sunflower. The potential volume of production of organic grain and leguminous crops in Saratov Region may amount to 774.4 thousand tons, sunflower – 440 thousand tons. A promising area of organic agriculture may be the production of lamb in the Volga region;

Potential markets for the export of Saratov organic products: EU, USA, Japan, China, countries of Southeast Asia, Africa, the Persian Gulf. The main competitors in the Western European market are Ukrainian and Kazakh producers. Despite the similarity of many institutional conditions (Bernet et al., 2018), Ukraine has achieved the greatest success in the development of organic agriculture among the countries of the post-Soviet space.

Of the variety of organic farming functioning models for Saratov region, the most appropriate is the cluster model, which assumes orientation to small and medium-sized businesses, the lack of narrow specialization and the construction of closed product chains from the production of innovations to the processing of agricultural organic products. The region has all the prerequisites for choosing this development model. This cluster spills off from the developed agricultural and biotechnological clusters existing in the region and creates “cross-cutting”, cross-industry competencies. The formation of an organic cluster should occur in stages. At the first stage, it is necessary to create an institutional environment (including the legal field) and only then the implementation of innovative projects. The gradualness should also be manifested in the observance of the continuity of technology, the gradual biologization of agricultural production from the production of products with improved environmental characteristics to environmentally friendly, that is organic.

At this stage, to further develop the organic food market and increase the competitiveness of the region, it is necessary to implement a set of measures:

to create a regulatory framework based on international recommendations and Russian legislation;

to develop the infrastructure for certification, control and labeling of organic products in accordance with market requirements;

on the formation of a "green" image of the region, the creation of the organic brand "Saratov Wheat";

to popularize organic production among producers;

to create a system to provide industry enterprises with the results of scientific research of Kazakhstan and foreign markets, to develop educational programs and to educate both state bodies and public organizations.

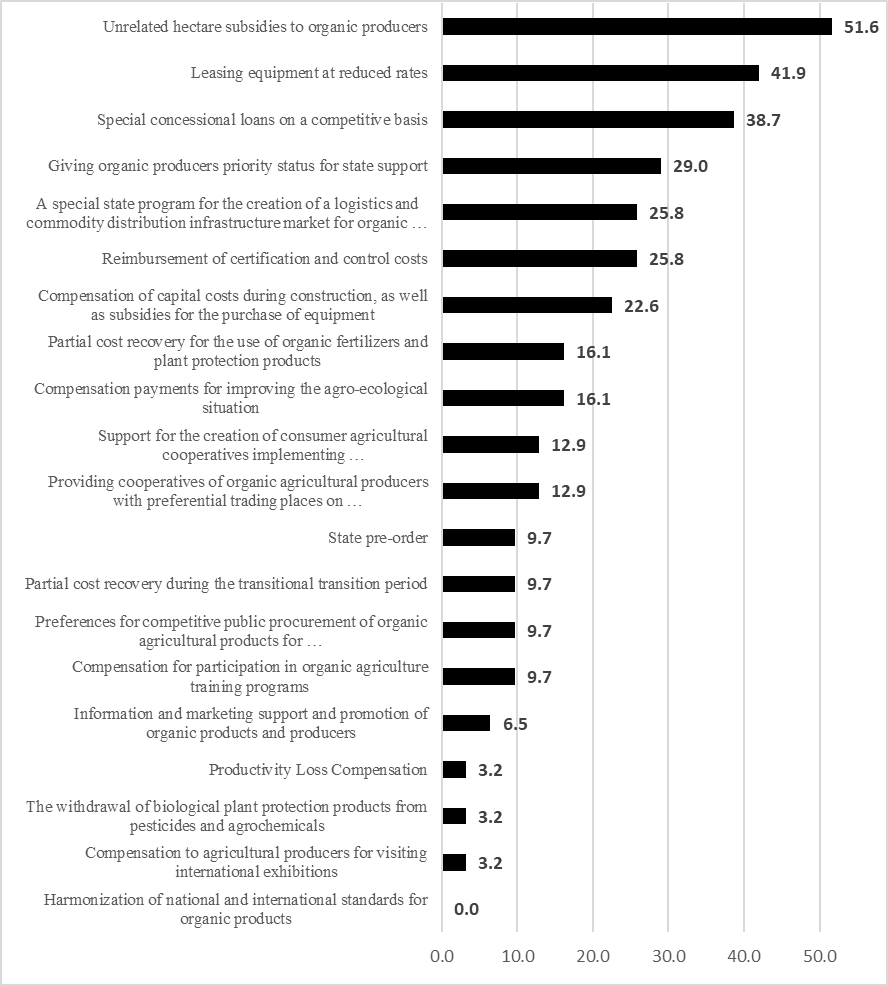

The conclusion about the need for state support of the industry actualizes the choice of its most effective tools. What awaits agribusiness from the state and regional authorities? More than half of managers find it necessary to increase unrelated hectare subsidies for organic producers. The scatter of the proposed values of the number of subsidies varies significantly (from 1000 rubles / ha to 5000 rubles / ha), but on average exceeds the existing level by 1.5–2 times. The second most popular and sought-after tool may be the provision of equipment on lease at reduced rates (more than 40 % of respondents). Practically, it is not inferior to its with special concessional long-term lending on a competitive basis at an annual percentage of 4 to 9 % (Figure

The absence of a guarantee of break-even sales of organic products (barrier No. 1) requires the construction of a special logistics supply chain and the development of specific sales channels. Obviously, they will vary significantly depending on the product, orientation to the domestic or export market, scale of batches, level of readiness, etc. Nevertheless, the most preferred distribution channels from the point of view of agricultural producers can be identified. According to the results of the survey, these include supplies to processing enterprises (45.2 % of respondents), wholesale intermediaries (25.8 % of respondents), tenders for government procurement and agricultural fairs (19.4 % of respondents). The most important are the answers of respondents who already have practical experience in the organic market. As the survey showed, pre-ordering is most convenient and convenient for them, when all products (with clear volumes and quality requirements) are manufactured by order of customers, whether private or public.

During the interview, experts repeatedly emphasized the need for comprehensive measures within the framework of a special state or a regional program that includes mandatory measures to create logistics and distribution infrastructure for organic products in the region (26 % of respondents).

Conclusion

The results of the study allow us to draw the following conclusions:

organic agriculture of Saratov region has a high potential, the region can become a supplier of organic food to both domestic and foreign markets;

the development of organic agriculture is faced with high objective barriers, the most significant constraining factors are the lack of formed domestic market demand and established sales channels, non-guaranteed break-even sales;

for the region, the cluster model is most appropriate, assuming orientation to small and medium-sized businesses, lack of narrow specialization and building closed food chains from production of innovations to processing of agricultural organic products;

comprehensive measures are needed within the framework of a special state or regional program, including mandatory measures to create a logistics and commodity distribution infrastructure for the organic products market in the region, increased hectare subsidies, concessional lending, compensation for certification and training costs, granting organic producers special status, etc.

References

- Arkhipova, V. A., Ivanova, T. V., & Cherdakov, M. P. (2016). Development of the global and national market for organic agriculture products. Basic res., 4-2, 346–349.

- Bernet, T., Home, R., & Hasiuk, O. (2018). Socio-Economic Study of Organic Market and Sector Development in Ukraine. http://orgprints.org/34371/1/SocioeconomicStudy OrganicSectorUkraine_published_Dec2018.pdf

- Egorov, A. Yu. (2011). Potential for the development of the market for organic agricultural and food products in the subjects of the Central Federal District. Vestnik ORELGIET, 4(18), 98–103.

- Gorbunov, S. I., Sukhanova, I. F., & Lyavina, M. Yu. (2018). Development prospects of the food export potential of Russia in terms of import substitution. J. of Soc. Sci. Res., S3, 115–120.

- Kharitonov, S. A. (2014). Organic agriculture: development paths in the regions of Russia. AIC: economics, management, 9, 51–58.

- Kuznetsov, N. I., Sukhanova, I. F., Lyavina, M. Yu., & Vorotnikov, I. L. (2018). Import substitution as the basis for ensuring Russia's food security. Espacios, 39(27), 28.

- Mironenko, O.V. (2017). Organic market of Russia. The results of 2016. Prospects for 2017. http://rosorganic.ru/files/statia%20org%20rinok%20rossii.pdff

- Peshkova, A. (2012). Economic prerequisites for the development of organic agriculture in the regions of Russia. Int. Agricult. J., 1, 62–64.

- Willer, H., & Lernoud, J. (Eds.) (2018). The World of Organic Agriculture. Statistics and Emerging Trends. Research Institute of Organic Agriculture FiBL and IFOAM – Organics International, Frick and Bonn. http://orgprints.org/34669/1/WILLER-LERNOUD-2018-final-PDF-low.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Alexandrova, L. A., Vasilieva, E. V., & Merkulova, I. N. (2020). An Empirical Study Of The Organic Products Regional Market: Methodology And Results. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 50-58). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.8