Abstract

This research is aimed at systematizing and analyzing risks of the entrepreneurial activity. The main research tasks are the consideration of changes in the modern business environment and changes in the character of business risks, analysis of the impact of risks on the efficiency of business structures activities; identification of the most significant areas of risk emergence in different industries; description of the risk nature for selected branches; and grouping the identified risks. In the article, the authors make a hypothesis about the high dynamism of the influence level of entrepreneurial risks. For the purpose of the study, the authors identified the following areas of the entrepreneurial activity: production of motor transport; construction; heavy industry; infrastructure; mining; industry; retail; technological entrepreneurship; transport and logistics. Based on the classical understanding of external and internal sources of risks, the authors determined such risk areas for the entrepreneurial activity as profitability and liquidity; technology; operational efficiency; strategy; compliance with requirements; human capital; growth; reputation and ethics; policy in the field of labor protection, industrial safety and environmental protection; compliance risks. As a result, all risks were grouped according to the principle of significance reduction, significance increase and stability of their impact. This grouping forms the basis for the development of risk management models of diversified business structures, which will be the object of authors’ further research.

Keywords: Risk managementbusiness risksdynamics of the importance level of business risks

Introduction

Risk is an integral part of any entrepreneurial activity. Business risks are circumstances, factors that can have a negative impact on the efficiency of business structures. Risks cannot be completely eliminated, however, understanding the nature of emerging risks and their sources, the entrepreneur can build a risk management system, minimizing possible negative consequences.

It is obvious that modern business structures are influenced by new types of risks associated with:

the digital transformation of business processes;

the implementation of innovative technological solutions that are complex and do not affect individual operations of technological processes, as it was previously;

the increasing importance of talents as a source of competitive advantages and changes aimed at improving the efficiency and effectiveness of business structures;

the need to create new business protection systems in the ever-changing business landscape;

the growing importance of customers’ experience.

The authors hypothesized that in a macro-turbulent environment, the nature and type of risks in the entrepreneurial activity are in a constant change. Therefore, the authors have attempted to determine: - current entrepreneurial risks by industries; - risks losing their significance; - risks that are increasing their importance.

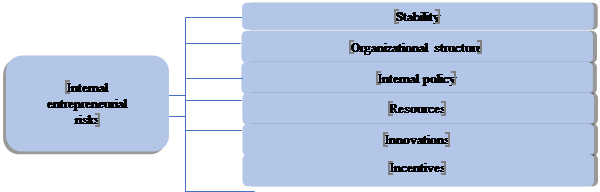

Traditionally, risks are classified according to two main factors: - internal factors (circumstances or events within the business structure); - external factors (these risks are in the wide business environment).

For example, KPMG, analyzing risks of business activities, note that companies, being focused on discussing external threats from their business environment, often do not fix the intra-structural factors that can threaten their success too ( KPMG, 2013). In figure

The organizational structure of the business structure is also a source of risks. The level of business structuring can both reduce and increase business success. When analyzing how an organizational structure can pose a risk to business, it is necessary to assess working positions, hierarchy and lines of communication, that is, how the structure of the business activity is ordered, clearly defined and whether all positions work in tandem with each other.

The internal policy of entrepreneurial structure functioning, especially in the family business, can be focused not on the market and operational work, but on what is happening inside. "Distraction" creates risks of increased competition and loss of a market share. Lack of proper control over finances, production, labor and marketing is also a part of the inadequate domestic policy leading to increased costs for businesses and increased levels of the financial instability.

The availability of sufficient financial, human and other resources is crucial. If an enterprise structure faces a shortage of any type of these resources, it is difficult to achieve its business goals. It should be noted that the lack of resources not only affects the nature and amount of work that an enterprise structure can undertake, but can also significantly affect the staff morale ( Zghurska, Somkina, Dymenko, & Kapelyushna, 2019).

Innovation is the most controversial risk factor. On the one hand, innovation – whether it is related to the product development, marketing and promotion or staff welfare – is what keeps a business one step ahead of its competitors. Lack of innovation leads to the fact that the company becomes stagnant and maladaptive in the changing market. On the other hand, innovation itself is a source of certain risks ( Gurley-Calvez & Lugovskyy, 2019).

Incentives for employees can pose business risks if they are not done correctly, fairly and appropriately. When introducing new incentives, it is necessary to assess whether group or individual performance bonuses, production bonuses or non-cash rewards will help to achieve better results, reinforcing the positive behavior that the entrepreneur wants to see in his staff.

Problem Statement

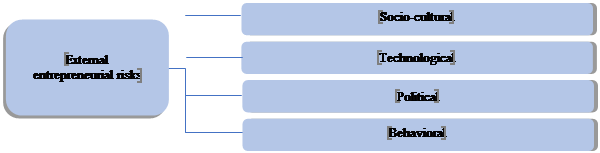

The authors systematized external risks of the entrepreneurial activity (figure

Economic factors, both during the boom and during the stagnation, have a significant impact on activities of business structures. And despite the fact that the entrepreneur does not have the ability to control the economy as a whole, understanding what drives it can help to manage threats and maximize business opportunities.

Socio-cultural risks are determined by the fact that business structures must take into account the research on aspects of social expectations of certain groups interested in the activities or products of these business structures ( Tolkachev, 2019).

The development of technologies is also controversial, as on the one hand, the emergence and application of advanced technologies create competitive advantages for business structures, and on the other hand, they create risks of social tension in the team, the risk of increasing financial instability, etc.

Political risks of the entrepreneurial activity are caused by changes, both in the internal and foreign policy of the state. However, these risks can also include agency conflicts between shareholders and top management. For example, the decision of the top management to invest profits into the business growth may contradict the desire of shareholders to receive dividends ( Markowska, Grichnik, Brinckmann, & Kapsa, 2019).

Behavioral risks are formed under the influence of changes in the individual consumer preferences (ICP). Analyzing and taking into account these risks is very important for business structures, as it determines the demand for their products or services, but at the present stage, tools for determining individual behavioral preferences used by different business structures are extremely heterogeneous ( Surinovich, 2017).

Based on such an systematization of internal and external risks of the entrepreneurial activity, we have identified current risks, risks that are losing their importance and risks that are increasing their importance in such areas as motor transport, construction, heavy industry, infrastructure, mining, industry, retail, technological entrepreneurship, transport and logistics.

Research Questions

This research covers the following issues:

the hypothesis about high speed of changes in the influence character of business risks in relation to the efficiency of business structures activities;

the identification of the most significant areas of risk emergence in the entrepreneurial activity of various industries;

the description of the nature of risks for each of the selected industries such as motor transport, construction, heavy industry, infrastructure, mining, industry, retail, technology entrepreneurship, transport and logistics;

the identified risks are grouped into three groups: risks with decreasing influence; risks with increasing influence; risks that have a stable impact on the activities of business structures.

Purpose of the Study

The purpose of this study is:

to identify areas of business structures’ activity where risks tend to change and the most relevant areas of business risks;

to describe different types of risks in relation to the analyzed industries and distribute them according to the principle of reducing the degree of the risk impact, increasing the degree of the risk impact and stability of the impact of the identified risk groups.

This analysis allowed us to confirm the hypothesis about the nature of changes in business risks taking into account the turbulence character of the modern business environment and to form the analytical basis for the development of risk management system models for diversified business structures.

Research Methods

The methodological basis of the study is a systematic approach. This approach allows considering the emergence and impact of various risks on the development of industries and enterprises as a complex of interrelated, interdependent aspects and factors. The authors used the following research methods: formal-logical (deduction, induction, justification, argumentation); abstract-logical, analytical.

Findings

We have identified nine areas of business activities: the production of motor transport; construction; heavy industry; infrastructure; mining; industry; retail; technological entrepreneurship; transport and logistics and nine areas of business risks emergence: profitability and liquidity; technology; operational efficiency; strategy; compliance with requirements; human capital; growth; reputation and ethics; policy in the field of labor protection, industrial safety and environmental protection; compliance risks.

For industrial enterprises, the risks of the economic uncertainty in the key markets are growing because of such factors as the British exit from the European Union, recessions in Brazil and Russia and the slowdown in China, affecting the sales and profitability of business structures in the industry. For the transport and logistics area, increasing volatility in commodity prices, including steel, aluminum, copper, zinc, rubber, platinum, palladium and rhodium, is a growing risk.

The analysis of actual growing technological risks of the entrepreneurial activity showed that almost all analyzed spheres of business activities are characterized by such risks as IT-risks associated with failures in the functioning of information systems or violation of the cybersecurity regime of business structures.

Obviously, technological risks tend to increase in their importance. For the motor transport field, the growing risks are the growth of competition associated with the development of new technologies by such transport companies as Uber, DidiChuxing, technology giants Apple and Google and equipment manufacturers, for example, Tesla. Another growing risk area in this branch is the need to invest in new innovative materials, automation and new technologies in production to remain competitive.

For construction, increasing risks are the growing need for new methods and technologies, such as building information modeling (BIM), modular or prefabricated construction techniques, and environmentally friendly structures ("green buildings"), as well as cybersecurity risks, including financial losses, business interruption, or failure of information systems.

For industry and heavy industry, pressure from competitors due to the development of digital technologies such as "smart" robotics, autonomous drones, sensors, Bigdata and mobility, which are changing traditional business models, is an increasing risk.

Business activities in the infrastructure sector are also affected by increasing risks, in particular the risks of competitive pressure from the owners of infrastructure facilities, using new technologies such as the Internet of things (IoT), robotics and data analysis, which allow real-time monitoring of infrastructure assets and improving the business performance. The risk of cyber attacks on infrastructure objects is increasing, accompanied by growing interconnectedness of systems and increasing costs for IT security.

For retail, the growing risk is the need to invest in new technologies that improve the efficiency and improve the quality of customer service, such as the Internet of things, virtual reality, unmanned vehicle control, robotics and artificial intelligence. For technology businesses, the risks of failing to standardize products in the sector that would ensure the effective integration of the Internet of things in the future are growing. Transport and logistics are facing stiff competition from both start-ups and large technology companies introducing new technologies (Bigdata, driverless cars, three-dimensional printing) and providing solutions based on digital and address platforms.

The analysis of risks related to the operational efficiency showed that risks associated with the strategic issues have always been of particular importance for any business structure. Increasing risks are identified for the transport and logistics sector, namely the risk in the field of air travel because of the geopolitical instability in the middle East and the constant transformations in the industry in Europe. In the construction sector, competition risks, limited access to financial resources and macroeconomic uncertainty are increasing risks, prompting construction companies to reconsider current business models and think about diversifying their activities.

For existing business strategies of the technological entrepreneurship, there are growing risks of increasing customer demand for pay-per-use or consumption-based models, as well as the risk of unforeseen competition from participants in rapidly developing digital eco-systems (industrial Internet or smart cities). For transport and logistics business, a growing risk is the slowdown in the Chinese economy: the decline in demand for services and the decline in exports and imports in China have a negative impact on the activities of shipping companies.

Significant risks of the entrepreneurial activity are concentrated in the need to meet the modern requirements and standards. In the field of compliance with the requirements, we have identified risks, the significance of which tends to decrease. The importance of risks associated with violation of the intellectual property rights decreases for business activities in the infrastructure sector. And for the mining industry, the importance of such risks as increased taxes, fees for the right to use subsoil, the cost of licenses and other permits (because of the desire of many countries to nationalize resources) is decreasing.

The risks and the influence degree of which is increasing are also identified. Thus, in the field of motor transport, the risks of regulatory inconsistency are increasing due to changes in the international and national legislation, rules, policies, tax requirements, technical standards and trade policies related to the tightening of transport safety requirements and environmental protection. For mining businesses, there are increasing risks of monitoring compliance with regulatory requirements and inefficient tax strategies, as business operations affect countries with different laws.

Every business structure tends for growth, but such a phenomenon as growth carries not only opportunities but also risks. For heavy industry, the increasing risk is the growing demand from dealers because of the excess of used equipment, as well as the instability and changing trends in industries such as: manufacturing, oil and gas, construction and agriculture.

For the mining industry, there is a growing risk of the market instability, lower commodity prices and rising product residues, leading to lower investment efficiency in the industry. Retail is threatened by the macroeconomic uncertainty in the key markets. For the same reasons, technology entrepreneurship faces a reduction in technology investment by companies.

Human capital creates opportunities for the business development, but at the same time it is a risk zone. We have not been able to identify risks, the importance of which decreases or, conversely, increases. The identified risks are relevant at the moment for a number of analyzed spheres, the risks of formation and use of human capital are similar in these branches. Operational risk caused by uncertainty in the labor market, protests of trade unions and strikes is relevant for construction, technological entrepreneurship, transport and logistics, business activity in the infrastructure sector. For the mining industry, this risk is more characteristic, namely violent and prolonged strikes in the key mining regions. The risk of failure to attract and retain qualified employees (by the proper management of personnel costs) is characteristic of all analyzed areas of the entrepreneurial activity.

Both in Russian and international practice, the policy in the field of labor protection, industrial safety and environmental protection is becoming increasingly important. As an increasing risk, we identified the risk of human factors in transport and logistics, which can lead to incidents and equipment failures.

And finally, the whole modern practice of "corporate scandals", reducing the value of business as a result of unethical behavior and reputation scandals shows the importance of reputation and ethical risks. As the analysis showed, reputational risks arising as a result of negative judgments or comments from interested parties are significant for all analyzed spheres of the entrepreneurial activity.

There are also specific risks. Thus, for technological enterprises, the risk zone is violation of the personal data protection regime, which can lead to identity theft, risks of unauthorized access and reputational damage. For such areas as industry and mining, the risks of corruption and fraud that prevail in the industrial sector and affect business profitability are highlighted.

In addition, we identified a group of compliance risks of business structures, that is, the risks of applying legal sanctions or regulatory sanctions, significant financial loss or loss of reputation of the business structure as a result of its failure to comply with laws, regulations, rules, standards of self-regulatory organizations or codes of conduct. A similar type of risks was determined for heavy industry enterprises, namely: risk of fraud, violation of tariff/policy requirements and international legislation; risks associated with increased costs because of stricter requirements in the field of the environmental protection, including air emissions and water pollution.

Conclusion

The obtained results show that the hypothesis made by the authors about a variability of types and character of risks in the entrepreneurial activity finds its confirmation. Risks change under the influence of external and internal factors in the environment of business structures, while some risks have a stable impact, the importance of others decreases over time, while some risks tend to increase the degree of their influence. Possessing information about which risks are decreasing in importance, business entities can optimize their risk management costs in terms of pre-event financing, loss compensation costs for retained risks (post-event financing) and administrative costs for risk management (ongoing financing) ( Khairullina, 2012). Understanding what negative trends are growing, business structures have the opportunity to form and build the necessary competencies. The analysis of coincidence of types of risks for different spheres revealed in the course of this research allows diversified business structures to build a complex risk management system with a synergistic effect. In further studies, we plan to develop models of a risk management system for diversified business structures, which would take into account the level of the risk impact and trends in their changes.

References

- Gurley-Calvez, T., & Lugovskyy, J. (2019). The role of entrepreneurial risk in financial portfolio allocation. Small Business Economics, 53(4), 839-858. https://doi.org/10.1007/s11187-018-0104-7

- Khairullina, A. D. (2012). Classical and alternative methods of risk financing. Kazan Economic Bulletin, 2(2), 19-22. [in Rus.].

- Khairullina, A. D., & Pavlova, A. D. (2015). Systematic approach to building the enterprise risk management system. Economics in the Industry, 4, 39-48. [in Rus.].

- KPMG (2013). Risks in business: Internal and external pressures. Retrieved from: https://home.kpmg/xx/en/home/insights/2013/07/business-risks-internal-external-pressures.html Accessed: 05.12.2019.

- Markowska, M., Grichnik, D., Brinckmann, J., & Kapsa, D. (2019). Strategic orientations of nascent entrepreneurs: Antecedents of prediction and risk orientation. Small Business Economics, 53(4), 859-878. https://doi.org/10.1007/s11187-018-0107-4

- Pavlova, A. D., Novikova, A. V., Pogulich, O. V., Chudnovskiy, A. D., Zakirova, C. S., Kaptelinina, E. A., …, & Matveeva, E. S. (2016). Organizational and economic mechanism of services spheres innovative development maintenance as a component of management of regional economy. International Review of Management and Marketing, 6(2), 288-293.

- Polgar, T. A., Sharkova, A. V., Aliyeva, I. Z., Volobueva, E. A., Fedotova, M. A., …, & Loseva, O. V. (2016). Entrepreneurship and business: Financial and economic, managerial and legal aspects of sustainable development. Monograph. Moscow: Publishing and trading Corporation "Dashkov and K". [in Rus.].

- Surinovich, V. Ya. (2017). Change of paradigm of risk management on the basis of process approach and theory of behavioral risks. Economics and Management: Problems, Solutions, 5(8), 71-78. [in Rus.].

- Tolkachev, P. A. (2019). Entrepreneurship and the phenomenon of risk: Organizational and socio-cultural features of risk determination in the economic space. Sociodynamics, 8, 22-36. https://doi.org/10.25136/2409-7144.2019.8.30370 [in Rus.].

- Yudintseva, L. A. (2017). On the issue of financial stability of organizations and stability of the financial system of the country. Management and Business Administration, 2, 114-125. [in Rus.].

- Zghurska, O., Somkina, T., Dymenko, R., & Kapelyushna, T. (2019). Diversification strategy of entrepreneurial activity in conditions of european integration. International Journal of Innovative Technology and Exploring Engineering, 9(1), 4809-4815. https://doi.org/ 10.35940/ijitee.J9443.119119

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Ashmarina, S. I., & Pavlova*, A. V. (2020). Actual, Growing And Falling Risks Of The Entrepreneurial Activity. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1546-1553). European Publisher. https://doi.org/10.15405/epsbs.2020.03.221