Abstract

In unstable economic conditions the equity capital, profitability, and improvement of stability and competitiveness indicate the success of agricultural organizations. Efficient management of working capital, rational use of material and financial resources, and risk mitigation against unproductive agricultural losses are considered the factors of equity capital formation. To assess the management efficiency of the working capital and taken managerial decisions on its use there is a need to improve the methods of economic analysis, which shall be adjusted to specifics of agricultural production, consider industrial features of organizations, strategic development of the state agricultural policy. Scientific approaches to the analysis of the influence of the working capital on elements of the equity capital within agricultural organizations will allow revealing problems and developing actions to eliminate them thus ensuring the equity capital growth. The paper considers successive evaluation stages of the working capital, its structure, assessment of its turnover characterizing speed and time of the working capital circulation in general on the total cost of the agricultural organization as well as their separate types, including inventory, receivables, cash flows and other working assets.

Keywords: Analysiscapitalprofitmanagementworking capital

Introduction

In modern crisis conditions, the main objective of agricultural development is to ensure food security of the state (Ternovykh & Nechayev 2012), create the life-support system, and increase the living standard of the population in the country. The implementation of the above objective requires the solution of certain organizational and administrative tasks:

to ensure food market saturation in sufficient quantity and range with high edibility in compliance with public needs;

to ensure sustainable development of agricultural organizations, availability of equity capital and individual sources of financing of agricultural production;

to increase the profit of agricultural organizations as one of the main elements of equity capital formation (Ulezko & Reymer 2016);

to assess the management system of working capital efficiency at the stages of working capital turnover in agriculture (Zagaytov & Thorny 1994);

to assess and interpret factors influencing the formation and accumulation of equity capital, including factors of working capital management.

The efficient management of working capital covers the group of essential factors changing the equity capital, receiving and accumulating the profit since the lack of working capital constrains agricultural production, reduces quality of agricultural products throughout the entire chain from the producer to the consumer. For example, the shortage of such material resources as feed, bioadditives, and vitamins in livestock production will affect fattening and gain of a young stock, and shortage of proper quality cereal seeds in crop production will reduce productivity and respectively, will influence the income.

The surplus of the working capital also has negative implications, which characterize inefficient use of equity capital, withdrawal of funds from circulation, presence of nonearning assets;

Problem Statement

Changes within the agricultural market and conditions of agricultural production development and aspects of agricultural organizations impose requirements on working capital management (Soboleva & Parshutina, 2016). The relevant areas of its development include the following: use of scientifically based methods and approaches of working capital analysis and assessment; improvement of the method to assess interrelation of working capital with the equity capital; increase in informative value of managerial decisions regarding acceleration of working capital turnover to maximize the profit (Lytneva, Parushina, Parshutina & Polyanin 2017).

The equity capital is formed at all lifecycle stages of agricultural organizations from the moment of agricultural business organization and throughout its subsequent development. The main objectives of capital formation and continuous maintenance include individual financing sources of enterprises for the acquisition of fixed and working assets and optimization of the capital structure promoting its accumulation and efficient use.

Research Questions

The organization of agricultural business starts with defining the need for equity capital, sufficient amount of funds to ensure production capacities of an agricultural company, acquisition of inventory. Optimization of investments in equity capital depends on the nature of agricultural business and the industry trends. It represents the calculation of investments based on the value of acquired assets to the extent required. At the establishment of agricultural organization the initial element of equity capital – authorized (invest) capital is formed.

The need for equity capital may be assessed via the balance equation, which characterizes the value equality of acquired fixed assets and working assets to the sum of invest capital. In addition, the invest capital is formed through costs of organizing the agricultural business, such as payment for the development of founding documents and development strategy of the organization, registration fees, costs of opening the settlement and other accounts in banks.

However, it is impossible to fully reach the optimum size of the invest capital of agricultural organizations since external investors are not deeply interested in investing to agricultural business. Besides, the limiting factor includes the investment risks related to uncertainty and crisis of the national economy, which may lead to losses in agricultural production

Purpose of the Study

Investments into modern agriculture is a nationwide objective, which may be reached through the contribution of the required state resources into the authorized capital of agricultural organizations. State investments may cover credit provision of agriculture development programs, allocation of different subsidies and other types of investment.

The formation of the equity capital of agricultural industry implies optimization of its composition and structure. The composition and structure of agricultural organizations depend on type of legal entity, scope of organization and industry affiliation. At this stage, the basic elements of equity capital include added and reserve capital, as well as retained earnings.

The added capital characterizes the increase of property cost; it may be created when the agricultural business is organized in the form of the share premium equal to the difference between face and market value of shares being distributed among shareholders and subsequently purchased. The second source of the added capital includes changes in the cost of fixed capital as part of fixed and intangible assets, which sum is defined by depreciation caused by the change in cost of acquired objects in the conditions of inflation. The inflationary tendency covers changes in exchange rates on founders’ contribution to authorized capital of the agricultural organization and exchange differences resulting from property deposits of founders to authorized capital of the organization (Ermakova, Vaytsekhovskaya, Malitskaya, & Prodanova, 2006).

The reserve capital as an element of equity capital is formed while the agricultural company bringing some profit is organized. Its purpose is to settle debts, recover losses of agricultural production. There is obligatory and voluntary provision of the reserve capital. For public joint stock agricultural companies and agricultural companies with foreign investments the legislation stipulates obligatory provision of the reserve capital. Limited liability companies provide and use the reserve capital according to the shareholders’ decision.

The basic element of equity capital provision in the course of agricultural business is profit being the source of its accumulation, source of increase in reserve and added capital (Lytneva, 2017). The profit ensures steady position of agricultural company, reduces risks of bankruptcy.

Research Methods

The methods of economic analysis providing for data acquisition for administrative decisions on the composition of capital elements, to change its structure, and ensure its efficient use are applied to assess and manage the equity capital (Gubina, 2014). The most popular are descriptive models, i.e. models having descriptive nature (Gubina, Butenko, Kovalyova, & Rykova, 2018). They are used both to assess the equity capital and to analyze the financial status of the agricultural company. They include: financial performance reports; structural and dynamic analysis of equity capital elements; ratio analysis, factor-analysis models. Such models are implemented according to accounting (financial) reports of agricultural organizations.

The methods of dynamic analysis are used to define the tendency of equity capital elements using data from the balance sheet (Bobrova & Kyshtymova, 2014). For example, the analysis of equity capital dynamics of Mtsensk Farming Company allowed defining the capital growth trend, which ensures its accumulation.

The analysis demonstrates that the equity capital stock increased year on year. In 2013 the equity capital value made 561 403 thousand rubles and in 2017 it reached 949 101 thousand rubles. The growth rate of equity capital covering a five-year period made 69.1%. The authorized (invest) capital, added and reserve capital over time remained invariable. The smallest element of equity capital according to its value is the reserve capital equal to 1 740 thousand rubles. The retained earnings prevail in the equity capital of Mtsensk Farming Company, which illustrates positive development of the agricultural business and sound strategy of the agricultural organization.

The dynamic analysis allows studying the change of retained earnings for the entire agricultural company and its separate kinds of activity regarding income generation of each of them in order to assess the efficiency of agricultural development (Gulyaeva, Tryastsina, & Ilyina, 2005). According to the study, Mtsensk Farming Company conducts its business in livestock production sector, namely cattle fattening and breeding and in crop production sector producing the cereal grain. The accompanying types of activity include fodder production, industrial cropping and agricultural processing with a variety of meat and sausage goods. The assessment of the earning capacity of the specified types of activity allows defining the promising areas of profit maximization.

The structural analysis of equity capital of agricultural organizations implied the relative assessment of its elements, including retained earnings. The relative values are characterized by specific cumulative weight of capital elements for the current period (Gulyaeva & Tryastsina, 2010), which allows optimizing the structure of equity capital, defining sources of its accumulation, developing actions to ensure profitability of projects performed by the organization within production and processing of agricultural raw materials.

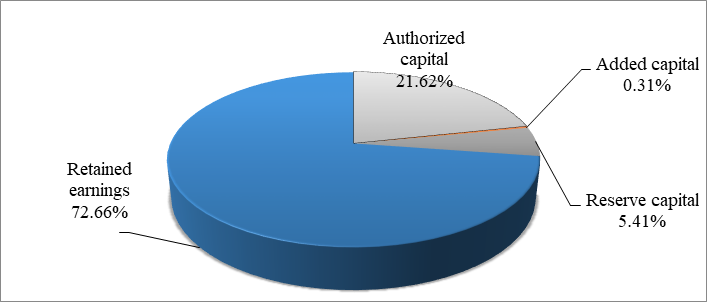

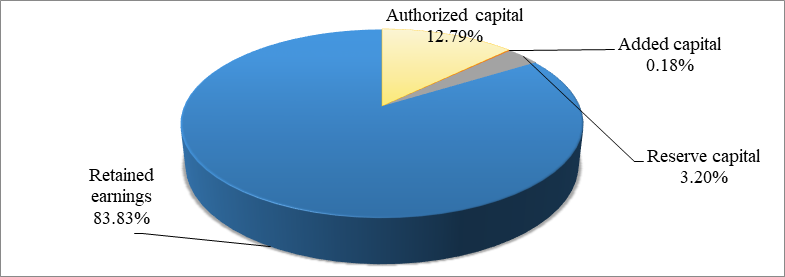

The structural analysis of equity capital of Mtsensk Farming Company confirms the profit share growth being the main source of organizational development and capital accumulation. Over a five-year period the profit share in the sum of equity capital changed from 72.66% to 83.83%.

The analysis of the equity capital elements structure characterizes the value of authorized capital equal to 21.62%. The added capital is characterized by the smallest share, which value annually decreases.

In magnitude, the authorized capital did not change over five years, but its specific weight in equity capital was reduced from 21.62% to 12.79%. Such situation characterizes poor management of equity capital by the agricultural company. The change of the capital structure demonstrates that the profit becomes the only source of capital accumulation, there is no capital investment from owners, addition to reserve and added capital is not implied, which restricts possibilities of equity capital rational use.

Thus, Mtsensk Farming Company faces the problem of increasing its profit as a source of formation and accumulation of equity capital alongside with the problem of its elements structure decision. Hence, there is a need to seek for opportunities of income growth of the agricultural company, decrease in farm production cost, acceleration of working capital turnover, and analysis of factors influencing the agricultural business development

Findings

The study showed that an essential internal factor influencing the formation of equity capital is the movement of working assets, their turnover ensuring timely supply of agricultural production with materials, stability of agricultural production, effective sales of agricultural products on internal and external food markets.

The structure of working assets includes production stock, cash assets, finished goods, receivables, short-term financial investments. The composition and structure of working capital depends on features of agricultural production, its industrial branch, level of agricultural production, and its sales conditions.

The working capital analysis of Mtsensk Farming Company demonstrates that their cost over five years increased from 704 536 thousand rubles to 721 147 thousand rubles. Inventory serves the main type of its working capital.

The dynamics of inventory characterize the tendency of their annual increase. The development of livestock and crop production, as well as the increase in production scales leads to the growth of seed and fodder supply, to the increase in cost of fuels and lubricants used in agricultural machinery during seeding and harvesting, to the increase in volume and cost of gross and commodity agricultural output.

In 2015 the cost of inventory made 457 261 thousand rubles, by 2017 it was increased 1.5 times thus reaching 630 813 thousand rubles, which indicates the increase in material resources of agricultural production and availability of unused working capital.

It is positive that the movement of working capital of Mtsensk Farming Company is marked by the decrease in receivables. This fact increases the mobility of working capital, improves consumer’s settlement of payments, reduces terms of payments for shipped agricultural products. At the same time, the receivables of the company’s working capital are insignificant and have no considerable impact on their liquidity.

The structural analysis of working capital confirms the prevalence of production inventory with the specific weight of 87.47% in 2017. In dynamics the proportion of production inventory increased considerably from 6.49% in 2013 to 87.47% in 2017. Such results negatively influence the profit since the growth of production inventory requires additional expenses for their storage, transportation, and release to production.

The negative fact reflects low proportion of the most floating assets such as free cash in hand and on bank accounts of the organization. The specific weight of the free cash balance was significantly reduced, in 2013 it made 29.98% and in 2017 it reached 4.84%. The reduction of money within the working capital of the company leads to the decrease in working capital turnover. The shortage of cash is caused by additional expenses for capital leveraging as interests on the use of borrowed funds (Bobrova, 2016). This situation refers to the decrease in agricultural sales profit influencing the equity capital of the organization.

The last two years saw the decrease in cash, the receivables made only 3.69% in 2017. Such factors impact the turnover of working capital, reduce the liquidity and efficiency of its use.

To estimate the turnover of company’s assets the indicators characterizing turnover speed in days and times are used. The analysis allows assessing the management efficiency of working capital, influence of turnover by types on the formation of equity capital and the overall financial position of the agricultural company.

The study was conducted according to accounting statements of Mtsensk Farming Company.

The table demonstrates that the turnover of all assets of Mtsensk Farming Company, including working capital, increased in dynamics. The speed of working capital turnover made 0.74 times in 2013, by 2017 it increased twice and made 1.39 times. The turnover period of all assets decreased from 651 days at the beginning of the analyzed period to 495 days for the closing period. The turnover period of the working capital decreased from 488 days to 260 days. The indicator of the turnover period of the working capital, not including cash, characterizes the spending cycle of the agricultural company, its additional costs on its use and profit reduction. The increase in the spending cycle leads to the increase in the period of cash kept within the working capital. At the same time, when evaluating the turnover of agricultural production there is a need to consider the duration of a production cycle, which cannot be reduced, for example, the growing period of grain, beet and other agricultures, seasonality of production, technological properties of agricultural products, etc.

The analysis of Mtsensk Farming Company showed that over the last year the company faced the reduction of working capital turnover in comparison with the last period from 1.62 times to 1.39 times. The turnover period increased from 222 days in 2016 to 260 days in 2017, which led to the increase in production costs, decrease in equity capital as a result of profit reduction.

To increase the management efficiency of the working capital the turnover analysis is conducted by types of the working capital. The calculation of indicators is carried out according to individual bases. The indicator of the turnover period of all inventory is characterized by the increase in 2017 in comparison with the last year from 193.7 days to 221.4 days. The average storage duration of all production inventory of the agricultural company over five years is 242 days, which reduces the release speed of money. Agricultural crop production requires the inventory of seeds, fertilizers, toxic chemicals, CWIP and other materials. The livestock production requires the inventory of feedstock, medicines, repair materials, and bio additives. To increase the management efficiency of production inventory the needs analysis shall be carried out for each type of inventory.

The negative aspect is the increase in turnover period of finished agricultural goods, in 2016 it made 47.4 days and in 2017 it was 55.2 days

Conclusion

The conducted study confirms the need of using the analysis to increase management efficiency of equity capital of the agricultural company by regulating the internal factors of agricultural production, including the working capital (Polyanin, Pronyaeva, Golovina, Avdeeva, & Polozhentseva, 2017).

The composition, structure and turnover of working capital affect the release of money, increase in spending cycle, decrease in one of the basic elements of the equity capital, i.e. the net profit of the company.

The increase in informative value of working capital management, improvement of the analysis regarding separate types of assets will allow increasing the quality and reliability of the following:

demands of the agricultural company for equity capital, material and financial resources;

rational distribution of material and financial resources by branches of agricultural production, production structures, and its separate processes (Vertakova, Grechenyuk, Emelianov, & Grechenyuk 2017);

turnover of working capital to ensure acceleration and release of financial resources;

turnover period of the working capital to decrease the spending cycle and increase profitability of the company;

The specified actions and managerial decisions on regulating the internal factors of agricultural production will increase the efficiency of equity capital formation and use, and will ensure their stability in conditions of economic uncertainty

References

- Bobrova, E.A. (2016). Priority directions of modern science. III international scientific and practical conference. Costs as an indicator in management of economic activity of agro-industrial enterprises (pp. 38-39). Orel.

- Bobrova, E.A., Kyshtymova, E.A. (2014). The development strategy of analytical and control systems in the mechanism of modern business management of commercial organizations. International economic forum Bakanovsky Readings. Cost management in the system of strategic management of agrarian and industrial complex of agro-industrial enterprises (pp. 111-114). Orel.

- Ermakova, A.N., Vaytsekhovskaya, S.S., Malitskaya, V.B., Prodanova, N.A. (2016). Investment attractiveness of small innovational business under the conditions of globalization and integration. European Research Studies Journal, Special Issue, 19, 2, 258-26.

- Gubina, O.V. (2014). Formation of modern model of complex capital analysis of an organization in the conditions of innovative economy. Multilevel system of staff training in economics within concepts of sustainable innovative development of the country (pp. 276-307). Orel.

- Gubina, O.V., Butenko, I.V., Kovalyova, A.M., Rykova, I.A. (2018). Improvement of capital analysis to increase the efficiency of financial and economic development. Penza.

- Gulyaeva, T.I., Tryastsina, N.Yu. (2010). Modern statistics and its role in effective management: problems and prospects. Proceedings of scientific and practical conference. Complex assessment of results of agrarian and industrial organizations using statistical methods. (pp. 146-151). Orel.

- Gulyaeva, T.I., Tryastsina, N.Yu., Ilyina, I.V. (2005). Complex economic analysis of business processes. Orel.

- Lytneva, N., Parushina, N., Polyanin, A., Kyshtymova, E., & Vertakova, Y. (2017). Education Excellence and Innovation Management through Vision 2020: From Regional Development Sustainability to Global Economic Growth. Proceedings of the 29th International Business Information Management Association Conference. Methods of Complex Analysis in Management of Commercial Organizations Owned Capital (pp. 2126-2135). Vienna, Austria.

- Lytneva, N.A., Parushina, N.V., Parshutina, I.G., & Polyanin, A.V. (2017). Policy effective succession planning in the business en-vironment. Journal of Science and Society. SCIEURO, 4, 66-75.

- Polyanin, A., Pronyaeva, L., Golovina, T., Avdeeva, I., & Polozhentseva, Y. (2017). Education Excellence and Innovation Management through Vision 2020: From Regional Development Sustainability to Global Economic Growth. Proceedings of the 29th International Business Information Management Association Conference. Administrative and managerial approaches to digital economy development (pp. 2166-2179). Vienna, Austria.

- Soboleva, Y. P., Parshutina, I. G., (2016). Management of Investment Attractiveness of the Region by Improving Company Strategic Planning. Indian Journal of Science and Technology, 9, 14.

- Ternovykh, K.S., & Nechayev, N.G., (2012). Development of integrated structures in agrarian and industrial complex: problems and solutions. Journal of Economy of Agricultural and Processing Enterprises, 8, 53-56.

- Ulezko, A.V., & Reymer, V. (2016). Mechanism of implementation of innovative scenario of development of regional agrarian and industrial complex. Journal of Rural Economics of Russia, 2, 2-8.

- Vertakova, Y., Grechenyuk, O., Emelianov, S., Grechenyuk, A. (2017). Education Excellence and Innovation Management through Vision 2020: From Regional Development Sustainability to Global Economic Growth. Proceedings of the 29th International Business Information Management Association Conference. Analysis and forecasting of the innovative development of regions and its influence on public economic policy (pp. 1783-1795). Vienna Austria

- Zagaytov, I.B., & Thorny, K.S. (1994) Intracompany transformations in the system of agrarian relations. Journal of agrarian and industrial complex: economy, management, 8, 61-67.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 December 2018

Article Doi

eBook ISBN

978-1-80296-049-5

Publisher

Future Academy

Volume

50

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1464

Subjects

Social sciences, modern society,innovation, social science and technology, organizational behaviour, organizational theory

Cite this article as:

Kyshtymova, E. .., Lytneva, N., Parushina, N., & Petrova, Y. (2018). Management Influence Of Working Capital On Equity Capital Formation Of Agricultural Organizations. In I. B. Ardashkin, B. Vladimir Iosifovich, & N. V. Martyushev (Eds.), Research Paradigms Transformation in Social Sciences, vol 50. European Proceedings of Social and Behavioural Sciences (pp. 732-741). Future Academy. https://doi.org/10.15405/epsbs.2018.12.90