Abstract

Few studies compare Shariah screening before and after the 2012-2013 methodology revision. This research intends to clarify the rationale for the procedure both before and after the Securities Commission (SC) of Malaysia revised the shariah screening methodology for businesses' performance and implemented it in 2012 to 2013. After the Shariah Advisory Council (SAC) announced that the Securities Commission (SC) formulated a new revised Shariah screening methodology of two-tier (i) qualitative assessment for business activity-based screening benchmarks and (ii) quantitative assessment of financial ratio which focuses on the company's operations and financial screening, which tries to exclude companies with undesirable amounts of liquidity and debt. The revised methodology aims to enhance the ICM's worldwide reach, in accordance with SC goals. Before and after the 2013 announcement, Bursa's business activity weighted percentage and ratios differed. We discovered many grounds for Bursa Malaysia's Shariah screening technique. Since the data only cover 2012 and 2013, the actual effect of the modification may not be reflected. This literature analysis will assist policymakers improve future practises, which will benefit investors and companies. Further investigation appears needed in context of the outcomes of this study to investigate either the influence of Shariah screening on firm performance or how stricter screening impacts the Islamic Capital Market (ICM) not just in Malaysia but also in other countries.

Keywords: Shariah-compliant, non-shariah compliant, shariah screening methodology, revised

An Overview of Shariah Screening Methodology Implementation in Malaysia

The effect of Shariah compliance on stock valuation, investor interest, public perception, and the overall attractiveness of a firm for acquisition. Supported by the Jamil et. al. (2020), found that the Shariah compliance announcements effect Malaysian stock returns significantly. The Shariah compliance notification helps Muslim investors avoid prohibited activities. A unique opportunity for investors is presented by Malaysia's dual financial system, which permits investors to choose between conventional and Shariah-compliant companies. Shariah screening guarantees the status of Shariah-approved firms for Muslim investors seeking halal and authorised securities. According to Ayedh, Shaharuddin, et al. (2019), using Shariah screening criteria, firms may be eliminated from consideration if they have unacceptable amounts of traditional debt, liquidity, investments that pay interest, or impure revenue.

In Malaysia, a Muslim investor's choice to invest in Shariah equities depends on a stock's status. Muslim investors may only acquire Shariah-compliant equities, rather than non-Shariah stocks. The SC's SAC developed the Shariah screening methodology in 1995. In 1999, RHB Unit Trust created Malaysia's first Islamic index of Kuala Lumpur Shariah Index (KLSI) and had 279 listed Shariah compliant companies. Local and global investors want Shariah-compliant equities and instruments, Ahmad and Ibrahim (2002). As of May 2022, about 751 listed Shariah compliant companies (79%) of Bursa Malaysia listings, SAC-SC (2022). The Stocks Commission of Malaysia (SC) created the Shariah Advisory Council (SAC-SC) to help investors find Shariah-compliant securities, Zainudin et al. (2014). On November, 2013, the Securities Commission Malaysia (SC) will issue the updated list of Shariah-compliant securities authorised by the Shariah Advisory Council (SAC), based on the improved screening process released on June, 2012.

SAC's updated screening technique uses a two-tier quantitative approach for company activity and financial ratio benchmarks. Both quantitative and qualitative assessments are used. The screening technique has been updated to take into account the evolution of the Shariah-compliant business, with a two-tiered approach to the qualitative assessment that employs business activity standards and newly-introduced financial ratio benchmarks for quantitative assessment. Bursa Malaysia securities will be decided by SAC-SC. Authorities across the globe utilise several Shariah screening methodologies, including SAC-SC. This caused differences in recognising Shariah-compliant large screening companies. The sources of law employed in Shariah screening and evaluations need additional study. Shariah screening has various problems and difficulties. Shariah is costly, incompatible with the global financial system, and little understood. Muslim investors must purify.

This change fits with the SC's plans to increase the number of Shariah-compliant equity and corporate finance markets and increase worldwide access to the Islamic capital market (ICM). The ICM continues to play a significant role in the Malaysian capital market, contributing approximately 65.40% of its whole size. The ICM's size climbed from RM2,256.36 billion at the end of 2020 to RM2,308.54 billion at the end of 2021. This included a total market capitalization of RM583.93 billion in non-Shariah-compliant securities and RM1,204,28 billion in Shariah-compliant securities shows it is crucial for funding the Malaysian economy, ICM (2022).

The research is limited by the fact that there are not many studies that compare the Shariah screening process before and after the revision of screening methodology that took place from June, 2012 to November, 2013. The primary objective of the study is to conduct an evaluation both before and after the revision of the Shariah screening methodology practices in Malaysia. This evaluation will be based on a literature review of previous studies and will help policymakers improve better practices in the future, which will be beneficial to investors and businesses.

Methodology Application in Screening Process

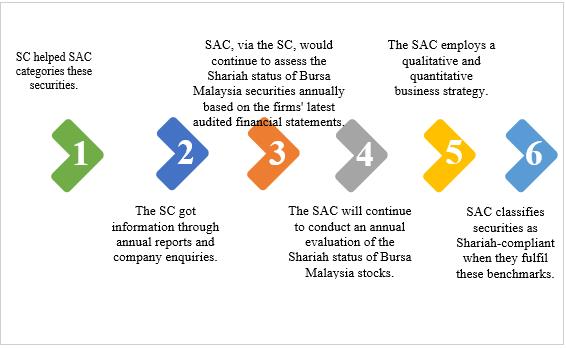

The screening process is the benchmarks or norms of tolerance level for Muslims from participating prohibits (Haram) activities in investments. These methods reduce interest-bearing and guarantee that investment portfolios meet these standards. Based on Ayedh, Kamaruddin, et al. (2019), studied on nine (9) Shariah financial screening indexes used throughout the global to reject enterprises with undesirable debt, liquidity, interest-based investments, or impure income. Such limits would eliminate most, if not all, market equities, including those in Islamic nations. Shariah screening methods used by major indexes vary. Some indexes identify Shariah-prohibited firms and activities more specifically than others. All users utilise qualitative (business activities) and quantitative (financial ratios) indices, classed by different nominator, denominator, and tolerance percentage. Some countries have Shariah screening boards that impose varying requirements based on their duties and purposes. It is indeed possible that other countries provide screening methods, but the majority of the industry's fund managers, banks, and other stakeholders do not really participate. In comparison to the Dow Jones Islamic Market (DJIM) and the FTSE Shariah indices, Securities Commission of Malaysia (SCM) implements very less flexible screening technique. Companies trading on Bursa Malaysia may or may not operate in accordance with Shariah law. Company compliance with Shariah law in Malaysia is a matter for the country's SCM. As shown in Figure 1, the SAC implements a comprehensive screening procedure.

(Source: Shariah Advisory Council of Securities Commission [SAC-SC], 2022)

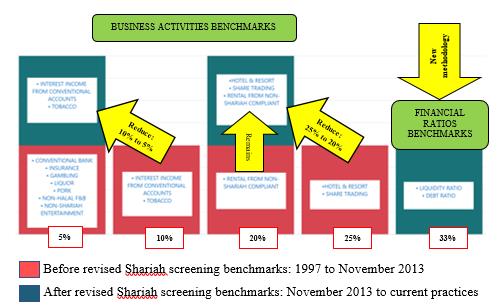

Based on figure 1 from screening proses stage 5, the Securities Commission's SAC established a new Shariah screening approach with two-tier (i) qualitative evaluation for activity-based screening standards and (ii) quantitative assessment which focuses on the company's operations and financial screening, which tries to exclude companies with undesirable amounts of liquidity and debt. Figure 2 shows the first tier, which solely includes qualitative benchmarks (red colour). Before the modification in November 2013, it reflects the period from 1997 to that point. Estimated group revenue and profit before taxes from shariah-compliant activities will be compared to relevant industry standards. After updating Shariah screening benchmarks for both qualitative and quantitative activities in November 2013, the second tier (blue colour) represents this. The qualitative business activity benchmark is reduced by the new technique from four weighted levels of activities (5%, 10%, 20%, and 25%) to only two weighted levels (5% and 20%). The business activities benchmarks of a company must be accepted less than 5% and 20% of specified market segments.

Source: Securities Commission Malaysia (2013)

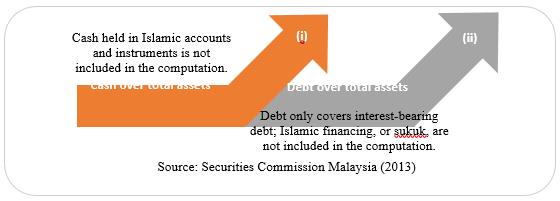

At the same time, the financial ratio screening is newly introduced as the second quantitative assessment. This is an improvement over the prior system, which did not filter financial ratios. SAC will analyse the financial ratio to estimate the company's (interest-bearing elements) level. Quantitative screens compare financial ratios to thresholds. In addition to qualitative screening, adopting quantitative screening is a viable option to determine whether organizations engage in Sharia-prohibited practices including trade and interest-based transactions, Nor et al. (2019). The evaluations are as described in figure 3 below:

Source: Securities Commission Malaysia (2013)

For Shariah-compliant securities, any ratio measuring riba-based items in a company's financial statements must be below 33%, as shown in Figure 3. The SAC also takes the public's opinion into account in addition to the two-tier quantitative requirements of the company's activity from an Islamic viewpoint, SCM (2013). The reduction of these weighted and introduced new financial ratios assessments aims to increase the worldwide reach of the Islamic capital market (ICM), in accordance with the SC goals. Qur'an and Sunna are significant screening sources, Abbas Elhussein and Abd Elmahmoud (2021); Yildirim and Ilhan (2018). Sharia prohibits Muslims from investing in alcohol, pork, gambling, guns, cigarettes, and traditional banking and insurance firms. Thus, at the industrial level, Sharia scholars or boards choose complying companies similarly, Jalil (2021).

Bursa uses total assets as the numerator in ratio calculations. Other Shariah index provider ratios fail to accomplish the intended objectives or do not serve the stated objectives at all. The screening process for listed securities will be more trustworthy if the business activity benchmarks and financial ratio standards are standardised. This is expected to make the Malaysian Islamic equity market and the Islamic fund management industry more competitive. According to Waris et al. (2018), a comparison study of Pakistan and Malaysia sharia screening process, shows that the different criteria lack of consensus among academics and advisory boards or councils of separate nations, as well as inconsistent screening processes. The lack of a governing authority may be behind the wide diversity of screening methods utilised today. Besides that, Abbas Elhussein and Abd Elmahmoud (2021) study Sharia-based admission criteria in Sudanese company. Changes on Sharia norms, which include screenings justify the inconsistent of Sharia screening standards and practises are not expected to hinder Islamic financing.

Comparisons Between Stock Screening Process for Shariah and Non-Shariah Compliant

Most sector implementers follow similar criteria screens. The financial displays vary greatly. Specifying the non-negligible threshold illegality is subjective. Financial screening standards vary than other disparities in Shariah-compliant thresholds problematic especially for non-Shariah compliant. Shariah-compliant investors check for interest, debt, liquidity, and prohibited income. Shariah scholars agree that the debt and interest-bearing screens relate to monetary and impermissible income. Impermissible income filters concentrate on Shariah-noncompliant profits. Example of the aviation business sold alcohol as a company's income or the entertainment sector with an unlawful programme with banned material violated Islamic regulations, practitioners seldom utilise such screens. Checks are already being conducted in every area, and present accounting standards do not require firms to disclose all income sources. If the amount of forbidden revenue is significant, it will be reflected in industry categories and each company's revenue may be examined, Alnamlah (2021).

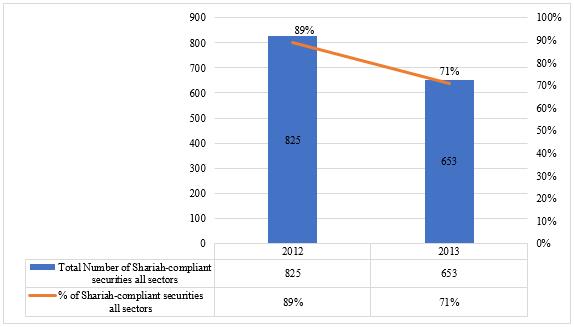

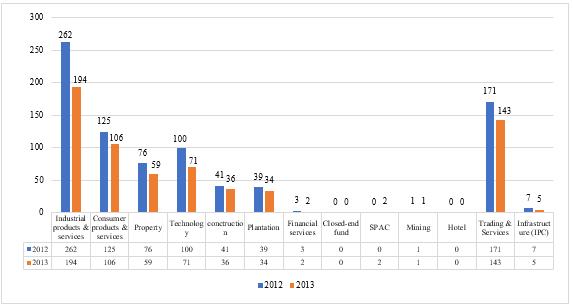

After the updated Shariah screening technique was announced, the number of listed Shariah reduced from 825 to 653, whereby also significantly supported by Wong (2013) and Nor et al. (2019). The 18% reduction indicates that placing non-Shariah compliant companies on Shariah index is taken lightly and overlooks prohibited profits. According to Islamic law, riba elements must be overlook, especially for Muslim investors to buy firm shares. Financial ratio benchmarks are essential and should be seen as a key tool for the company to consider becoming Shariah-compliant with lesser debt and the avoidance of prohibited aspects. The new policy's Shariah screening mechanism will enable more international Muslim investors to invest. In table 1 is the total number of Shariah compliant for listed market before and after the revision in year 2012 and 2013 (see figure 4).

Source: Shariah Advisory Council of Securities Commission (SAC-SC), May 2022

As a consequence of the announcement of changes to weighted business activity assessments and introduction of financial ratio benchmarks, it is obvious that they decreased by an average of 18% across the board when based on comparisons across each industry. Between 2012 and 2013, the number of Shariah-compliant businesses in the technology sector fell by 40%, making it the industry with the largest percentage loss. Second place, with around 35%, corresponds to the industrial products and services sector. Because there are no new firms that will be listed between the years 2012 and 2013, some sectors, such as closed-end funds, mining, and hotels, will continue to operate in the same capacity. The impact of reduction of Shariah-compliant firms on overall ICM as the number of Shariah-listed is reduced after the screening revision is affected to the company activity standards. According to Rahim et al. (2019), Shariah-compliant companies reduce 30% to 70% of the capital structure gap in one to two years. Target leverage level statistics also imply that after the better screening method was applied in November 2013, adjustment accelerated. Management must maintain target leverage throughout financial decision making to promote Shariah-compliant financial stability and sustainability. By introducing financial ratio benchmarks, listed securities screening will be more trustworthy. This could boost Malaysia's Islamic stock market and money management business. In table 5 is the breakdown by sectors for listed Shariah-compliant securities before and after the revision in year 2012 and 2013.

Source: SAC-SC, List of Shariah Compliant Securities, 2012-2013

Issues of Screening Methodology

The Shariah screening methodologies are applied globally. Inconsistencies Shariah screening listed firms' Shariah-compliant status should also be reviewed to see whether the company follows Shariah regulations. To ensure that Muslim investors are protected in this instance, may put their money into businesses that adhere to Shariah, not just because they did all the Shariah benchmark activities and passed, but also because of how the authorities judged them. The problem of excluding the liquidity ratio from the quantitative Shariah screening evaluation is discussed since it overlaps with the debt ratio. Indeed, differing views on how lenient the present Shariah screening technique and some respondents said that the Malaysia others said that although shariah screening process is neutral or wasatiyyah (moderate), it might be deemed stringent, Ayedh, Shaharuddin, et al. (2019).

Pok (2012) reported that 63% of local Shariah-compliant equities meet FTSE requirements. Different screening methods may undermine investor trust. SCM will change its Shariah screening approach in November 2013 to strengthen it. In Malaysia, the Islamic financial system has raised concerns over halal and 'barakah' money produced by Muslim investors. The SAC of the SCM would provide Muslim investors with assurance that stock trading activities are listed in securities that comply with Shariah. A new Shariah screening method was developed by the SAC of the SC using newly developed financial ratio benchmarks and a two-tier quantitative assessment for activity-based screening benchmarks. The qualitative evaluation is unchanged. The updated approach expands the ICM's worldwide reach in accordance with SC priorities.

This study is driven by the revised screening method. Most studies compare Shariah-compliant securities to conventional ones based on past literature. Several studies on Sharia stock screening exists; Yazi et al. (2015); Rahim et al. (2019); and Saba et al. (2020), but some do not investigate the revised Shariah and non-Shariah compliant companies’ performance before and after the revised screening methodology. We also investigate the delisting causes. This study looks at how the announcement of new the Malaysian SC’s Shariah screening procedures had an impact on company’s performance and the Islamic capital market.

Based on Ho (2015), it advocates harmonising Shariah screening procedures for clearer Islamic investment, which might assist the trend. The Holy Qur'an, which Muslims believe is God's message, and the Sunnah (Prophet Muhammad's (PBUH) sayings and practises). Shariah law outlaws riba, gharar, maysir, etc. These are frequent in traditional finance, Yildirim and Ilhan (2018). Several writers have addressed the issue of having disparate screening criteria and the significance of harmonising them, including, Ho (2015), Gamaleldin (2015), and Ayedh, Kamaruddin, et al. (2019). Neither a thorough explanation of the justification nor a resolution to the long-standing issue of harmonisation has been provided. Still, Abbas Elhussein and Abd Elmahmoud (2021) say that different countries, both in the Islamic world and outside of it, use different screening indexes.

According to Jalil (2021), the study from Bangladesh found that every country has a different Shariah index provider with different measurement benchmarks than in Malaysia. The different ratios and criteria may be Shariah-compliant and Bangladesh may not be the same as SAC Malaysia. Even within Bangladesh, the same stock may be Shariah-compliant due to various financial ratios and numerator and denominator requirements. A company may be Shariah-compliant in Bangladesh but not in Malaysia due to differing criteria and ratios of numerators and denominators. Bursa uses two-tier for non-Shariah compliance benchmarks for sector-based screening, whereas the Bangladesh Shariah index uses 5% and 4% to get the status of Shariah. Bangladesh's Shariah index uses market value of equity for financial screening, whereas Bursa uses total assets. A company may be included in Bangladesh's Shariah Index but not Malaysia's, and vice versa.

Malaysia's SAC took hotels and resorts off the list of places that don't follow Shariah because their main purpose is to house people, which is allowed. Another study from the Abbas Elhussein and Abd Elmahmoud (2021) from Sudanese, the association between Sudanese stakeholders' willingness to embrace Sharia screening standards and their assessment that it may provide investors with more information and provide Sharia-compliant businesses with economic advantages. The diverse levels of comprehension and tolerance for compromise across the various Shariah boards are the primary causes of the observed disparities, as Alam et al. (2017) and Jalil (2021) suggest.

Future Directions and Regulatory Implementation in Malaysia

Shariah screening methodology in this research on the before and after the revised context of the recently adopted stock screening process was reviewed. To differentiate between businesses that are Shariah compliant and those that are not Shariah compliant screening procedures that are established on qualitative and quantitative screenings. owing to the phenomenal rise of Islamic finance and its globalization where Muslims make up a majority in Malaysia, the resolution that approved Sharia screening securities of companies that refrain from engaging in actions that are against Sharia law were approved. The resolution authorised the screening of securities issued by businesses that refrain from engaging in actions that are against Sharia law.

Due to the rising number of individual and institutional Muslim investors who are eager to invest only in equities that are compatible with Sharia compliance, several index providers have started to develop their own Islamic indices based on the Sharia screening procedure. This is particularly true in light of the Islamic laws to permit obtaining funding for certain economic areas via more conventional practices of financing. The goal of this study is to determine if Sharia screening methodologies before and after the revised of screening to the Malaysia business sector is practicable. In order to perform the study, many study's conclusions it is advised that laws and regulations be passed to apply the Sharia screening methodologies. Since Malaysia screening criteria methodology that it has released may be used, it is a greater chance of bridging the gap between the principles and tactics used by various Sharia screening methodologies benchmarks. The existing screening procedures have been criticised by many writers, who have also emphasised the need of harmonising the screening standards, Yildirim and Ilhan (2018).

This research concludes that the Holy Qur'an offers solid evidence of reasonable and fair corporate judgement and governance. 5% to 20% is reasonable based on economic operations and fiqh al-awlawiyyat (priorities). Total assets are more suited for all sectors, therefore employing them as the nominator in quantitative Shariah screening ratios reduces misunderstanding. Shariah screening process and financial ratio come from Qur'an and Sunnah. This study also emphasises the advantages of utilising a screening method that adheres to the spirit of the Qur'an and Islamic finance and economics. Malaysia may benefit from the expertise of other countries in this field, such as separating compliant and non-compliant stocks and having Bursa Malaysia declare and announce compliance.

The conclusions of this research are limited to a literature review pertaining to the stock screening process that is based on prior studies, and it is recommended that this study be improved by conducting an interview, a discussion, or an empirical investigation on the Shariah screening methodology before and after the revision. Future study should include Shariah screening techniques to the updated method. Even when Shariah screening is applied, future researcher should investigate either the influence of Shariah screening on firm performance or how stricter screening impacts the Islamic Capital Market (ICM) not just in Malaysia but also in other countries such as ASEAN countries.

Acknowledgments

We are thankful to UNITEN, which gave us a BOLD research grant J510050002/2022048 for this work, and to the organisers of the International Symposium and Exhibition on Business and Accounting (ISEBA) 2022, where we were able to share our findings.

References

Abbas Elhussein, N. H., & Abd Elmahmoud, S. A. (2021). Sharia Screening Methodology: Does Its Non-Unification Affect Its Implementation? International Journal of Economics and Finance, 13(6), 59.

Ahmad, Z., & Ibrahim, H. (2002). A study of performance of the KLSE Syariah index. Malaysian Management Journal, 6(1&2), 25-34. https://e-journal.uum.edu.my/index.php/mmj/ article/view/8594

Alam, M. M., Akbar, C. S., Shahriar, S. M., & Elahi, M. M. (2017). Islāmic Sharī’ah Principles for Investment in Stock Market. Qualitative Research in Financial Markets, 9(2), 132-146.

Alnamlah, A. K. (2021). A New Model for Screening Shariah Compliant Firms. https://doi.org/10.2139/ssrn.3818533

Ayedh, A. M. A., Kamaruddin, M. I. H., & Shaharuddin, A. (2019). Challenging the Current Shariah Screening Methodology Assessments in Kuala Lumpur Shariah Index (KLSI). International Journal of Academic Research in Accounting, Finance and Management Sciences, 9(4), 253-268.

Ayedh, A. M. A., Shaharuddin, A., & Kamaruddin, M. I. H. (2019). Shariah screening methodology: Does it ‘really’ Shariah compliance? Journal of Islamic Economics and Business, 12(2), 144-172.

Gamaleldin, F. M. (2015). Shariah-Compliant Stocks Screening and Purification. Research Gate, 1-44.

Ho, C. S. F. (2015). International comparison of Shari'ah compliance screening standards. International Journal of Islamic and Middle Eastern Finance and Management, 8(2), 222-245.

Islamic Capital Market (ICM). (2022). Statistics for Islamic Capital Market in Malaysia. https://www.sc.com.my/api/documentms/download.ashx?id=ccac93f7-c385-418a-811e-47b30843d681

Jalil, M. A. (2021). Stock Screening Methodologies in Bangladesh and Malaysia: A Comparative Study. Journal of Integrated Sciences, 1(2). https://jis.iou.edu.gm/article/download/106/73/330

Jamil, N. S., Hassan, H., & Bujang, I. (2020). The effect of shari’ah compliance announcements on stock returns in Malaysia. International Journal of Business and Society, 21(1), 217-233.

Nor, F. M., Shaharuddin, A., Marzuki, A., & Ramli, N. A. (2019). Revised Malaysian Shariah screening: Its impact on Islamic capital market. Research in World Economy, 10(1), 17.

Pok, W. C. (2012). Analysis of Syariah quantitative screening norms among Malaysia Syariah-compliant stocks. Investment Management and Financial Innovations, 9(2), 69-80.

Rahim, N., Nor, F. M., Ramli, N., & Marzuki, A. (2019). Determinants of capital structure for Malaysian shariah-compliant firms: The Impact of Revised Screening Methodology. International Journal of Banking and Finance, 14, 45-74.

Saba, I., Ariff, M., & Rasid, E. S. M. (2020). Performance of Shari’ah-compliant and non-Shari’ah-compliant listed firms: a case study of Malaysia. International Journal of Islamic and Middle Eastern Finance and Management. Shariah Advisory Council Securities Commission Malaysia (SAC-SC). (2022), List of Shariah Compliant Securities, May 2022, 1-56. https://www.sc.com.my/api/documentms/download.ashx?id=f594c8f5-17a1-4007-9334-4db1330e705f

Securities Commission of Malaysia (SCM). (2013). Asked questions on revised shariah screening methodology. https://www.sc.com.my/regulation/regulatory-faqs/frequently-asked-questions-on-revised-shariah-screening-methodology

Shariah Advisory Council of Securities Commission (SAC-SC). (2022). List of Shariah-Compliant Securities by SC’s Shariah Advisory Council. Kuala Lumpur: Securities Commission of Malaysia (SC). https://www.sc.com.my/development/icm/shariah-compliant-securities/list-of-shariah-compliant-securities

Waris, A., Hassan, H. A., Abbas, S. K., Mohsin, M., & Waqar, N. (2018). Sharia screening process: a comparison of Pakistan and Malaysia. Asian Journal of Multidisciplinary Studies, 6(5).

Wong, T. (2013). Shariah Non-Compliant Stocks: Strategy Flash Note: CIMB.

Yazi, E., Morni, F., & Imm, S. S. (2015). The effects of Shariah compliance announcement towards stock price changes in Malaysia. Journal of Economics, Business and Management, 3(11), 1019-1023.

Yildirim, R., & Ilhan, B. (2018). Shari'ah Screening Methodology: New Shari'ah Compliant Approach. Journal of Islamic Economics, Banking and Finance, 113(6219), 1-24. 111(14).

Zainudin, N. B., Miskam, S. B., & Sulaiman, M. B. (2014, May). Revised Shariah screening methodology for Shariah-compliant securities: New standard to meet global expectation. In Conference on Management and Muamalah, International Islamic University College Selangor.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Idayu Razali, F., Mohd Saad, N., & Mohamed, Z. (2023). Shariah Screening Methodlogy in Malaysia: Before and After the Revision. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 342-352). European Publisher. https://doi.org/10.15405/epfe.23081.30