Abstract

Coronavirus disease (Covid-19) pandemic is creating overwhelming effects globally since the beginning of 2020. Some people may be having financial difficulties and be able to recover by using their emergency or pension plans. Over 88 percent of Malaysian employees are relying on their Employee Provident Fund (EPF) savings as the main source of retirement funds for their golden years. However, approximately 1.6 million active EPF members had almost deflated their Account 1, and 3 million or 60 percent of active EPF members had used their entirely savings in Account 2. Therefore, the objective of this study is to examine the effect of financial awareness, financial knowledge, financial planning and retirement goal clarity towards attitude of retirement planning. Using convenience sampling technique, 232 employees either working in the public sector, private sector, or self-employed in Klang Valley has been chosen. The conceptual framework is tested using a partial least square (PLS) modeling via SmartPLS 4.0.7.5 version. A structured questionnaire is employed, and a pre-test is conducted. From the analysis, this study shows that financial awareness, financial knowledge, and financial planning were positively related to attitude. Besides, retirement goal clarity was negatively related to attitude. In addition, the findings indicate that financial awareness has a major influence towards attitude of retirement planning.

Keywords: Awareness, financial knowledge, financial planning, goal clarity, retirement planning

Introduction

Overview of retirement planning system in Malaysia during the covid-19 pandemic

Coronavirus disease (Covid-19) pandemic is creating overwhelming effects globally since the beginning of 2020. Covid-19 pandemic also has disrupted Malaysian economic as well as peoples’ daily lives. Currently, over 36,357 deaths in Malaysia have been recorded due to the virus of covid-19 (Ministry of Health Malaysia, 2022). Furthermore, over 37,415 entrepreneurs have been affected and forced to power cut their businesses (Othman et al., 2022). Moreover, unemployment rate in Malaysia was drastically increased from 3.26 percent in 2019 to 4.50 percent in 2020 and 4.61 percent in 2021. After covid-19 pandemic, Malaysia unemployment rate was declined to 3.7 percent in July 2022, as the economy recovered from the covid-19 hit (Department of Statistics Malaysia, 2022).

Consequently, some people may be having financial difficulties and be able to recover by using their emergency or pension plans. But, for employees who were not properly connected to pension plans, it would cause an economic catastrophe and result in financial incapacity. Therefore, to cushion the impact of pandemic on the employees, Malaysian government has allowed several special withdrawals from Employee Provident Fund (EPF), namely; i-Citra (withdrawal up to RM5,000), i-Sinar (RM10,000) and i-Lestari (up to RM6,000). According to EPF, from April 2020 to February 2022, a total of 7.3 million EPF members were made the special withdrawals which amounted to RM100.9 billion. In addition to that, from April to December 2020, Malaysian government has allowed statutory contributions to be cut from 11 to 7 percent, and to 9 percent from January 2021 to June 2022. Therefore, the amount not saved in EPF rises to RM110 billion including the RM9 billion reduction in the statutory contributions.

Besides that, approximately 1.6 million active EPF members had almost deflated their Account 1 (30 percent of entire savings and formerly off-limits up to 55-years), and 3 million or 60 percent of active EPF members had used their entirely savings in Account 2 (Yeap, 2021). Thus, numerous Malaysian employees having insufficient funds if they are relying on EPF savings, and it may force them to work longer post-retirement age. On top of that, only 3 percent of EPF contributors have enough retirement savings for a decent existence after they leave workforce (EPF, 2021b, October 31). The possibility that 14 percent of the population will fall into this age range by 2044, making Malaysia an older society (Zulfaka & Kasim, 2022).

Research problem

Bank Negara Malaysia (BNM) (2016) was reported that 92 percent of Malaysian employees are worried about their retirement savings after retirement. BNM stated that 33 percent of them ‘very worried’ about their retirement savings, while the remaining 59 percent were ‘a bit worried’ (BNM, 2016). BNM also specified that only 40 percent of Malaysian employees are financially ready for retirement and 60 percent of them are still lack of long-term financial planning. On top of that, more than 75 percent of Malaysian employees find difficulty in savings RM1,000 for emergency needs, with the high living cost and economic uncertainties (Lin, 2017). The savings plan of RM1,000 is the minimum pension for public-sector employees and expect to live approximately 75.6 years, which is the average life expectancy of Malaysians (DOSM, 2021, July 29). However, RM1,000 will likely not be sufficient savings after retirement because this suggested savings amount is based on expenditure for basic needs. Employees need to look into the other factors such as, increase standard of living, protection for spouse and dependents, rising medical expenses, and protect post-retirement lifestyle.

According to the survey by EPF (2021a), the estimated monthly expenses at Klang Valley in year 2021 showed that the provisional estimates of a living wage ranged from RM1,900 to RM6,810 per month. For single adult (public transport user), monthly expenses was estimated to be RM1,900 per month; single adult (car owner) was RM2,570 per month; married couple without children was RM4,590 per month; married couple with one child was RM5,910 per month; married couple with two children was RM6,810 per month; senior single was RM2,490 per month; senior couple was RM3,170 per month; single parent with one child was RM4,690 per month; and single parent with two children was RM5,590 per month. EPF also stated that employees need to save at least RM240,000 by the time they retire at 55 years old to cover the basic needs. Nevertheless, due to the covid-19 pandemic, 73 percent of EPF members will not be able to meet this necessity and having insufficient funds to retire above the poverty line (EPF, 2021a). Imagine by age 55, if retirees are married couple without children, they would need at least RM1,101,600 in savings to safely cover their monthly expenses. Because of inflation and lifestyle changes, living wage estimation would likely evolve over time.

Moreover, after pandemic of covid-19, Sun Life Malaysia was conducted a survey on retirement called “Kembara Bersara” with 1,853 respondents. This survey discovered that there are still gaps in financial planning, particularly in relation to structure sufficient financial resources. Many employees may have underestimated the funds needed for their life after retirement. From survey by Sun Life Malaysia, 63 percent of the respondents stated that the cost of living is a major retirement distress, and having insufficient funds for a comfortable retirement life is the biggest fear for them. The survey also found that, over 88 percent of the respondents are relying on their EPF savings as the main source of retirement funds for their golden years (Vasu, 2022). In addition to that, DOSM announced the number of employed people has been increasing from 5.2 million in 1982 to 16.14 million persons in the fourth quarter of 2021 (DOSM, 2022, February 8). Hence, the number of pre-retirees will increase in the future if this situation is maintained.

Consequently, most of Malaysian employees claimed that they do not have adequate savings for their life after retirement (Habib, 2007; Ibrahim et al., 2012; Martin, et al., 2016; Moorthy et al., 2012). Issue on retirement planning is very important since many retirees force to work longer post-retirement age in order to sustain their daily life after retirement (Hassan et al, 2016). As employees, they should have attitude towards retirement savings and intention to do so. Therefore, due to the covid-19 crisis, Malaysian employees need to identify what factors that influence attitude towards retirement planning, to survive and ensure that they have sufficient savings in their afterlife of retirement. Accordingly, the objective of this study is to examine the effect of financial awareness, financial knowledge, financial planning and retirement goal clarity towards attitude of retirement planning.

Literature Review

Attitude towards retirement planning

Attitude can be described as the evaluative effect of individual’s either positive or negative in performing a particular behaviour (Ajzen & Fishbein, 1980; Shanmugam & Abidin, 2013). Attitude comprises the combination of behavioural beliefs and the person’s feelings when they are attempting to fix the precise things, such as honest and dishonest, beneficial and harmful, motivating and tedious, and other precise things (Ajzen, 1985). Retirement attitude was the major factor influencing savings contribution and employees tend to have excellent retirement planning (Hassan et al., 2016; Moorthy et al., 2012). Hassan et al. (2016) and Lim (2003) stated that employees age 50-years and above had more positive attitude towards retirement savings compared to the employees below age 50-years. It is also consistent with Moorthy et al. (2012), which revealed a positive attitude of employees towards retirement planning, and enable them to achieve an adequate of retirement income.

Financial awareness

Awareness can be defined as the passive involvement of individuals and raised attention into the subject matters (Bickford & Reynolds, 2002). Awareness is important in understanding the retirement planning (Ibrahim et al., 2012). According to Duval and Silvia (2002), self-awareness and the ability to improve will lead to the accomplishment or failure attributions. Nevertheless, financial planner Dr. Niki Shuhada Shukor (MalayMail, 2017) stated that Malaysian employees are still lack of awareness towards retirement planning. She cited this issue as the main reason why Malaysian employees are still not have enough savings for retirement. Several studies have been addressed the issue on awareness towards attitude of retirement planning. Rillotta and Nettelbeck (2007), and Zolait et al. (2009), have found a significant effect of awareness towards attitude of retirement planning. However, Ison et al. (2010) and Zabri et al. (2016) have found insignificant effect of awareness towards attitude of retirement planning. Talib and Manaf (2017) also discovered that no significant relationships between awareness and retirement planning behaviour among EPF employees. Consequently, awareness and retirement planning are the most important factor among Malaysian employees either working in government or private sector as well as self-employed (Zulfaka & Kassim, 2022).

Financial knowledge

Financial knowledge is the possessing of knowledge and information, self-confidence and skills in establishing financial wellness as well as financial decisions (Shanmugam & Abidin, 2013). Increase in financial knowledge will be increasing the power of retirement planning and retirement confidence (Hopkins & Pearce II, 2019). Lusardi and Mitchell (2007) also stated that employees with higher financial knowledge are more capable to prepare sufficient funds for their post-retirement spending. Hence, financial knowledge has a positive and significant effect towards attitude of retirement planning (Michelle, 2018; Mustafa et al., 2017; Sarpong-Kumankoma, 2021). However, Kaur (2021) revealed that employees has been affected on retirement planning due to their income adequacy during covid-19 pandemic. Therefore, Malaysian employees should have higher financial knowledge and information to make the right financial decisions in their retirement planning.

Financial planning

Financial planning is the process that takes into account the employee’s behaviour, financial position, socio-economic and legal environment, that lead to the adoption of strategies in achieving the employee’s financial goals (Warschauer, 2001). Financial planning is a key factor in establishing an economic wellbeing that can sustain a standard of living during retirement life (Ekici & Koydemir, 2016; Gitman et al., 2011; Scharn et al., 2018). Moorthy et al. (2012) determined employees in category of 26 to 35 years is a suitable age to start planning for retirement, since the employees show a positive attitude towards retirement at this age. Nonetheless, if the employees are relying more on the compulsory of retirement savings, such as EPF, they are not really preparing themselves for their retirement (Kim et al., 2005). According to Lai et al. (2009) and Ng et al. (2011), employees need a monetary obligation and illustrated income in their financial planning to encourage the tendency of attitude on retirement planning. Hence, Malaysian employees should have a better financial planning that lead to financial wellness and retirement confident, along with a comfortable life after retirement.

Retirement goal clarity

Retirement goal clarity is a psychological mechanism that motivate and encourage employees to plan for their upcoming life, and thus, influencing the quality of retirement decision (Moen, 1996; Shanmugam & Abidin, 2013; Stawski et al., 2007). Besides, prior research shows that the goal clarity is a significant and positive predictor towards attitude of retirement planning (Afthanorhan et al., 2020; Hoffmann & Plotkina, 2021; Moorthy et al., 2012; Petkoska & Earl, 2009). Brougham and Walsh (2005) also implied that, goal clarity provides a unique and important contribution in predicting the attitude towards retirement planning. In addition, based on the research made by Moorthy et al. (2012), employees had a clear vision towards retirement life when they discussed their plans with their spouse, friends or financial consultant. However, Zhu and Chou (2018) stated that employees intend to save for their retirement aged over 44 years old. In addition to that, Hassan et al. (2016) also found that employees aged above 50 years old are more concerned about living expenses after retirement compared to employees aged less than 30 years.

Methods

Research framework and hypothesis development

Previously, several literature hypotheses appealed that financial awareness, financial knowledge, financial planning and retirement goal clarity could influence attitude towards retirement planning during pandemic of covid-19. Figure 1 demonstrate the research framework, which included assertions about the four variables for this study.

Attitude towards retirement planning among Malaysian employees as the dependent variable in this study. Meanwhile, four independent variables for this study namely; financial awareness, financial knowledge, financial planning and retirement goal clarity. Hence, four hypotheses were formulated as following to meet the objective of this study.

Hypothesis 1 (H1):Financial awareness has a positive and significant effect towards attitude of retirement planning.

Hypothesis 2 (H2):Financial knowledge has a positive and significant effect towards attitude of retirement planning.

Hypothesis 3 (H3):Financial planning has a positive and significant effect towards attitude of retirement planning.

Hypothesis 4 (H4): Retirement goal clarity has a positive and significant effect towards attitude of retirement planning.

Research design and sampling

Quantitative method has been used in this study. In achieving the objectives of this study, a structured questionnaire is employed in order to get answers and feedback from the target sample. This study also developed a self-administered questionnaire to measure the four significant factors; (1) financial awareness, (2) financial knowledge, (3) financial planning and (4) retirement goal clarity, as well as in collecting demographic profile. The questionnaire is divided into two sections. Section A comprised of 5-point Likert scale measurement questions; strongly disagree (1), disagree (2), neutral (3), agree (4), and strongly agree (5). While section B seeks the respondent’s demographic details, such as gender, age group, marital status, occupation status, work experience, highest education level, monthly income, monthly saving, and number of dependents. Moreover, the questionnaire is designed using an adapted questionnaire, revised from previous studies addressing similar research; Hershey and Mowen (2000); Lai and Tan (2009); Moorthy et al. (2012); Noone et al. (2010); and Petkoska and Earl (2009). 26 items in the questionnaire is modified to outfit the objectives of this study. In order to reduce the possible ambiguity of the items in the questionnaire, a pre-test is conducted.

For the target sample of this study, Malaysian employees either working in the public sector, private sector, or self-employed in Klang Valley has been chosen. This sample is chosen due to two aspects; (1) employees in Malaysia are dominant in Klang Valley because of the most developed region in Peninsular Malaysia; and (2) Klang Valley is a good sample area due to its highest monthly household income in Malaysia (Department of Statistics Malaysia, 2021). In addition to that, due to the lack of census and widely spread respondents, thus, this study has been employed a non-probability convenience sampling technique as it ensures noble estimations of the population characteristics (Malhotra, 2019). For deciding the sample size, G*power calculator has been used. Making the required total sample size to be 74, thus, usable data of 232 respondents was collected for the analysis.

Data collection method

A self-administered questionnaire is conducted using online platform among employees either working in public sector, private sector, or self-employed in Klang Valley, Malaysia. The data was collected in three months starting from 1 October 2021 to 31 December 2021 during Malaysian movement control order. Before the questionnaire is distributed to the target sample of this study, a detailed consideration of the distribution process and several procedures has been conducted. First, the questionnaire is created through Google form as it is an appropriate online platform for Malaysian employees during pandemic of covid-19. Second, area of Klang Valley which includes adjoining cities and towns in Selangor has been decided to be part of the survey position as this area is a mass urban in Malaysia. Third, this study is performed the non-probability convenience sampling technique.

Data analysis and interpretation

Partial least squares (PLS) modeling via SmartPLS 4.0.7.5 version has been used for the data analysis. PLS does not require normality assumption and survey research is usually not normally distributed, and thus, PLS is a suitable statistical tool in determining the measurement and structural model (Chin et al., 2003). After that, to present the demographic profile from the target sample of this study (refer to Table 1), descriptive statistics such as frequency and percentage is used. This study also presented an assessment of the measurement model to test the reliability value of loadings, composite reliability and the average variance extracted (AVE). Other than that, to test the reliability and validity criterion assessment, this study used Heterotrait-monotrait ratio (HTMT) criterion for the discriminant validity (Franke & Sarstedt, 2019; Henseler et al., 2015). Finally, to determine the variables’ effect and to test the current study hypotheses, the structural model assessment is presented by reporting the path coefficients, t-values and p-values using a 5,000-sample re-sample bootstrapping procedure (Hair et al., 2019; Ramayah et al., 2018).

Findings and Discussion

Data screening and cleaning

The first step in conducting analysis is by using data screening and data cleaning. All the responses will be screening to verify the reliability and validity in testing a causal theory for this study. From the total of 255 responses of the target sample in this study, 23 cases of completed questionnaires were unusable for the analysis. These unusable questionnaires were dropped immediately if the responses were inconsistent and missing data. Therefore, 232 usable responses have been used for this study.

Demographic profile of respondents

Table 1 presented the demographic profile from the target sample of this study. Frequency analysis is used to identify the samples’ characteristics, specifically; gender, age group, marital status, occupation status, working experience, highest education level, monthly income, monthly saving, and number of dependents.

Of the 232 respondents, 134 (57.8%) are male and 98 (42.2%) are female. The respondents’ ages ranged from 18 years to 60 years and above. However, the respondents mostly below 40 years old; 18 to 29 years old (34.9%), and 30 to 39 years old (38.4%). In term of marital status, almost 65.5% of the respondents are married. The result also shows that the highest percentage of respondents are working in private sector with a total of 53.4%. Besides, work experience statistics presented that a large proportion of the respondents have been used more than 15 years (32.8%). For educational level of respondents, mostly they have bachelor’s degree (35.8%), followed by 33.2% respondents have STPM/ diploma/ certificate. Furthermore, 29.7% of the respondents have a monthly income of RM2,500 and below, while, 35.8% of the respondents are saved RM250 and below per month. Finally, about 41.4% of the respondents have responsible for 1 to 3 dependents, it might include spouse, children, as well as parents and siblings if they are disabled and not have earned.

Measurement model

This study evaluated the loadings, composite reliability and the average variance extracted (AVE) for the measurement model. Hair et al. (2006) and Urbach and Ahlemann (2010) suggested that loadings should be more than 0.7. However, Byrne (2016) mentioned that loadings of 0.5 are still considered acceptable if the research is in early stage of development, particularly the existing of additional indicators for the construct. In addition to that, Hair et al. (2019) claimed that if only one or two loadings below than 0.708 were also acceptable for the analysis. After that, to measure the reliability of the constructs, the composite reliability should be higher than 0.7 (Chin, 2010; Gefen et al., 2000). However, Bagozzi and Yi (1988) stated that value of above 0.6 also considered acceptable for exploratory research. Besides, AVE score should be more than 0.5 (items explaining more than 50% of the variation in construct) establishes a good measure of composite reliability.

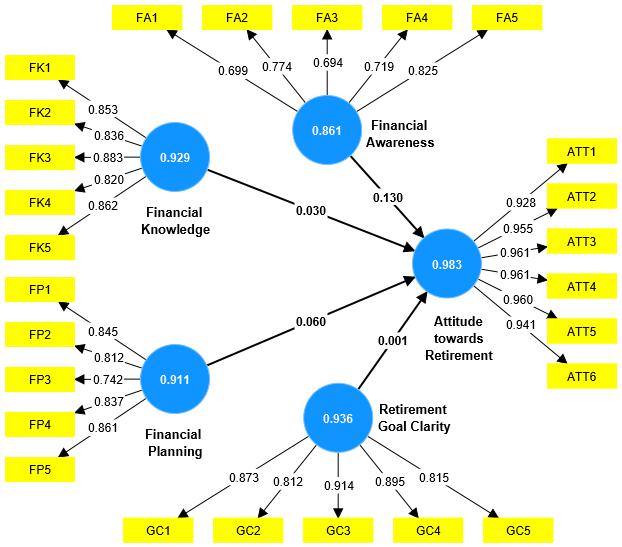

As shown in Figure 2, result from the algorithm showed that all the values of the factor loadings were higher than the minimum value of 0.6 (Byrne, 2016). Table 2 presented a result summary of the composite reliability and average variance extracted (AVE). As a means of evaluating discriminant validity, the composite reliability was calculated. Composite reliability for all constructs in this study were greater than the minimum value of 0.7. Finally, AVE for each construct were higher than the suggested value 0.5 level. Therefore, this study was establishing the discriminant validity as the AVE for each construct is significantly greater than any correlations relating to the construct.

Discriminant validity

This study used the Heterotrait-monotrait ratio (HTMT) criterion for the discriminant validity (Franke & Sarstedt, 2019; Henseler et al., 2015). The HTMT values should be lower than 0.90 the mode lenient criterion. Table 3 disclosed that all the HTMT values were lower than the mode lenient criterion of 0.90, and thus, it is showed that the respondents understood the constructs are different. Overall, based on the valuation of reliability and validity criterion, the measurement model in this study was satisfactory. Therefore, the model is valid and fit to continue for the structural model assessment.

Structural model

This study used 5,000-sample re-sample bootstrapping procedure to assess the path coefficients, t-values and p-values for the structural model (Hair et al., 2019; Ramayah et al., 2018). According to Hahn and Ang (2017), to test the significance of hypothesis, p-values are not the good measurement. Hence, they are suggested to use combination measurements such as p-values, effect sizes, and collinearity statistics (VIF) for testing the current study hypotheses. After that, to test the direct effect between independent variable and dependent variable, the result for the t-values of one-tailed should be greater than 1.645 (Hair et al., 2019). Moreover, p-values in this study used 10% significant level, thus, the result of p-values should be less than 0.10. For the effect sizes, the result based on the important of the variables, includes; no effect (less than 0.02); small effect (between 0.02 to 0.14); medium effect (between 0.15 to 0.34); and large effect (0.35 and above) (Cohen, 2013). Finally, result for the VIF should be less than 3.3 (Hahn and Ang, 2017). Table 4 presented the result summary of the measurements that have used to test the hypotheses developed for this study.

Likewise, this study tested the effect of the four predictors, namely; financial awareness, financial knowledge, financial planning, and retirement goal clarity towards attitude of retirement planning. The R2 was 0.459 which demonstrated that all the four predictors explained 45.9% of the variance in attitude towards retirement planning. PLS analysis hypothesised that financial awareness, financial knowledge, and financial planning have a positive and significant effect towards attitude of retirement planning. The result supported the hypothesis 1 (H1), hypothesis 2 (H2), and hypothesis 3 (H3), showing a significant factor of financial awareness with attitude (β = 0.382, t = 3.575, p = 0.000, F2 = 0.159, VIF = 1.841), financial knowledge with attitude (β = 0.165, t = 1.761, p = 0.078, F2 = 0.025, VIF = 2.189), and financial planning with attitude (β = 0.270, t = 1.996, p = 0.046, F2 = 0.055, VIF = 2.628). However, retirement goal clarity has a negative and not significant effect towards attitude of retirement planning (β = -0.010, t = 0.095, p = 0.925, F2 = 0.001, VIF = 2.239), thus, hypothesis 4 (H4) was not supported.

Discussion

Retirement awareness is important since by 2040, Malaysia is projected to over six million of the number of people over 65 years from two million in year 2022 (David, 2022). Ibrahim et al. (2012), Kushwaha and Jain (2022), Rillotta and Nettelbeck (2007), and Zolait et al. (2009), proved that financial awareness has become increasingly important. This study also showed that financial awareness has a positive and significant effect towards attitude of retirement planning, thus, H1 was accepted. Therefore, Malaysian employees should beat the inflation which regularly diminishing the retirement funds, since most of them are entirely dependent on retirement benefits earned to preserve their retirement life. Accordingly, before employees reach their retirement phase, financial awareness is the importance factor in certifying a proper strategy or action towards their plan for retirement.

Furthermore, this study was found that financial knowledge has a positive and significant effect towards attitude of retirement planning, hence, H2 was accepted. Even though most of the employees’ income adequacy has been affected during covid-19 pandemic, nonetheless, they have abundant of financial knowledge to make well-organized decisions in their plan for retirement (Kaur, 2021). However, findings of this study showed that the financial knowledge gives a very small effect towards attitude of retirement planning. According to Franca et al. (2016), positive changes in financial knowledge towards attitude of retirement planning, will increase retirement planning behaviour across various demographic characteristics of employees. Thus, Malaysian employees should have higher financial knowledge to make a better life after retirement.

Moreover, covid-19 pandemic has changed employees’ concept of retirement and how they make decisions about retirement plans based on short-term circumstances, which will have long-term consequences for financial wellbeing and retirement (Trusted Financial Advice, 2020). Based on this study, financial planning shows a positive and significant effect towards attitude of retirement planning, thus, H3 was accepted. Most of the employees are aware in planning for retirement and are looking forward to increase retirement savings after covid-19 pandemic. It was consistent with a study done by Ghadwan et al. (2022); Henkens (2022); and Yeung and Lee (2022). Even with the outbreak of the covid-19 pandemic, when it comes to plan for retirement, employees should still think, as a well-planned retirement is a happy retirement.

Finally, according to Gollwitzer (2011), to establish future intention in achieving certain goals, employees must have a clear and specific retirement goals. When employees have clearly set their goals for their life after retirement, it will be resulting a positive impact of retirement goal clarity towards attitude of retirement planning. However, this study was found that retirement goal clarity has a negative and not significant effect towards attitude of retirement planning during covid-19 pandemic, hence, H4 was rejected. Besides, Dychtwald and Morison (2020) also revealed that roughly 38 percent of Americans have affected their retirement goal clarity due to the covid-19 pandemic.

Conclusion and Recommendation

The purpose of this study is to examine the effect of financial awareness, financial knowledge, financial planning and retirement goal clarity towards attitude of retirement planning. The conceptual framework was tested in a partial least square (PLS) against 232 Malaysian employees either working in the public sector, private sector, or self-employed in Klang Valley. This study showed that financial awareness, financial knowledge, and financial planning were positively related to attitude, thus, H1, H2, and H3 were accepted. Besides, retirement goal clarity was negatively related to attitude. In addition, the findings indicate that financial awareness has a major influence towards attitude of retirement planning, hence, H4 was rejected.

To sustain the level of awareness among Malaysian employees, various pre-retirement planning programs should be conducted by organisation, policymakers or related agencies, such as retirement trainings or seminars, roadshows, and campaigns. Moreover, to increase employees’ financial knowledge, it is essential to have government intervention programs to make clear understandings about retirement planning. According to Dennis (2007), when employees attending any retirement planning or education programs, they should bring together their spouses and partners.

Furthermore, in terms of financial planning, employer or organisation needs to give guidance and advice through workplace financial education. Zulfaka and Kassim (2022) suggested to the Malaysian government or policymakers not to be involved B40 employees with any economic package or incentive by the government, in helping them to keep their EPF savings during retirement. Last but not least, Malaysian employees should start observing other alternatives plan for retirement such as, diversifying employees’ investment decision and defer the retirement age in order to have sufficient savings for a comfortable life after retirement.

Implications and Limitations

Implications

From this study, a few implications have been reached. First, since financial planning was positively affecting attitude towards retirement planning, employees must have an effort to plan their investment and spending. If most of the Malaysian employees have enough savings for the post-retirement expenses, financial burden during their retirement life can be avoided. Second, employers should provide a better living wage which reflects the cost of living. Due to inflation and lifestyle changes, employers also could sponsor a pension plan as a marginal benefit to the employees. Third, Malaysian government could concentrate on the awareness of retirement planning, such as by providing financial education and seminars.

Fourth, financial advisors could consider establishing their practices to be family-oriented. Financial advisors might encourage employees to bring their spouse, parent, relatives, friends and others to give a better advice with regards to the retirement planning. In addition to that, financial advisors can evaluate and give advice the appropriate retirement funds based on the employees’ retirement goal clarity. Fifth, Malaysian employees may lack of financial knowledge and financial exposure, thus, regulators need to attract the employee’s awareness of the importance of retirement planning. Other than that, the extension of RM3,000 yearly tax relief for the Private Retirement Scheme (PRS) as announced in Budget 2021, can attract more employees to save in PRS, which is one of the retirement planning schemes, and hence, would lead them a better life after retirement.

Limitations and future research

For the future research, recommended to look at the sampling a more diverse workforce which is more representative of the entire Malaysian population. Besides that, research framework in this study also can be used to investigate employees’ intention to participate other types of personal financial planning, such as investment and insurance planning. Last but not least, to explore the measurement of the constructs as well as conceptual dimension in this study, more additional research is needed.

Acknowledgments

This publication was supported by YCU Grant from Universiti Tenaga Nasional [202210009YCU]. Its contents are solely the responsibility of the authors and do not necessarily represent the official views of the university.

References

Afthanorhan, A., Mamun, A. A., Zainol, N. R., Foziah, H., & Awang, Z. (2020). Framing the retirement planning behavior model towards sustainable wellbeing among youth: The moderating effect of public profiles. Sustainability, 12(21), 8879.

Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. In J. Kuhl, & J. Beckmann (Eds.), Action control (pp. 11-39). Springer.

Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social behavior. Prentice-Hall.

Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74-94.

Bank Negara Malaysia. (2016, August 10). 92% of Malaysians worry over retirement funds. https://www.thestar.com.my

Bickford, D. M., & Reynolds, N. (2002). Activism and service-learning: reframing volunteerism as acts of dissent pedagogy. Critical Approaches to Teaching Literature, Language, Composition and Culture, 8(2), 229-252.

Brougham, R. R., & Walsh, D. A. (2005). Goal expectations as predictors of retirement intentions. International Journal of Aging and Human Development, 61(2), 141-160.

Byrne, B. M. (2016). Adaptation of assessment scales in cross-national research: Issues, guidelines, and caveats. International Perspectives in Psychology: Research, Practice, Consultation, 5(1), 51–65.

Chin, W. W. (2010). How to write up and report PLS analyses. In Handbook of partial least squares (pp. 655-690). Springer.

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least square latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion adoption study. Information Systems Research, 14(2), 189-217.

Cohen, J. (2013). Statistical power analysis for the behavioral sciences (2nd edition). Lawrence Erlbaum Associates, Publishers.

David, A. (2022, May 15). Malaysia’s ageing population: Planning for the future. https://www.nst.com.my/news/nation/2022/05/796355/malaysias-ageing-population-planning-future

Dennis, H. (2007). Retirement planning among couples: Observations and recommendations. Generations, 31(3), 60-62.

Department of Statistics Malaysia. (2021). Household income estimates and incidence of poverty report, Malaysia, 2020. https://www.dosm.gov.my

Department of Statistics Malaysia. (2022). Principal statistics of labour force, Malaysia, fourth quarter (Q4) 2021. https://www.dosm.gov.my

Duval, T. S., & Silvia, P. J. (2002). Self-awareness, probability of improvement, and the self-serving bias. Journal of Personality and Social Psychology, 82(1), 49–61.

Dychtwald, K., & Morison, B. (2020, August 4). 68 million Americans are changing their retirement plans. Forbes. https://www.forbes.com/sites/kendychtwald/2020/08/04/68-million-americans-are-changing-their-retirement-plans/?sh=478305734346

Ekici, T., & Koydemir, S. (2016). Income expectations and happiness: evidence from British panel data. Applied Research in Quality of Life, 11(2), 539-552.

Employees Provident Fund. (2021a). Expenditure guide for Malaysians. Belanjawanku 2021. https://swrc.um.edu.my/wp-content/uploads/2022/01/Belanjawanku-Report-2021-final-_uploaded-21012022-reviewed-10032022.pdf

Employees Provident Fund. (2021b, October 31). Only 3% of contributors can afford their retirement. https://www.thestar.com.my/news/nation/2021/10/31/epf-only-3-of-contributors-can-afford-their-retirement-says-chief-strategy-officer

Franca, C. L., Murta, S. G., & Hershey, D. A. (2016). Evaluation of retirement planning programs: A qualitative analysis of methodologies and efficacy. Educational Gerontology, 42(7,) 497-512.

Franke, G., & Sarstedt, M. (2019). Heuristics versus statistics in discriminant validity testing: A comparison of four procedures. Internet Research, 29(3), 430-447.

Gefen, D., Straub, D., & Boudreau, M. C. (2000). Structural equation modelling and regression: Guidelines for research practice. Communications of the association for information systems, 4(1), 7.

Ghadwan, A., Wan Ahmad, W. M., & Hanifa, M. H. (2022). Financial planning for retirement: The mediating role of culture. Risks, 10(5), 104.

Gitman, L. J., Joehnk, M. D., & Billingsley, R. S. (2011). Personal financial planning (12th edition). South-Western Publishing.

Gollwitzer, P. M. (2011). Goal achievement: The role of intentions. European Review of Social Psychology, 4(1), 141-185.

Habib, S. (2007, May 27). Counting on the Nest Egg. https://www.thestar.com.my/news/nation/2007/05/27/counting-on-the-nest-egg

Hahn, E. D., & Ang, S. H. (2017). From the editors: New directions in the reporting of statistical results in the Journal of World Business. Journal of World Business, 52(2), 125-126.

Hair, J., Risher, J., Sarstedt, M., & Ringle, C. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2-24.

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis. (6th edition). Prentice Hall International.

Hassan, K. H., Rahim, R. A., Ahmad, F., Noor, T., & Tengku, A. (2016). Retirement planning behaviour of working individuals and legal proposition for new pension system in Malaysia. Journal of Politics and Law, 9(4), 43-52.

Henkens, K. (2022). Forge healthy pathways to retirement with employer practices: a multilevel perspective. Work, Aging and Retirement, 8(1), 1-6.

Henseler, J., Ringle, C., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modelling. Journal of the Academy of Marketing Science, 43(1), 115-135.

Hershey, D. A., & Mowen, J. C. (2000). Psychological determinants of financial preparedness for retirement. Gerontologist, 40(6), 687-697.

Hoffmann, A. O., & Plotkina, D. (2021). Positive framing when assessing the personal resources to manage one’s finances increases consumers’ retirement self‐efficacy and improves retirement goal clarity. Psychology and Marketing, 38(12), 2286-2304.

Hopkins, J. P., & Pearce, J. A. II (2019). Retirement income literacy: A key to sustainable retirement planning. Journal of Financial Planning, 32(1), 36-44.

Ibrahim, D., Isa, Z. M., & Ali, N. (2012). Malaysian savings behavior towards retirement planning. In Proceedings of 2012 International Conference on Economics Marketing and Management, 28, 102-105.

Ison, N., Mcintyre, S., Rothery, S., Sheedy, H. S., Goldsmith, S., Parsonage, S., & Foy, L. (2010). Just like you’: a disability awareness programme for children that enhanced knowledge, attitudes and acceptance: pilot study findings. Developmental Neurorehabilitation, 13(5), 360-368.

Kaur, S. (2021). A Study on the factors affecting retirement planning among employees in Malaysia during covid-19 pandemic. In Proceedings of International Conference on Advanced Marketing, 24.

Kim, J., Kwon, J., & Anderson, E. A. (2005). Factors Related to Retirement Confidence: Retirement Preparation and Workplace Financial Education. Financial Counseling and Planning, 16(2), 77–89.

Kushwaha, N., & Jain, M. R. (2022). Covid-19 crisis: An opportunity to start retirement planning amongst professionals - An awareness study with reference to Madhya Pradesh.

Lai, M. M., Lai, M. L., & Lau, S. H. (2009). Managing money and retirement planning: Academics’ perspectives pension. An International Journal, 14(4), 282-292.

Lai, M. M., & Tan, W. K. (2009). An empirical analysis of personal financial planning in an emerging economy. European Journal of Economics, Finance and Administrative Sciences, 16(1), 99-111.

Lim, V. K. G. (2003). An empirical study of older workers’ attitudes towards the retirement experience. Employee Relations, 25(4), 330-346.

Lin, W. E. (2017, April 07). Only 40% of Malaysians are financially ready for retirement. https://www.theedgemarkets.com/article/only-40-malaysians-are-financially-ready-retirement

Lusardi, A., & Mitchell, O. S. (2007). Baby Boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics, 54(1), 205–224.

MalayMail. (2017, November 13). Malaysians’ lack of retirement planning awareness worrying. https://www.malaymail.com/news/malaysia/2017/11/13/malaysians-lack-of-retirement-planning-awareness-worrying-financial-planner/1509511

Malhotra, N. K. (2019). Marketing research: An applied orientation (7th edition). Pearson Education, Inc.

Martin Jr, T. K., Guillemette, M. A., & Browning, C. M. (2016). do retirement planning strategies alter the effect of time preference on retirement wealth? Applied Economics Letters, 23(14), 1003-1005.

Michelle, R. (2018). Perception of retirement adequacy: Evidence from South Africa. Journal of Finance Counselling and Planning, 29(2), 343-356.

Ministry of Health Malaysia. (2022, September 26). Covid-19 deaths in Malaysia. https://covidnow.moh.gov.my

Moen, P. (1996). A life course perspective on retirement, gender, and well-being. Journal of Occupational Health Psychology, 1(2), 131-144.

Moorthy, M. K., Durai, T., Chelliah, L., Sien, C. S., Leong, L. C., Kai, N. Z., & Teng, W. Y. (2012). A study on the retirement planning behaviour of working individuals in Malaysia. International Journal of Academic Research in Economics and Management Sciences, 1(2), 54.

Mustafa, A., Yusof, S. K., Silim, A., Adiman, R., & Hassan, N. L. (2017). Factors influencing retirement planning behaviour of lecturers in Polytechnics. Advanced Journal of Technical and Vocational Education, 1(4), 9-13.

Ng, T. H., Tay, W. Y., Tan, N. L., & Lim, Y. S. (2011). Influence of investment experience and demographic factors on retirement planning intention. International Journal of Business and Management, 6(2), 196-203.

Noone, J., Alpass, F., & Stephens, C. (2010). Do men and women differ in their retirement planning? Testing a theoretical model of gendered pathways to retirement preparation. Research on Aging, 32(6), 715-738.

Othman, I. W., Hassan, H., Ahmad, S. N. B., Topimin, S., & Buncha, M. R. A. (2022). Recognizing Ministry of Entrepreneur Development and Cooperation (MEDAC) In the Furtherance Interest of Entrepreneurs and Cooperatives. International Journal of Accounting, 7(43), 454-474.

Petkoska, J., & Earl, J. K. (2009). Understanding the influence of demographic and psychological variables on retirement planning. Psychology and Aging, 24(1), 245-251.

Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial least squares structural equation modeling (PLS-SEM) using SmartPLS 3.0: An updated guide and practical guide to statistical analysis (2nd ed.). Pearson.

Rillotta, F., & Nettelbeck, T. (2007). Effects of an awareness program on attitudes of students without an intellectual disability towards persons with an intellectual disability. Journal of Intellectual and Developmental Disability, 32(1), 19-27. https://doi.org/10.1080/1366825070119 4042

Sarpong-Kumankoma, E. (2021). Financial literacy and retirement planning in Ghana. Review of Behavioral Finance.

Scharn, M., Sewdas, R., Boot, C. R., Huisman, M., Lindeboom, M., & Van Der Beek, A. J. (2018). Domains and determinants of retirement timing: A systematic review of longitudinal studies. BMC Public Health, 18(1), 1-14.

Shanmugam, A., & Abidin, F. Z. (2013). Retirement confidence and preparedness: A study among working adults in a Northern State in Malaysia. Proceeding on Business Management Research, 404-414.

Stawski, R. S., Hershey, D. A., & Jacobs-Lawson, J. M. (2007). Goal clarity and financial planning activities as determinants of retirement savings contributions. International Journal of Aging and Human Development, 64(1), 13-32.

Talib, N. F. M., & Manaf, H. A. (2017). Attitude towards retirement planning behaviour among employees. International Journal of Business and Management, 1(1), 12-17.

Trusted Financial Advice. (2020). Guide to post-covid-19 retirement planning, Pandemic leads to change in future retirees’ plans. September 2020. www.tfagroup.co.uk

Urbach, N., & Ahlemann, F. (2010). Structural equation modeling in information systems research using partial least squares. Journal of Information Technology Theory and Application, 11(2), 5-40.

Warschauer, M. (2001). Millennialism and media: Language, literacy, and technology in the 21st century. Aila Review, 14(1), 49-59.

Vasu, P. (2022, September 20). 4% of respondents in a Sun Life Malaysia retirement survey says EPF accounts no longer have enough amount to withdraw. https://www.theedgemarkets.com/article/4-respondents-sun-life-malaysia-retirement-survey-says-epf-accounts-no-longer-have-enough#:~:text=KUALA%20LUMPUR%20(Sept%2020)%3A,have%20enough%20amounts%20to%20withdraw.

Yeap, C. (2021, February 27). EPF assets hit RM1.02 trillion but 30% may have zero balance in Account 1, 60% for Account 2. https://www.theedgemarkets.com/article/epf-assets-hit-rm102-trillion-30-may-have-zero-balance-account-1-60-account-2

Yeung, W. J. J., & Lee, Y. (2022). Aging in East Asia: new findings on retirement, health, and well-being. The Journals of Gerontology: Series B, 77(3), 589-591.

Zabri, S. M., Ahmad, K., & Lian, A. A. L. H. (2016). The awareness of private retirement scheme and the retirement planning practices among private sector employees in Malaysia. International Journal of Economics and Financial Issues, 6(6), 120-124.

Zhu, A. Y. F., & Chou, K. L. (2018). Retirement goal clarity, needs estimation, and saving amount: Evidence from Hong Kong, China. Journal of Financial Counseling and Planning, 29(2), 328-342.

Zolait, A. H. S., Mattila, M., & Ainin, S. (2009). The effect of user’s informational-based readiness on innovation acceptance. International Journal of Bank Marketing, 27(1), 76-100.

Zulfaka, A., & Kassim, S. (2022). Retirement awareness among the working population below 40 in Malaysia. Journal of Islamic Finance, 10, 101-110.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

18 August 2023

Article Doi

eBook ISBN

978-1-80296-963-4

Publisher

European Publisher

Volume

1

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1050

Subjects

Multi-disciplinary, Accounting, Finance, Economics, Business Management, Marketing, Entrepreneurship, Social Studies

Cite this article as:

Ismail, N., Abdullah, Z., & Md Husin, M. (2023). Employees’ Attitude Towards Retirement Planning During Pandemic of Covid-19 in Malaysia. In A. H. Jaaffar, S. Buniamin, N. R. A. Rahman, N. S. Othman, N. Mohammad, S. Kasavan, N. E. A. B. Mohamad, Z. M. Saad, F. A. Ghani, & N. I. N. Redzuan (Eds.), Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, vol 1. European Proceedings of Finance and Economics (pp. 270-287). European Publisher. https://doi.org/10.15405/epfe.23081.23